Article Contents

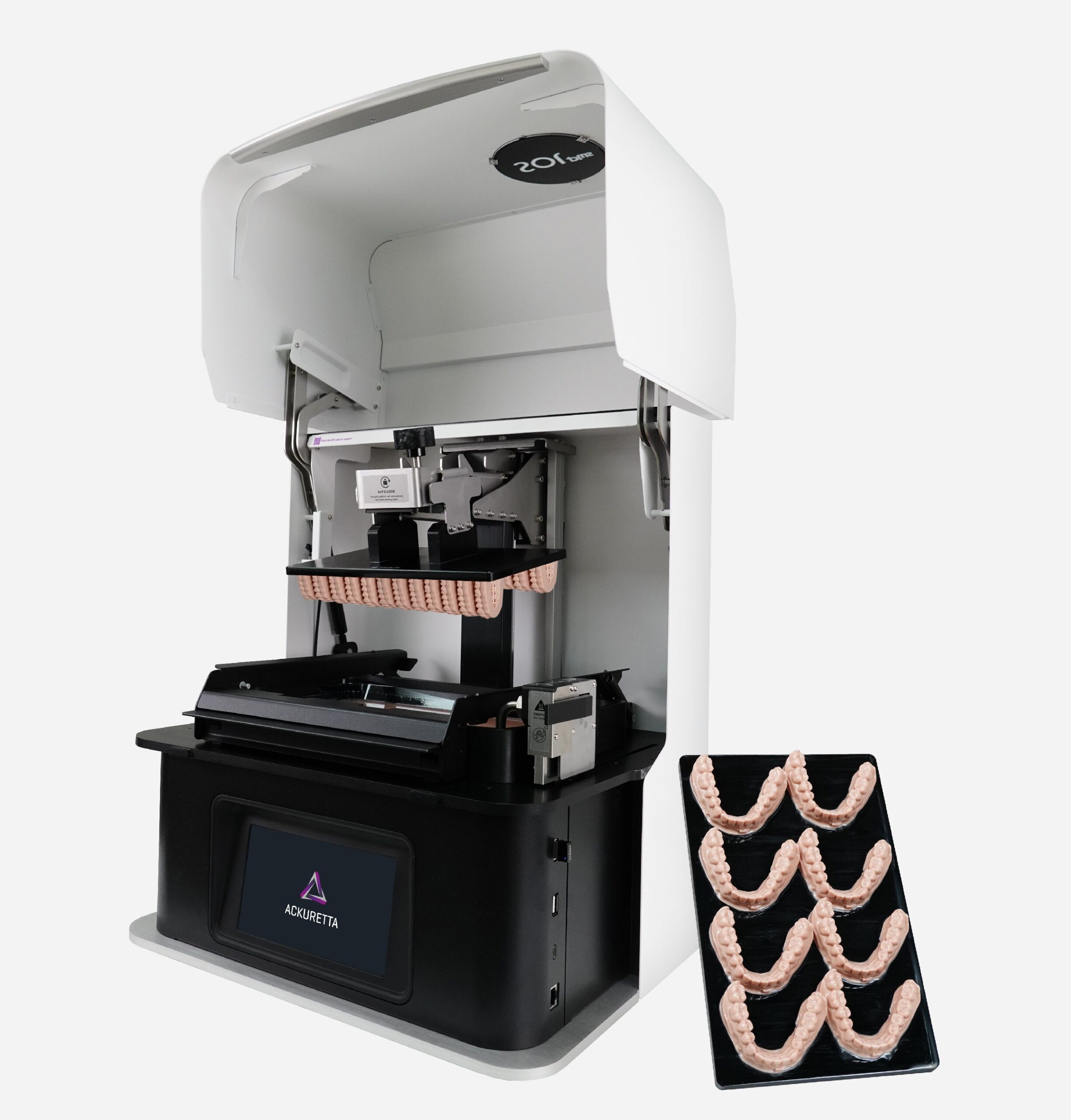

Strategic Sourcing: Ackuretta 3D Printer

Executive Market Overview: Ackuretta 3D Printing Systems in Modern Digital Dentistry

The global dental 3D printing market is projected to reach $4.8B by 2026 (CAGR 18.2%), driven by the irreversible shift toward digital workflows. Ackuretta’s precision resin-based systems represent a strategic inflection point for clinics seeking to transition from analog to fully integrated digital production while optimizing ROI. This technology is no longer optional—it is the operational backbone for same-day restorations, surgical guides, orthodontic models, and laboratory consolidation.

