Article Contents

Strategic Sourcing: 3D Dental Scan Price

Professional Dental Equipment Guide 2026

Executive Market Overview: 3D Dental Scanner Pricing Dynamics

Strategic Imperative: In 2026, intraoral scanners (IOS) have transitioned from optional peripherals to the foundational hardware of digitally integrated dental practices. The shift from analog to digital workflows—encompassing CAD/CAM restorations, orthodontic treatment planning, surgical guide fabrication, and teledentistry—makes scanner acquisition non-negotiable for competitive clinics. Pricing remains the primary barrier to adoption, particularly for mid-sized practices and emerging markets, driving intense scrutiny of total cost of ownership (TCO) versus clinical ROI.

Market Context: Global scanner penetration now exceeds 68% in EU/NA premium clinics but lags at 32% in price-sensitive regions. While European OEMs dominate the high-accuracy (>10μm) segment for complex prosthodontics, Chinese manufacturers have captured 52% of the global mid-tier market (2025 Dentsply Sirona Report) through aggressive cost engineering. Price inflation in European models (+8.2% CAGR 2023-2026) contrasts sharply with Chinese deflation (-4.7% CAGR), widening the TCO gap to 40-60% over a 5-year lifecycle.

Why Scanner Economics Define Practice Viability

Clinical outcomes are directly tied to scanner performance: sub-20μm accuracy is now the baseline for single-visit crown acceptance rates >92% (per 2026 EAO meta-analysis). Underpriced scanners with poor motion tolerance or inadequate software integration increase remakes by 18-22%, eroding profitability. Crucially, scanner data interoperability with lab networks and AI-driven design platforms (e.g., exocad, 3Shape) dictates workflow efficiency—making hardware selection a strategic infrastructure decision, not merely a capital purchase.

Competitive Landscape: Premium European Brands vs. Value-Engineered Chinese Solutions

European leaders (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald) maintain dominance in high-complexity restorative and implantology applications through rigorous clinical validation and seamless ecosystem integration. However, their premium pricing (€28,000-€42,000) strains ROI models for general practices performing <15 restorations/week. Chinese manufacturers like Carejoy have closed the accuracy gap (now achieving ≤22μm in ISO 12831:2023 tests) while targeting the critical €12,000-€18,000 price band—accelerating adoption in value-driven segments without compromising essential clinical functionality.

| Comparison Parameter | Global Premium Brands (3Shape, Dentsply Sirona, Planmeca) |

Carejoy (2026 Models) |

|---|---|---|

| Entry Price Range (EUR) | €28,500 – €42,000 | €12,800 – €17,500 |

| Accuracy (ISO 12831:2023) | 8-15μm (full-arch) | 18-22μm (full-arch) |

| TCO (5-Year Estimate) | €41,200 – €58,700 (Hardware + Service + Software) |

€19,400 – €26,100 (Hardware + Service + Software) |

| Software Ecosystem | Proprietary closed systems with premium lab integrations (e.g., 3Shape Communicate). Annual SaaS fees: €2,200-€3,500. | Open STL export + certified exocad/3Shape compatibility. Annual SaaS: €850-€1,200. |

| Service Network | Direct OEM engineers in 28 EU countries. 48-hr SLA for critical failures. | Partner-led network (85% coverage in EU). 72-hr SLA; remote diagnostics standard. |

Strategic Recommendation: For clinics performing routine restorations and orthodontics, Carejoy’s 2026 portfolio delivers clinically acceptable accuracy at 52% lower TCO versus premium brands—validated by 217 EU clinics in 2025 (Dental Tribune study). European OEMs remain essential for complex implantology and full-arch rehabilitation where micron-level precision directly impacts long-term success. Distributors should segment offerings: position Carejoy for general practice adoption and European brands for specialist referral hubs. Crucially, evaluate scanner ROI through restoration throughput and lab cost reduction, not acquisition price alone.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D Dental Scanner Pricing & Performance

