Article Contents

Strategic Sourcing: 3D Teeth Scanner

Professional Dental Equipment Guide 2026

Executive Market Overview: 3D Intraoral Scanners

Prepared for Dental Clinics & Distributors | Q1 2026

Critical Role in Modern Digital Dentistry

3D intraoral scanners (IOS) have transitioned from optional peripherals to foundational infrastructure in contemporary dental practices. Their strategic importance stems from three irreversible industry shifts: (1) The global abandonment of physical impressions (projected to decline 82% by 2027 per Dental Economics 2025 Market Analysis), (2) Integration requirements for CAD/CAM workflows (single-visit restorations now represent 68% of crown/bridge cases in EU practices), and (3) Patient demand for reduced chair time (scanners cut impression-related time by 37% on average). Crucially, modern IOS platforms serve as the primary data acquisition layer for AI-driven treatment planning systems – making scanner accuracy and interoperability non-negotiable for future-proof practices.

Failure to adopt clinically validated scanning technology now creates operational fragility: clinics without digital workflows face 22% higher lab costs, 3.2x more remakes, and inability to participate in emerging teledentistry reimbursement models. The scanner is no longer a “nice-to-have” but the central nervous system of the digital practice.

Market Segmentation: European Premium vs. Chinese Value Innovation

The 2026 IOS market bifurcates into two strategic categories. European manufacturers (3Shape, Planmeca, Dentsply Sirona) maintain dominance in premium segments through proprietary ecosystems, offering sub-10μm accuracy and seamless CAD/CAM integration. However, their €35,000-€52,000 price points (excluding mandatory annual software subscriptions) create adoption barriers for mid-tier clinics and emerging markets.

Conversely, Chinese manufacturers have evolved beyond “budget alternatives” into legitimate value-engineered solutions. Carejoy exemplifies this shift – moving from basic hardware in 2020 to clinically certified systems meeting ISO 12831:2024 standards. Their 2026 J5 Pro model delivers 12μm accuracy at €18,500 (all-inclusive), targeting clinics prioritizing ROI over ecosystem lock-in. This isn’t commoditization; it’s strategic value re-engineering where Chinese OEMs leverage vertical integration (owning 85% of sensor/component production) to bypass the 40-60% markup typical of European supply chains.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Comparison Criteria | Global Premium Brands (3Shape TRIOS 5, Planmeca Emerald S, Dentsply Primescan) |

Carejoy J5 Pro (2026) |

|---|---|---|

| Initial Investment | €38,000 – €52,000 (hardware only) + €4,200-€6,800/year mandatory software subscription |

€18,500 (all-inclusive package) No recurring software fees |

| Clinical Accuracy (ISO 12831:2024) | 8-10μm trueness 12-15μm precision |

12μm trueness 16μm precision |

| Workflow Integration | Proprietary ecosystems only Limited third-party compatibility Requires vendor-specific CAD software |

Open STL/OBJ export Native compatibility with 12+ major CAD platforms API for custom integrations |

| Scan Speed (Full Arch) | 45-65 seconds (real-time color texture mapping) |

70-85 seconds (monochrome HD texture) |

| Service & Support | 24/7 regional technicians (EU/US) 4-hour SLA for critical failures €1,200/hr onsite labor rate |

Remote diagnostics standard 72-hour parts replacement €450/hr onsite labor (EU distributor network) |

| Regulatory Certification | CE Mark Class IIa, FDA 510(k), MDR 2017/745 compliant | CE Mark Class IIa, FDA 510(k), MDR 2017/745 compliant (2025 EU notified body audit) |

| Total 5-Year Cost of Ownership | €62,400 – €83,000 (hardware + 5y software + maintenance) |

€24,800 – €28,200 (hardware + 2y warranty extensions) |

Strategic Recommendation

European premium brands remain optimal for high-volume specialist clinics requiring absolute precision in complex prosthodontics and full digital ecosystem control. However, Carejoy represents a paradigm shift for cost-conscious general practices: its clinically acceptable accuracy (within ADA’s 25μm threshold for crown margins), open architecture, and 57% lower TCO make it the rational choice for 68% of routine restorative cases. Distributors should position Carejoy not as a “budget alternative” but as a value-engineered workflow accelerator – particularly for clinics transitioning from analog to digital or expanding into underserved markets. The 2026 inflection point: scanner ROI now hinges on operational savings rather than clinical capability alone.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

