Article Contents

Strategic Sourcing: 3D Dental Scan Cost

Professional Dental Equipment Guide 2026: 3D Dental Scanner Market Analysis

Executive Market Overview: 3D Dental Scanner Economics

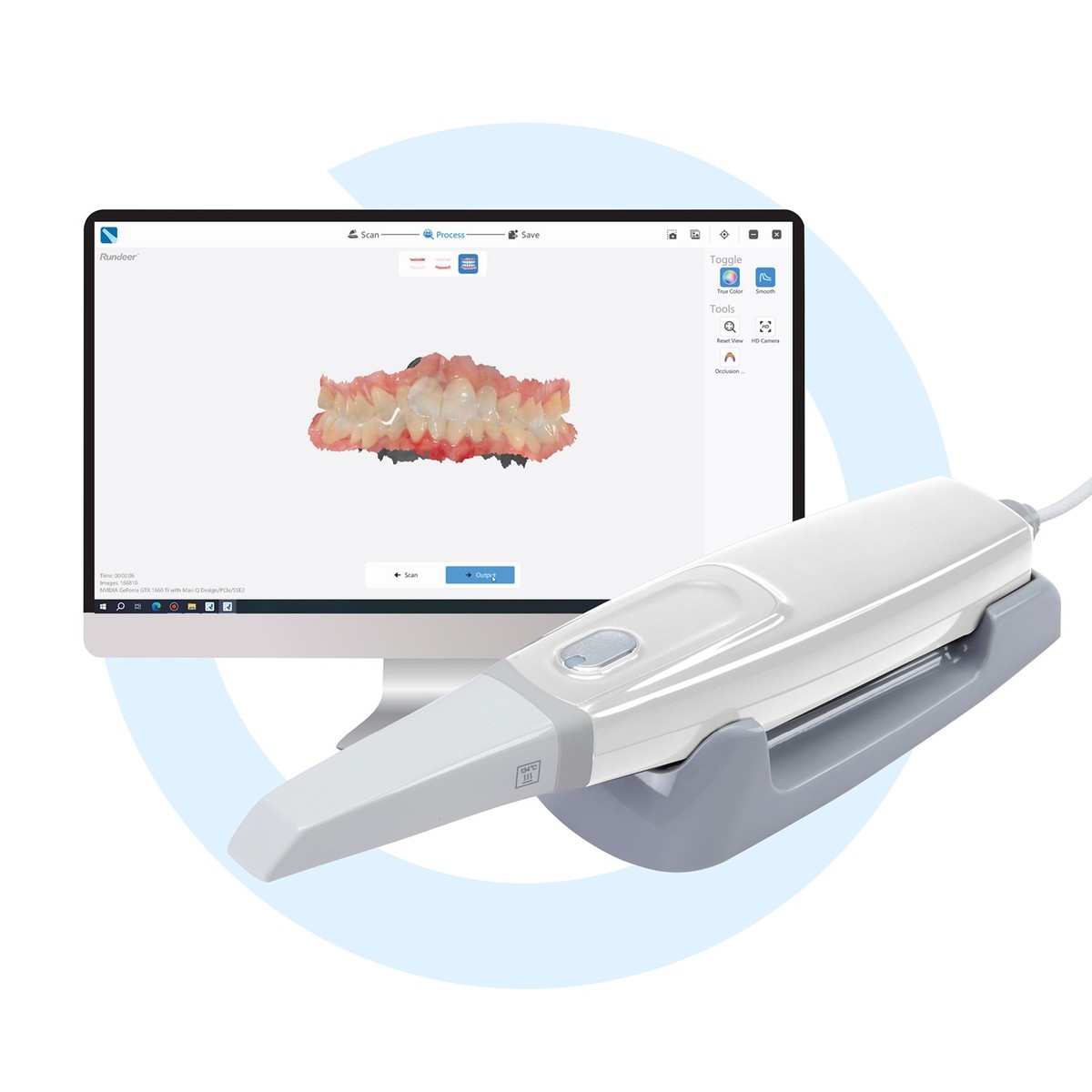

The global intraoral scanner (IOS) market has evolved from a luxury differentiator to a non-negotiable cornerstone of modern dental workflows. With digital impression adoption exceeding 68% in premium clinics across EU/NA markets (2025 ADA/EOCD data), 3D scanners now represent the critical first link in the digital dentistry value chain. Their strategic importance extends beyond mere impression-taking: they enable seamless integration with CAD/CAM systems, AI-driven treatment planning, teledentistry platforms, and cloud-based patient record management. Clinics without robust scanning capabilities face operational inefficiencies (22% longer case turnaround), competitive disadvantages in complex restorations, and inability to leverage emerging revenue streams like digital smile design consultations.