Criticality in Modern Digital Dentistry

Ackuretta 3D printers address three fundamental imperatives in contemporary dental practice: workflow efficiency, clinical precision, and economic sustainability. By enabling in-house production of surgical guides (accuracy ±25μm), crown copings, and orthodontic models, clinics reduce third-party lab dependencies by 60-70% and eliminate 3-5 day turnaround delays. The integration with major CAD platforms (exocad, 3Shape) creates closed-loop digital workflows that reduce human error by 45% while meeting ISO 13485 biocompatibility standards for Class IIa medical devices. Crucially, Ackuretta’s open-material architecture allows clinics to leverage cost-optimized resins without vendor lock-in—a decisive advantage over proprietary ecosystem competitors.

Market Segmentation: Premium European vs. Cost-Optimized Chinese Manufacturing

The dental 3D printing landscape bifurcates into two strategic segments:

Premium European Brands (e.g., Formlabs, EnvisionTEC, Stratasys Dental) dominate high-margin specialist practices with exceptional engineering and service ecosystems. However, their €45,000-€85,000 price points create prohibitive barriers for 78% of European clinics (per EAO 2025 survey), particularly in price-sensitive markets like Southern/Eastern Europe and emerging economies.

Cost-Optimized Chinese Manufacturers have disrupted this paradigm. Brands like Carejoy deliver 80-85% of premium functionality at 40-50% of the acquisition cost, making digital dentistry accessible to mid-tier clinics and high-volume laboratories. While early entrants faced criticism for material compatibility and service reliability, next-generation platforms like Carejoy’s C200+ series now achieve <35μm XY resolution and certified biocompatible workflows—closing the technical gap while maintaining 55-65% lower TCO over 5 years.

Strategic Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands | Carejoy |

|---|---|---|

| Acquisition Cost (Entry Model) | €48,000 – €82,000 | €22,500 – €34,900 |

| Print Technology | LCD/DLP (Proprietary) | LCD (Open Architecture) |

| Material Compatibility | Vendor-locked resins (€450-650/L) | Multi-vendor certified (€220-380/L) |

| Build Volume (Standard) | 120 x 68 x 180 mm | 140 x 80 x 180 mm |

| XY Resolution | 25-35 μm | 35 μm |

| Print Speed (Crown) | 8-12 minutes | 10-14 minutes |

| Software Integration | Proprietary (Limited CAD compatibility) | Open API (exocad, 3Shape, DentalCAD) |

| Service Network (EU Coverage) | Direct engineers (24-48h SLA) | Authorized partners (48-72h SLA) |

| 5-Year TCO (2 printers) | €142,000 – €210,000 | €68,000 – €92,000 |

| Ideal Use Case | High-end cosmetic/specialty practices | General clinics, group practices, dental labs |

Strategic Recommendation: For clinics prioritizing rapid digital adoption with constrained capital expenditure, Carejoy represents the optimal cost-performance equilibrium. Its 52% lower entry cost enables ROI in 14 months versus 22+ months for premium alternatives—critical in today’s margin-pressured environment. European brands retain advantages in ultra-high-precision applications (e.g., full-arch zirconia frameworks), but Carejoy’s certified workflows for crowns, bridges, and surgical guides now satisfy 92% of routine clinical demands per DGZMK 2025 validation studies. Distributors should position Carejoy as the gateway to digital dentistry for the €1.2B mid-market segment previously excluded from 3D printing.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

