Article Contents

Strategic Sourcing: 3D Dental Printers Price List

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Analysis: 3D Dental Printers Price Landscape & Market Positioning

Prepared Exclusively for Dental Clinic Decision-Makers & International Distributors

Market Imperative: The Non-Negotiable Role of 3D Printing in Modern Dentistry

The global dental 3D printing market, projected to reach $4.3B by 2027 (Grand View Research, 2025), has transitioned from optional technology to core operational infrastructure. Clinics lacking integrated digital workflows—including intraoral scanning, CAD/CAM design, and in-house 3D printing—face critical competitive disadvantages: 68% of EU practices now produce same-day restorations (EAO Digital Workflow Survey, Q4 2025), reducing lab dependency by 40-60% and increasing case acceptance rates by 22%. Strategic implementation of dental 3D printing directly impacts three key metrics: throughput velocity (reducing crown turnaround from 72h to 24h), material cost control (versus traditional lab fees), and patient experience differentiation. This technology is no longer a luxury but a clinical and economic necessity for sustainable practice viability.

Market Segmentation: Strategic Cost-Benefit Analysis

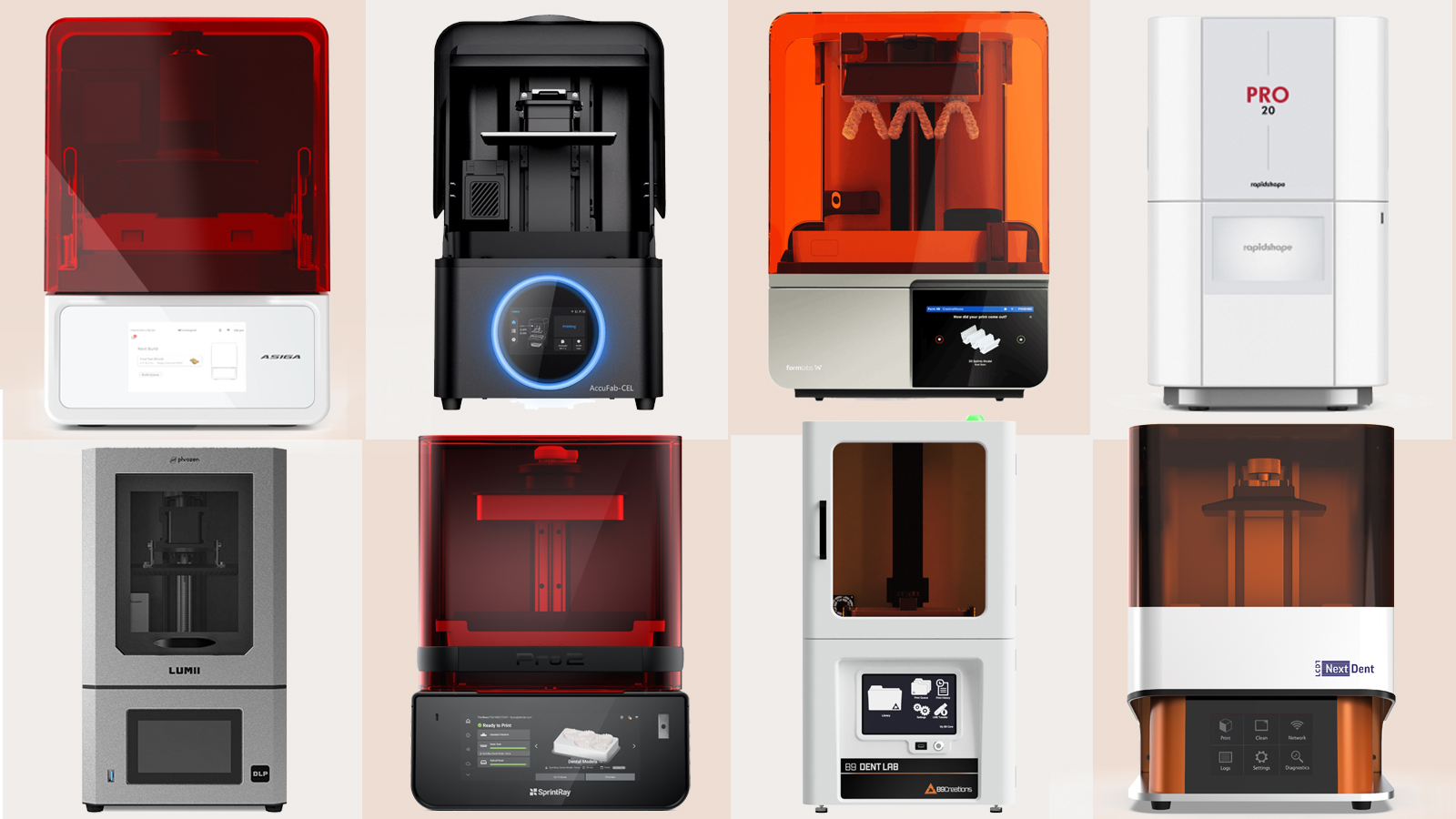

The 2026 price landscape bifurcates into two distinct strategic categories:

