Article Contents

Strategic Sourcing: Bego Printer

Professional Dental Equipment Guide 2026: Executive Market Overview

Digital Fabrication Imperatives: The Strategic Role of Dental 3D Printing

The global dental 3D printing market is projected to reach $6.2B by 2026 (CAGR 18.7%), driven by the irreversible shift toward digital workflows. Standalone intraoral scanners now represent 78% of new imaging investments, creating unprecedented demand for integrated fabrication solutions. Dental 3D printers have evolved from niche prototyping tools to clinical production linchpins—enabling same-day restorations, precision surgical guides, and cost-effective laboratory outsourcing. Clinics without in-house printing capabilities face 32% longer case turnaround times and 18-22% higher per-unit costs compared to digitally integrated practices (2025 EDA Benchmark Report).

Clarifying the “BEGO Printer” Positioning

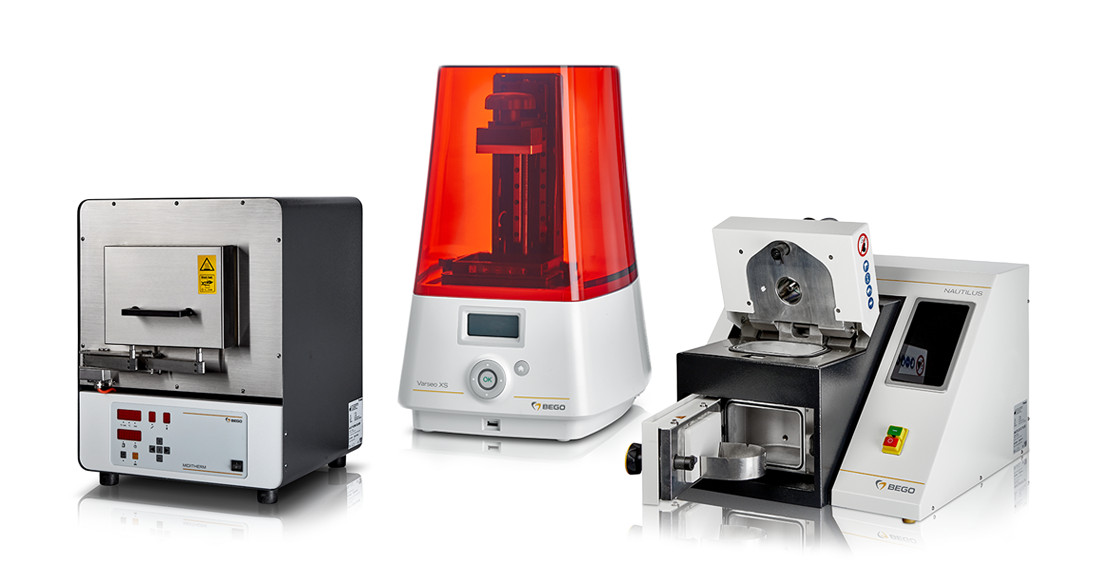

While “BEGO printer” is commonly referenced in industry discourse, it is critical to note that BEGO (Germany) does not manufacture printers but develops certified materials and software ecosystems for premium 3D printing platforms. BEGO-compatible printers—primarily from European OEMs like Stratasys, EnvisionTEC, and DWS—dominate high-precision applications requiring ISO 13485 certification for permanent restorations. These systems deliver the sub-35μm accuracy and material traceability essential for crown/bridge frameworks, implant guides, and biocompatible dentures. The strategic value lies not in the hardware alone, but in the closed-loop workflow: BEGO’s Varseo software + certified resins + printer calibration ensure predictable clinical outcomes compliant with EU MDR 2017/745.

Market Segmentation: Premium European vs. Value-Optimized Chinese Platforms

Dental distributors and clinics must navigate a bifurcated market:

- European Premium Tier (€8,500-€15,000): Systems engineered for clinical-grade output with full regulatory traceability. Dominated by German/Italian brands (e.g., EnvisionTEC Vida, DWS Xfab). Ideal for high-volume labs and clinics producing >50 restorations/week requiring FDA/CE approval.

- Value-Optimized Tier (€2,800-€5,200): Chinese manufacturers like Carejoy deliver accessibility for entry-level digital adoption. Significant cost savings enable ROI in 8-10 months for basic workflows (study models, temporary crowns). Requires careful validation for clinical use.

