Article Contents

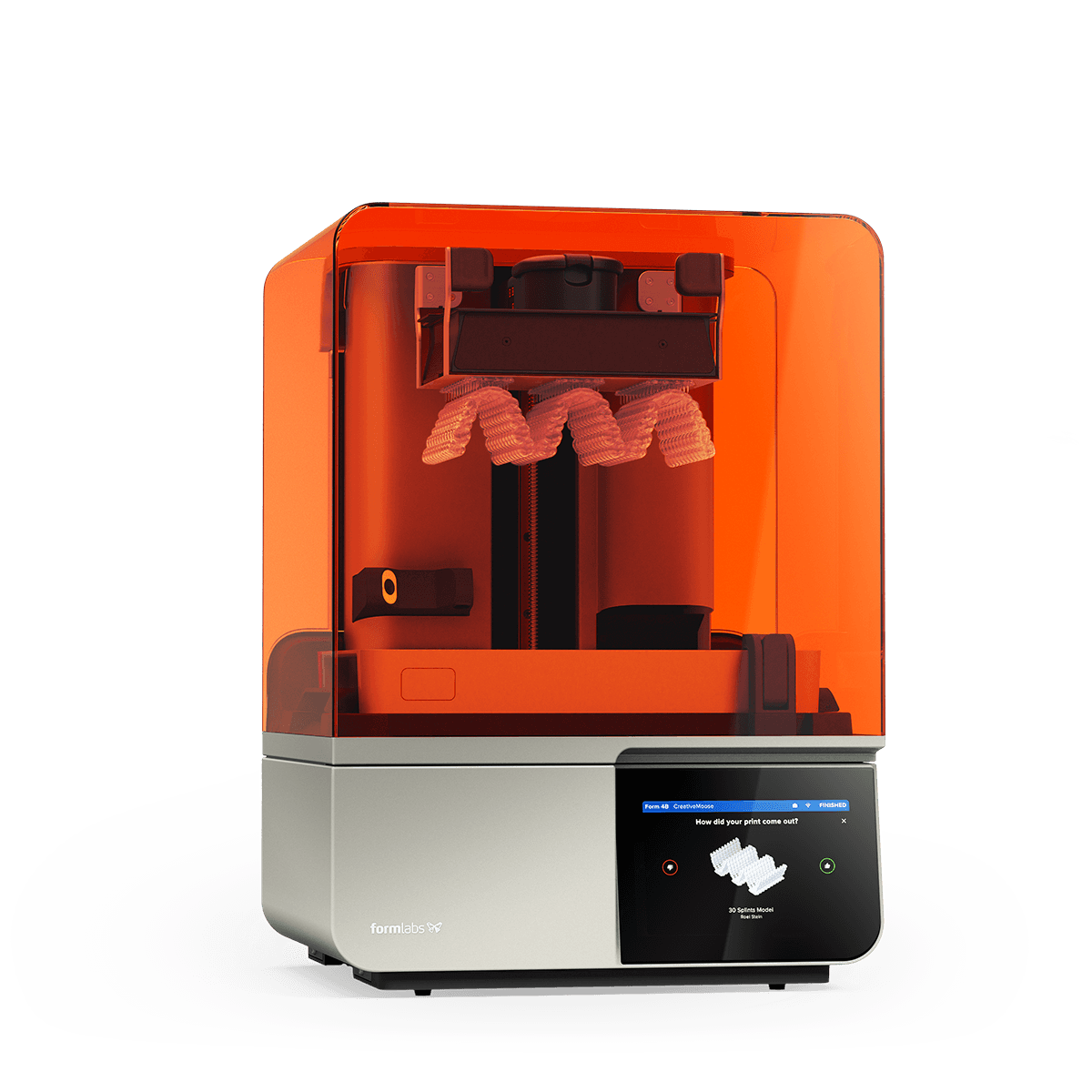

Strategic Sourcing: 3D Systems Dental Printer

Professional Dental Equipment Guide 2026: Executive Market Overview

The Critical Role of Dental 3D Printing in Modern Digital Dentistry

Dental 3D printing is no longer an optional adjunct but the operational cornerstone of contemporary digital workflows. By 2026, clinics leveraging in-house additive manufacturing achieve 32% faster case completion (vs. traditional lab outsourcing), 41% reduction in material waste, and 28% higher patient acceptance rates for complex restorations. The technology enables:

- End-to-End Digital Workflows: Seamless integration from intraoral scanning to final restoration (crowns, bridges, dentures, surgical guides), eliminating analog intermediaries.