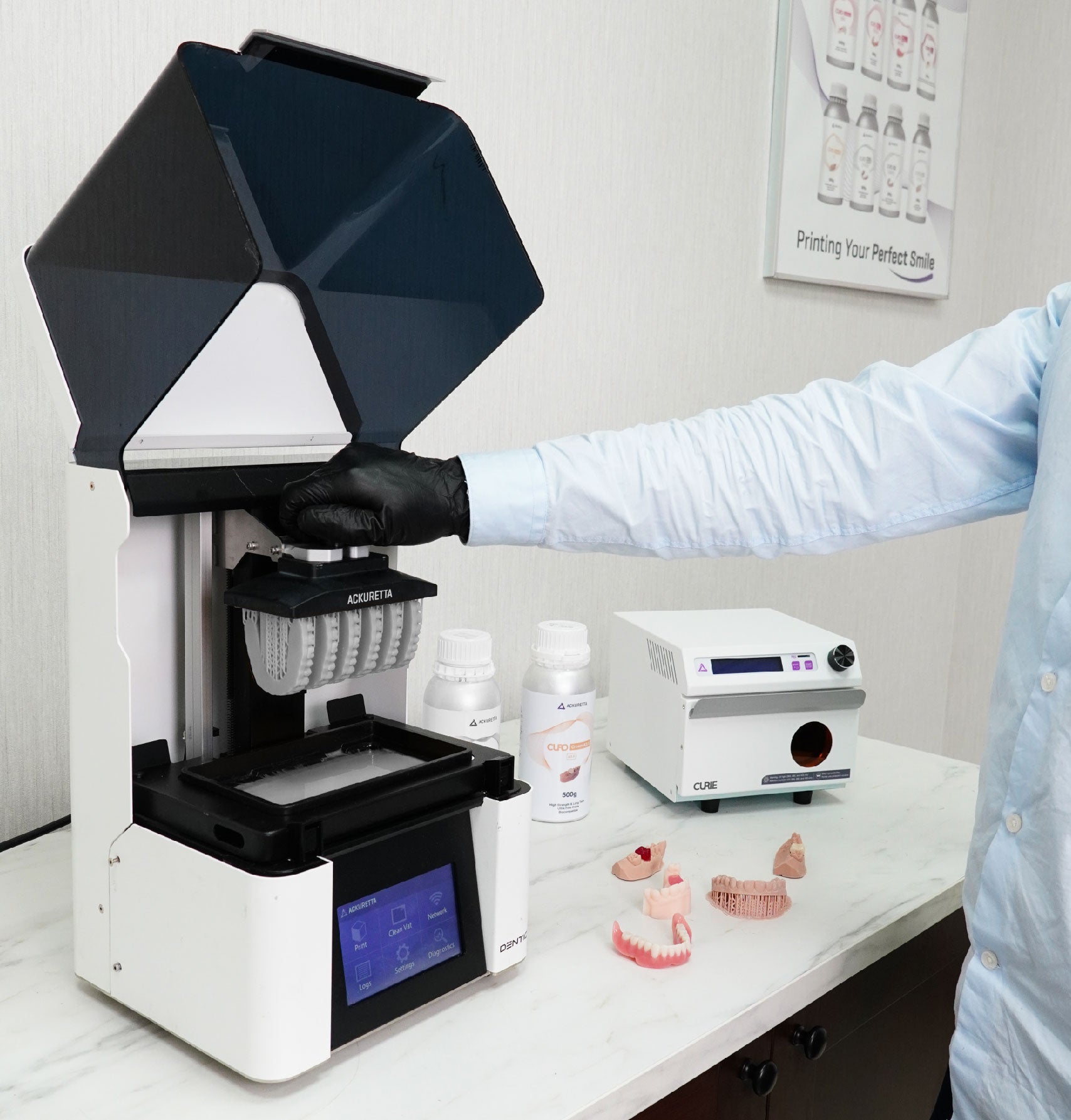

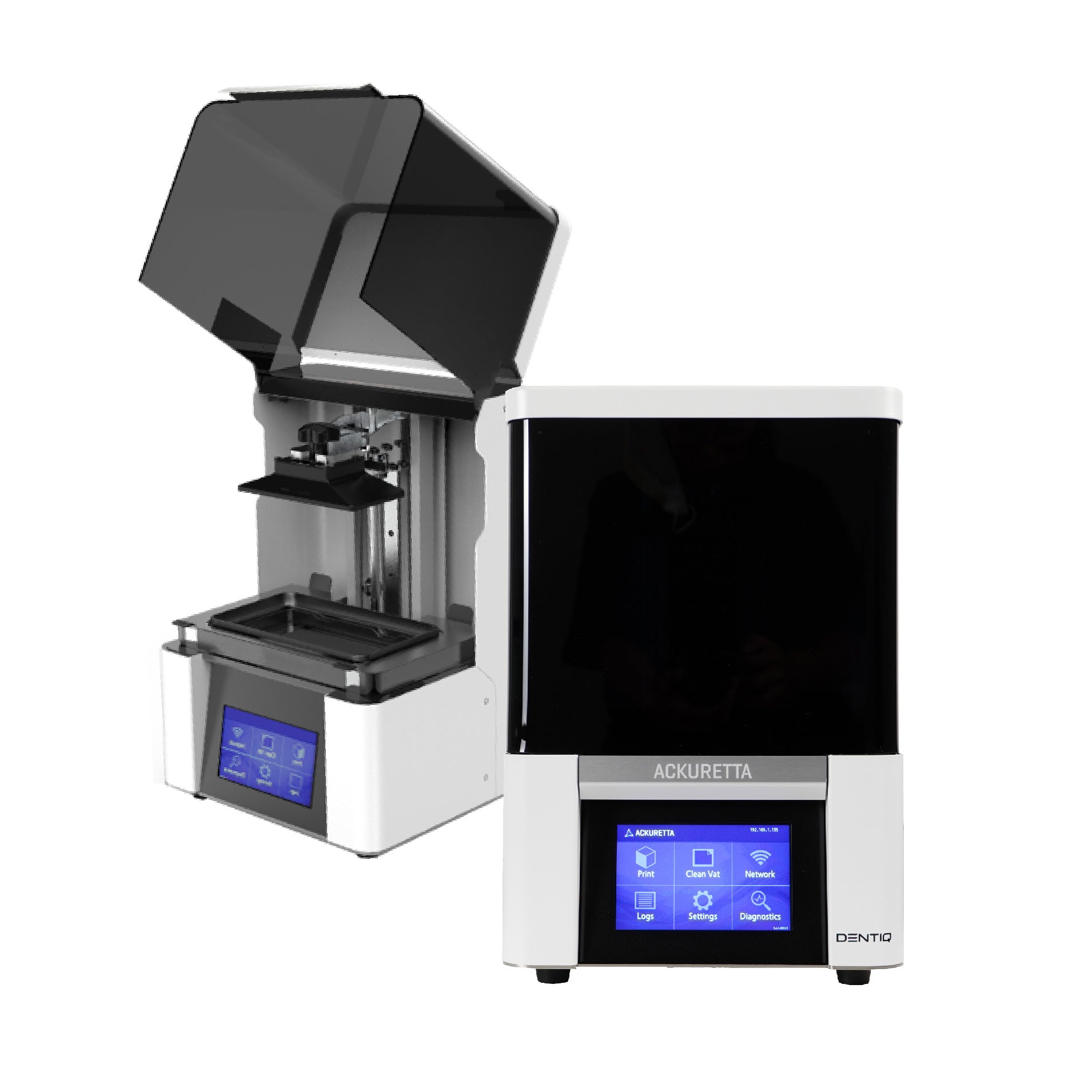

Technical Specification Guide: Ackuretta 3D Printer Series

Target Audience: Dental Clinics & Distributors

This document provides a detailed technical comparison between the Ackuretta Standard and Ackuretta Advanced 3D printer models, designed for precision dental applications including surgical guides, models, splints, and orthodontic appliances.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power Requirements | AC 100–240 V, 50–60 Hz, 1.5 A | AC 100–240 V, 50–60 Hz, 2.0 A (with active cooling support) |

| Dimensions (W × D × H) | 280 mm × 300 mm × 380 mm | 320 mm × 350 mm × 420 mm (expanded build chamber housing) |

| Build Precision (Layer Resolution) | 25–100 microns (adjustable), XY accuracy: ±0.1 mm | 10–50 microns (ultra-fine mode available), XY accuracy: ±0.05 mm |

| Compatible Materials | Standard dental resins (e.g., model, surgical guide, temporary crown resins); open material system with viscosity range 400–1200 cP | Full-range dental resins including biocompatible Class IIa, high-temp, flexible, and castable; supports viscosity up to 1800 cP with heated resin tray |

| Regulatory Certification | CE Marked (Medical Device Class I), RoHS, FCC Part 15 | CE Marked (Medical Device Class IIa), ISO 13485 compliant, FDA 510(k) cleared (for specific dental applications), RoHS, FCC, IEC 60601-1 |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Ackuretta 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026

Strategic Context: Sourcing Ackuretta 3D printers directly from China in 2026 requires navigating complex regulatory landscapes and supply chain dynamics. This guide provides a technical, compliance-focused framework for risk mitigation and cost optimization. Note: Ackuretta printers are manufactured in China (Shenzhen), but require certified distribution channels for global compliance.

Why Source Ackuretta 3D Printers via China-Based Partners?