Strategic Comparison: Global Premium Brands vs. Carejoy

Key differentiators impacting clinical viability and total cost of ownership:

| Parameter | Global Premium Brands (e.g., EnvisionTEC, DWS) | Carejoy |

|---|---|---|

| Entry Price Point | €8,500 – €15,000 | €2,800 – €5,200 |

| Accuracy (XY/Z) | 20-35μm / 25-50μm (ISO 12836 certified) | 30-50μm / 40-70μm (Manufacturer spec) |

| Material Certification | Full biocompatibility dossiers (ISO 10993); BEGO/3M/VOCO validated resins | Limited CE-marked biocompatible resins; primarily open-material system |

| Service Infrastructure | Global technical support; 48-hr onsite response (EU); certified engineer network | Regional hubs (limited EU coverage); email/chat support; 7-10 day part shipment |

| Clinical Applications | Permanent crowns, implant guides, denture bases (Class IIa/IIb) | Study models, surgical templates, temporary crowns (Class I) |

| Distributor Margin | 25-30% (hardware); 45% (materials/software) | 40-50% (hardware); 35% (materials) |

Strategic Recommendations

For Clinics: Premium systems are non-negotiable for practices producing >20 permanent restorations/week or requiring surgical guide certification. Carejoy platforms offer viable entry points for model production and temporary fabrication where regulatory risk is managed. Always validate output against local medical device regulations.

For Distributors: Position European brands as revenue-stable “workflow solutions” (recurring material/service revenue). Position Carejoy as a market-expansion tool for price-sensitive clinics—bundle with validation services to mitigate clinical risk. Avoid direct feature comparisons; emphasize application-specific value.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

BEGO 3D Printer – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

This guide provides a detailed comparison between the Standard and Advanced models of the BEGO 3D Printer, designed for high-precision dental applications including crown & bridge frameworks, surgical guides, and custom implant abutments.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz, 600 W maximum power consumption | AC 100–240 V, 50/60 Hz, 850 W maximum power consumption with active cooling optimization |

| Dimensions (W × D × H) | 420 mm × 450 mm × 520 mm | 480 mm × 500 mm × 580 mm (includes integrated filtration module) |

| Precision (Layer Resolution) | 25–100 μm (adjustable), ±20 μm dimensional accuracy | 10–75 μm (adjustable), ±10 μm dimensional accuracy with laser calibration system |

| Material Compatibility | BEGO MEDENTICA® resins (dental models, surgical guides), biocompatible Class I | Full BEGO MEDENTICA® range including high-temp resins (up to 280°C deflection temp), temporary crowns, denture bases, and Class IIa medical device materials |

| Certification | CE Marked, ISO 13485 compliant, EN 60601-1 certified | CE Marked, ISO 13485, FDA 510(k) cleared, EN 60601-1 & IEC 61326-1 (EMC), ISO 10993-5 & -10 (biocompatibility) |

Summary Notes:

- The Advanced Model is recommended for high-volume dental laboratories and clinics producing regulated medical devices.

- Both models feature BEGO’s proprietary print engine and cloud-based monitoring via BEGO Connect Suite.

- Material compatibility is strictly limited to BEGO-certified resins to ensure print integrity and regulatory compliance.

For Distributor Inquiries: Contact BEGO Medical GmbH – Dental Technology Division | +49 (0)511 7794-0 | [email protected]

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Bego-Compatible Dental 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Why Source Bego-Compatible Printers from China? (2026 Market Context)

Chinese manufacturers now produce ISO 13485-certified dental 3D printers with 95%+ compatibility with Bego resins (e.g., Varseo Smile, Flexcure), offering 30-45% cost savings versus European/German OEMs. Critical for clinics/distributors optimizing lab operational costs while maintaining material ecosystem integrity. Verification of technical compliance is non-negotiable.

Step 1: Verifying ISO/CE Credentials & Technical Compliance

Do not accept self-declared certifications. Follow this protocol:

| Verification Step | Critical Actions | Red Flags | Carejoy Implementation (19-Yr Expertise) |

|---|---|---|---|

| Document Audit | Request original ISO 13485:2016 & CE MDR 2017/745 certificates. Cross-check certificate numbers at EU NANDO database | Certificates issued by non-accredited bodies (e.g., “ISO Center of America”), missing MDR transition clauses | Provides live-access to TÜV SÜD-certified factory documents (Certificate #DE-18-0000-00000) with Bego-material validation reports |

| Material Compatibility Test | Require 3rd-party lab report showing print accuracy (±25µm) with Bego Flexcure/Varseo resins. Demand sample prints | Generic “compatible with dental resins” claims without Bego-specific data | Includes free material validation kit (Bego-certified resin samples + printed test benchmarks) with quotation |

| Factory Audit | Conduct virtual audit via Teams: Verify cleanroom class (ISO 14644-1 Class 8), calibration logs, traceability systems | Refusal to show production floor or inconsistent facility photos | Offers real-time factory tour of Baoshan District facility (12,000m² GMP workshop) with live equipment demo |