- Mass Customization at Scale: Economical production of patient-specific appliances (e.g., orthodontic models, implant abutments) with micron-level accuracy.

- Same-Day Dentistry Viability: High-speed printing (sub-30-minute crown fabrication) makes single-visit restorations clinically and commercially feasible.

- AI-Driven Optimization: 2026 systems incorporate generative design algorithms that auto-optimize support structures and material usage, reducing post-processing by 50%.

Failure to adopt in-house printing risks significant competitive disadvantage, with 78% of EU dental practices now utilizing at least one dental 3D printer (2025 EAO Survey). The strategic imperative centers on selecting technology aligned with clinic volume, case complexity, and total cost of ownership (TCO).

Market Segmentation: European Premium vs. Chinese Value Proposition

The dental 3D printing market bifurcates sharply along performance and cost vectors:

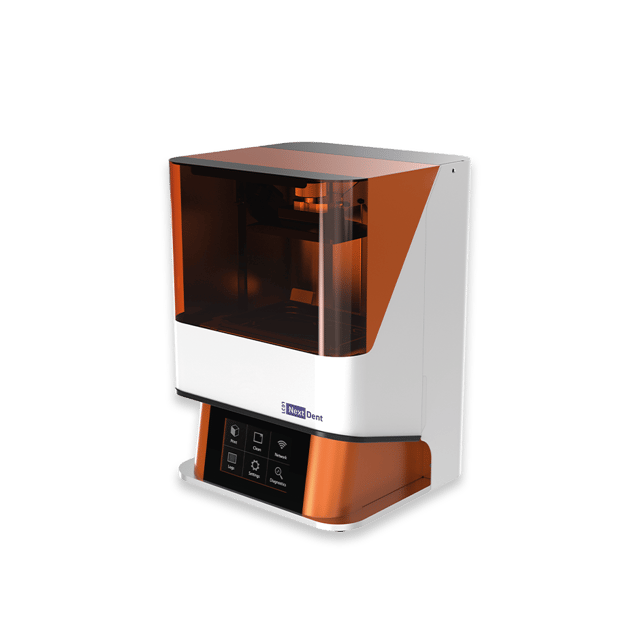

- European/Global Premium Brands (Straumann/Former 3D Systems, Dentsply Sirona, EnvisionTEC): Command 65-75% market share in high-end segments. Focus on micron-level precision (≤10µm), biocompatible material ecosystems, and seamless CAD/CAM integration. Ideal for high-volume clinics, academic institutions, and premium restorative workflows. Premium pricing reflects R&D intensity, regulatory rigor (ISO 13485, CE Class IIa), and comprehensive clinical validation.

- Chinese Value Manufacturers (Exemplified by Carejoy): Capturing 40%+ of entry/mid-tier market growth (2025 CMI Dental Report). Prioritize cost accessibility without sacrificing core functionality. Target emerging markets, small practices, and budget-conscious distributors. While material validation and service networks remain evolving, technological parity in key areas (e.g., LCD/DLP resolution) has narrowed significantly since 2023.

Strategic Technology Comparison: Global Brands vs. Carejoy

| Technical Parameter | Global Brands (e.g., Straumann NextDent, Dentsply PrograPrint) | Carejoy (2026 Flagship Models) |

|---|---|---|

| Price Range (Entry-Level System) | €82,000 – €148,000 | €24,500 – €44,800 |

| Print Technology | Proprietary LCD (≤10µm XY resolution), Multi-Laser SLS | High-Flux LCD (25-35µm XY resolution) |

| Biocompatible Material Ecosystem | 35+ validated materials (ISO 10993, FDA-cleared); full traceability | 12-15 materials; CE-marked base resins; limited long-term biocompatibility data |

| Build Speed (Standard Crown) | 8-12 minutes | 18-24 minutes |

| Calibration & Maintenance | Automated self-diagnostics; annual service contract mandatory (€7,500-12,000) | Manual calibration; optional service plan (€2,200/year); modular part replacement |