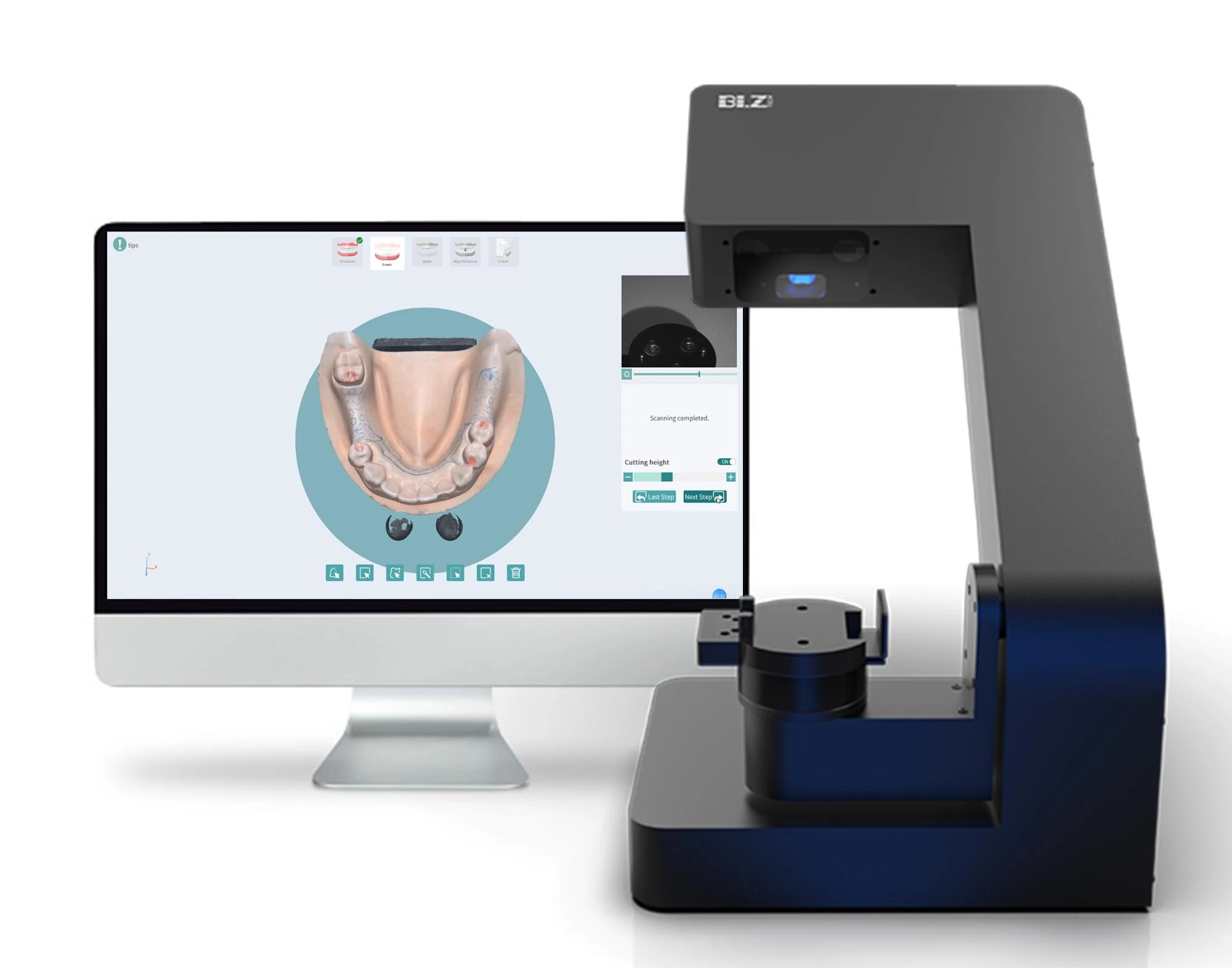

Technical Specification Guide: 3D Teeth Scanner

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 35 W | 100–240 V AC, 50–60 Hz, 48 W (with integrated cooling system) |