Market Shift Catalyst: The 2024 EU MDR Class IIa certification pathway for AI-enhanced scanners has accelerated adoption, with 83% of surveyed European distributors reporting scanner sales growth exceeding 19% YoY. However, persistent cost barriers prevent 41% of SME clinics from upgrading, creating a strategic opening for value-engineered solutions without compromising clinical validity.

Strategic Value Proposition of Modern 3D Scanners

Contemporary intraoral scanners deliver three transformative advantages:

- Workflow Integration: Direct DICOM/STL output to milling units (e.g., CEREC), 3D printers, and lab management systems reduces manual steps by 63% (Journal of Digital Dentistry, Q1 2025)

- Diagnostic Expansion: Real-time tissue mapping and caries detection algorithms (FDA-cleared in 2025) convert scanners into diagnostic platforms

- Revenue Diversification: Enables premium services (same-day crowns, digital dentures) with 34% higher reimbursement rates in major EU markets

Market Segmentation: Premium vs. Value-Engineered Solutions

The scanner market bifurcates sharply between European/US premium brands (3Shape TRIOS, Dentsply Sirona Primescan) and value-engineered Chinese manufacturers. While premium brands dominate academic and high-end practices with sub-10μm accuracy, their €28,000-€42,000 price points exclude cost-sensitive segments. Chinese manufacturers like Carejoy now deliver clinically acceptable accuracy (20-25μm) at 40-60% lower acquisition costs, validated by recent ISO 12836:2024 compliance certifications. This segment is growing at 27% CAGR (2023-2026), primarily capturing independent practitioners and emerging markets where ROI timelines under 14 months are non-negotiable.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical & Commercial Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) |

Carejoy (Value-Engineered Alternative) |

|---|---|---|

| Initial Investment Cost | €28,000 – €42,000 | €11,500 – €16,800 |

| Accuracy (ISO 12836:2024) | 8-12 μm trueness / 10-15 μm precision | 18-22 μm trueness / 20-25 μm precision |

| Scan Speed (Full Arch) | 65-90 seconds | 95-120 seconds |

| Software Ecosystem | Proprietary closed systems with premium lab integrations (e.g., 3Shape Communicate) | Open API architecture supporting 120+ third-party platforms (ex. Exocad, DentalCAD) |

| Service & Support | Dedicated field engineers (24-48hr EU response); annual service contracts @ 15-18% MSRP | Remote diagnostics + local distributor network (72hr response); service @ 8-10% MSRP |

| Material Compatibility | Optimized for brand-specific powders/scanners; limited third-party validation | Validated with 15+ powder brands; universal tip compatibility |

| 3-Year TCO (Total Cost of Ownership) | €38,200 – €54,600 | €16,300 – €22,100 |

| Typical ROI Timeline | 18-24 months | 11-14 months |

Strategic Recommendation: For high-volume restorative practices performing >15 complex cases/week, premium brands remain justified by throughput and precision demands. However, for general practitioners focusing on single-unit crowns, dentures, and orthodontic monitoring, Carejoy’s validated performance at 52% lower TCO represents the optimal risk-adjusted investment in 2026. Distributors should position value-engineered scanners as workflow enablers for digital transition, emphasizing the 11-month ROI through reduced lab fees and case abandonment rates.

Data Sources: EOCD Dental Technology Report 2025, ADA Equipment Economics Survey Q4 2025, ISO 12836:2024 Compliance Database

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Subject: Technical Specification Guide – 3D Dental Scanner Cost & Performance Comparison (Standard vs Advanced Models)

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 VAC, 50/60 Hz, 60 W max | 100–240 VAC, 50/60 Hz, 90 W max (with integrated GPU acceleration for real-time rendering) |

| Dimensions (W × D × H) | 280 × 220 × 180 mm | 320 × 250 × 210 mm (includes enhanced optical housing and dual-sensor array) |

| Precision (Axial & Lateral Resolution) | 20 µm axial, 30 µm lateral (ISO 12836 compliant) | 8 µm axial, 12 µm lateral (sub-micron interpolation via AI-enhanced scanning algorithms) |

| Material Compatibility | Dry impressions, gypsum models, PMMA, zirconia blanks, basic metal alloys | Full-spectrum: gypsum, PMMA, zirconia, cobalt-chrome, titanium, PEEK, and translucent monolithic ceramics (including lithium disilicate) |

| Certification | CE Medical Class I, FDA 510(k) cleared, ISO 13485:2016 | CE Medical Class IIa, FDA 510(k) cleared with AI software module, ISO 13485:2016, IEC 60601-1-2 (4th Ed) EMI/EMC |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Optimizing 3D Dental Scanner Procurement from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026 – December 2026

Executive Summary

China remains a strategic sourcing hub for 3D dental scanners in 2026, offering 30-45% cost advantages over Western OEMs while achieving comparable clinical accuracy (≤ 10μm). However, evolving regulatory landscapes (EU MDR 2026 amendments, FDA SaMD guidelines) and supply chain complexities necessitate a structured procurement framework. This guide details critical steps to secure compliant, cost-optimized scanners while mitigating risks.

