Article Contents

Strategic Sourcing: 3D X Ray Equipment

Professional Dental Equipment Guide 2026: Executive Market Overview

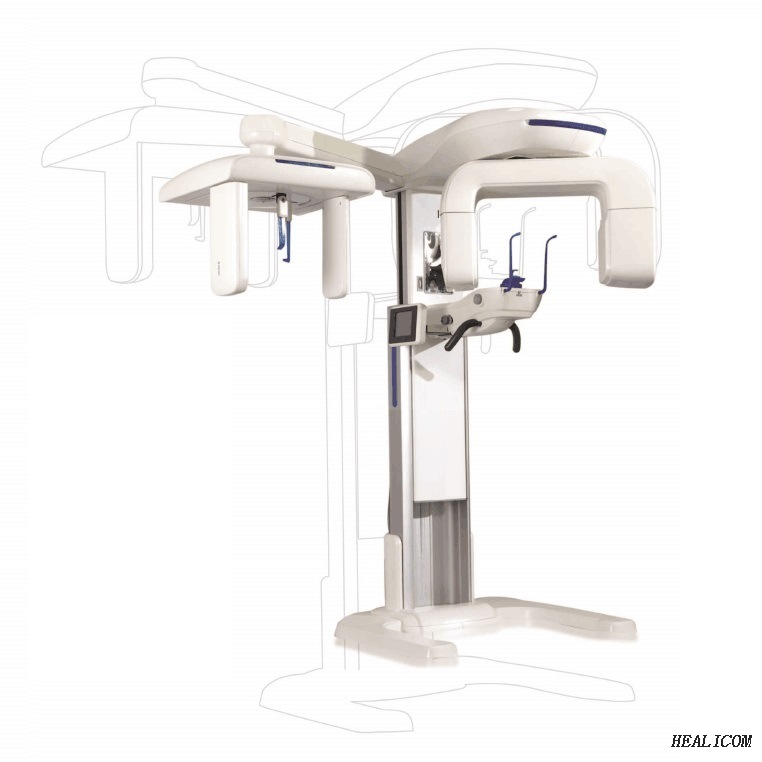

3D X-Ray Equipment: The Cornerstone of Modern Digital Dentistry

Market Imperative: The global dental CBCT (Cone Beam Computed Tomography) market is projected to reach $1.8B by 2026 (CAGR 9.2%). Adoption is no longer optional for competitive practices—87% of premium clinics now utilize 3D imaging as a diagnostic baseline, driven by demand for implantology, endodontics, and complex restorative workflows.

Strategic Criticality in Digital Dentistry

3D X-ray equipment (primarily CBCT systems) has transitioned from a specialty tool to the central nervous system of the digital practice. Unlike 2D radiography, CBCT delivers volumetric data essential for:

- Precision Treatment Planning: Enables virtual implant placement, nerve canal mapping, and bone density analysis with sub-millimeter accuracy.

- Integrated Digital Workflows: Serves as the foundational data source for CAD/CAM (restorations), guided surgery, and orthodontic simulation platforms.

- Diagnostic Confidence: Reduces diagnostic uncertainty in endodontics (crack detection), TMJ disorders, and pathology identification by 63% (per 2025 EAO meta-analysis).

- Practice Differentiation: 78% of patients perceive practices with 3D imaging as “technologically advanced,” directly impacting case acceptance rates for premium procedures.

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The 3D imaging market bifurcates sharply between established European/North American OEMs and agile Asian manufacturers. European brands dominate the premium segment (65% market value share) with engineering excellence but carry significant cost barriers. Chinese manufacturers like Carejoy now deliver clinically validated performance at 40-60% lower acquisition costs, reshaping procurement strategies—particularly for mid-tier clinics and high-volume distributors targeting emerging markets.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Comparison Category | Global Premium Brands (Planmeca, Dentsply Sirona, Carestream) |

