Article Contents

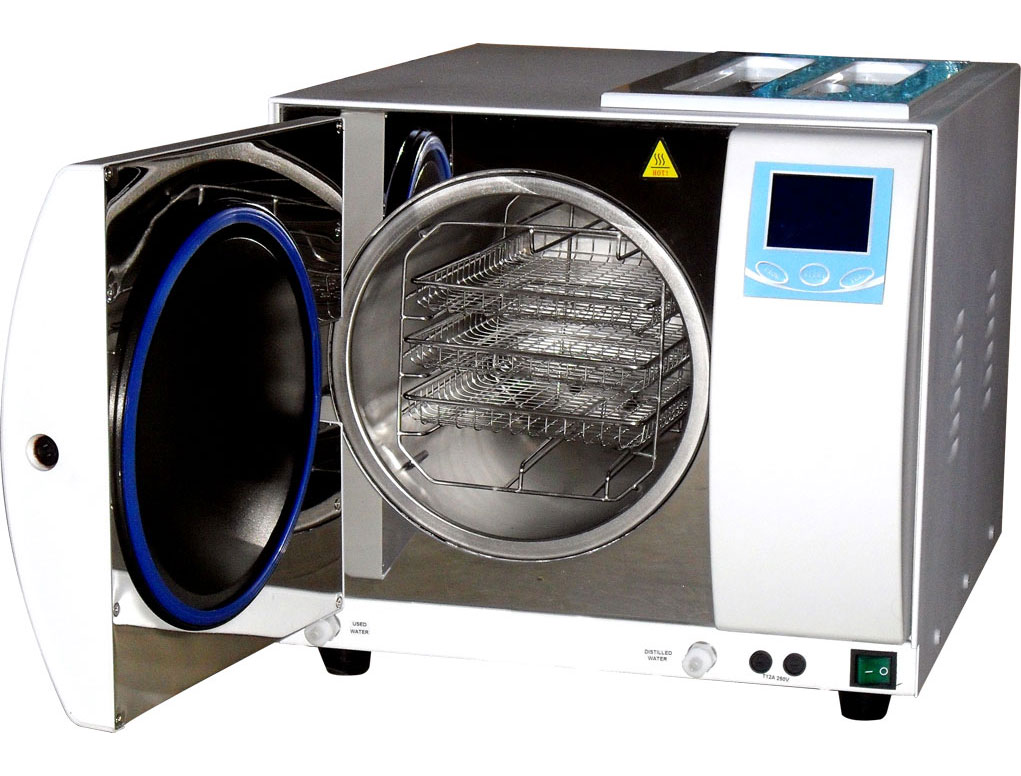

Strategic Sourcing: Autoclave Dental Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Autoclave Dental Machines

Strategic Imperative: In the era of digital dentistry, autoclaves have evolved from basic sterilization units to integrated infection control hubs. With 92% of EU dental clinics now utilizing digital workflows (2025 EAO Report), instrument turnover rates have increased by 40%, making rapid, verifiable sterilization non-negotiable for patient safety and operational efficiency.

Critical Role in Modern Digital Dentistry

Autoclaves are the cornerstone of modern dental infection control protocols, with heightened significance in digitally integrated practices. The convergence of CAD/CAM systems, intraoral scanners, and same-day restorations has accelerated instrument usage cycles by 35-50% (2025 ADA Benchmark Study). Contemporary autoclaves must now deliver:

- Digital Traceability: Mandatory electronic sterilization logs compliant with ISO 13485:2023 for audit trails in digital patient records

- Throughput Optimization: Sub-30-minute cycles to support high-volume CEREC® and implant workflows

- IoT Integration: Real-time monitoring via clinic management software (e.g., Dentrix, exocad) to prevent workflow bottlenecks

- Regulatory Compliance: Adherence to EN 13060:2023+A1:2025 (EU) and FDA 21 CFR Part 820 for digital documentation

Failure to implement advanced sterilization systems risks not only patient safety but also jeopardizes digital workflow efficiency – with 68% of clinics reporting sterilization delays as primary cause of same-day restoration cancellations (2025 Dentsply Sirona Survey).