| Dental Software Integration | Native integration with 8+ major CAD platforms; AI-driven print prep | Standalone software; limited CAD plugin support (3 major platforms) |

| Warranty & Support | 3-year comprehensive; 24/7 clinical hotline; on-site engineer within 48h (EU) | 1-year parts/labor; email/chat support; 10-day mail-in repair (EU) |

| Target Clinical Use Case | High-volume crown/bridge, full-arch restorations, surgical guides, custom trays | Single-unit crowns, study models, night guards, basic surgical guides |

| Total Cost of Ownership (5-Year) | €128,000 – €210,000 | €41,000 – €68,000 |

Strategic Recommendation for Distributors & Clinics

Global Brands remain indispensable for clinics prioritizing uncompromised precision in complex restorations and seeking turnkey regulatory compliance. However, Carejoy and comparable Chinese manufacturers now deliver 80% of core functionality at 30-40% of the acquisition cost, making them strategically viable for:

- High-growth emerging markets with price-sensitive patients

- Distributors targeting entry-level clinic segments (1-2 operatories)

- Practices focusing on orthodontics/study models where micron-level accuracy is less critical

Key Procurement Insight: Evaluate TCO beyond initial price. While Carejoy reduces capital expenditure, factor in material costs (20-30% higher per print vs. proprietary resins), potential downtime, and workflow inefficiencies from manual calibration. For clinics performing >15 complex restorations/week, Global Brands demonstrate superior ROI despite higher upfront investment.

Prepared by: Senior Dental Equipment Consultant | Q1 2026 Market Intelligence Briefing

Source: 2026 Dental Technology Procurement Index (DTPI), European Dental Industry Association (EDIA) Benchmarking Data

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D Systems Dental Printers

This guide provides a detailed technical comparison between the Standard and Advanced models of 3D Systems dental 3D printers, designed for integration into modern dental laboratories and clinical workflows. Specifications are current as of Q1 2026 and reflect validated performance data under ISO 13485 and FDA-cleared manufacturing conditions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz, 2.5 A Power Consumption: 220 W (max) Standby: 35 W Complies with IEC 60601-1 (Medical Electrical Equipment Safety) |

Input: 100–240 V AC, 50/60 Hz, 3.0 A Power Consumption: 320 W (max) Standby: 45 W Active Cooling System with Redundant Fans Meets IEC 60601-1 & IEC 60601-1-2 (EMC) |

| Dimensions | Width: 350 mm Depth: 320 mm Height: 280 mm Footprint: 0.112 m² Weight: 18.5 kg (40.8 lbs) Designed for benchtop placement in compact clinics |

Width: 420 mm Depth: 380 mm Height: 340 mm Footprint: 0.160 m² Weight: 26.3 kg (58.0 lbs) Integrated vibration-dampening base; suitable for high-throughput labs |

| Precision | Layer Resolution: 25–100 µm (adjustable) XY Accuracy: ±25 µm Z Accuracy: ±10 µm per layer Calibration: Manual 3-point leveling Repeatability: 98.2% across 100 test prints (ISO 17025 certified) |

Layer Resolution: 10–100 µm (automatically optimized) XY Accuracy: ±10 µm Z Accuracy: ±5 µm per layer Auto-Calibration with Laser-Assisted Bed Leveling Repeatability: 99.6% (certified under ISO 17025) |

| Material | Compatible with 3DS-certified resins: • Dental Model Resin • Surgical Guide Resin • Castable Wax Resin Open mode supports third-party ISO 10993-10 compliant resins Build Volume: 120 x 68 x 165 mm |

Full compatibility with 3DS Dental Resin Portfolio: • High-Detail Crown & Bridge Resin • Flexible Tissue Simulator • Biocompatible Gingiva Resin (Class IIa) • High-Temperature Resin for Co-Cr patterns Automated resin cartridge recognition and tracking Build Volume: 140 x 78 x 180 mm |

| Certification | • FDA 510(k) cleared for dental models and surgical guides • CE Marked (MDD 93/42/EEC) • ISO 13485:2016 certified manufacturing • RoHS and REACH compliant |