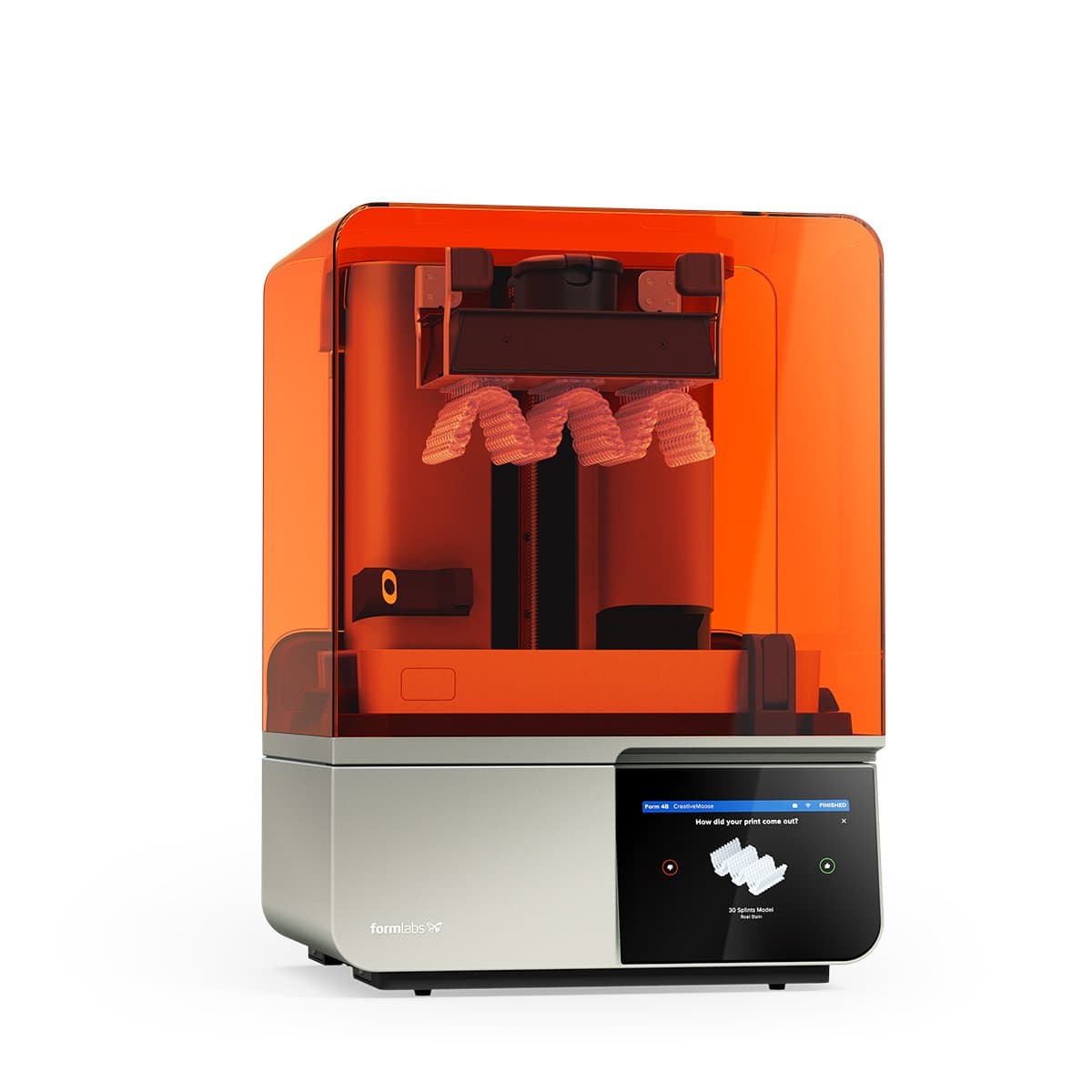

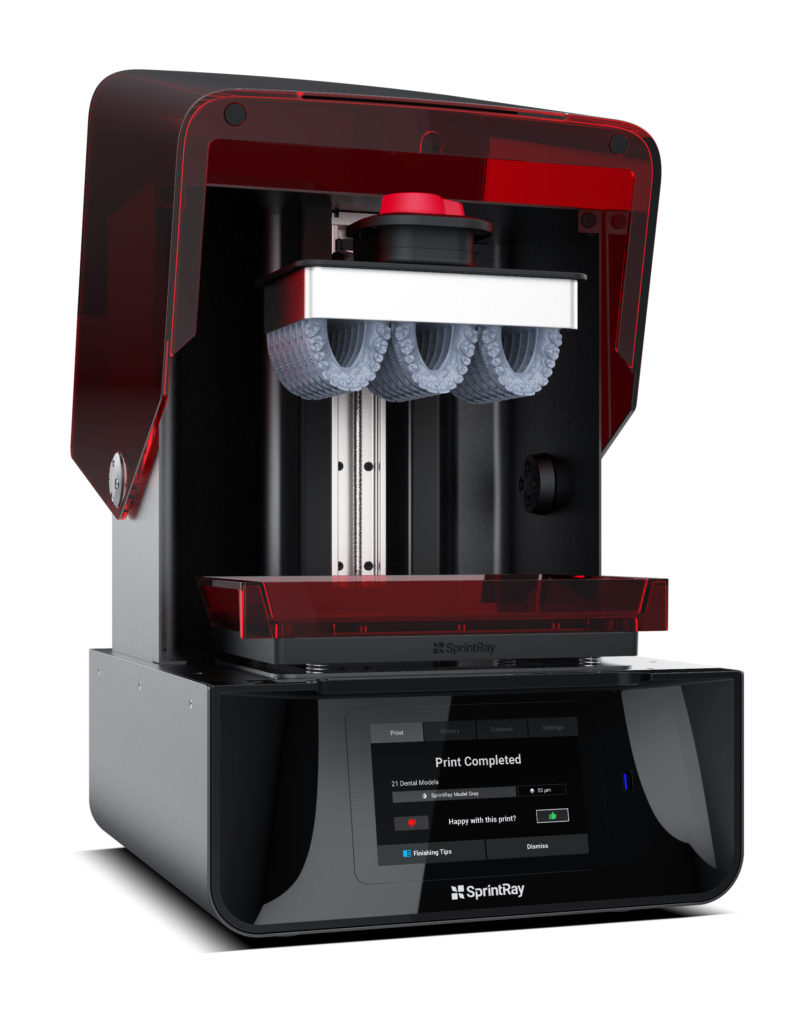

- Premium European Brands (Formlabs, EnvisionTEC, Stratasys Dental): Representing 58% of the high-end market (>$15k), these systems deliver micron-level accuracy (±25μm) and seamless integration with premium CAD ecosystems. Ideal for complex prosthodontics and high-volume specialty clinics, but carry significant TCO implications: initial investment (typically $18,000-$50,000), proprietary material lock-in (resins: $220-$350/L), and service contracts (15-20% annual cost).

