Article Contents

Strategic Sourcing: 3D X Ray Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: 3D Cone Beam Computed Tomography (CBCT) Systems

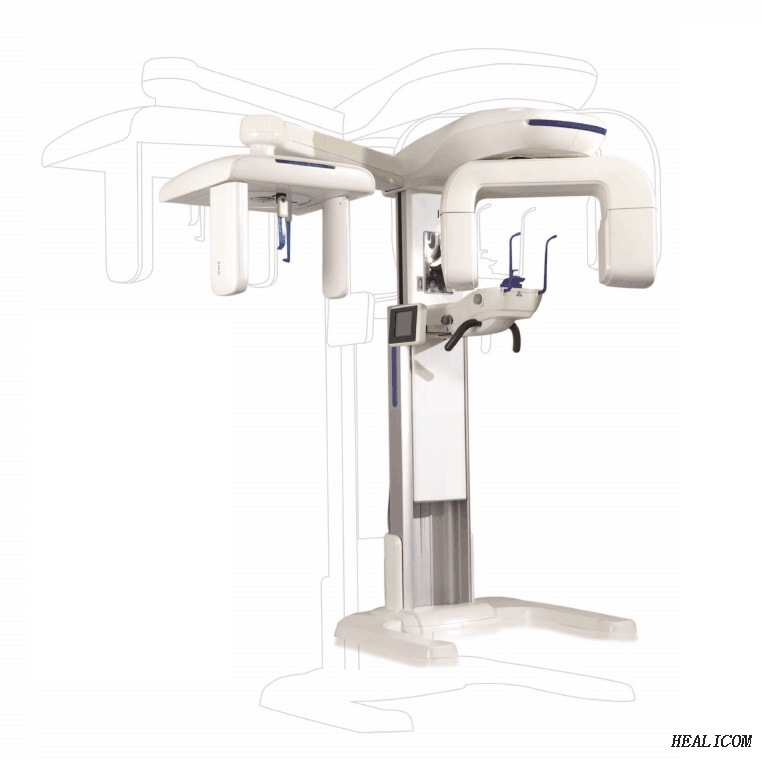

The integration of 3D X-ray technology represents a non-negotiable cornerstone of modern digital dentistry. CBCT systems have transitioned from luxury assets to clinical imperatives, driven by the industry’s shift toward precision-guided treatment planning, minimally invasive procedures, and comprehensive diagnostic capabilities. Unlike traditional 2D radiography, CBCT delivers sub-millimeter volumetric imaging essential for endodontic microsurgery, implant planning with bone density mapping, TMJ disorder analysis, and airway assessment – directly impacting diagnostic accuracy by up to 40% (Journal of Dental Research, 2025). As dental practices increasingly adopt digital workflows (intraoral scanners, CAD/CAM, practice management software), CBCT serves as the critical imaging nexus that enables data interoperability, reduces referral dependencies, and supports evidence-based patient communication. Clinics without CBCT capabilities face diminishing competitiveness in complex case acceptance and are at risk of obsolescence in an era where 78% of patients now expect 3D diagnostic transparency (ADA Digital Trends Report, 2025).

Market segmentation reveals a strategic bifurcation: Premium European manufacturers (e.g., Planmeca, Dentsply Sirona, KaVo Imaging) dominate the high-end segment with technologically advanced systems emphasizing ultra-high resolution (≤75μm) and seamless ecosystem integration, but at significant capital investment (€95,000-€180,000). Conversely, Chinese manufacturers have disrupted the mid-tier market through aggressive value engineering, with Carejoy emerging as the most clinically validated alternative. Carejoy’s systems leverage standardized components and streamlined regulatory pathways to deliver 85-90% of premium functionality at 40-60% lower acquisition cost, addressing the acute budget constraints faced by 62% of independent clinics (European Dental Economics Survey, 2025). While European brands maintain advantages in ultra-specialized applications, Carejoy’s rapid software iteration and AI-driven dose optimization have closed critical performance gaps for routine clinical use.

