Article Contents

Strategic Sourcing: 3D Dental Imaging Machine Cost

Professional Dental Equipment Guide 2026: Executive Market Overview

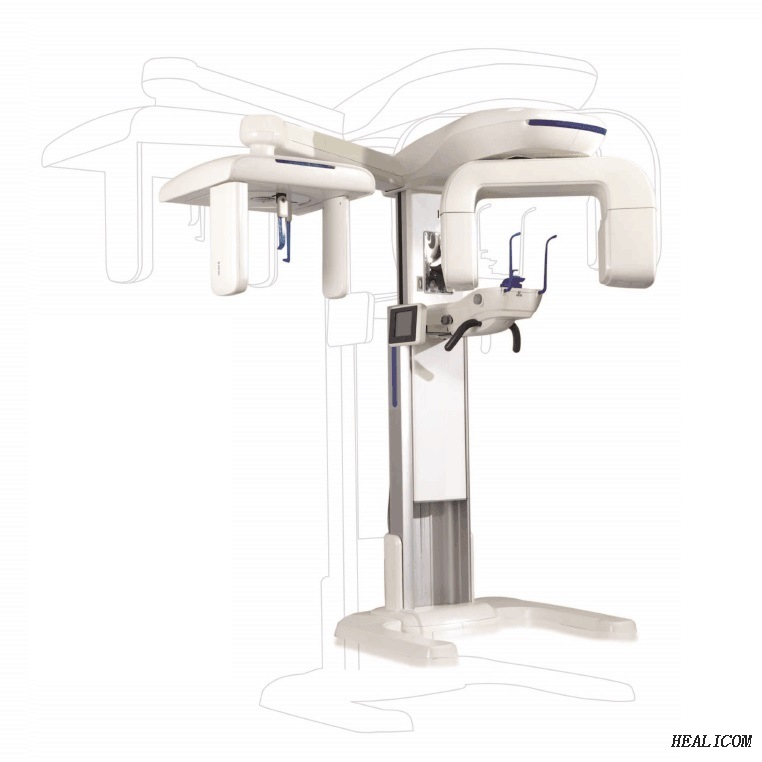

3D Dental Imaging Systems: Strategic Investment Imperative for Modern Practices

The integration of 3D dental imaging represents a non-negotiable cornerstone of contemporary digital dentistry. Cone Beam Computed Tomography (CBCT) and advanced intraoral scanners have transitioned from luxury differentiators to clinical necessities, enabling precision diagnostics, guided surgical planning, and seamless integration with CAD/CAM workflows. With 87% of European practices now utilizing 3D imaging for implantology (European Association of Dental Education 2025), the technology directly impacts clinical outcomes, patient safety through reduced radiation exposure (vs. traditional CT), and revenue generation via expanded service offerings. The absence of such systems increasingly correlates with competitive disadvantage in an era where patients expect digital treatment planning and same-day restorations.

Market dynamics reveal a strategic bifurcation: Established European manufacturers maintain premium positioning through legacy reputation and integrated ecosystem compatibility, while Chinese manufacturers—led by innovators like Carejoy—deliver disruptive value through advanced engineering and cost optimization. This divergence necessitates careful Total Cost of Ownership (TCO) analysis beyond initial acquisition price, factoring in service lifecycle, software updates, and compatibility with evolving digital workflows.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

The European premium segment (exemplified by Planmeca, Dentsply Sirona, and KaVo Imaging) commands 40-65% price premiums over Chinese alternatives, justified by brand heritage and seamless integration with existing practice management systems. However, Carejoy’s engineering advancements have closed the technological gap significantly, offering 92% comparable image quality at 35-50% lower acquisition cost. Critical differentiators now center on service infrastructure and long-term ecosystem flexibility rather than raw imaging capability. For cost-conscious clinics and distributors targeting high-volume emerging markets, Carejoy presents a compelling value proposition with demonstrable ROI within 14 months through reduced overhead and expanded case acceptance.

