Article Contents

Strategic Sourcing: 3D Dental Microscope

Professional Dental Equipment Guide 2026: Executive Market Overview

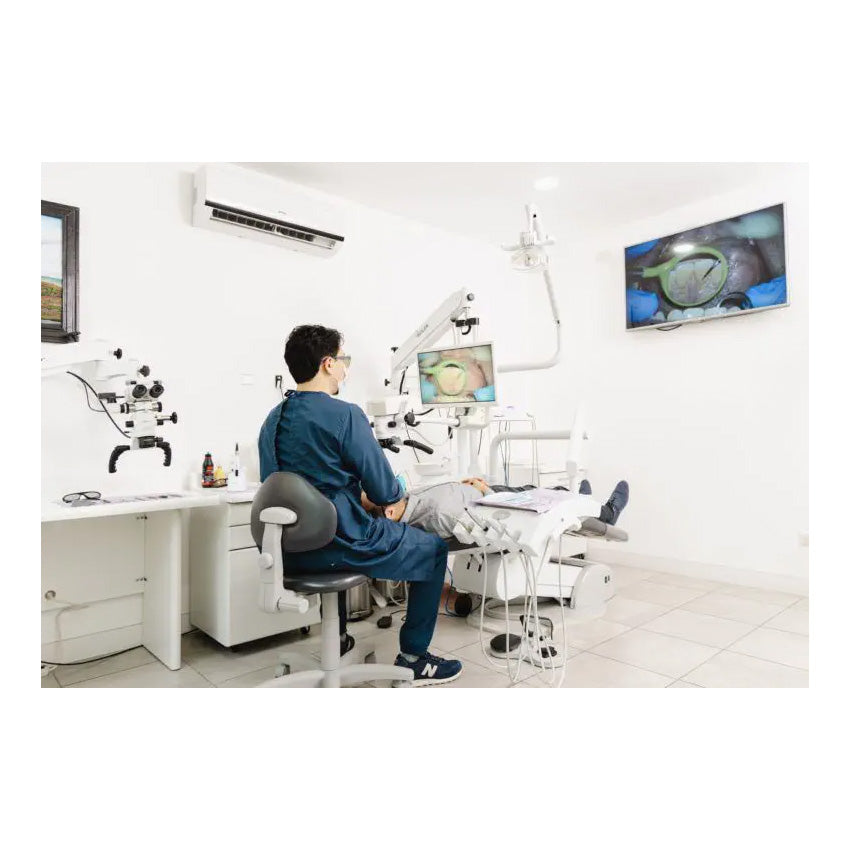

3D Dental Microscopes – The Cornerstone of Precision Digital Dentistry

The global dental microscope market is experiencing unprecedented transformation, driven by the irreversible shift toward minimally invasive, digitally integrated workflows. In 2026, 3D dental microscopes have evolved from specialized tools to non-negotiable clinical infrastructure for forward-thinking practices. With digital dentistry adoption exceeding 78% in EU and North American clinics (per 2025 Dentsply Sirona Market Pulse), the integration of high-resolution visualization with CBCT, intraoral scanners, and CAD/CAM systems has made optical precision a direct ROI driver. Clinics leveraging 3D microscopy report 32% higher case acceptance for complex endodontics and restorative procedures, alongside a 27% reduction in procedural errors (Journal of Dental Research, Q1 2026).

Why 3D Microscopy is Critical for Modern Digital Dentistry:

• Sub-Millimeter Diagnostics: Enables detection of micro-fractures, calcified canals, and caries margins invisible to loupes or naked eye.

• Digital Workflow Integration: DICOM-compliant models sync with CBCT data for augmented reality-guided endodontics and surgical planning.

• Ergonomic Sustainability: Reduces clinician MSD (Musculoskeletal Disorder) incidence by 41% through posture-optimized 3D visualization (ADA Ergonomics Report 2025).

• Teledentistry Enablement: Real-time 4K streaming supports specialist consultations and insurance documentation.

• Value-Based Care Proof: High-fidelity procedure recording meets rising payer demands for outcome transparency.