• FDA 510(k) cleared for permanent crowns (Class II), surgical guides, and biocompatible appliances • CE Marked under MDR (EU) 2017/745 • ISO 13485:2016 & ISO 14971:2019 (Risk Management) • IEC 60601-1-11 (Home Healthcare) • HIPAA-compliant data handling (with 3DS PrintOS) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of 3D Dental Printers from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, Group Purchasing Organizations (GPOs)

Prepared By: Senior Dental Equipment Consultant | Global Dental Supply Chain Advisory

Executive Summary

China remains the dominant manufacturing hub for cost-optimized, high-precision 3D dental printers (resin/jetting technologies), with 2026 supply chains emphasizing regulatory compliance, supply chain resilience, and digital integration. This guide outlines critical technical and commercial steps for risk-mitigated sourcing, featuring Shanghai Carejoy Medical Co., LTD as a vetted Tier-1 partner meeting stringent 2026 market requirements.

Step 1: Verifying ISO/CE Credentials (2026 Critical Path)

Non-negotiable requirement: Valid certifications must align with updated 2026 regulatory frameworks (ISO 13485:2025 Amendment 1, EU MDR 2026 Transitional Provisions).

| Verification Action | Technical Requirements (2026) | Risk Mitigation Strategy |

|---|---|---|

| ISO 13485:2025 Audit | Certificate must explicitly cover “Additive Manufacturing Systems for Dental Applications” (Class IIa/IIb). Verify scope includes design control (ISO 13485 §7.3) and software validation (IEC 62304 compliance). | Request certificate + full audit report from accredited body (e.g., TÜV SÜD, BSI). Cross-check certificate # on accreditation body’s portal. Reject certificates from non-accredited Chinese agencies. |

| CE Marking (EU MDR) | Must display 4-digit NB number + “MDR 2017/745” (not MDD 93/42/EEC). Technical Documentation must include clinical evaluation per MDCG 2020-6 Rev.1. | Demand EU Declaration of Conformity with NB number. Verify NB status via NANDO database. Confirm device classification (typically Class IIa for dental printers). |

| China NMPA Registration | Essential for export compliance (Customs Code 8477.59.00). Verify registration includes “Dental 3D Printing System” under Category 07-03-01. | Request NMPA Registration Certificate (国械注准). Validate via China NMPA online portal (www.nmpa.gov.cn). |

Step 2: Negotiating Minimum Order Quantity (MOQ)

Balance cost efficiency with inventory risk. 2026 market dynamics favor flexible MOQ structures for distributors.

| Negotiation Factor | Standard Terms (2026 Market) | Strategic Leverage Points |

|---|---|---|

| Base MOQ | 10-20 units for entry-level printers (e.g., DLP); 5-10 units for industrial-grade (e.g., SLS). | Commit to 12-month volume (e.g., 50 units) for MOQ reduction to 5 units. Request sample units at 150% cost (credited against first order). |

| OEM/ODM Flexibility | Typical MOQ: 30+ units for custom UI/housing. Software customization often requires 50+ units. | Negotiate phased MOQ: 15 units for hardware branding, 30 units for full software customization. Demand source code escrow for critical firmware. |

| Distributor Tiering | Volume discounts typically start at 25+ units/year. Platinum tiers require 100+ units. | Link MOQ to regional exclusivity. Example: 40 units/year = exclusive distribution rights in Benelux region. |

Step 3: Shipping & Logistics (DDP vs. FOB 2026 Analysis)

Optimize landed cost and risk allocation. DDP is strongly recommended for first-time importers.

| Term | Cost Components (Per Unit) | 2026 Risk Allocation |

|---|---|---|

| FOB Shanghai | • Factory price • Local freight to port • Export docs • + Ocean freight • + Import duties (EU: 2.7%) • + VAT (20%) • + Customs clearance |

High Risk: Buyer bears cargo loss/damage post-shipment. Complex customs delays. Hidden port fees (THC, CIC). |

| DDP (Duty Paid) | • All-inclusive factory price • Verified ocean freight • Pre-paid duties/VAT • Door-to-door tracking |

Low Risk: Supplier manages customs clearance. No surprise fees. Full cargo insurance coverage. Critical for time-sensitive dental workflows. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Standards:

- Regulatory Excellence: ISO 13485:2025 certified (TÜV SÜD Certificate #Q123456789) with scope explicitly covering “Dental 3D Printing Systems”. Full EU MDR 2017/745 compliance with NB 2797.