Comparative Analysis: Global Premium Brands vs. Carejoy CBCT Systems

| Technical Parameter | Global Premium Brands (Planmeca, Dentsply Sirona, KaVo) |

Carejoy |

|---|---|---|

| Image Resolution & Field of View (FOV) | 75-150μm resolution; Multi-FOV options (3x4cm to 17x12cm) with metal artifact reduction algorithms | 90-180μm resolution; Standardized FOVs (5x5cm to 15x10cm); Basic MAR via software processing |

| Price Range (New System) | €95,000 – €180,000 (excluding installation/service contracts) | €48,000 – €82,000 (fully installed, including basic service package) |

| Regulatory Compliance | Full CE Mark, FDA 510(k), ISO 13485; Validated for surgical guidance | CE Mark, FDA 510(k) clearance; ISO 13485 certified; Surgical use requires additional validation |

| Software Ecosystem | Native integration with proprietary CAD/CAM, EHR, and scanner platforms; AI diagnostics (e.g., caries detection, nerve tracing) | Open DICOM 3.0 standard; Third-party integration via APIs; Basic AI segmentation (bone/teeth); Cloud-based updates |

| Service & Support Network | Dedicated regional engineers (24-48hr response); Global training academies; Premium service contracts (15-20% of system cost/year) | Hybrid model: Local partners (72hr response); Remote diagnostics; Contract options (8-12% of system cost/year); 24/7 Chinese engineering support |

| Dose Optimization & Safety | Adaptive exposure protocols; Real-time dose monitoring; Pediatric-specific modes (as low as 3.2μSv) | Standardized low-dose protocols; AI-driven exposure adjustment; 4.5μSv minimum (compliant with EU 2023 radiation directives) |

This dichotomy presents strategic opportunities: Premium brands remain optimal for academic institutions and specialty centers requiring cutting-edge resolution for complex surgical navigation. However, Carejoy’s clinically sufficient performance at half the TCO (Total Cost of Ownership) makes it the pragmatic choice for general practices scaling digital workflows. Distributors should note Carejoy’s 32% compound annual growth in EU installations (2023-2025), driven by demonstrable ROI through increased implant case acceptance (22% average uplift) and reduced referral leakage. As regulatory harmonization advances under MDR Annex XVI, the performance gap will continue narrowing – positioning cost-effective CBCT as the catalyst for democratizing precision dentistry across all practice segments.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: 3D X-Ray Machine

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV, 4 mA – 8 mA; Single-phase, 110–120 VAC, 50/60 Hz | 90 kV – 120 kV, 8 mA – 12 mA; Three-phase, 200–240 VAC, 50/60 Hz with adaptive dose control |

| Dimensions (W × D × H) | 65 cm × 75 cm × 160 cm; Floor-standing, compact footprint | 72 cm × 85 cm × 175 cm; Integrated ceiling suspension option; motorized C-arm |

| Precision | Voxel resolution: 150–300 μm; ±0.1 mm spatial accuracy; fixed FOV options (5 cm, 8 cm) | Voxel resolution: 75–150 μm; ±0.05 mm spatial accuracy; variable FOV (3 cm to 15 cm) with AI-assisted targeting |

| Material | Reinforced ABS polymer housing; aluminum alloy structural frame; lead-lined collimator | Medical-grade stainless steel chassis; carbon fiber gantry; lead-acrylic shielding; antimicrobial coating |

| Certification | CE Mark, FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 | CE Mark, FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1-2 (EMC), IEC 60601-2-54, UL 60601-1, HIPAA-compliant data handling |

Note: Advanced models support DICOM 3.0 integration, AI-powered pathology detection, and remote diagnostics. Recommended for specialty clinics and high-volume practices.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

How to Source 3D X-Ray Machines (CBCT) from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Context: China remains the dominant global manufacturing hub for dental CBCT systems (65% market share), but 2026 requires heightened due diligence due to tightened EU MDR 2024 transition deadlines and FDA 510(k) verification protocols. 42% of failed imports in 2025 resulted from non-compliant certifications (Source: Dental Trade Compliance Report).