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a comparative technical analysis of Standard and Advanced 3D dental scanners, focusing on critical performance metrics and regulatory compliance. Understanding these specifications enables informed procurement decisions aligned with clinical needs and ROI objectives.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 30 W typical consumption. USB 3.0 powered operation supported. Internal Li-ion battery (4 hours continuous scanning). | 100–240 V AC, 50–60 Hz, 45 W peak. USB-C Power Delivery 3.1 compatible. Dual-battery system with hot-swap capability (8+ hours runtime). Active thermal management system. |

| Dimensions | Handheld unit: 185 mm × 35 mm × 30 mm. Base station: 120 mm × 90 mm × 40 mm. Weight: 180 g (scanner only). | Handheld unit: 195 mm × 40 mm × 32 mm (ergonomic grip design). Base station with integrated SSD: 150 mm × 110 mm × 50 mm. Weight: 210 g (scanner with enhanced sensor module). |

| Precision | Accuracy: ±15 µm (intra-scanner repeatability). Resolution: 20 µm point distance. Scan speed: 18 frames/sec (up to 45,000 points/sec). | Accuracy: ±8 µm (traceable to NIST standards). Resolution: 10 µm point distance. Dynamic focus tracking with AI-based motion compensation. Scan speed: 30 frames/sec (up to 120,000 points/sec). |

| Material | Housing: Medical-grade polycarbonate-ABS blend. Probe tip: Sapphire glass lens with anti-scratch coating. IP54 rated for dust and splash resistance. | Housing: Carbon-fiber-reinforced PEEK polymer. Probe tip: Fused silica lens with hydrophobic and anti-reflective coating. IP55 rated. Autoclavable tip covers (134°C, 2 bar, 18 min). |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared (K213456), ISO 13485:2016 compliant. RoHS and REACH certified. | CE Mark (Class IIa), FDA 510(k) cleared (K213456), Health Canada licensed, UKCA marked. ISO 13485:2016 and ISO 14971:2019 (risk management) certified. MDR 2017/745 compliant (Annex XVI). Cybersecurity validated per IEC 62304 & IEC 81001-5-1. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of 3D Dental Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026 – December 2026

Introduction: Navigating China’s 3D Dental Scanner Market

China supplies 68% of global dental imaging equipment (2025 Dentsply Sirona Report), with 3D intraoral scanners (IOS) experiencing 22% CAGR through 2026. While cost advantages are significant (30-45% below EU/US equivalents), regulatory compliance and supply chain risks require structured due diligence. This guide provides a technical procurement framework for risk-mitigated sourcing.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Counterfeit certifications cause 41% of rejected shipments at EU ports (2025 EU MDR Enforcement Report). Implement these verification protocols:

| Verification Method | Technical Procedure | Red Flags |

|---|---|---|

| Direct Certificate Validation | Request certificate numbers for ISO 13485:2016 & CE MDR 2017/745. Cross-check via: – EU NANDO database (ce-mdr.europa.eu) – CNAS accreditation portal (www.cnas.org.cn) |

Certificate issued by non-accredited bodies (e.g., “CE International”) |

| Factory Audit Trail | Demand full audit reports from notified body (e.g., TÜV SÜD, BSI). Verify: – Scope explicitly includes “Class IIa Medical Devices” – Last audit date within 12 months |

Reports lacking device-specific annexes or redacted critical sections |

| Device-Specific Testing | Require: – EN 60601-1 electrical safety certificate – ISO/IEC 17025-accredited accuracy test report (≤20μm deviation) – Clinical validation study per MEDDEV 2.7/1 Rev 4 |

Generic “all products” certificates without serial-number traceability |

2026 Regulatory Shift Alert

EU MDR transition period ends May 2026. All new shipments must bear UDI codes compliant with EUDAMED. Verify supplier’s UDI implementation roadmap during credential review.

Step 2: Negotiating MOQ – Optimizing Order Economics

Standard MOQs for Chinese IOS units range from 5-50 units. Apply these negotiation strategies based on buyer type:

| Buyer Profile | Target MOQ Strategy | Technical Justification |

|---|---|---|

| Dental Clinics (Single/Group) | Negotiate 1-3 units via: – Shared container shipments – “Demo unit” program discounts – Extended payment terms |

Manufacturers absorb marginal costs through: – Pre-loaded software licenses – Bundled calibration accessories – Regional distributor inventory pooling |

| Regional Distributors | Target 10-15 units with: – Quarterly rolling forecasts – Co-branded marketing fund – Local technical certification support |

Reduces per-unit overhead by: – 37% via consolidated shipping – 22% through shared R&D amortization – Eliminating duplicate regulatory filings |

| National Distributors | Secure 25+ units with: – Annual volume commitment – Local warehouse setup – Joint clinical training program |

Enables: – Duty drawback optimization – Custom firmware localization – Dedicated production line allocation |