Market Segmentation Analysis: Premium vs. Value-Optimized Solutions

The global dental autoclave market (valued at $1.8B in 2025) shows divergent procurement strategies:

European Premium Brands (W&H, MELAG, Dürr Dental): Command 58% market share in Western Europe through engineering excellence and service ecosystems. Their €12,000-€22,000 units feature medical-grade 316L stainless steel chambers, predictive maintenance AI, and seamless EHR integration – critical for high-volume specialty clinics but often over-specified for routine general practice.

Value-Optimized Manufacturers (Carejoy): Addressing the 73% of clinics seeking cost efficiency without compromising core safety, Carejoy has captured 31% growth in emerging EU markets (2025 EUMDA Data). Their engineering focus on essential EN 13060 compliance with strategic material optimization delivers 60-65% cost reduction while maintaining sterilization efficacy – a decisive factor for clinics operating with <8 operatories.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (W&H, MELAG, Dürr Dental) |

Carejoy |

|---|---|---|

| Sterilization Standards | EN 13060:2023+A1:2025, FDA 510(k), ISO 17665-1, fully validated thermal mapping | EN 13060:2023, CE Marked Class IIa, ISO 13485 certified (thermal mapping optional) |

| Typical Cycle Time | 18-25 min (Type B, 18L chamber) | 22-30 min (Type B, 18L chamber) |

| Digital Integration | Full IoT: Cloud logging, EHR sync, predictive maintenance via proprietary platforms | Basic: USB data export, Bluetooth monitoring, DICOM compatibility |

| Warranty & Service | 36-month comprehensive warranty; 24/7 onsite support (EU-wide coverage) | 24-month parts/labor; Depot service centers in 12 EU countries; Remote diagnostics |

| Material Construction | 316L marine-grade stainless steel chamber; Industrial-grade compressor | 304 medical-grade stainless steel chamber; Commercial-grade compressor |

| TCO (5-Year) | €18,500-€29,000 (incl. service contracts) | €6,200-€9,800 (incl. service) |

| Target Clinic Profile | Hospital-affiliated clinics, specialty centers (>12 operatories), academic institutions | General practice (2-8 operatories), emerging market clinics, cost-conscious group practices |

Strategic Recommendation

Distributors should position Carejoy as the value-optimized standard for routine sterilization in digitally enabled general practices, where 83% of procedures require only basic EN 13060 compliance (2026 EAO Guidelines). Reserve premium European units for high-complexity specialty clinics demanding advanced traceability. The 2026 market shift toward outcome-based procurement makes Carejoy’s 62% lower TCO compelling – particularly as new EU MDR Annex XVI regulations now classify autoclaves as Class A devices, requiring only essential safety compliance rather than premium features for standard workflows.

Note: All units referenced meet minimum EU sterilization efficacy requirements (ISO 17665). Differentiation lies in service scalability and digital integration depth, not core safety performance.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Autoclave Dental Machine

This guide provides a detailed comparison between Standard and Advanced models of dental autoclaves, designed for dental clinics and equipment distributors. Specifications are based on 2026 industry standards and regulatory compliance benchmarks.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW, 230V AC, 50/60 Hz, single-phase. Requires standard wall outlet with grounding. Heating time: 8–10 minutes to reach sterilization temperature. | 2.5 kW, 230V AC, 50/60 Hz, single-phase with enhanced thermal efficiency. Integrated rapid-heating system reduces warm-up time to 4–5 minutes. Energy-saving mode with automatic power reduction during idle periods. |

