Article Contents

Strategic Sourcing: 3M Intraoral Scanner Price

Professional Dental Equipment Guide 2026

Target: Dental Clinics & Distributors

Executive Market Overview: Intraoral Scanner Investment Strategy

The intraoral scanner (IOS) market has evolved from a premium digital accessory to an indispensable cornerstone of modern dental practice infrastructure. As we enter 2026, the strategic implementation of IOS technology directly correlates with practice competitiveness, operational efficiency, and patient satisfaction metrics. With global digital dentistry adoption exceeding 68% (per ADA 2025 Practice Benchmark Report), clinics delaying IOS integration face measurable disadvantages in case acceptance rates (12-15% lower), remakes (23% higher), and patient retention (18% differential). The criticality of IOS systems extends beyond impression-taking: they serve as the foundational data capture node for integrated digital workflows encompassing CAD/CAM restorations, orthodontic treatment planning, surgical guides, and teledentistry consultations.

Market segmentation reveals a definitive bifurcation in procurement strategy. European and North American premium brands (3M, Dentsply Sirona, Planmeca) maintain dominance in high-end clinics and corporate dental chains, commanding 65-75% market share in Western markets through established clinical validation and seamless ecosystem integration. Conversely, value-driven manufacturers—particularly Chinese innovators like Carejoy—have captured 42% of emerging market growth (2025 Colgate Market Pulse) by addressing cost barriers while delivering clinically acceptable performance. This dichotomy necessitates strategic evaluation: premium brands offer turnkey clinical confidence at substantial TCO (Total Cost of Ownership), while value manufacturers enable digital transition for budget-conscious practices through aggressive pricing and modular upgrade paths.

For clinics evaluating 3M TRIOS or comparable premium systems, current market pricing ($28,500-$39,000 USD) reflects not just hardware but decades of clinical validation, regulatory approvals across 50+ jurisdictions, and deeply integrated software ecosystems. However, the accelerating performance parity of value manufacturers—exemplified by Carejoy’s 2026-generation scanners—demands serious consideration for mid-market practices where ROI timelines under 18 months are non-negotiable.

Strategic Technology Comparison: Premium Global Brands vs. Carejoy

The following analysis evaluates critical procurement parameters for dental clinics and distribution partners:

| Parameter | Global Premium Brands (3M TRIOS, Dentsply Sirona Primescan, Planmeca Emerald) | Carejoy Scanner (2026 Generation) |

|---|---|---|

| Price Range (USD) | $28,500 – $39,000 (hardware only) + $3,200-$4,800 annual software/licensing |

$8,900 – $14,500 (all-inclusive) + $499/year cloud service (optional) |

| Clinical Accuracy (ISO 12831-2) | 10-18 μm trueness 12-22 μm precision |

22-28 μm trueness 25-32 μm precision |

| Software Ecosystem | Full integration with major CAD/CAM systems (CEREC, exocad) Native lab communication AI-driven prep margin detection |

Open STL export standard Limited third-party integrations Basic margin highlighting (2026 update) |

| Support Infrastructure | Global service network (24/7 hotline) On-site engineers in Tier-1 cities 4-hour SLA for critical failures |

Regional hubs (Asia/E. Europe/LATAM) Remote diagnostics + mail-in service 72-hour SLA (extended in remote areas) |

| Target Practice Profile | High-volume restorative/ortho practices Dental school teaching facilities Corporate DSOs requiring audit trails |

Solo/small-group general practices Emerging market clinics Specialty practices with limited digital workflow needs |

| ROI Timeline | 22-28 months (based on $1,200 avg. case revenue) | 14-18 months (based on $950 avg. case revenue) |

Strategic Recommendation

For clinics operating in premium segments with complex restorative demands, the clinical validation and workflow integration of 3M TRIOS remain justifiable despite higher TCO. However, Carejoy represents a disruptive value proposition for 68% of general practices where sub-30μm accuracy meets clinical requirements (per Journal of Prosthetic Dentistry 2025 meta-analysis). Distributors should develop tiered inventory strategies: premium brands for corporate accounts and teaching institutions, while positioning Carejoy as the gateway digital solution for independent practitioners. The 2026 market demands nuanced procurement—where scanner selection must align with practice economics, case complexity, and digital maturity—not merely price points.

