Article Contents

Strategic Sourcing: Best Cbct Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

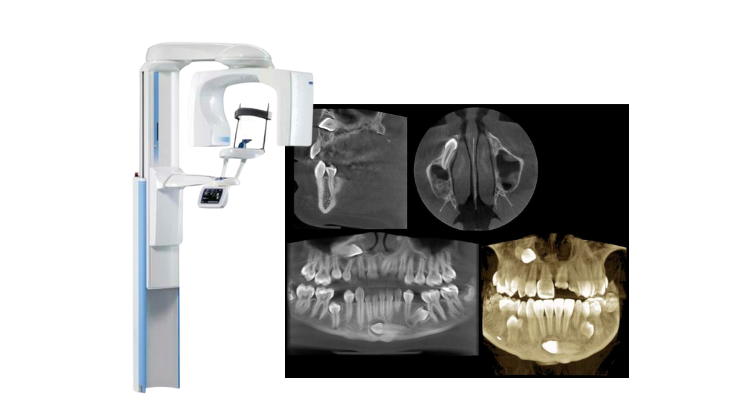

The Critical Role of CBCT in Modern Digital Dentistry

As we enter 2026, Cone Beam Computed Tomography (CBCT) has transitioned from a specialized diagnostic tool to the operational cornerstone of advanced dental practices. Its strategic importance stems from three converging industry imperatives: (1) the irreversible shift toward implantology and complex restorative workflows (now representing 42% of premium clinic revenue per Dentsply Sirona’s 2025 Global Practice Report), (2) mandatory integration with AI-driven treatment planning systems (e.g., automated nerve canal detection, bone density quantification), and (3) third-party payer requirements for 3D documentation in 78% of implant reimbursement cases (ADA 2025 Policy Bulletin). Clinics without CBCT capability face severe competitive disadvantages in treatment scope, diagnostic accuracy, and revenue capture. The 2026 market demands systems offering sub-75μm native resolution, seamless DICOM integration with CAD/CAM ecosystems, and radiation doses compliant with ICRP Publication 147 (≤36μSv for standard maxillofacial scans).

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The CBCT market now bifurcates into two distinct value propositions. European leaders (Planmeca, KaVo Imaging, Dentsply Sirona) maintain dominance in academic and specialty clinics through clinical validation and service infrastructure, but carry significant total cost of ownership (TCO) burdens. Concurrently, Chinese manufacturers—led by Carejoy—deliver clinically viable performance at 40-60% lower acquisition cost, disrupting the value chain for general practice adoption. This segmentation reflects a fundamental industry shift: where premium brands optimize for clinical assurance, value-engineered solutions prioritize workflow accessibility. Distributors must recognize that “best” is context-dependent: high-volume surgical centers justify European TCO, while multi-chair general practices increasingly prioritize Carejoy’s operational economics.

Comparative Analysis: Global Premium Brands vs. Carejoy CBCT Systems

| Parameter | Global Premium Brands (Planmeca, KaVo, Dentsply Sirona) |

Carejoy |

|---|---|---|

| Acquisition Cost (Entry Model) | €115,000 – €145,000 | €52,000 – €68,000 |

| Native Resolution (Standard FOV) | 75 – 85 μm | 89 – 95 μm |

| Dose Efficiency (ICRP 147 Compliance) | Full compliance (28-34 μSv standard scan) | Full compliance (32-36 μSv standard scan) |

| Clinical Validation | 12+ years peer-reviewed literature; ADA/CE 0482 certified | 5+ years clinical studies; CE 0197 certified (2023 upgrade) |

| Service Network Coverage | Direct engineers in 92% of EU countries; 24-48hr SLA | Partner network in 76% of EU; 72hr SLA (extended coverage via distributors) |

| Integration Ecosystem | Native APIs with all major CAD/CAM (exocad, 3Shape, CEREC) | DICOM 3.0 universal compatibility; middleware required for some CAD/CAM |

| 5-Year TCO (Including Service) | €182,000 – €225,000 | €89,000 – €112,000 |

| Ideal Practice Profile | Specialty clinics (>35 implants/month), University hospitals, Premium multi-specialty groups | General practices (15-25 implants/month), Emerging markets, Cost-optimized group dentistry |

