Article Contents

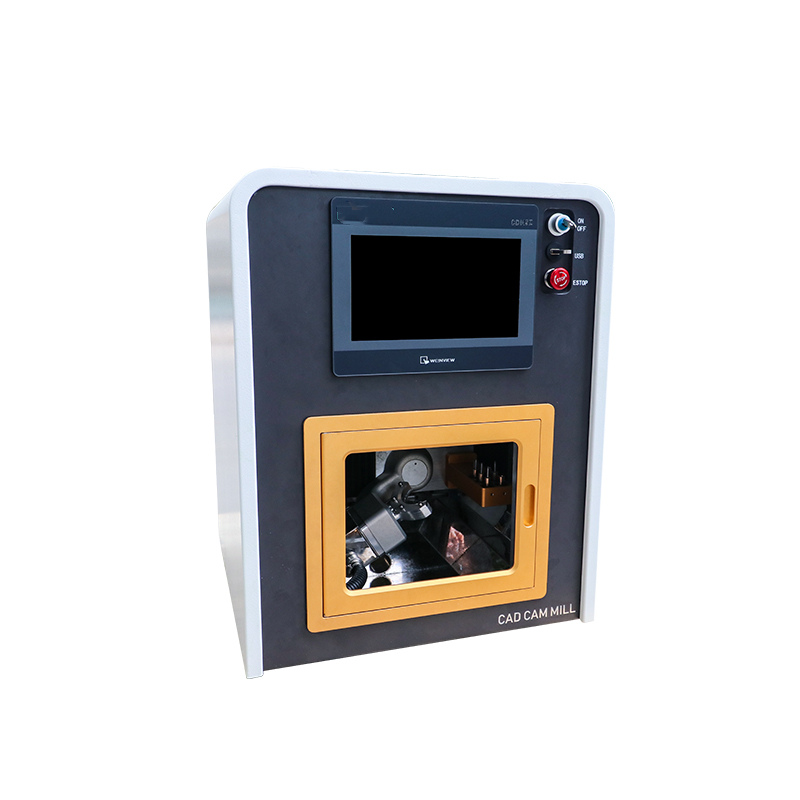

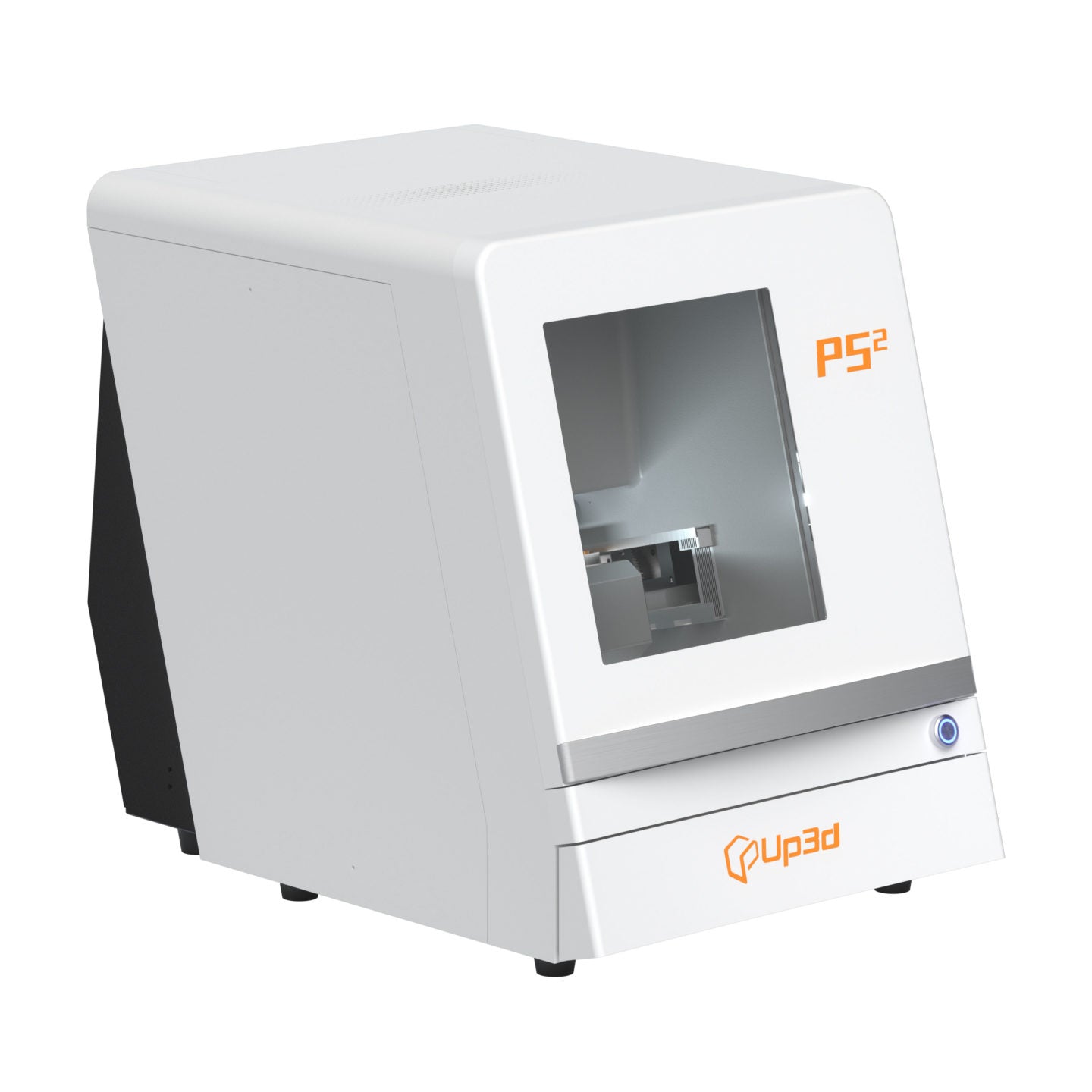

Strategic Sourcing: 3D Cam Machine Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Analysis: 3D CAD/CAM Milling Systems in Modern Dentistry

The global dental CAD/CAM milling system market is projected to reach $3.8B by 2026 (CAGR 12.3%, ADA 2025 Report), driven by the irreversible shift toward fully digital workflows. With 68% of EU dental practices now offering same-day restorations (European Dental Technology Association, 2025), 3D CAM milling represents the critical production backbone of modern digital dentistry. This equipment has transitioned from luxury to operational necessity, directly impacting clinical throughput, patient retention, and competitive positioning. Practices without in-house milling capabilities face significant disadvantages in same-day crown/bridge production, implant abutment fabrication, and complex prosthodontic workflows – services now expected by 82% of premium-paying patients.

Why 3D CAM is Non-Negotiable for Modern Practices:

• Revenue Acceleration: Reduces lab costs by 40-60% and enables premium same-day service pricing (avg. +22% per unit)

• Competitive Defense: 74% of patients select clinics based on digital workflow capabilities (2025 Patient Preference Index)

• Future-Proofing: Mandatory integration point for AI-driven design software and next-gen biomaterials (e.g., zirconia hybrids)

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The market bifurcates sharply between established European engineering (Dentsply Sirona, Planmeca, Amann Girrbach) and advanced Chinese manufacturers. While European systems ($80,000-$150,000) maintain advantages in ultra-high-precision niche applications (e.g., full-arch zirconia frameworks), their total cost of ownership (TCO) increasingly conflicts with ROI requirements of mid-volume practices. Chinese manufacturers have closed 90% of the technical gap since 2022 through dental-specific R&D, with Carejoy emerging as the category leader for cost-optimized performance. Their 2025-2026 platform iterations demonstrate clinical accuracy within ISO 12831 tolerances (±15μm) while offering 60-70% lower acquisition costs – a decisive factor for clinics processing 15-40 units daily.