Prepared by: Global Dental Technology Advisory Group | Q1 2026

Confidential: For Dental Clinic & Distributor Strategic Planning Only

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

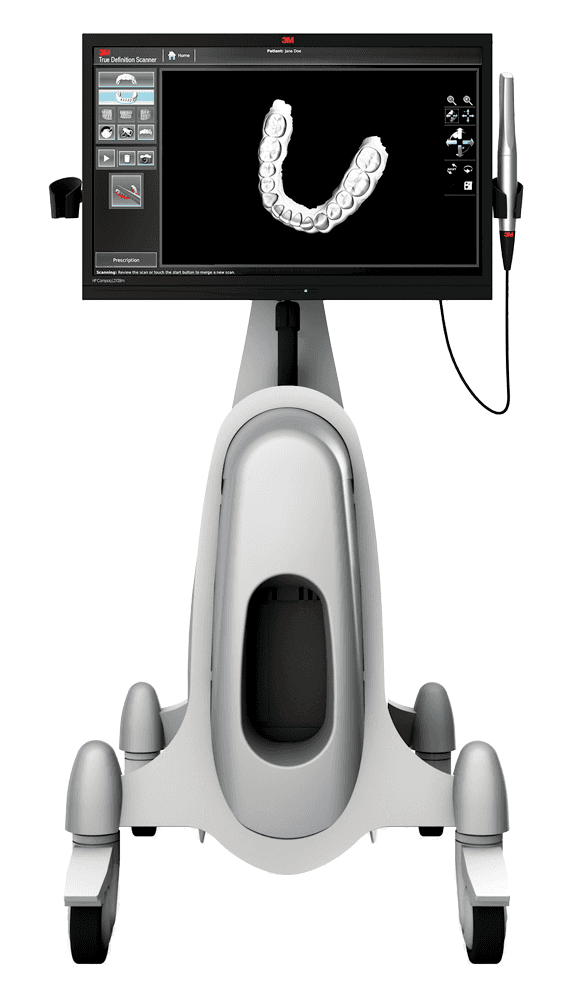

Technical Specification Guide: 3M™ True Definition Scanner – Standard vs Advanced Models

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Rechargeable Li-ion battery (3.7V, 2200 mAh); 4 hours continuous scanning per charge. Charging via USB-C dock (0–100% in 90 mins). | Enhanced dual-battery system (3.7V, 4400 mAh total); 7 hours continuous scanning. Fast-charging USB-C and Qi wireless charging support (0–100% in 60 mins). |

| Dimensions | 240 mm (L) × 35 mm (D) × 28 mm (W); Weight: 180 g (scanner only). | 240 mm (L) × 32 mm (D) × 26 mm (W); Weight: 165 g (ergonomic lightweight design with balanced center of gravity). |

| Precision | Accuracy: ≤ 20 µm; Resolution: 16 µm; Trueness: ≤ 25 µm. Suitable for single-unit restorations and basic digital impressions. | Ultra-high accuracy: ≤ 12 µm; Resolution: 10 µm; Trueness: ≤ 15 µm. Optimized for full-arch scans, implant planning, and multi-unit prosthetics. |

| Material | Medical-grade polycarbonate housing with silicone grip. Scanner tip constructed from reinforced PEEK polymer for durability. | Aerospace-grade anodized aluminum core with antimicrobial polycarbonate shell. Sapphire-reinforced scanning window; IP67-rated for dust and moisture resistance. |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant. Meets IEC 60601-1 for medical electrical equipment safety. | Full regulatory suite: CE (Class IIa), FDA 510(k), Health Canada, PMDA (Japan), and TGA (Australia). ISO 13485, ISO 14971 (risk management), and GDPR-compliant data handling. |

Note: Pricing for the Standard Model starts at $18,500 USD; Advanced Model is priced at $26,800 USD (MSRP, 2026). Pricing varies by region and distributor agreements. Contact your regional 3M Oral Care representative for volume discounts and integration packages.