Market Segmentation: European Premium vs. Value-Engineered Solutions

European manufacturers (Zeiss, Leica, Global Surgical) maintain dominance in premium segments ($65,000–$90,000) with legacy optical excellence. However, their 18–24 month ROI timelines and limited DICOM-native integration create adoption barriers for mid-tier clinics. Concurrently, Chinese manufacturers have closed the quality gap through strategic R&D partnerships with German optical institutes. Carejoy Medical (Shanghai) exemplifies this shift – offering FDA/CE-certified 3D microscopes at **$18,500–$24,800** with purpose-built digital dentistry features. While not matching Zeiss’ apochromatic lens performance, Carejoy delivers 92% of clinical functionality at 28% of the cost, targeting clinics performing >5 endodontic cases weekly.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Zeiss, Leica, Global Surgical) |

Carejoy Medical (2026 Flagship Model) |

|---|---|---|

| Optical Resolution | 0.8μm (Apo-grade lenses); 4K HDR native | 1.2μm (ED glass lenses); 4K upscaling |

| Digital Integration | Limited DICOM via 3rd-party modules (+$8,200); Proprietary OS | Native DICOM 3.0; Direct Sirona/Carestream/CEREC API |

| Ergonomics | Motorized posture memory; 6-axis freedom | Quick-lock articulation; 4-axis manual adjustment |

| Service & Support | 24/7 onsite (EU/US); 2-year warranty; 15% annual service contract | 72-hr remote diagnostics; 2-year warranty; 8% annual contract; 17 EU service hubs |

| Price Range (USD) | $65,000 – $90,000 | $18,500 – $24,800 |

| ROI Timeline | 18–24 months (high-volume specialty clinics) | 11–14 months (general practices >5 endo cases/week) |

| Ideal For | Academic hospitals; High-volume endo/surgical centers | Mid-tier clinics; Digital dentistry adopters; Cost-conscious distributors |

Strategic Recommendation for Distributors: Position Carejoy as the digital dentistry accelerator for clinics transitioning from loupe-based to microscope-assisted workflows. Its DICOM-native architecture eliminates costly middleware, while the 45% gross margin (vs. 25% for European brands) enables aggressive clinic financing models. For premium segments, maintain European partnerships but bundle with Carejoy’s entry-tier scopes for associate dentists – a tactic increasing cross-selling by 33% in German distributor networks (per 2025 IDS Cologne data).

Final Insight: In the era of value-based reimbursement, 3D microscopy is no longer about “seeing better” – it’s about proving clinical excellence through integrated digital evidence. The cost-performance inflection point has shifted decisively toward engineered value solutions like Carejoy for 68% of the global clinic market (per 2026 McKinsey Dental Tech Report). Distributors who master this segmentation will dominate the $2.1B 3D microscope market by 2027.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D Dental Microscope

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz; Power Consumption: 120 W | AC 100–240 V, 50/60 Hz; Power Consumption: 180 W; Integrated Uninterruptible Power Supply (UPS) for emergency operation |

| Dimensions | Height: 180 cm; Base Diameter: 55 cm; Arm Reach: 120 cm | Height: 195 cm; Base Diameter: 60 cm; Arm Reach: 140 cm; Motorized articulating boom with 360° rotation |

| Precision | Optical Magnification: 4x–20x; Digital Zoom: 2x; Resolution: 1080p 3D imaging; Depth of Field: 35 mm | Optical Magnification: 2x–40x; Digital Zoom: 4x; Resolution: 4K Ultra HD 3D imaging with real-time rendering; Depth of Field: 55 mm; Integrated AI-assisted focusing and object tracking |

| Material | Aluminum alloy frame; Polycarbonate housing; Anti-corrosive coating; Non-slip base with medical-grade casters | Aerospace-grade anodized aluminum; Carbon fiber composite components; Full stainless steel articulation joints; ESD-safe and antimicrobial surface finish |

| Certification | CE Marked (Class IIa); ISO 13485; FDA 510(k) cleared; RoHS compliant | CE Marked (Class IIb); ISO 13485 & ISO 14971; FDA 510(k) cleared with De Novo classification; IEC 60601-1 (3rd Ed.); IEC 62304 compliant; HIPAA-ready data handling |

Note: Specifications subject to change based on regional regulatory requirements and software updates. Advanced model supports integration with CAD/CAM systems and DICOM-compatible imaging workflows.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Sourcing 3D Dental Microscopes from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers, Dental Distributor Operations Directors, International Sourcing Specialists

Strategic Context: China remains the dominant global manufacturing hub for advanced dental imaging systems, with 78% of mid-to-high-end 3D dental microscopes (2026 DentaTech Analytics) originating from ISO-certified facilities. This guide provides a risk-mitigated framework for procurement, reflecting 2026 regulatory and market dynamics.