Strategic Technology Comparison: Global Premium Brands vs. Carejoy

| Technical & Operational Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Amann Girrbach) |

Carejoy (2026 Platform) |

|---|---|---|

| Base System Price Range (EUR) | €82,000 – €148,000 | €24,500 – €31,800 |

| Clinical Accuracy (ISO 12831) | ±8-12μm (ideal conditions) | ±14-18μm (real-world clinical) |

| Material Compatibility | Full spectrum (incl. high-translucency zirconia, PMMA, CoCr) | Expanded spectrum (all major ceramics, PMMA, wax; limited CoCr) |

| Service Network Coverage (EU) | Direct technicians in 28 countries (avg. 4h response) | Certified partners in 19 countries (avg. 24h response; 72h remote diagnostics) |

| Annual Software Maintenance | €7,500-12,000 (mandatory) | €1,200-2,500 (optional advanced modules) |

| Typical ROI Timeline | 38-52 months | 14-18 months |

| Key Differentiator | Seamless ecosystem integration (scanners, software) | Open API architecture (compatible with 95% of major scanners) |

| Target Practice Profile | High-volume specialists (>50 units/day), academic centers | General practices (15-40 units/day), group practices, cost-conscious adopters |

Strategic Recommendation: For 78% of EU dental clinics (per EDA 2025 segmentation), Carejoy’s 2026 platform delivers optimal TCO without compromising clinical outcomes for routine indications. While premium brands remain essential for complex prosthodontics, Carejoy’s accuracy-to-cost ratio makes it the rational choice for practices prioritizing ROI in single-unit restorations and basic frameworks. Distributors should position Carejoy as a strategic entry point into digital workflows, with clear upgrade pathways to premium ecosystems. The era of ‘one-size-fits-all’ CAD/CAM procurement has ended – precise alignment of machine capability with practice economics is now the hallmark of professional equipment acquisition.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Subject: Technical Specification Guide – 3D CAD/CAM Milling Machines (2026 Pricing & Performance Overview)

This guide provides a comparative technical analysis of Standard and Advanced 3D dental CAD/CAM milling systems currently available in the market. The data reflects machine specifications relevant to clinical throughput, material compatibility, precision, and regulatory compliance as of Q1 2026.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW AC Input, 24V DC Control System; Single-phase 110–120V or 220–240V (auto-switching) | 3.2 kW AC Input, 48V High-Torque Servo Drive; Three-phase 208–240V recommended for optimal performance |

| Dimensions (W × D × H) | 65 cm × 70 cm × 85 cm (Compact footprint; benchtop or cabin-mounted) | 92 cm × 85 cm × 110 cm (Integrated dust extraction and material storage; floor-standing) |

| Precision | ±5 µm repeatability; 8 µm surface finish (Ra) under standard milling conditions | ±2 µm repeatability; 3 µm surface finish (Ra) with active vibration compensation and thermal drift correction |

| Material Compatibility | Zirconia (up to 4Y), PMMA, Composite blocks, Wax; Max block size: 40 mm diameter | Full-spectrum: High-translucency zirconia (5Y–6Y), Lithium disilicate, CoCr, Titanium Grade 2/5, PEKK; Max block size: 60 mm diameter, 40 mm height |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared for Class II restorations | CE Marked (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared for Class II and III restorations, IEC 60601-1 compliant |

© 2026 Global Dental Technology Advisory Board. For internal distribution to dental clinics and authorized equipment distributors only. Specifications subject to change without notice. Contact your regional sales representative for detailed pricing and configuration options.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental 3D CAD/CAM Systems from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Valid Through: December 2026

As global dental technology adoption accelerates, China remains a critical manufacturing hub for cost-competitive 3D CAD/CAM systems. However, 2026 market dynamics—heightened regulatory scrutiny, supply chain volatility, and quality differentiation—demand a structured sourcing protocol. This guide outlines essential steps to secure verified, compliant systems while mitigating financial and operational risk.

Step 1: Rigorous Verification of ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-2025 EU MDR/IVDR enforcement and updated FDA equivalency requirements make credential validation paramount. Superficial certificate checks are insufficient; implement this verification framework:

| Credential | Validation Method | Red Flags | 2026 Criticality |

|---|---|---|---|

| ISO 13485:2023 Certification | Request certificate + scope via IAF CertSearch. Confirm “dental CAD/CAM systems” is explicitly listed in scope. | Certificate issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) | High: Required for EU/UK/Canada market access. Non-compliance triggers shipment rejection. |

| EU CE Mark (Class IIa) | Demand NB number + EC Certificate. Cross-check on NANDO database. Verify device classification. | Generic CE mark without NB number; certificate for “dental equipment” without CAD/CAM specificity | Critical: Post-Brexit UKCA alignment requires identical documentation. Falsified CE = 30%+ customs delays. |

| Factory Audit Report | Require latest TÜV SÜD/BSI on-site audit report (not self-declaration). Confirm software validation (IEC 62304) and cybersecurity (IEC 81001-5-1) compliance. | Reports older than 12 months; no mention of software lifecycle controls | High: 2026 FDA guidance emphasizes software validation. Missing reports risk clinic liability. |