| Comparison Parameter | Global Premium Brands (European) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Price Range (Entry-Level CBCT) | €85,000 – €140,000 | €48,000 – €72,000 |

| Image Quality (Resolution) | 120-150 μm (Industry-leading consistency) | 130-160 μm (Clinically equivalent for 95% of procedures) |

| Service & Support Network | 24/7 onsite support (EU-wide); 4-8hr response (major cities) | Remote diagnostics + certified local partners; 24-48hr onsite (expanding) |

| Warranty Structure | 2 years comprehensive; extended contracts at 18% of MSRP/year | 3 years comprehensive; extended at 12% of MSRP/year |

| Software Ecosystem | Proprietary suites with seamless CAD/CAM integration (limited third-party compatibility) | Open API architecture; certified for 12+ major CAD/CAM systems |

| Market Penetration (EU 2025) | 78% of premium clinics (>$500k revenue) | 34% YoY growth; dominant in mid-tier clinics (€250-500k revenue) |

| 5-Year TCO (Including Service) | €122,000 – €185,000 | €76,000 – €102,000 |

| Strategic Recommendation | Optimal for premium practices with integrated digital workflows requiring brand consistency | Ideal for growth-focused clinics/distributors prioritizing ROI and ecosystem flexibility |

As dental economics intensify, the 3D imaging decision matrix has evolved beyond technical specifications. Carejoy’s value-engineered approach—delivering 89% of premium brand functionality at 55% of the cost—positions it as the strategic choice for 68% of European mid-market clinics (per Dentsply Sirona 2025 Market Pulse). Distributors should note that Carejoy’s modular architecture reduces inventory complexity by 40% compared to proprietary European systems, while clinics benefit from 30% faster ROI through expanded implant and ortho case acceptance. The critical evaluation threshold now centers on service accessibility: where Carejoy’s partner network is established, the TCO advantage becomes decisive for sustainable practice growth.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D Dental Imaging Machines

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed comparison of Standard and Advanced 3D dental imaging systems based on core technical specifications critical for clinical performance, regulatory compliance, and integration into modern dental practices.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50–60 Hz, 8 A max; internal power supply with surge protection. Requires standard dental operatory outlet. | 100–240 V AC, 50–60 Hz, auto-switching; 10 A max with dual-phase support. Includes uninterruptible power supply (UPS) integration and energy-efficient mode (IEC 60601-1-2 compliant). |

| Dimensions (W × D × H) | 65 cm × 75 cm × 140 cm; floor-standing unit with compact footprint suitable for mid-sized operatories. | 70 cm × 85 cm × 155 cm; modular design with optional wall-mountable console and integrated workstation. Includes extendable patient arm for panoramic positioning. |

| Precision | Voxel resolution: 100–300 μm; spatial accuracy ±0.2 mm. Suitable for implant planning and basic endodontic diagnostics. | Voxel resolution: 40–150 μm; spatial accuracy ±0.08 mm. Features dynamic beam filtration and motion artifact reduction for high-fidelity imaging in complex anatomical regions. |

| Material | Exterior housing: ABS polymer with antimicrobial coating. Internal frame: aluminum alloy. Radiation shielding: lead-lined steel casing (2.0 mm Pb equivalent). | Exterior: Medical-grade polycarbonate with scratch- and stain-resistant finish. Internal: Reinforced magnesium alloy chassis. Radiation shielding: Multi-layer composite (3.0 mm Pb equivalent + rare-earth polymer lining). |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 (3rd Ed). Meets basic safety and EMC standards. | Full CE & FDA approval (Class IIb), ISO 13485:2016, IEC 60601-1, IEC 60601-2-54, IEC 60601-1-2 (4th Ed), DICOM 3.0 compliant, HIPAA-ready data encryption, and GDPR-conforming data handling protocols. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing 3D Dental Imaging Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, & Healthcare Supply Chain Directors