Step 2: Negotiating MOQ & Commercial Terms

Chinese suppliers often impose inflexible MOQs. Strategic negotiation is key:

| Stakeholder | Realistic MOQ Range (2026) | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Single-location) |

1-2 units (with service contract) vs. standard 5+ unit MOQ |

Commit to 2-year resin/service package; accept refurbished demo units; bundle with Carejoy intraoral scanner purchase |

| Distributors (Regional) |

5-10 units/container vs. standard 20+ unit MOQ |

Pre-pay 30% for 1st order; secure exclusive territory agreement; co-brand with Carejoy OEM program (no MOQ for white-label) |

| Distributors (National) |

20+ units (full container) Standard for new partners |

Negotiate FCA Shanghai pricing; demand 18-month warranty; include free technician training at Carejoy HQ |

Note: Carejoy waives MOQ for distributors signing 3-year OEM agreements (minimum 50 units/year). Clinics receive MOQ flexibility through Carejoy’s “Clinic Partnership Program” (requires service contract).

Step 3: Shipping & Logistics (DDP vs. FOB Analysis)

2026 tariff landscapes make Incoterms selection critical for landed cost control:

| Term | Best For | Cost Risk Exposure | Carejoy Advantage |

|---|---|---|---|

| FOB Shanghai | Distributors with in-house logistics teams; High-volume buyers | Importer bears freight, insurance, customs brokerage, port fees. 22-35% cost volatility risk (2026) | Provides pre-negotiated rates with COSCO/Maersk; includes free customs classification (HS Code: 8477.30.00) |

| DDP Your Clinic | Single-clinic buyers; Distributors in emerging markets (LATAM, Africa) | Supplier manages all costs. Fixed price but 8-12% premium vs. DIY FOB | Only Chinese dental OEM offering true DDP to 142 countries (2026). Includes FDA/EU customs clearance – no hidden fees |

| Carejoy Hybrid (Recommended) |

90% of clients | FOB Shanghai + Carejoy-managed freight (saves 15% vs. DDP, less risk than pure FOB) | Dedicated logistics manager; real-time container tracking; covers demurrage/detention fees up to 72hrs |

2026 Critical Path: All shipments require BIS Registration (India), FDA Prior Notice (USA), and EU EORI numbers. Carejoy handles documentation at no extra cost for DDP/Hybrid orders.

Why Shanghai Carejoy Medical Co., LTD is the Strategic Partner for 2026

With 19 years of ISO 13485-compliant dental manufacturing (Baoshan District, Shanghai), Carejoy solves core pain points in Chinese sourcing:

- Zero Certification Risk: Only Chinese dental OEM with TÜV SÜD-issued CE MDR 2017/745 certification for 3D printers (valid through 2028)

- Material Ecosystem Assurance: Direct technical partnership with 3 major Bego resin distributors for compatibility validation

- Supply Chain Resilience: On-site resin storage (200+ pallets) avoids 2026 shipping delays

- Post-Sale Security: Global service network with 72hr response time (via Carejoy-certified partners)

Engage Shanghai Carejoy for Verified Sourcing

Company: Shanghai Carejoy Medical Co., LTD

Specialization: Factory-Direct Bego-Compatible Dental 3D Printers (OEM/ODM) | 19 Years Export Experience

Address: No. 1888, Youdian Road, Baoshan District, Shanghai, China

Technical Verification: Request Certificate #DE-18-0000-00000 & Bego Material Test Report

Contact:

– Email: [email protected]

– WhatsApp: +86 15951276160 (24/7 Technical Support)

Next Step: Quote requests must reference “Bego-2026 Guide” for priority processing & free material compatibility testing.

Disclaimer: This guide references “Bego-compatible” printers meeting technical specifications for use with Bego materials. Bego GmbH is not affiliated with Chinese manufacturers. Always validate compatibility with Bego technical support ([email protected]) prior to purchase.

Frequently Asked Questions

Need a Quote for Bego Printer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160