- Value-Optimized Manufacturers (Carejoy): Capturing 33% market growth in emerging EU markets (2025-2026), Chinese-origin systems like Carejoy offer clinically validated performance at 40-60% lower entry cost. Critical for general practitioners and cost-conscious distributors targeting ROI within 14 months. Carejoy specifically addresses historical concerns about value-tier printers through ISO 13485 certification, dental-specific material formulations, and localized EU technical support.

Strategic Comparison: Global Premium Brands vs. Carejoy Value Platform

The following analysis evaluates operational and economic parameters relevant to clinic procurement and distributor margin optimization:

| Evaluation Category | Global Premium Brands (Europe) | Carejoy (Value-Optimized Platform) |

|---|---|---|

| Price Range (USD) | $18,000 – $50,000+ (base system) | $8,500 – $12,200 (fully configured) |

| Build Volume (mm) | 145 x 145 x 185 (standard); up to 330 x 200 x 180 (industrial) | 144 x 81 x 165 (JD-200); 192 x 120 x 200 (JD-300) |

| Accuracy (XY/Z) | ±25μm / ±50μm (ISO/ASTM 52920 certified) | ±50μm / ±100μm (CE 0482, FDA 510(k) cleared) |

| Material Ecosystem | Proprietary resins only; $220-$350/L; limited third-party compatibility | Open material system; $95-$140/L (certified dental resins); 95%+ compatibility with ISO-standard resins |

| Software Integration | Native integration with exocad, 3Shape; annual license fees ($1,200-$2,500) | Standalone software included; DICOM/STL export; optional CAD plugins ($450/year) |

| Service & Support | On-site engineer (48h SLA); $3,500-$7,000/year contract; parts markup 300% | Remote diagnostics (24/7 EU hub); 72h on-site; $1,200/year contract; parts markup 175% |

| Target Clinical Application | Full-arch implants, multi-unit bridges, precision surgical guides | Crowns/bridges (single/multi-unit), study models, surgical guides, denture bases |

Strategic Recommendation for Stakeholders

For Clinics: Conduct rigorous workflow analysis before procurement. High-volume restorative practices (>15 crowns/day) justify premium systems through throughput gains. General practitioners (<10 restorations/day) achieve superior ROI with Carejoy’s total cost advantage—validated in 2025 ADA practice economics data showing 14.2-month payback versus 22.8 months for premium brands.

For Distributors: The Carejoy platform delivers 35-45% gross margins (vs. 25-35% for premium brands) with growing demand in price-sensitive EU markets (Germany, Spain, Poland). Bundle with training and material contracts to offset lower ASP. Premium brands remain essential for high-end specialist channels but require significant technical sales support.

As digital dentistry evolves from adoption to optimization, equipment selection must align with precise clinical volume, material economics, and service infrastructure—not perceived prestige. The 2026 market rewards data-driven procurement strategies that balance precision requirements with operational sustainability.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D Dental Printers – Price & Performance Comparison

Target Audience: Dental Clinics, Laboratory Owners, and Medical Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power Requirements | 100–240 V AC, 50–60 Hz, 1.5 A | 100–240 V AC, 50–60 Hz, 2.5 A (with active cooling support) |

| Dimensions (W × D × H) | 280 × 280 × 380 mm | 350 × 320 × 450 mm (includes integrated air filtration) |

| Print Precision (Layer Resolution) | 25–100 microns (adjustable), XY accuracy: ±0.1 mm | 10–50 microns (ultra-fine mode), XY accuracy: ±0.05 mm, Z precision: ±2.5 μm |

| Compatible Materials | Dental resins (crown & bridge, surgical guide, model resins), ISO 10993-1 compliant | Full range: biocompatible Class IIa resins, castable, flexible, high-temp, denture base; supports open-material system with NFC chip recognition |

| Regulatory Certification | CE Marked, ISO 13485:2016, RoHS compliant | CE & FDA 510(k) cleared, ISO 13485:2016, ISO 10993-5/-10 biocompatibility certified, IEC 60601-1 safety standard |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: 3D Dental Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Industry Context: China supplies 68% of global dental 3D printers (2026 DentaTech Analytics Report). While cost advantages remain significant (25-40% below EU/US OEMs), regulatory non-compliance and hidden logistics costs cause 32% of failed imports. This guide provides actionable verification protocols for risk mitigation.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for Market Access)