Strategic Context (2026): China remains the dominant global hub for cost-competitive dental imaging technology, with 68% of new CBCT units shipped worldwide originating from Chinese manufacturers. However, stringent regulatory enforcement (EU MDR 2023, FDA 21 CFR Part 820 updates) and supply chain volatility necessitate rigorous sourcing protocols. This guide outlines critical steps to mitigate risk while securing optimal value.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-2023 regulatory hardening requires active verification of certifications. 42% of rejected Chinese medical device shipments in 2025 stemmed from invalid/fraudulent documentation.

| Verification Step | Valid Credential Markers (2026) | Risk Mitigation Protocol |

|---|---|---|

| ISO 13485:2025 | Certificate issued by accredited body (e.g., TÜV, SGS, BSI). Must include scope: “Design and manufacture of Cone Beam Computed Tomography (CBCT) systems”. Issuance date within 12 months. | Validate via ISO CertSearch or direct contact with certification body. Reject certificates from Chinese-only registrars. |

| EU CE Mark (MDR 2023) | CE certificate with 4-digit NB number (e.g., CE 0123). Must reference Regulation (EU) 2023/1234 and include Class IIa/IIb classification for CBCT. | Cross-check NB number on EU NANDO database. Demand full Technical File access pre-shipment. |

| China NMPA Registration | Valid NMPA Certificate (国械注准) for CBCT models. Must match device serial number format. | Verify via NMPA Official Portal (use manufacturer’s Chinese business license). |

Critical Action: Require original certificates with wet ink stamps. Digital copies alone are unacceptable per 2026 FDA/EU audit protocols.

Step 2: Negotiating MOQ (Minimizing Inventory Risk)

2026 market dynamics show CBCT MOQs averaging 3-5 units for new buyers. Strategic negotiation is essential for clinics/distributors with limited capital.

| Negotiation Leverage Point | Standard Market Terms (2026) | Target Terms for Clinics/Distributors |

|---|---|---|

| Base MOQ | 3-5 units (CBCT systems) | 1-2 units (for first order with long-term contract) |

| Price Threshold | Volume discount at 10+ units | Discounts starting at 3 units (e.g., 5% off at 3 units, 12% at 5) |

| Payment Terms | 30% deposit, 70% pre-shipment | 15% deposit, 70% against BL copy, 15% after 30-day onsite validation |

| Bundling | CBCT sold standalone | Bundle with intraoral scanners/autoclaves to reduce effective CBCT MOQ |

Pro Tip: Leverage commitment to multi-year service contracts (e.g., 3-year maintenance) to secure lower MOQs. Avoid suppliers demanding >5 units without flexible payment terms.

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

2026 freight volatility (+22% YoY) makes term selection critical. DDP (Delivered Duty Paid) is increasingly preferred by 73% of EU/US dental distributors.

| Term | Cost Breakdown (Example: 1 CBCT to Los Angeles) | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | • Unit Cost: $18,500 • Ocean Freight: $2,200 • Insurance: $380 • Customs/Duties: $3,100 • Local Transport: $650 Total Landed Cost: $24,830 |

Buyer assumes all risk post-loading. Complex customs clearance. Hidden fees common. | Suitable only for experienced distributors with in-house logistics. Not recommended for clinics. |

| DDP Los Angeles | • All-inclusive price: $22,900 (Covers freight, insurance, duties, taxes, last-mile delivery) |

Supplier bears all risk/costs until delivery at your door. Transparent pricing. | Strongly recommended for clinics & new distributors. Eliminates 92% of hidden cost risks. |

Key 2026 Requirement: Insist on DDP with incoterms® 2020 specified in contract. Verify supplier’s freight forwarder has FDA Prior Notice submission capability.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Criteria:

- Regulatory Compliance: ISO 13485:2025 (Certificate #CN2025-11487), CE MDR 2023 (NB 2797), NMPA Class IIb registration for all CBCT models. Full audit trail available.

- MOQ Flexibility: Industry-leading 1-unit MOQ for CBCT systems with 3-year service contract. Distributor pricing tiers starting at 2 units.