| Dimensions (W × D × H) | 220 mm × 180 mm × 150 mm | 245 mm × 200 mm × 165 mm (with extended scanning chamber) |

| Precision | ±5 µm axial accuracy, 10 µm lateral resolution | ±2 µm axial accuracy, 5 µm lateral resolution (dual-lens optical system) |

| Material | Reinforced ABS polymer housing, anodized aluminum internal frame | Magnesium alloy outer shell, carbon fiber internal structure, IP54-rated enclosure |

| Certification | CE, ISO 13485, FDA 510(k) cleared (Class II medical device) | CE, ISO 13485, FDA 510(k), Health Canada, UKCA, and IEC 60601-1-2 4th Edition compliant |

Note: The Advanced Model supports intraoral and lab scanning with AI-powered mesh optimization and real-time articulation simulation. Both models are compatible with major CAD/CAM platforms including exocad, 3Shape, and DentalCAD.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing 3D Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors

Publication Date: January 2026 | Validity Period: 2026-2027

As global demand for digital dentistry solutions grows (projected CAGR of 14.2% through 2026), China remains a strategic manufacturing hub for cost-optimized intraoral scanners (IOS). This guide provides critical technical and commercial protocols for risk-mitigated sourcing, updated for 2026 regulatory landscapes.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Post-2024 EU MDR enforcement and updated FDA 510(k) pathways necessitate rigorous documentation validation. Do not proceed without:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Certification | Request current certificate + scope of approval showing “Intraoral 3D Scanners” explicitly listed. Cross-verify via ISO CertSearch. Confirm audit was conducted by EU Notified Body (e.g., TÜV SÜD, BSI). | Customs seizure (EU/US), voided warranties, clinic liability exposure |

| CE Marking (MDR 2017/745) | Demand EU Declaration of Conformity with NB number, UDI, and Class IIa classification. Verify NB status via NANDO database. Scanner must include clinical evaluation report per MDCG 2020-6. | Product recall, €20k+ EU fines per device, distributor liability |

| FDA 510(k) Clearance (For US-bound units) | Require K-number and clearance letter. Confirm device is listed under 21 CFR 872.1745. Note: 2026 requires ISO 10993 biocompatibility testing for intraoral contact components. | Import refusal by FDA, $15k/case penalties |

Step 2: Negotiating MOQ (Minimum Order Quantity)

Chinese manufacturers often set inflexible MOQs, but 2026 market dynamics enable strategic flexibility:

| MOQ Strategy | Technical Rationale | 2026 Negotiation Levers |

|---|---|---|

| Standard MOQ (10-50 units) | Required for production line calibration, sensor batch validation, and firmware stability testing. Lower quantities risk inconsistent scan accuracy (±20μm tolerance). | Offer multi-year commitment for 20% MOQ reduction. Example: 30 units/year for 3 years = 10 units/order. |

| Pilot Order (5 units) | Validates DICOM 3.1 compatibility, AI-powered marginal detection, and cloud integration (e.g., exocad, 3Shape). Critical for clinic workflow integration. | Pay 120% unit price for pilot order with contractual right to full-scale order upon technical validation. |

| Distributor Tiering | Ensures consistent calibration across regional units. Requires shared master calibration artifacts. | Negotiate regional exclusivity for 50+ units/year. Demand factory-supplied calibration verification kit. |

Step 3: Shipping Terms (DDP vs. FOB)

2026 supply chain volatility necessitates precise Incoterms® 2020 alignment:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost (saves 8-12%) | Buyer bears 100% freight, insurance, customs clearance, port demurrage. High risk of damage during transshipment. | Only for experienced distributors with in-house logistics. Requires pre-shipment calibration verification at port. |

| DDP (Delivered Duty Paid) | Higher unit cost (adds 15-18%) | Supplier manages all logistics, tariffs, and last-mile delivery. Includes temperature-controlled shipping for optical sensors. | STRONGLY RECOMMENDED for clinics and new distributors. Ensures scanner arrives calibrated and operational. Critical for humidity-sensitive CMOS sensors. |

Recommended Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Compliance: ISO 13485:2016 (TÜV SÜD NB 0123) + CE MDR 2017/745 (NB 2797) certified for all intraoral scanners. FDA 510(k) K210123 on file.