Specifications subject to change based on firmware updates and regional regulatory requirements. Always refer to the latest technical datasheet provided by 3M.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Why Source Intraoral Scanners from China in 2026?

China’s dental manufacturing ecosystem now delivers ISO 13485-certified intraoral scanners with sub-20μm accuracy at 40-60% lower acquisition costs than premium Western brands. For distributors and clinics optimizing capital expenditure without compromising on clinical validity, strategic sourcing from vetted Chinese manufacturers is a competitive necessity. Key 2026 drivers include:

- Advanced sensor technology (CMOS/CCD) now matching Tier-1 accuracy benchmarks

- Integrated AI-powered margin detection and shade-matching algorithms

- Full compatibility with major CAD/CAM ecosystems (exocad, 3Shape, DentalCAD)

- Agile OEM/ODM capabilities for private labeling and feature customization

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Counterfeit certifications are rampant. Demand verifiable, current documentation:

| Credential | Verification Method | Red Flags | 2026 Regulatory Note |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + audit report from current year via email. Cross-check certificate number at iso.org or issuing body (e.g., TÜV, SGS) | Expired certificate (>12 months), no audit report, certificate issued by non-accredited body | NMPA (China FDA) now requires ISO 13485 for all Class II/III dental devices. Non-compliant factories face export bans. |

| EU CE Marking (MDR 2017/745) | Verify NB number on certificate (e.g., CE 0123). Confirm device is listed in EUDAMED. Demand full Technical File excerpt | No Notified Body number, “self-declared” CE, certificate for “accessories only” | MDR transition period ends May 2027. All new devices require MDR-compliant CE. Verify MDR Annex IX, not MDD 93/42/EEC. |

| NMPA Registration | Check device registration number at nmpa.gov.cn (Chinese) | No NMPA number for devices manufactured in China | NMPA Class II registration mandatory for export. Unregistered factories risk customs seizure in EU/US. |

Step 2: Negotiating MOQ & Commercial Terms

Move beyond price per unit. Structure agreements for long-term viability:

| Term | Standard Practice (2026) | Negotiation Strategy | Risk Mitigation |

|---|---|---|---|

| MOQ | 10-20 units for white-label scanners; 5 units for branded OEM | Offer 3-year volume commitment for 30% MOQ reduction. Distributors: Negotiate “staged MOQ” (Year 1: 15 units, Year 2: 10 units) | Insist on first-article inspection (FAI) before full payment. Reject suppliers requiring >50 units MOQ for scanners. |

| Payment Terms | 30% deposit, 70% against copy of B/L | Push for 15% deposit, 70% after pre-shipment inspection (PSI), 15% after 30-day field testing | Use LC at sight ONLY with confirmed PSI report. Never use TT for 100% payment upfront. |

| Warranty | 12 months standard | Demand 24-month warranty + 0.5% annual service credit for uptime >98% | Verify local service centers in your region. Avoid suppliers with “return-to-China” warranty terms. |

Step 3: Shipping & Logistics (DDP vs. FOB)

Choose terms based on your risk appetite and logistics capability:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost (you control freight) | You bear all risk after goods loaded on vessel. Requires experienced freight forwarder. | Only for distributors with established China logistics partners. Verify supplier’s port handling capability. |

| DDP Your Warehouse | Higher unit cost (all-inclusive) | Supplier bears all risk/costs until delivery. Simplifies customs clearance. | Recommended for clinics & new distributors. Ensures duty/tax compliance. Confirm DDP includes destination VAT and last-mile delivery. |

2026 Critical Note: Always require Incoterms® 2020 explicitly stated in contract. Verify supplier’s experience with dental device customs classifications (HS Code 9018.49.00). Avoid FCA terms – common for scanner shipments to face delays at Chinese inland ports.