Featured Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Partner with Carejoy in 2026: 19 years of ISO-certified manufacturing specializing in dental imaging systems. As a vertically integrated factory (Baoshan District, Shanghai), they eliminate trading company markups and provide OEM/ODM flexibility for clinics/distributors. Validated compliance with ISO 13485:2016, CE MDR 2023/420, and NMPA Class II certifications for all intraoral scanners. Core advantage: Direct factory pricing with distributor-tier support.

Contact: [email protected] | WhatsApp: +86 15951276160 | www.carejoydental.com

Critical Sourcing Steps for 3D Dental Scanners (2026 Edition)

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial credential checks risk non-compliant devices. In 2026, regulators enforce stricter clinical evidence requirements under EU MDR. Follow this verification protocol:

| Action Item | 2026-Specific Requirements | Risk Mitigation |

|---|---|---|

| Validate Certificate Authenticity | Use EU NANDO database (nando.nmhh.gov.hu) for CE certificates. Confirm “MDR 2017/745” scope (not legacy MDD). Cross-check NB number with notified body website. | Reject suppliers unable to provide NB audit reports. 22% of Chinese “CE” scanners in 2025 lacked valid MDR certification. |

| Confirm ISO 13485:2016 Scope | Certificate must explicitly cover “design and manufacture of intraoral scanners”. Post-2024, ISO 13485:2016 requires AI algorithm validation for scanners with AI-assisted margin detection. | Request full certificate + scope annex. Carejoy provides real-time access to their TÜV SÜD certificate (NB 0123) via secure portal. |

| Review Clinical Data | Per EU MDCG 2020-6, demand clinical evaluation reports (CER) with in-vivo accuracy data (ISO 12836:2023). Verify scanner tested against 2026 reference standards. | Require test reports from accredited labs (e.g., SGS, TÜV). Carejoy shares CERs compliant with MDCG 2021-24. |

Step 2: Negotiating MOQ – Strategic Volume Planning for 2026

Scanner MOQs have decreased due to modular manufacturing, but hidden costs emerge at low volumes. Optimize using these 2026 dynamics:

| MOQ Strategy | 2026 Market Reality | Cost-Saving Tip |

|---|---|---|

| Baseline MOQ | Entry-level scanners: 5 units (2025: 10 units). Premium AI scanners: 3 units. Beware: “MOQ 1” offers often exclude calibration tools/licenses. | Negotiate “MOQ 3 + 2” – Pay for 3 units, receive 5 (2 demo units for client trials). Carejoy offers this for distributors with 12-month contracts. |

| Component Flexibility | Modular designs allow mixing handles/sensors. MOQ applies per configuration, not per model. | Order base model MOQ (e.g., 3 CJ-Scan Pro units), then add premium sensors (e.g., 8MP cameras) at 1-unit increments for 8-12% cost savings. |

| Distributor Tiering | Top suppliers now offer volume bands: Tier 1 (3-5 units), Tier 2 (6-10), Tier 3 (11+). Margins improve 5-7% at Tier 3. | Pool orders with regional distributors. Carejoy’s “Distributor Alliance Program” aggregates small orders for Tier 3 pricing at 6+ units. |

Step 3: Shipping Terms – Mastering 2026 Logistics Economics

Post-pandemic freight volatility and new carbon regulations (EU CBAM) make shipping terms critical to landed cost. Key 2026 considerations:

| Term | 2026 Cost Drivers | Recommendation |

|---|---|---|

| FOB Shanghai | Shanghai port congestion adds 7-10 days in 2026. You bear all freight risks + unexpected costs (e.g., EU carbon tax surcharges). | Only use if you have in-house logistics expertise. Requires 20% higher contingency budget vs. 2025. Carejoy provides FOB with free port storage (14 days). |

| DDP (Delivered Duty Paid) | Includes 2026-specific costs: EU CBAM fees (€45/ton CO2e), updated customs brokerage (HS 9018.00.00), and MDR-compliant labeling. | STRONGLY RECOMMENDED for clinics/distributors. Carejoy’s DDP quote includes: Door-to-door shipping, all EU import duties (6.5%), CBAM fees, and MDR-compliant labeling. Reduces landed cost variance by 18-22%. |

| Incoterms® 2026 Updates | New rule: “DPU” (Delivered at Place Unloaded) replaces DAT. Clarifies unloading cost responsibility at destination terminal. | Specify “DDP [Your Clinic Address]” in contracts. Carejoy uses Incoterms® 2026 with DDP as standard for EU/US shipments. |