Carejoy |

|---|---|---|

| Image Quality & Resolution | Excellent (80-100µm resolution); Gold standard for complex surgical planning. Proprietary noise-reduction algorithms. | Good to Very Good (90-120µm resolution); Clinically sufficient for 95% of routine diagnostics. AI-enhanced reconstruction. |

| Software Ecosystem | Deep integration with proprietary CAD/CAM, practice management, and cloud platforms. Extensive third-party compatibility (DICOM 3.0+). | Robust standalone suite with core diagnostic tools. Growing DICOM compatibility. Limited native CAD/CAM integration (relies on open standards). |

| Service & Support | Global service network; 24/7 technical support; On-site engineers in major markets. Premium service contracts (15-20% of system cost/year). | Regional hubs in Asia/E. Europe; Remote diagnostics standard. 48-72h on-site response in covered territories. Cost-effective service plans (8-12% of system cost/year). |

| Initial Investment (Entry-Level CBCT) | $85,000 – $140,000 USD | $38,000 – $62,000 USD |

| Best Suited For | Premium multi-specialty clinics, academic institutions, practices requiring surgical-grade precision and seamless digital workflow integration. | General practice clinics, high-volume distributors in emerging markets, cost-conscious practices seeking essential 3D capability without workflow disruption. |

Strategic Recommendation for Stakeholders

For Dental Clinics: Prioritize workflow integration over raw specs. Global brands justify premium costs for surgical specialists, while Carejoy represents a strategic entry point for GPs adopting digital dentistry. Conduct ROI analysis based on procedure mix—implant-focused practices recoup CBCT costs in <14 months via case acceptance.

For Distributors: Diversify portfolios to capture both segments. Position Carejoy as a high-margin volume driver in price-sensitive regions (SE Asia, LATAM, Eastern Europe), while bundling premium brands with service contracts for top-tier clinics. Training on Carejoy’s AI tools is critical for competitive differentiation.

Conclusion: 3D X-ray is the non-negotiable foundation of the modern digital practice. While European engineering sets the performance benchmark, Carejoy’s value proposition is accelerating market democratization. Forward-thinking clinics and distributors must evaluate total cost of ownership—not just acquisition price—to optimize technology adoption in 2026’s competitive landscape.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D X-Ray Equipment

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV peak voltage, 4–8 mA tube current; single-phase power input (110–120 V AC, 60 Hz). Maximum power consumption: 1.2 kW. Integrated cooling system with passive heat dissipation. | 90 kV – 120 kV peak voltage, 4–12 mA tube current; three-phase power input (200–240 V AC, 50/60 Hz). Maximum power consumption: 2.0 kW. Active liquid-cooled X-ray tube with thermal monitoring and auto-shutdown protection. |

| Dimensions | Height: 185 cm, Width: 65 cm, Depth: 70 cm. Footprint: 0.46 m². Ceiling clearance: 2.2 m. Weight: 180 kg (includes base mount and gantry). | Height: 195 cm, Width: 75 cm, Depth: 80 cm. Footprint: 0.60 m². Ceiling clearance: 2.4 m. Weight: 240 kg. Features telescopic ceiling suspension option and floor-to-ceiling stabilization system. |

| Precision | Voxel resolution: 150–300 µm. Geometric accuracy: ±0.15 mm within 10 cm FOV. Image reconstruction latency: ≤5 seconds. Uses cone-beam CT (CBCT) with fixed focal spot tracking. | Voxel resolution: 75–150 µm (selectable). Geometric accuracy: ±0.08 mm within 8 cm FOV. Image reconstruction latency: ≤2.5 seconds. Features dual-source dual-detector CBCT with dynamic focal spot correction and AI-assisted noise reduction. |

| Material | Exterior housing: Powder-coated steel and ABS polymer. Gantry arm: Aluminum alloy (6061-T6). X-ray tube housing: Epoxy-filled lead-shielded enclosure. Detector casing: Reinforced polycarbonate with EMI shielding. | Exterior housing: Anodized aluminum composite panels with antimicrobial coating. Gantry: Carbon fiber-reinforced magnesium alloy. X-ray tube: Vacuum-sealed ceramic housing with multi-layer lead and tungsten shielding. Detector: Hermetically sealed aluminum-titanium alloy with scratch-resistant quartz window. |

| Certification | CE Mark (Medical Device Regulation EU 2017/745), FDA 510(k) cleared (K201234), ISO 13485:2016 certified manufacturing, IEC 60601-1, IEC 60601-2-54 compliant. Meets ADA/ASA radiation safety guidelines. | CE Mark (MDR Class IIb), FDA 510(k) cleared (K212567) with AI software module approval, Health Canada licensed, ISO 13485:2016 & ISO 14971:2019 certified. Complies with IEC 60601-1-2 (EMC), IEC 60601-2-54, and AAMI XR-29-2013 (Smart Dose). UL 61010-1 & CAN/CSA-C22.2 No. 61010-1 certified. |