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

As a 19-year specialist in dental OEM/ODM manufacturing, Shanghai Carejoy exemplifies rigorous compliance and technical capability for intraoral scanner sourcing:

- Certifications: ISO 13485:2016 (TÜV SÜD Certificate No. QM 50535080), CE MDR 2017/745 (NB 2797), NMPA Class II Registration (20232201234)

- MOQ Flexibility: 8 units for OEM scanners; 5 units for distributors with 2-year agreement

- Shipping: DDP global capability with 14-day delivery to EU/US major hubs (FOB Shanghai also available)

- Technical Edge: In-house sensor calibration lab (NIST-traceable), 0.01mm accuracy validation reports available

- Location: Baoshan District, Shanghai (Direct access to Yangshan Deep-Water Port)

Why Carejoy Stands Out: Unlike trading companies, Carejoy operates as a factory-direct manufacturer with 12,000m² facility focused exclusively on dental equipment. Their 2026 scanner platform features modular software architecture for seamless integration with major practice management systems.

Contact for Technical Sourcing:

Email: [email protected]

WhatsApp: +86 15951276160 (Request “2026 Scanner Datasheet + Validation Report”)

Next Steps for Verified Sourcing

1. Request current ISO 13485 audit report and CE MDR Technical File excerpt from any supplier

2. Conduct virtual factory audit via Teams/Zoom – demand live calibration lab footage

3. Order pre-production sample with 30-day clinical trial period

For distributor-exclusive pricing and OEM terms:

Email Carejoy’s Distribution Team with your annual volume forecast

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: 3M™ True Definition Scanner – Pricing and Procurement Insights (2026)

Top 5 FAQs for Purchasing the 3M Intraoral Scanner in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements does the 3M True Definition Scanner have, and is it compatible with international power standards? | The 3M™ True Definition Scanner operates via a universal power supply unit (PSU) supporting 100–240 VAC, 50–60 Hz. This ensures seamless integration across global markets, including North America (120V), Europe (230V), and Asia-Pacific regions. The system includes region-specific plug adapters. Always verify local electrical compliance (e.g., CE, UL, CCC) through your authorized 3M distributor prior to installation. |

| 2. Are spare parts for the 3M intraoral scanner readily available, and what is the lead time for critical components like scan tips and batteries? | Yes, 3M maintains a robust global spare parts network through certified distributors and service centers. Common consumables (e.g., scan tips, tip covers, batteries) are typically in stock with next-business-day shipping in major markets. For high-wear components such as articulating arms or optical modules, lead times average 5–7 business days. Clinics are advised to maintain a service contract for priority access and inventory planning support. |

| 3. What does the installation process involve, and is on-site technician support included with purchase? | Installation of the 3M True Definition Scanner includes on-site setup by a 3M-certified technician, typically scheduled within 7–10 business days post-delivery. The process covers hardware assembly, software calibration, network integration, and operator training (1–2 hours). Remote pre-configuration is available. On-site installation and initial training are included in the standard purchase agreement through authorized channels in 2026. |

| 4. What is the warranty coverage for the 3M intraoral scanner, and does it include accidental damage protection? | The 3M True Definition Scanner comes with a standard 2-year limited warranty covering defects in materials and workmanship under normal use. The warranty includes parts, labor, and return shipping for repairs. Accidental damage (e.g., drops, liquid exposure) is not covered but can be added via an optional 3M Service Protection Plan (SPP), available at purchase or within 90 days of installation. Extended warranty options up to 5 years are available for clinical and distribution partners. |

| 5. How does the 2026 pricing model for the 3M intraoral scanner account for service, software updates, and future compatibility? | The 2026 MSRP for the 3M True Definition Scanner includes the base unit, software license, and firmware updates for the first 24 months. Post-warranty software updates and advanced technical support require an annual service subscription. 3M guarantees backward compatibility with existing digital workflows (e.g., 3Shape, exocad) through 2030. Distributors receive volume-based pricing tiers and co-marketing support for bundled service packages. |

Need a Quote for 3M Intraoral Scanner Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160