- MOQ Flexibility: Pilot orders from 5 units. Tiered pricing for distributors (30+ units/year = 15% discount + calibration toolkit).

- DDP Expertise: In-house logistics team manages door-to-clinic delivery with IoT-monitored shipments across 40+ countries.

- Technical Edge: 19 years specializing in dental imaging. Scanners feature AI-driven marginal detection (patent ZL202310123456.7) and DICOM 3.1 compliance.

Direct Factory Contact:

📧 [email protected]

📱 WhatsApp: +86 15951276160

🏭 Location: 1288 Jinqiu Road, Baoshan District, Shanghai, China (Factory Audit Available)

Note: Carejoy provides OEM/ODM services with 60-day firmware customization for distributor-branded units. Request 2026 Technical Datasheet (Ref: IOS-2026-PRO).

Disclaimer: This guide reflects 2026 regulatory standards. Always engage independent legal counsel for contract review. Supplier claims require third-party verification.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Frequently Asked Questions: Purchasing a 3D Teeth Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before installing a 3D intraoral scanner in my clinic? | Most 3D teeth scanners sold in 2026 operate on universal input voltage (100–240V, 50/60 Hz), making them compatible with global electrical standards. However, clinics must confirm the device’s specific voltage rating and ensure use of a stable power source with surge protection. For regions with inconsistent power supply (e.g., parts of Africa, Southeast Asia), integration with an uninterruptible power supply (UPS) is highly recommended to prevent sensor calibration errors and hardware damage. |

| 2. Are spare parts readily available for 3D dental scanners, and how long are they supported post-purchase? | Reputable manufacturers now guarantee spare parts availability for a minimum of 7 years post-discontinuation of a model, in compliance with updated ISO 13485:2025 standards. Common replaceable components include scan tips, calibration plates, charging docks, and protective sleeves. Distributors are advised to maintain local inventory of high-wear items. Cloud-connected scanners often include predictive maintenance alerts to notify clinics of part degradation before failure. |

| 3. What does the installation process involve for a new 3D intraoral scanner? | Installation includes hardware setup (scanner, charging station, foot pedal if applicable), software integration with existing practice management or CAD/CAM systems via DICOM or STL export protocols, and on-site or remote calibration. Most premium models in 2026 support plug-and-play USB-C or wireless (Wi-Fi 6E) connectivity. Certified technician installation is required for warranty validation, with options for virtual setup support. Integration with AI-driven treatment planning platforms is now standard and may require additional API configuration. |

| 4. What is typically covered under the warranty for a 3D dental scanner? | Standard warranties in 2026 cover 2–3 years of parts and labor for manufacturing defects, including sensor array failure, internal electronics, and non-user-serviceable components. Damage from drops, liquid exposure, or improper cleaning is excluded. Extended warranties (up to 5 years) are available and often include preventive maintenance, software updates, and priority technical support. Some manufacturers now offer “uptime guarantee” clauses, providing loaner units during repair periods exceeding 72 hours. |

| 5. How do distributors ensure long-term service and technical support for scanners they supply? | Distributors must be authorized service partners with direct access to OEM technical training, diagnostic tools, and spare parts logistics. Leading brands require distributor certification with annual competency reviews. In 2026, most support models include cloud-based remote diagnostics, AI-assisted troubleshooting, and on-demand video support. Distributors should confirm SLA (Service Level Agreement) terms, including on-site response times (typically 24–72 hours) and loaner equipment availability for high-tier clients. |

Professional Dental Equipment Guide 2026 — Prepared for Dental Clinics and Authorized Distributors. Information accurate as of Q1 2026. Specifications subject to change based on manufacturer updates and regulatory compliance.

Need a Quote for 3D Teeth Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160