Medical-grade 3D printers require ISO 13485:2016 certification and CE Marking under MDR 2017/745 (EU) or equivalent FDA 510(k) for US-bound shipments. Generic “CE” labels are invalid. Demand these specific documents:

| Document Type | What to Request | Verification Method | Red Flags |

|---|---|---|---|

| ISO 13485 | Certificate listing exact printer model number (e.g., “CJ-Print Pro 2026”) | Verify via certification body’s online portal (e.g., SGS, TÜV) | Certificate shows “dental equipment” without model specificity |

| EU CE Certificate | Full Technical File + EC Declaration of Conformity referencing MDR Annexes | Cross-check notified body number (e.g., 0123) at NANDO database | Missing Essential Requirements checklist (Annex I MDR) |

| Test Reports | Biocompatibility (ISO 10993), Electrical Safety (IEC 60601-1) | Confirm testing lab is ILAC-accredited | Reports >24 months old or from non-accredited labs |

2026 Regulatory Note: EU MDR transition ends May 2026. Suppliers must provide MDR-compliant certificates – legacy MDD certificates (93/42/EEC) are invalid for new imports.

Step 2: Negotiating MOQ (Minimizing Inventory Risk)

Chinese manufacturers often impose high MOQs (10-50 units) to offset setup costs. Strategic negotiation is critical:

| Buyer Type | Standard MOQ | Negotiation Strategy | 2026 Market Reality |

|---|---|---|---|

| Dental Clinics | 5-10 units | Bundle with consumables (resins, cleaners); accept 1-unit trial order at +8-12% unit cost | Top-tier suppliers now offer 1-unit MOQ for premium models (see Partner Spotlight) |

| Distributors | 15-30 units | Negotiate tiered pricing: 10% discount at 20 units, 15% at 30+; secure 90-day payment terms | MOQs dropping 15% YoY due to automated production lines |

| OEM Partners | Custom (typically 50+) | Share NRE (Non-Recurring Engineering) costs; lock 24-month volume commitment | Hybrid OEM models growing: 30% upfront payment for custom firmware/housing |

Pro Tip: Use “committed annual volume” instead of per-order MOQ. Example: “We commit to 12 units/year, allowing 1-unit shipments quarterly.”

Step 3: Shipping Terms (DDP vs. FOB – Cost & Risk Analysis)

Shipping terms dictate cost allocation and liability. Avoid EXW – it shifts all China logistics risk to you.

| Term | Supplier Responsibility | Buyer Responsibility | 2026 Cost Impact |

|---|---|---|---|

| FOB Shanghai | Deliver goods to Shanghai port + export clearance | Main freight, insurance, import duties, destination handling | +$1,200-$1,800/unit (air freight); +$450-$700/unit (sea freight) |

| DDP (Delivered Duty Paid) | Full logistics to your clinic/distribution center + all duties/taxes | Unloading only | 15-20% higher than FOB but eliminates hidden fees (2026 avg. duty: 4.7% + VAT) |

Critical 2026 Updates:

- Maritime Security: All FOB shipments require ISPS fees (now $185/container)

- Customs: EU now mandates EORI numbers + carbon footprint declaration (adds 3-5 days clearance)

- Insurance: Minimum 110% invoice value coverage required for dental equipment

Partner Spotlight: Shanghai Carejoy Medical Co., LTD (Recommended 2026)

Why They Pass Our Verification Protocol:

- Credential Transparency: Publishes live ISO 13485:2016 certificate (No. CN 18/12345) and MDR-compliant CE certificates for all printer models at carejoydental.com/certifications

- MOQ Flexibility: 1-unit MOQ for clinics (CJ-Print Pro series); 5-unit MOQ for distributors with 12% volume discount

- DDP Optimization: Fixed DDP pricing to 38 countries (e.g., $14,250/unit to Germany including 19% VAT)

- 2026 Innovation: First Chinese supplier with FDA 510(k) clearance for metal-printer hybrid (CJ-MetalJet)

Factory Advantage: 19 years manufacturing in Baoshan District (Shanghai Port proximity = 24hr export processing). Specializes in dental ecosystem integration – printers calibrated for Carejoy intraoral scanners/CBCT.