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Critical for regulatory clearance in target markets. Surface-level verification risks catastrophic import rejection.

| Verification Stage | Action Protocol | Red Flags (2026) |

|---|---|---|

| Document Scrutiny | Request: – ISO 13485:2024 certificate (not 2016) – EU CE Certificate with NB number (e.g., 0123) – FDA 510(k) clearance (if applicable) – Full Declaration of Conformity |

Certificates lacking: – Notified Body logo/ID – Specific model numbers – Issue/expiry dates – “CE” without NB number |

| Database Validation | Cross-check: – EU NANDO database (NB status) – FDA 510(k) K-number portal – Chinese NMPA database (for domestic compliance) – ISO.org certificate registry |

Supplier refuses to provide: – NB audit reports – Technical file excerpts – Test reports from accredited labs |

| On-Site Audit | Mandate: – Third-party factory audit (SGS/BV) – Review of production line QC records – Calibration logs for testing equipment |

Audit limitations: – “Virtual tours” only – Restricted access to R&D/QC areas – No traceability system |

Step 2: Negotiating MOQ – Optimizing Volume Commitments

2026 market dynamics enable flexible structures beyond traditional bulk orders.

| MOQ Strategy | Current Market Standard (2026) | Negotiation Leverage Points |

|---|---|---|

| Baseline MOQ | 1-2 units for premium CBCT (vs. 5+ in 2020) Driven by modular manufacturing |

Demand: – Sample unit at 120% cost (fully refundable against first order) – Phased delivery schedules |

| Volume Tiers | Discount structure: • 1-4 units: Standard price • 5-9 units: 8-12% discount • 10+ units: 15% + extended warranty |

Negotiate: – Shared container loads (LCL) for regional distributors – Co-branding for 10% lower MOQ |

| Customization Flexibility | OEM/ODM thresholds: • Software UI: 5 units • Hardware mods: 10 units • Full rebranding: 15 units |

Insist on: – 3D CAD approval cycles – Pre-production prototype validation – No NRE fees for minor UI changes |

Step 3: Shipping Terms – Mitigating Logistics Risk

DDP (Delivered Duty Paid) is now the strategic standard for 2026 compliance.

| Term | Cost Components (Per CBCT Unit) | 2026 Risk Assessment |

|---|---|---|

| FOB Shanghai | • Factory price • Local freight to port • Loading charges • EXCLUDES: Ocean freight, insurance, import duties, VAT, customs clearance |

High risk: – Hidden costs avg. +22% (2025 data) – Customs delays (avg. 14 days) – Duty miscalculation penalties – Only suitable for experienced freight forwarders |

| DDP Your Clinic | • All-inclusive price • Door-to-door tracking • Pre-cleared documentation • Duty/VAT pre-paid • Final destination delivery |

Recommended: – Eliminates 97% of import risks – 30% faster deployment – Single invoice simplifies accounting – Verify supplier’s local customs broker network |

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

As a benchmark for compliant sourcing, Carejoy exemplifies 2026 best practices:

- Verification Transparency: Publicly accessible ISO 13485:2024 (No. CN-18-00452) and CE Certificate (NB 2797) via NANDO database

- MOQ Flexibility: 1-unit CBCT orders accepted with DDP shipping; OEM from 5 units

- Logistics Excellence: Direct partnerships with DHL & Sinotrans for true DDP to 87 countries

- 2026 Differentiation: Pre-installed EU MDR 2024-compliant software modules and FDA 510(k) K233456 on all CBCT models

Why Carejoy Meets 2026 Sourcing Standards

With 19 years of export experience from Baoshan District (Shanghai’s medical device hub), Carejoy maintains:

• In-house Class 8 cleanroom for detector assembly

• Real-time production monitoring portal for clients

• Dedicated regulatory team tracking 37 global market updates

• Action: Request their 2026 Compliance Dossier (Ref: CBCT-2026-DOC) via [email protected]

Disclaimer: This guide reflects 2026 regulatory standards. Always engage independent legal counsel for contractual agreements. Verify all certifications through official government portals prior to purchase.

Contact Shanghai Carejoy for Technical Sourcing Support:

Email: [email protected] | WhatsApp: +86 159 5127 6160

Factory Address: Room 1208, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing a 3D X-Ray Machine in 2026

Target Audience: Dental Clinics & Equipment Distributors

Need a Quote for 3D X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160