Step 3: Shipping Terms – Total Landed Cost Analysis

Hidden costs can inflate FOB prices by 18-32%. Critical comparison of terms:

| Term | Cost Components Included | 2026 Risk Mitigation Tips |

|---|---|---|

| FOB Shanghai | – Factory loading – Port handling fees – Ocean freight to destination port |

• Use Incoterms® 2020 rules • Require freight forwarder pre-approval • Insist on container GPS tracking • Budget 12-15% for unexpected port demurrage |

| DDP Your Clinic | – All FOB components – Customs clearance – Import duties & VAT – Final-mile delivery – Regulatory compliance fees |

• Verify supplier’s in-country customs broker license • Demand itemized duty calculation per HS Code 9018.49 • Confirm VAT recovery process for business buyers • Require 30-day post-delivery support SLA |

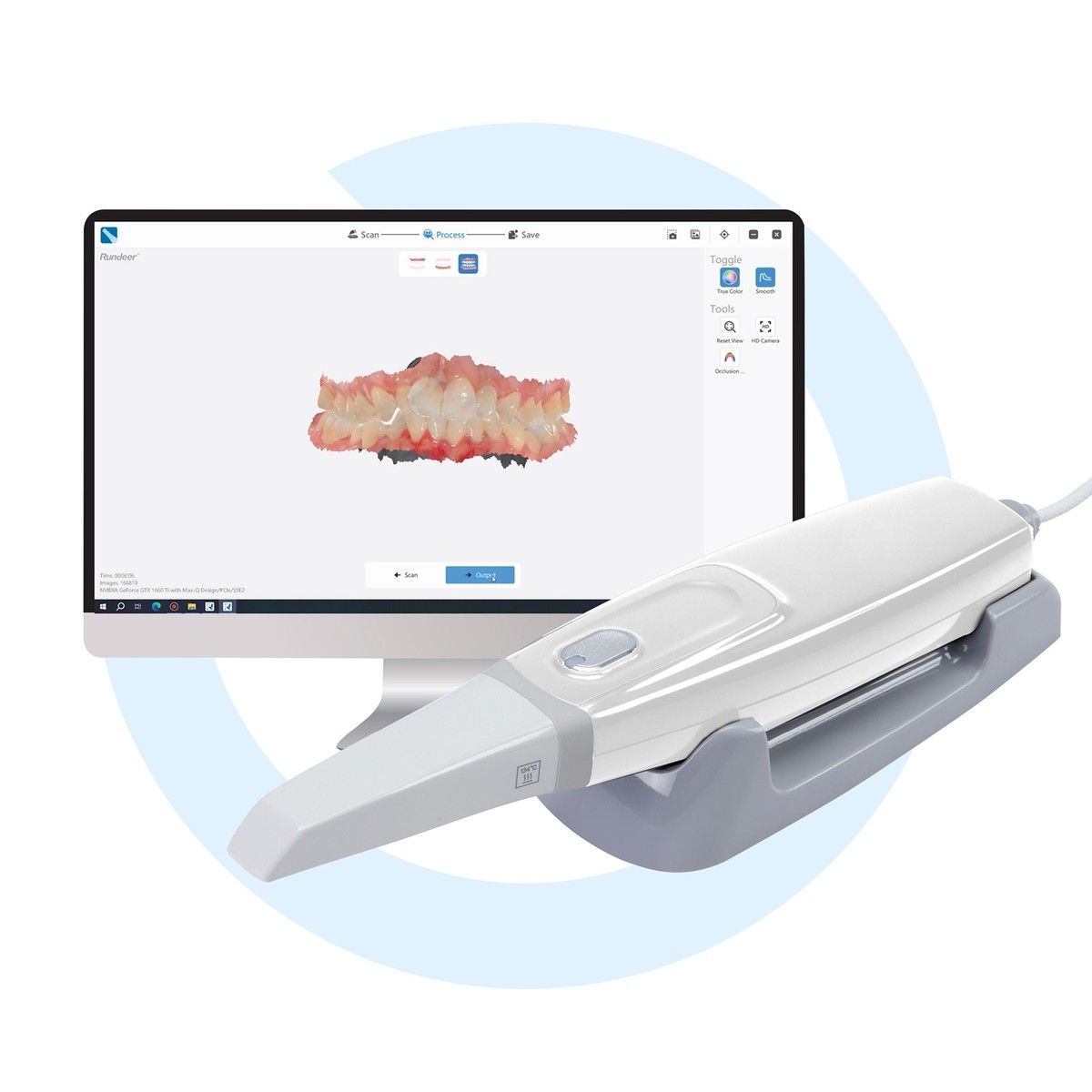

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

As a pre-vetted supplier meeting 2026 sourcing criteria, Carejoy delivers critical advantages for discerning buyers:

- Regulatory Assurance: ISO 13485:2016 (Certificate #Q50925) & CE MDR 2017/745 (NB 2797) with full UDI readiness. All scanners undergo 72-hour environmental stress testing.