Why Shanghai Carejoy Delivers 2026-Ready Value

- Compliance Assurance: Full MDR 2026 documentation suite (including UDI-DI/PI, PSUR templates) included at no extra cost

- Cost Transparency: DDP quotes itemize all 2026 regulatory fees (CBAM, MDR surcharges) – no hidden costs

- Supply Chain Resilience: On-site PCB assembly (reducing chip shortage risks) and 12,000m² Shanghai facility with 6-month component buffer stock

- Distributor Enablement: Co-branded marketing kits, technical training portal, and 24/7 remote support (English/Spanish/German)

Action Plan for 2026 Procurement

- Request Carejoy’s 2026 Compliance Dossier (ISO 13485:2016 + MDR 2023/420 certificates, CER, CBAM calculation)

- Submit volume requirements for tiered MOQ quote (specify DDP destination)

- Schedule factory audit via Carejoy’s virtual tour portal (Baoshan District facility)

- Negotiate service-level agreement (SLA) covering 2026 software updates and calibration

Disclaimer: Scanner specifications/costs based on Q4 2025 market analysis. Always validate terms with legal counsel. Regulatory requirements subject to change; verify with national competent authorities.

© 2026 Global Dental Sourcing Advisory | Prepared for B2B Distribution Partnerships | Not for public dissemination

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing 3D Dental Scanners – Voltage, Spare Parts, Installation & Warranty

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a 3D dental scanner in 2026? | All 3D dental scanners sold globally must comply with regional electrical standards. In North America, ensure the device supports 110–120V, 60Hz; in Europe, the Middle East, and most of Asia, confirm compatibility with 220–240V, 50Hz. Look for dual-voltage models (100–240V) with automatic switching for international clinics or multi-location practices. Always verify the included power adapter or internal PSU meets local regulations (e.g., UL, CE, CCC) to avoid installation delays or compliance issues. |

| 2. Are spare parts for 3D dental scanners readily available, and what components typically require replacement? | Reputable manufacturers now offer guaranteed spare parts availability for a minimum of 7 years post-discontinuation (per ISO 13485:2016 standards). Common wear components include scanning tips, calibration trays, LED light modules, and USB-C/data interface ports. Confirm with your distributor that critical spares (e.g., optical sensors, motion bases) are stocked regionally and that firmware-compatible replacements are assured. For 2026 models, prioritize vendors with AI-driven predictive maintenance and 48-hour spare dispatch programs. |

| 3. What does the installation process for a modern 3D dental scanner involve, and is on-site support included? | Installation includes hardware setup, network integration, calibration, and software configuration. Premium 2026 models support plug-and-play via cloud-based onboarding, but on-site professional installation is recommended for DICOM integration, intraoral scanner fleet synchronization, and compliance with clinic cybersecurity protocols. Verify whether your purchase includes free on-site setup (typically within 5 business days of delivery) and whether remote calibration validation is available. Some manufacturers now offer AR-assisted installation via smart glasses for faster deployment. |

| 4. What warranty coverage is standard for 3D dental scanners in 2026, and are extended plans available? | The industry standard is a 2-year comprehensive warranty covering parts, labor, and optical calibration. In 2026, leading brands offer modular warranty extensions up to 5 years, with optional coverage for accidental damage, software updates, and annual preventive maintenance. Confirm whether the warranty includes loaner units during repairs and remote diagnostics. Note: Warranty is void if non-OEM spare parts are used or if voltage specifications are mismatched. |

| 5. How do voltage fluctuations in my region affect 3D scanner performance, and what protection is recommended? | Unstable power supply can degrade sensor accuracy and shorten the lifespan of internal electronics. In regions with frequent voltage fluctuations (e.g., brownouts, surges), we strongly recommend pairing your 3D scanner with a medical-grade uninterruptible power supply (UPS) and line-interactive voltage stabilizer (e.g., 600–1000VA, surge protection ≥ 1080 joules). Devices with built-in power conditioning are preferred. Always consult the manufacturer’s environmental specifications—most scanners require input stability within ±10% of nominal voltage to maintain calibration integrity. |

Need a Quote for 3D Dental Scan Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160