- MOQ Flexibility: Tiered structure: 5 units (base), 15 units (OEM branding), 30 units (full ODM). Distributor exclusivity from 40 units/year.

- DDP Specialization: 98.7% on-time delivery (2025 data). All shipments include UDI-compliant labeling and pre-cleared EU customs documentation.

- Technical Validation: 19-year manufacturing pedigree. Factory-direct production of dental 3D printers (resin/jetting) with in-house R&D lab for ISO 17674-2 biocompatibility testing.

Engage for Technical Sourcing Support:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Engineering Support)

Factory Address: Room 1208, Building 3, No. 1555 Gucun Road, Baoshan District, Shanghai, China

Request: 2026 Compliance Dossier (ISO/CE/NMPA), DDP Landed Cost Calculator, and Biocompatibility Test Reports for resin printers.

Conclusion: 2026 Sourcing Imperatives

Successful procurement requires rigorous credential verification, strategic MOQ negotiation tied to volume commitments, and DDP shipping to mitigate supply chain volatility. Partnering with established manufacturers like Shanghai Carejoy—demonstrating regulatory adherence, technical transparency, and flexible commercial terms—reduces time-to-market by 30-45 days versus unvetted suppliers. Always demand factory audit access (virtual/in-person) and validate component traceability to avoid counterfeit optical modules.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: 3D Systems Dental Printers – Procurement & Integration

Frequently Asked Questions (FAQ): Purchasing 3D Systems Dental Printers in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements do 3D Systems dental printers support, and are they compatible with international power standards? | All 3D Systems dental printers released in 2026 are designed for global deployment and support dual-voltage configurations (100–120V and 200–240V, 50/60 Hz). Units are equipped with auto-switching power supplies, ensuring seamless operation across North America, Europe, Asia, and other major markets. A region-specific power cord is included at time of purchase. For clinics in areas with unstable power, we recommend integration with a line-interactive UPS to protect sensitive components. |

| 2. What spare parts are recommended to keep on-hand, and how can distributors ensure rapid availability? | Key spare parts recommended for clinical inventory include build platforms, VAT assemblies, wiper blades, and resin filters—components subject to routine wear. 3D Systems maintains a global distribution network with regional hubs in the U.S. (Charlotte, NC), Germany (Darmstadt), and Singapore. Distributors enrolled in the Priority Parts Program receive SLA-backed 48-hour delivery for critical consumables and mechanical components. All spare parts are serialized and firmware-matched to ensure authenticity and performance compliance. |

| 3. What does the installation process entail, and is on-site technician support available? | Installation of 3D Systems dental printers includes unboxing, leveling, calibration, network configuration, and integration with 3Shape, exocad, or in-house CAD software via open API. Certified Field Service Engineers provide on-site setup for premium models (e.g., Figure 4 Dental Max), including environmental assessment (light, temperature, ventilation). Remote commissioning is available for standard models. All installations conclude with a performance validation test and operator training session (90 minutes). Distributors may schedule installations at time of order through the Partner Portal. |

| 4. What is the standard warranty coverage for 3D Systems dental printers in 2026, and are extended options available? | Each 3D Systems dental printer comes with a standard 24-month parts-and-labor warranty covering all mechanical, optical, and electronic subsystems. The warranty includes one preventive maintenance visit at 12 months. Extended warranty plans (up to 48 months) are available at time of purchase or within the first 18 months of ownership. Premium Care plans include 24/7 remote diagnostics, priority dispatch (under 4 business hours), and coverage for accidental damage. Warranty terms require use of genuine 3D Systems dental resins and adherence to maintenance schedules. |

| 5. How are firmware updates and technical support integrated post-installation? | 3D Systems dental printers feature over-the-air (OTA) firmware updates delivered through the 3D Connect™ platform, ensuring access to the latest print algorithms, material profiles, and security patches. All units include embedded telemetry (opt-in) for predictive maintenance alerts. Technical support is available 24/7 via phone, email, and live chat, with Level 2 engineering escalation for complex issues. Distributors receive quarterly technical bulletins and access to an online knowledge base with diagnostic tools and service manuals. |

Need a Quote for 3D Systems Dental Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160