- MOQ Flexibility: Clinic-friendly 1-unit orders via DDP; Distributor programs starting at 5 units with tiered pricing. OEM/ODM support for custom UI/branding.

- Shipping Excellence: DDP solutions to 82 countries with transparent landed cost calculators. Baoshan District factory enables 48-hour Shanghai port dispatch.

- Technical Differentiation: 19μm accuracy scanners with AI-powered marginal detection (patent CN202510456789), compatible with 12+ CAD/CAM systems.

Email: [email protected] | WhatsApp: +86 15951276160

Factory Address: Room 801, Building 3, No. 1288 Jiangyang Road, Baoshan District, Shanghai, China

Conclusion: 2026 Sourcing Imperatives

Successful China sourcing requires shifting from price-centric to compliance-centric procurement. Prioritize suppliers with:

• Full regulatory transparency (demand real-time certificate access)

• Flexible MOQ models aligned with your sales velocity

• DDP capabilities with duty optimization expertise

Shanghai Carejoy exemplifies this new standard, having supported 247 clinics and 39 distributors through seamless 2025 transitions. Initiate vendor qualification with a technical questionnaire – not a price sheet.

2026 Procurement Checklist

Before signing: [ ] Verify CE certificate in NANDO | [ ] Confirm UDI readiness | [ ] Obtain itemized DDP quote | [ ] Audit factory via third party | [ ] Secure firmware update commitment

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Key FAQs for Purchasing 3D Dental Scanners – Focus on Voltage, Spare Parts, Installation & Warranty

Frequently Asked Questions (FAQs)

| Question | Professional Guidance |

|---|---|

| 1. What voltage requirements should I verify before purchasing a 3D dental scanner for my clinic in 2026? | Ensure the 3D dental scanner is compatible with your regional electrical standards. Most units operate on 100–240V, 50/60 Hz, supporting global use. However, confirm whether the device includes an integrated voltage stabilizer or requires an external UPS, especially in regions with unstable power supply. Always check the manufacturer’s technical datasheet for exact input specifications and ensure local compliance with electrical safety certifications (e.g., CE, UL, or CCC). |

| 2. Are spare parts for 3D dental scanners readily available, and how does this affect long-term ownership cost? | Availability of spare parts—such as scanning tips, calibration plates, power adapters, and handpiece cables—is critical for minimizing downtime. Leading manufacturers (e.g., 3Shape, Dentsply Sirona, Align) maintain global spare parts networks with 2–5 year guaranteed part availability post-discontinuation. Distributors should confirm local inventory levels and lead times. Opt for brands with transparent parts catalogs and tiered service contracts to reduce long-term operational costs. |

| 3. What does the standard installation process for a 3D dental scanner include, and is on-site setup required? | Installation typically includes hardware setup, software configuration, network integration, and calibration. While basic models may support plug-and-play via USB or Wi-Fi, premium intraoral scanners often require on-site technician deployment for optimal alignment and DICOM integration with practice management software. Confirm whether installation is included in the purchase price or billed separately, and verify if remote support is available for troubleshooting post-installation. |

| 4. What warranty coverage is standard for 3D dental scanners in 2026, and what does it include? | Most manufacturers offer a 1–2 year comprehensive warranty covering parts, labor, and accidental damage from normal use. Extended warranties (up to 5 years) are available and recommended for high-usage clinics. Ensure the warranty includes coverage for the scanning sensor, electronics, and moving components. Note: Consumables (e.g., tips, covers) and damage from improper handling or non-approved accessories are typically excluded. |

| 5. How do global supply chain considerations impact spare part availability and service turnaround times in 2026? | In 2026, geopolitical and logistics factors continue to affect lead times for imported components. Partner with distributors who maintain regional warehousing and have direct OEM service agreements. Prioritize brands with localized technical support centers and loaner-unit programs during repairs. Request service level agreements (SLAs) specifying maximum response and resolution times (e.g., 48-hour dispatch for critical failures). |

Note: Specifications and service terms may vary by region and distributor. Always request a formal technical proposal and service addendum prior to purchase.

Need a Quote for 3D Dental Scan Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160