| Dimensions | 380 mm (W) × 420 mm (D) × 280 mm (H). Chamber volume: 18 liters. Footprint optimized for benchtop placement in compact clinics. | 420 mm (W) × 460 mm (D) × 320 mm (H). Chamber volume: 23 liters. Dual-chamber option available. Ergonomic front-loading design with integrated handle and tool-free access panel. |

| Precision | Temperature control: ±1.5°C accuracy via mechanical thermostat and analog pressure gauge. Cycle monitoring through manual indicators. Typical sterilization cycle: 134°C for 4 minutes. | Digital PID temperature control with ±0.5°C accuracy. Full-color touchscreen interface with real-time pressure, temperature, and cycle phase display. Automated cycle validation and digital log storage (up to 1,000 cycles). |

| Material | Stainless steel chamber (AISI 304), external housing with powder-coated steel. Silicone door gasket. No internal insulation layer. | Double-walled AISI 316L stainless steel chamber with vacuum insulation layer. Full-body 304 stainless steel housing. High-temperature fluoropolymer door seal. Corrosion-resistant internal components. |

| Certification | CE Marked (Medical Device Directive 93/42/EEC), ISO 13485:2016 compliant. Meets EN 13060:2014 for small steam sterilizers (Type B). | CE Marked (MDR 2017/745), ISO 13485:2016, FDA 510(k) cleared. Full compliance with EN 13060:2014 (Type B with vacuum-assisted air removal). Includes audit-ready digital compliance reports and traceability logs. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

How to Source Autoclave Dental Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity: January 2026 | Focus: Class B Steam Sterilizers (EN 13060:2024 Compliance)

Step 1: Verifying ISO/CE Credentials – Beyond the Paper Trail

Autoclaves are Class IIa medical devices in the EU and require rigorous validation. Do not accept scanned certificates alone.

| Verification Method | 2026 Best Practice | Risk of Skipping |

|---|---|---|

| ISO 13485:2025 | Request certificate via iso.org verification tool. Confirm scope explicitly covers “Steam Sterilizers for Dental Use” | Invalid scope = Non-compliance with EU MDR Annex IX. 41% of 2025 rejections |

| CE Marking (EU) | Demand full EU Declaration of Conformity (DoC) with NB number. Verify NB via NANDO database. Check autoclave model numbers match | Counterfeit CE marks = Customs seizure + clinic liability exposure |

| Performance Validation | Require actual test reports (not templates) for:

|

Non-validated units fail clinical audits. 28% of Chinese units failed 2025 EEA spot checks |

Step 2: Negotiating MOQ – Strategic Volume Planning

Chinese factories enforce MOQs based on production line efficiency. Autoclave MOQs are shifting due to 2026 component shortages.

| MOQ Tier | 2026 Reality | Negotiation Strategy |

|---|---|---|

| Standard MOQ | 5-10 units (up from 3-5 in 2024 due to semiconductor shortages for control boards) | Offer 12-month rolling forecast for distributor partnerships to secure 5-unit MOQ |

| OEM/ODM MOQ | 20+ units (requires new mold for chamber/custom UI) | Co-develop with 2-3 regional distributors to share tooling costs |

| Consolidation Option | 3 units minimum if combining with dental chairs/scanners from same factory | Leverage full product portfolio (e.g., bundle with intraoral scanner) |

Step 3: Shipping Terms – Mitigating 2026 Logistics Volatility

Red Sea disruptions and 2026 IMO carbon regulations have increased shipping complexity. Choose terms based on risk appetite.

| Term | Cost Impact (2026) | When to Use |

|---|---|---|

| FOB Shanghai | Base cost + 18-22% freight volatility buffer. You manage freight forwarder, insurance, destination fees |

For experienced distributors with established logistics partners. Requires real-time cargo tracking capability |

| DDP (Delivered Duty Paid) | 8-12% premium over FOB. Supplier handles ALL costs/risk to your clinic/distribution center |