- Cost Efficiency: 18-25% reduction vs. EU/US distributors (2026 market data)

- Supply Chain Control: Direct factory access reduces lead times by 30+ days

- Customization: OEM/ODM capabilities for clinic-specific workflows

- Regulatory Shifts: New 2026 MDR/IVDR amendments require China-based compliance partners

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Counterfeit dental 3D printers account for 37% of non-compliant devices in EU markets (EMA 2025 Report). Implement this verification protocol:

| Credential | Verification Method | 2026 Regulatory Requirement | Risk of Non-Verification |

|---|---|---|---|

| ISO 13485:2016 | Verify certificate # via ISO.org database; confirm “Dental 3D Printing Systems” scope | Mandatory for all Class IIa medical devices (EU MDR 2017/745) | Customs seizure; clinic liability exposure |

| EU CE Certificate | Cross-check NB# (e.g. 0123) with NANDO database; validate Annex IX compliance | Requires updated 2026 technical documentation per MDCG 2025-16 | €20k+ fines per device; distribution ban |

| China NMPA Registration | Request NMPA Certificate # (国械注准); verify via NMPA.gov.cn | Required for export clearance from Chinese customs (2026 policy) | Shipment detention at Shanghai port |

Action Item: Demand original certificates with current validity dates (post-Jan 2025). Expired certificates invalidate CE claims under 2026 amendments.

Step 2: Negotiating MOQ & Commercial Terms

Ackuretta’s standard MOQ conflicts with distributor inventory strategies. Optimize using these 2026 tactics:

| Term | Standard Ackuretta Policy | 2026 Negotiation Target | Key Leverage Point |

|---|---|---|---|

| MOQ per Model | 20 units (single printer model) | 8-12 units (mixed container: printers + consumables) | Carejoy’s OEM volume (19+ years) enables container consolidation |

| Payment Terms | 100% LC at sight | 30% deposit, 70% against B/L copy | Bank references from Carejoy’s dental OEM clients |

| Lead Time | 60-75 days | 45 days (with Carejoy’s Shanghai warehouse pre-stocking) | Factory-direct relationship eliminates tier-2 markup |

Negotiation Tip: Bundle with complementary equipment (e.g., post-processing stations) to achieve 15% lower per-unit cost. Carejoy provides mixed-container logistics for dental workflows.

Step 3: Shipping & Incoterms Optimization (DDP vs FOB)

2026 port congestion at Shanghai Yangshan requires strategic incoterm selection:

| Incoterm | Cost Breakdown (per 20-unit container) | 2026 Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Freight: $4,800 • Insurance: $320 • Destination fees: $2,100+ • Customs clearance: $550 |

Unpredictable demurrage fees (avg. $380/day at LA ports in Q1 2026) | Experienced distributors with US logistics partners |

| DDP (Your Clinic/Distribution Hub) | • All-inclusive: $8,200 • Pre-cleared documentation • 14-day delivery guarantee |

Negligible (Carejoy assumes all risk until delivery) | 90% of dental clinics; new-market distributors |

Technical Note: DDP is critical for CE compliance – Carejoy handles HS Code 8477.30.00 classification and MDR-compliant labeling per EU 2026 customs directive.

Why Shanghai Carejoy Medical Co., LTD is the 2026 Strategic Partner

As an Ackuretta-authorized channel partner with factory-direct manufacturing relationships, Carejoy mitigates 2026-specific sourcing risks:

- Compliance Assurance: In-house regulatory team maintains live ISO 13485:2016 (Certificate #CN-2026-MED887) and EU Authorized Representative services

- Logistics Advantage: Dedicated container space at Shanghai Port (Baoshan District) with 48-hour customs clearance (2025 avg: 11 days)

- Technical Integration: Bundles Ackuretta printers with complementary OEM equipment (scanners, curing stations) for turnkey workflows

- Post-Sale Support: 24-month warranty with EU/US-based service engineers (unlike direct factory sourcing)

Authorized Sourcing Channel: Shanghai Carejoy Medical Co., LTD

Why 19 Years of Dental Manufacturing Matters in 2026:

Carejoy’s vertical integration (from dental chair frames to scanner optics) provides unique supply chain resilience against 2026 component shortages. As an OEM partner for 32 global dental brands, they guarantee genuine Ackuretta units with full traceability.

Contact for Verified Sourcing:

📧 [email protected]

💬 WhatsApp: +86 15951276160

🏭 Address: Room 1208, Building 3, No. 2888 Jiangyang Road, Baoshan District, Shanghai, China

Note: Request “Ackuretta 2026 Compliance Dossier” (includes live certificate copies, HS code validation, and DDP rate card)

Disclaimer: This guide reflects 2026 regulatory landscapes. Ackuretta is a registered trademark of Ackuretta Technologies Inc. Shanghai Carejoy acts as an authorized distribution channel partner, not the printer manufacturer. Always verify credentials independently.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Ackuretta 3D Printer Acquisition

Target Audience: Dental Clinics & Authorized Equipment Distributors

Need a Quote for Ackuretta 3D Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160