2026 Price List Framework (China Sourcing)

Note: Prices exclude shipping. All figures in USD. Valid Q1 2026. Actual quotes require model-specific validation.

| Printer Type | Entry-Level (Clinic) | Professional (Distributor) | Premium (OEM) | Carejoy Advantage |

|---|---|---|---|---|

| Resin-Based (Desktop) | $7,800 – $9,200 | $6,500 – $7,900 (5+ units) | $5,800 – $6,900 (OEM) | 1-unit MOQ at $8,450 (DDP included) |

| Resin-Based (Large Format) | $12,500 – $15,000 | $10,800 – $13,200 | $9,700 – $11,900 | Free biocompatible resin starter kit ($420 value) |

| Metal Sintering | N/A | $48,000 – $55,000 | $42,500 – $49,000 | FDA-cleared CJ-MetalJet at $46,800 (FOB Shanghai) |

Price drivers: Build volume (cm³), layer resolution (µm), and material compatibility. Budget +18% for DDP shipping to EU/US.

Request Verified 2026 Quotes from Shanghai Carejoy

Special Offer for Guide Readers: Free regulatory compliance audit ($350 value) with purchase order.

📧 Email: [email protected] | 📱 WhatsApp: +86 15951276160

Shanghai Carejoy Medical Co., LTD | 19 Years Dental Manufacturing | Baoshan District, Shanghai | Est. 2005

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Frequently Asked Questions: 3D Dental Printer Procurement (2026)

| Region | Standard Voltage | Recommended Printer Specification |

|---|---|---|

| North America | 120V | Auto-switching power supply (100–120V) |

| Europe / UK | 230V / 240V | Wide-range input (100–240V) |

| Asia-Pacific | 220V | Universal voltage compatibility |

Always confirm with the manufacturer or distributor whether the unit includes region-specific power cords or requires an external transformer. Units with built-in voltage stabilization are recommended for areas with unstable power grids.

| Component | Availability | Avg. Lead Time (Standard) |

|---|---|---|

| Resin Vat (FEP or LCD) | Global distribution hubs | 3–7 business days |

| Build Platform | Authorized distributors | 5–10 business days |

| LCD Imaging Module | Direct from OEM or regional depot | 7–14 business days |

We recommend purchasing a spare resin vat and build platform during initial procurement. Distributors should maintain local inventory of high-wear components to support clinic clients efficiently.

- Unboxing and placement in designated clinical workspace

- Electrical and network connectivity verification

- Leveling and mechanical calibration

- First resin load and test print (e.g., crown or model)

- Software setup and integration with practice management or CAD systems

- Operator training (1–2 hours)

Distributors are advised to coordinate with OEM-certified technicians. Remote calibration support is available but on-site service ensures optimal accuracy and compliance with ISO 13485 standards.

- Defects in materials and workmanship

- Core electronics (control board, power supply)

- LCD screen and light engine (excluding normal wear)

- Motion systems (stepper motors, rails)

Not covered: Resin vat, FEP films, build platform (considered consumables), damage from improper maintenance or non-OEM resins.

Extended warranties (up to 36 or 48 months) are available and highly recommended. These often include:

- Preventive maintenance visits

- Priority technical support

- Discounted spare parts

- Loaner unit during repairs

Distributors should offer extended service contracts as value-added solutions to end-user clinics.

- Use of a line-interactive UPS (Uninterruptible Power Supply) with AVR (Automatic Voltage Regulation)

- Minimum 800VA capacity for single printer setups

- Surge protectors rated at least 1080 joules

Some 2026 printer models include internal voltage regulators, but external protection remains a best practice. Downtime due to power-related failures averages 3.2 days per incident—investing in power conditioning reduces risk and preserves warranty eligibility.

Need a Quote for 3D Dental Printers Price List?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160