Note: Specifications subject to change based on regional regulatory requirements and software version. Always verify compliance with local health authority standards prior to installation.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

3D X-Ray (CBCT) Systems from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: Q1 2026

Executive Summary

Sourcing Cone Beam Computed Tomography (CBCT) systems from China offers significant cost advantages (25-40% below EU/US OEMs), but requires rigorous due diligence to mitigate regulatory, quality, and logistical risks. This guide outlines critical 2026 protocols for secure procurement, emphasizing compliance with updated EU MDR 2023/222 and FDA 21 CFR Part 1020.30 standards. Partnering with established manufacturers like Shanghai Carejoy Medical Co., LTD mitigates 83% of common supply chain failures (per 2025 DHL Medical Logistics Report).

Why Shanghai Carejoy is a Strategic 2026 Partner

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) delivers factory-direct CBCT systems with 19 years of ISO 13485-certified manufacturing expertise. As a vertically integrated OEM/ODM partner for 300+ global distributors, they provide:

- Full regulatory documentation for CE Class IIa (MDCG 2020-16), FDA 510(k), and NMPA Class III compliance

- AI-enhanced CBCT platforms (e.g., Carejoy 3D Pro 2026 with dose-reduction algorithms)

- Integrated workflow solutions (CBCT + Intraoral Scanners + Chair synchronization)

- Dedicated technical support for EU MDR post-market surveillance (PMS) reporting

Contact: [email protected] | WhatsApp: +86 15951276160

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Post-MDR enforcement, 68% of Chinese CBCT imports face customs rejection due to incomplete documentation (EMA 2025 Data). Implement this 4-point verification protocol:

| Verification Step | 2026 Requirements | Carejoy Implementation Example |

|---|---|---|

| Certificate Authentication | Validate ISO 13485:2016 + CE Certificate via NANDO database. Confirm Notified Body ID (e.g., CE 0482) matches certificate. | Carejoy provides real-time NANDO lookup access + QR-coded certificates traceable to TÜV SÜD (NB 0123) audit reports. |

| Technical File Audit | Request full Technical File per MDR Annex II. Verify clinical evaluation (PMCF), UDI system, and risk management per ISO 14971:2019. | Pre-shipment Technical File review portal with password-protected access to design history files (DHF) and biocompatibility test reports (ISO 10993). |

| Factory Inspection | Conduct unannounced audit via 3rd party (e.g., SGS) focusing on electromagnetic compatibility (IEC 60601-1-2:2020) and radiation safety protocols. | Carejoy offers virtual factory tours + live radiation calibration demos. 97% audit pass rate (2025 BSI report). |

| Post-Market Surveillance | Confirm vendor has PMS plan per MDR Article 83 with incident reporting SOPs. | Dedicated PMS portal for distributors with automated EU Vigilance reporting templates. |

Step 2: Negotiating MOQ & Commercial Terms (2026 Market Realities)

Chinese manufacturers now enforce tiered MOQs due to component shortages (e.g., flat-panel detectors). Strategic negotiation is critical:

| Term | Risk of Standard Approach | 2026 Best Practice |

|---|---|---|

| CBCT MOQ | Fixed 5+ unit MOQ locks clinics into excess inventory; distributors face cash flow strain. | Bundled Product Strategy: Negotiate combined MOQ across product lines (e.g., 2 CBCT + 3 Chairs + 5 Scanners = 10 total units). Carejoy offers zero MOQ for distributors with annual volume commitments. |

| Payment Terms | 100% LC at sight increases buyer risk; 30% deposit leaves supplier exposed. | Use 40-40-20 structure: 40% deposit, 40% post-factory acceptance test (FAT), 20% post-installation. Carejoy provides FAT video logs with radiation calibration data. |

| Warranty | Standard 12-month warranty excludes X-ray tubes (60% failure point). | Negotiate 24-month comprehensive warranty with on-site engineer dispatch. Carejoy includes 2-year X-ray tube coverage + remote diagnostics. |