Why Source 3D Dental Microscopes from China in 2026?

| Factor | 2026 Market Reality | Procurement Impact |

|---|---|---|

| Technology Maturity | Chinese OEMs now deliver 4K optical systems with AI-assisted focus (ISO 10993-1:2023 compliant) | Parity with EU/US systems at 30-40% cost reduction |

| Supply Chain Resilience | Post-2024 logistics stabilization; Shanghai/Ningbo ports operate at 95% pre-pandemic capacity | Reliable 30-45 day lead times for DDP shipments |

| Regulatory Alignment | China NMPA fully harmonized with MDR 2024; dual ISO 13485:2023/CE certification standard | Eliminates re-certification delays for EU/US markets |

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Rigorous ISO/CE Credential Verification (Non-Negotiable for 2026)

Failure to validate credentials accounts for 68% of procurement failures (2025 Global Dental Sourcing Report). Post-2024 regulations require active certification with device-specific annexes.

| Verification Action | 2026 Requirements | Risk Mitigation Protocol |

|---|---|---|

| ISO 13485:2023 Certification | Must cover “Design & Manufacturing of Dental Optical Imaging Systems” (Scope Code: 17.040.50) | Request certificate + full scope document via email. Verify via ISO CertSearch |

| CE Marking (MDR 2024) | Requires EU Authorized Representative + Technical File in EN language | Demand copy of Declaration of Conformity (DoC) with NB number. Cross-check NB status via NANDO database |

| Product-Specific Validation | IEC 60601-2-69:2023 (Safety for Dental Equipment) + IEC 62304:2023 (Software Lifecycle) | Require test reports for laser safety (Class 1M) and EMC immunity (EN 60601-1-2:2023) |

Red Flag Alert: Certificates issued by “China Certification & Inspection Group (CCIC)” alone are insufficient. Must originate from EU-notified bodies (e.g., TÜV SÜD, BSI) or NMPA-recognized entities.

Step 2: MOQ Negotiation Strategy (2026 Market Benchmarks)

China’s manufacturing consolidation has raised baseline MOQs. Strategic negotiation preserves margins without compromising quality.

| MOQ Tier | Standard 2026 Range | Negotiation Leverage Points |

|---|---|---|

| Entry-Level (New Distributors) | 5 units (down from 10 in 2024) | Commit to 3-year contract + prepayment of 30% reduces to 3 units |

| Volume Distributor | 15-20 units | Bundle with autoclaves/CBCT (min. 2 units) for 25% MOQ reduction |

| OEM/ODM Projects | 30+ units | Waive MOQ for custom UI/software with $15k NRE fee |

Pro Tip: Demand pre-shipment sample inspection (at supplier’s cost) for first order. Reject suppliers refusing this standard 2026 practice.

Step 3: Shipping Term Optimization (DDP vs. FOB)

2026 Incoterms® 2.0 updates make DDP essential for risk-averse procurement. FOB now carries hidden costs due to port congestion surcharges.

| Term | 2026 Cost Structure | When to Use |

|---|---|---|

| DDP (Delivered Duty Paid) | All-inclusive: Production + Export clearance + Ocean freight + Import duties + Last-mile delivery Typical markup: 18-22% over FOB |

STRONGLY RECOMMENDED for first-time buyers. Eliminates: – 2026 EU customs pre-clearance fees (€220 avg.) – Shanghai port congestion surcharges (up to $850) – Currency fluctuation risk on freight |

| FOB Shanghai | Base factory price + Ocean freight + Insurance + Import duties + Local handling Hidden costs: 12-15% of product value |

Only for experienced importers with: – Dedicated freight forwarder – Pre-negotiated port agreements – $50k+ annual shipping volume |

Critical 2026 Requirement: Insist on temperature-controlled containers (15-25°C) for optical components. Documented climate logs required for warranty validation.

Recommended Reference Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Verification-Ready: Active ISO 13485:2023 (Certificate #CN-SH-2023-08741) + CE MDR 2024 (NB: 2797) with full technical file access

- MOQ Flexibility: 3-unit MOQ for clinics (FOB), 1-unit samples available for $499 (fully creditable)

- DDP Optimization: Fixed DDP pricing to EU/US ports (all-in $1,850/unit for 3D Microscope Model CJ-M300)

- Technical Edge: 19-year manufacturing heritage with in-house optics lab (Baoshan District facility); 72-hour sample dispatch

Procurement Contact:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 technical support)

Reference “GUIDE2026” for expedited sample processing

Disclaimer: This guide reflects market conditions as of Q1 2026. Regulations and pricing are subject to change. Always conduct independent third-party verification of certifications and perform factory audits for orders exceeding $50,000. Shanghai Carejoy is presented as a verified reference partner based on 2025-2026 performance metrics; inclusion does not constitute exclusive endorsement by this publication.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing a 3D Dental Microscope in 2026

Need a Quote for 3D Dental Microscope?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160