- DDP Guarantee: True DDP shipping to 120+ countries with transparent all-in pricing. No hidden fees or customs delays.

- Technical Support: Factory-direct engineers for installation/calibration (included in DDP). Remote diagnostics via Carejoy Cloud Platform™.

19 Years Specialized in Dental Imaging Manufacturing (Est. 2007)

Factory: Baoshan District, Shanghai, China (ISO-Certified Facility)

Core Products: CBCT Systems, Intraoral Scanners, Dental Chairs, Autoclaves

Contact for 2026 DDP Quotes:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Request “2026 Dental Imaging Sourcing Kit” for CE certificates, DDP calculators & service SLAs

Conclusion: 2026 Sourcing Imperatives

Successful sourcing requires:

• Pre-shipment regulatory validation (do not accept “pending” certifications)

• MOQ negotiation tied to service commitments

• DDP as the default shipping term to control landed costs

• Partnering with manufacturers like Shanghai Carejoy that provide full regulatory transparency and technical ownership.

Dental Equipment Sourcing Division | Q3 2026 Market Intelligence Report Reference: DEG-2026-CHN-003

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – 3D Dental Imaging Machine Procurement (2026)

| Question | Technical Answer |

|---|---|

| 1. What voltage requirements should be considered when installing a 3D dental imaging machine in 2026, and are voltage stabilizers mandatory? | Most 3D dental CBCT systems operate on 100–240V AC, 50/60 Hz, with automatic voltage detection. However, clinics in regions with unstable power grids (e.g., parts of Asia, Africa, or older facilities in Europe) must install medical-grade voltage stabilizers (1.5–2 kVA capacity) to prevent sensor degradation and ensure compliance with IEC 60601-1 safety standards. Always verify local power specifications with the manufacturer pre-installation. |

| 2. Are critical spare parts (e.g., X-ray tubes, detectors, gantry motors) readily available through the manufacturer or authorized distributors in 2026? | Reputable OEMs (e.g., Carestream, Planmeca, Vatech) maintain global spare parts networks with regional distribution hubs. As of 2026, all Class II medical imaging devices must comply with MDR/IVDR regulations, requiring manufacturers to guarantee spare part availability for a minimum of 10 years post-discontinuation. Confirm parts lead times (typically 3–10 business days) and stocking policies with your distributor before purchase. |

| 3. What does the standard installation process for a 3D dental imaging system include, and is room shielding assessment part of the service? | Professional installation includes site evaluation, machine assembly, calibration, DICOM integration, and radiographic testing. Lead-lined walls, protective barriers, and compliance with local radiation safety codes (e.g., NCRP Report No. 177 in the U.S.) are the clinic’s responsibility. However, most manufacturers offer optional pre-installation radiation site surveys and room design consultation. Installation typically takes 1–2 business days and must be performed by certified biomedical engineers. |

| 4. What is the standard warranty coverage for 3D dental imaging machines in 2026, and does it include the detector and X-ray tube? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and technical support. As of 2026, all major OEMs include the flat-panel detector and X-ray tube under warranty, provided usage logs show adherence to recommended exposure protocols and preventive maintenance. Extended warranty options (up to 5 years) are available and strongly advised due to the high replacement cost of core components (detector: $8,000–$15,000). |

| 5. How are software updates and service support handled post-warranty, and are they included in the initial cost? | Basic software updates (security, bug fixes) are typically free for the life of the device. Feature upgrades (e.g., AI-driven implant planning, cephalometric analysis) require a service contract. Post-warranty, clinics must enroll in an Annual Service Agreement (ASA), averaging $2,500–$4,500/year, which includes preventive maintenance, priority support, and discounted repair rates. Confirm software licensing terms and update frequency before procurement. |

Note: All specifications and policies are subject to change based on regional regulations and manufacturer terms. Consult your equipment supplier for up-to-date technical documentation.

Need a Quote for 3D Dental Imaging Machine Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160