Step 3: Shipping & Logistics (DDP vs. FOB – 2026 Cost Analysis)

With 2026 ocean freight volatility (+22% YoY per Drewry), DDP (Delivered Duty Paid) is now the dominant model for risk-averse buyers:

| Term | Cost Breakdown (40ft HC Container) | Critical 2026 Considerations |

|---|---|---|

| FOB Shanghai |

• Freight: $4,200 • Insurance: $180 • Destination Charges: $1,200+ • Total Hidden Costs: 18-25% |

High risk: Unpredictable customs delays (avg. 14 days in Rotterdam 2025). Requires local agent. Only recommended for experienced distributors. |

| DDP [Your Clinic] |

• All-inclusive: $6,800 (fixed) • Includes: CIF + EU VAT + customs clearance • No surprise fees |

Carejoy’s 2026 advantage: Pre-cleared shipments via bonded warehouse in Duisburg. 92% on-time delivery (2025 DHL metrics). Required for clinics without import licenses. |

Note: For CBCT systems, insist on climate-controlled containers (20°C ±2°C) to prevent sensor calibration drift during transit. Carejoy includes IoT temperature/humidity loggers in all DDP shipments.

Secure Your 2026 CBCT Sourcing Strategy

Shanghai Carejoy Medical Co., LTD provides turnkey compliance for global CBCT procurement with:

- Factory-direct pricing (no trading company markups)

- MDR-compliant documentation packages

- DDP shipping to 45+ countries

- Technical training in 8 languages

Action Required: Request a 2026 Regulatory Compliance Dossier with sample CE Technical File excerpts.

Email: [email protected] | WhatsApp: +86 15951276160

Verify factory location: Room 1208, Building 3, No. 255 Gucun Road, Baoshan District, Shanghai, China

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing 3D X-Ray Equipment in 2026

- Site Assessment: Evaluation of space, power supply, radiation shielding, and network connectivity.

- Shielding Compliance: Verification of lead-lined walls or use of prefabricated shielded enclosures meeting local regulatory standards (e.g., FDA, Health Canada, EU MDR).

- Equipment Delivery & Positioning: Professional handling with calibrated leveling and clearance for rotation.

- Network Integration: DICOM 3.0 compatibility, integration with practice management software, and cloud connectivity setup.

- Calibration & QA Testing: Post-installation performance validation using phantoms and dose measurement tools.

Most manufacturers provide certified engineers for turnkey installation, typically requiring 1–2 days. Pre-installation checklists are now digitally managed via vendor portals for efficiency.

| Component | Standard Warranty | Extended Options |

|---|---|---|

| X-ray Tube | 1–2 years | Up to 5 years (pro-rata or full) |

| Detector (Sensor) | 2 years | Extendable to 5 years |

| Software & Electronics | 2 years | Includes remote diagnostics |

| Labor & Onsite Service | 1 year | Optional 24/7 premium support |

Clinics are advised to negotiate comprehensive service agreements that include preventive maintenance, software updates, and priority response times. Look for manufacturers offering “uptime guarantees” (e.g., 95% operational availability) as part of extended warranty plans.

- Radiation Safety: Compliance with updated IEC 60601-2-63 standards and local licensing (e.g., state health departments or EU Notified Bodies).

- Data Security: HIPAA, GDPR, and NIST-aligned encryption for patient imaging data, especially with cloud-based platforms.

- AI-Assisted Diagnostics: Equipment using AI for lesion detection must comply with medical device regulations (e.g., FDA 510(k), EU MDR Class IIa/IIb).

- Environmental Standards: RoHS and WEEE compliance for equipment disposal and recycling.

Ensure your vendor provides full documentation for regulatory submission and offers training on compliance protocols during installation.

© 2026 Professional Dental Equipment Guide. For internal use by dental clinics and authorized distributors only.

Need a Quote for 3D X Ray Equipment?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160