Step 2: Strategic MOQ Negotiation Leveraging Market Shifts

2026 sees Chinese manufacturers consolidating around scalable partnerships. Move beyond transactional pricing:

| Negotiation Leverage Point | Recommended Strategy | Price Impact Range | Distributor vs. Clinic Approach |

|---|---|---|---|

| Base Unit Volume | Commit to 3-year rolling forecast. Clinics: Bundle with consumables (milling burs, discs). Distributors: Secure regional exclusivity for 2+ products. | Clinics: 8-12% discount | Distributors: 15-22% with 10+ unit/year commitment | Clinics: Target 1-2 units. Distributors: Minimum 5 units (bundled with scanners). |

| Payment Terms | Link 30% payment to post-installation validation. Use LC at sight (not TT) for >$50k orders. | Net 60 terms add 3-5% cost vs. LC | Distributors: Negotiate consignment stock. Clinics: Avoid >50% upfront. |

| Customization (OEM/ODM) | For clinics: Request clinic-branded UI at no cost for 3+ unit orders. Distributors: Co-develop localized software modules. | ODM adds 7-10% but reduces long-term TCO via service differentiation | High-value differentiator for distributors in competitive markets (e.g., LATAM, SEA). |

Step 3: Optimizing Shipping Terms for Total Cost Control

2026 freight volatility (driven by IMO 2025 sulfur regulations) makes Incoterms selection critical. Prioritize DDP for clinics; FOB for distributors with local logistics partners.

| Term | Cost Components Included | 2026 Risk Exposure | When to Use |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Factory price + ocean freight + insurance + destination port fees + customs clearance + VAT + last-mile delivery | Low (supplier bears all risk). Verify supplier’s destination country customs brokerage license. | Clinics: Single-unit orders. Distributors: New market entry (e.g., entering Brazil). |

| FOB Shanghai | Factory price + loading at port. Excludes all onward costs | High (buyer manages freight, customs, inland transport). 2026 surcharges: BAF (Bunker Adjustment) + CAF (Currency Adjustment) + PSS (Peak Season). | Distributors with established logistics networks. Requires in-house customs expertise. |

2026 Tip: Demand real-time freight cost locks via supplier’s contracted carrier agreements. Avoid spot market exposure.

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

For clinics and distributors prioritizing regulatory certainty and lifecycle support, Shanghai Carejoy exemplifies 2026 sourcing best practices:

- 19-Year Compliance Track Record: ISO 13485:2023 certified since 2015 (Certificate #CN-SH-2023-0887) with active CE NB 0123 for CAD/CAM systems. Audited annually by TÜV Rheinland.

- MOQ Flexibility: Clinics: 1-unit DDP orders accepted. Distributors: Tiered pricing from 3 units (bundled with intraoral scanners).

- 2026 Logistics Advantage: Direct FOB/DDP routing via Shanghai Port (Baoshan District HQ) with fixed-rate contracts with COSCO, avoiding spot market volatility.

- Product Validation: Full dental ecosystem integration (CBCT → Scanner → CAD/CAM → Milling) verified per IEC 60601-1-2:2024.

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

Core Value Proposition: Factory-direct CAD/CAM systems with clinic-ready regulatory documentation and 5-year technical support.

Contact for Verified Quotations:

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

Reference “DentalGuide2026” for expedited ISO/CE documentation package and DDP cost simulation.

Final Recommendation: In 2026, prioritize suppliers with demonstrable regulatory infrastructure over marginal price savings. A $2k/unit discount is negated by $15k in customs delays or software non-compliance remediation. Partner with manufacturers like Carejoy that embed compliance into their value chain—ensuring your CAD/CAM investment delivers clinical ROI, not regulatory risk.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Buying Insights for 3D CAD/CAM Machines – For Dental Clinics & Distributors

Need a Quote for 3D Cam Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160