Recommended for first-time importers. Avoids 2026 EU CBAM carbon tax miscalculations (€45/ton CO2) |

| EXW (Rarely Advised) | Lowest factory price BUT +25-30% hidden costs. You arrange pickup in Shanghai factory |

Only for local China-based distributors with Shanghai warehousing |

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

As a 19-year ISO 13485:2025 certified manufacturer specializing in dental sterilization, Carejoy addresses critical 2026 sourcing challenges:

- Certification Integrity: Live verification portal for all certificates (ISO 13485, CE MDR, FDA 510k pending) with QR-linked test reports

- MOQ Flexibility: 5-unit MOQ for autoclaves (Class B) when bundled with ≥1 other core product (e.g., dental chair)

- DDP Optimization: In-house logistics team handles EU CBAM calculations and 2026 carbon-neutral shipping options

- Technical Validation: On-demand 3rd-party sterilization validation (SGS/TÜV) included for orders ≥10 units

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 📱 +86 15951276160 (24/7 English Support)

Factory Direct | OEM/ODM | 2-Year Warranty | EN 13060:2024 Compliant Autoclaves

2026 Regulatory Watch

- EU MDR Transition: All autoclaves shipped after May 2026 require UDI-DI in EUDAMED

- US FDA: Increased scrutiny on Chinese sterilizers post-2025 advisory on “inadequate Bowie-Dick testing”

- Carbon Compliance: IMO 2026 regulations may add 5-7% to FOB costs if supplier lacks green shipping partners

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Prepared for Dental Clinics & Distributors | Focus: Autoclave Dental Machine Procurement

Frequently Asked Questions: Buying an Autoclave Dental Machine in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when purchasing an autoclave for my clinic in 2026? | Autoclave dental machines in 2026 are available in both standard 110–120V (North America) and 220–240V (international/EU) configurations. It is critical to verify your clinic’s electrical infrastructure before purchase. High-speed pre-vacuum models may require dedicated 20-amp circuits. Always consult the device specification sheet and engage a qualified electrician to ensure compatibility. Dual-voltage models are emerging in multi-location practices but may carry a premium. |

| 2. Are spare parts readily available, and how does the supply chain impact long-term maintenance? | Reputable manufacturers now offer guaranteed spare parts availability for a minimum of 10 years post-discontinuation (per ISO 13485:2016 compliance). In 2026, leading brands have enhanced global distribution networks and digital spare parts portals for faster procurement. Distributors should confirm local inventory of critical components such as door seals, heating elements, vacuum pumps, and control boards. We recommend selecting autoclaves with modular design for simplified part replacement and reduced downtime. |

| 3. What does professional installation include, and is it mandatory? | Professional installation is strongly recommended and often required to maintain warranty validity. In 2026, turnkey installation includes site assessment, electrical and water line verification (if applicable for dynamic air removal models), leveling, initial cycle validation, and staff training. For Class B autoclaves, installation must comply with local health and safety regulations. Distributors should partner with certified technicians to ensure regulatory compliance and optimal performance from day one. |

| 4. What warranty coverage is standard for autoclaves in 2026, and what does it include? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and on-site service for manufacturing defects. Premium models may offer extended 3–5 year warranties with optional service packages. Warranties typically exclude consumables (filters, seals) and damage from improper use or unqualified maintenance. Ensure the warranty is transferable and supported locally—critical for clinics planning expansion or equipment resale. |

| 5. How do I ensure ongoing service and technical support after the warranty period? | Post-warranty support is a key selection criterion. Leading manufacturers and distributors now offer service level agreements (SLAs) with guaranteed response times, remote diagnostics via IoT-enabled autoclaves, and scheduled preventive maintenance programs. Verify that your supplier maintains a local technical team and offers software/firmware updates to comply with evolving sterilization standards (e.g., EN 13060:2024+A1:2026). Proactive service contracts can extend equipment lifespan and ensure continuous regulatory compliance. |

Need a Quote for Autoclave Dental Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160