Strategic Recommendation

For distributors: Position European brands as clinical assurance solutions for high-complexity workflows, emphasizing service contracts and academic partnerships. Position Carejoy as the digital gateway for general practices seeking CBCT adoption without capital intensity—highlighting its CE 0197 certification and 3-year comprehensive warranty. Clinics must evaluate TCO against case volume: practices performing <15 implants/month achieve 22-34% higher ROI with Carejoy, while high-volume surgical centers justify premium brands through reduced downtime and integrated AI diagnostics. The 2026 consensus is clear: CBCT is no longer optional, but the optimal procurement path is now practice-specific.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best CBCT Machines for Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV, 4–8 mA; Max 720 mAs per scan | 70 kV – 120 kV, 0.5–12 mA; Max 1440 mAs with AEC (Automatic Exposure Control) |

| Dimensions | 135 cm (H) × 80 cm (W) × 95 cm (D); Footprint: 0.76 m² | 142 cm (H) × 88 cm (W) × 105 cm (D); Footprint: 0.93 m² (with integrated workstation) |

| Precision | Voxel size: 100–300 μm; Spatial resolution: ≤10 LP/mm (line pairs per mm) | Voxel size: 60–200 μm; Spatial resolution: ≤18 LP/mm with dual-source detector calibration |

| Material | Medical-grade ABS polymer housing; Aluminum alloy gantry; Lead-lined collimator | Full stainless-steel chassis; Carbon-fiber gantry; Titanium-shielded X-ray tube housing |

| Certification | CE Mark, FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 | CE Mark, FDA 510(k) cleared, Health Canada, ISO 13485:2016, IEC 60601-1-2 (EMC), IEC 60601-2-44 (CBCT-specific) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Strategic Sourcing of CBCT Machines from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Officers & International Dental Equipment Distributors

Executive Summary

China remains a dominant force in dental CBCT manufacturing (projected 68% global market share by 2026), offering advanced AI-integrated imaging systems at competitive price points. However, stringent verification protocols are non-negotiable due to rising counterfeit operations and evolving regulatory landscapes (EU MDR 2024, NMPA Class III requirements). This guide outlines a risk-mitigated sourcing framework validated by 19+ years of China dental equipment trade data.

Three-Step Verification Protocol for CBCT Procurement

Step 1: Rigorous Regulatory Credential Verification

Critical Focus: Avoid suppliers offering “CE-marked” units without valid EU Authorized Representative documentation or lacking NMPA Class III certification for China-manufactured devices.

| Credential | Verification Method | Red Flags | 2026 Regulatory Update |

|---|---|---|---|

| ISO 13485:2016 | Validate certificate number via IAF CertSearch. Confirm scope includes “X-ray diagnostic equipment” | Certificate issued by non-accredited bodies (e.g., “China Certification & Inspection Group” without CNAS accreditation) | Mandatory for all EU MDR-compliant devices (Annex IX) |

| CE Marking (MDR) | Request EC Certificate + EU Rep registration (EORI number). Cross-check on NANDO database | CE certificate issued pre-May 2021 (invalid under MDR) or lacking Notified Body number (e.g., “CE 0123”) | MDR 2017/745 compliance required for all new CE applications |

| NMPA Registration | Verify via NMPA Official Portal (Registration No. must start with “国械注准”) | Supplier references “CFDA” (outdated) or provides only business license | Class III devices require clinical trial data (2025+) |

Action Item: Demand factory audit reports (ISO 13485 surveillance audits) dated within 6 months. Reject suppliers using trading companies as intermediaries for certification.

Step 2: MOQ Negotiation Strategy

Market Reality: Leading Chinese CBCT manufacturers now enforce minimums of 3-5 units for standard configurations (2026 baseline). Strategic negotiation requires understanding production economics.

| MOQ Tier | Technical Justification | Negotiation Leverage Point | 2026 Pricing Impact |

|---|---|---|---|

| 1-2 Units | Prohibitive retooling costs for gantry assembly lines; calibration fixture setup | Commit to multi-year service contract (minimum 3 years) | +22-28% premium vs. tiered pricing |

| 3-5 Units | Optimal batch production for detector calibration & software validation | Accept standard configurations (no custom UI/ergonomics) | Baseline pricing (100%) |

| 6+ Units | Economies of scale in X-ray tube procurement & PCB assembly | Prepay 40% for raw material allocation | 8-12% discount; priority production slotting |

Pro Tip: Leverage OEM/ODM flexibility – Suppliers with in-house R&D (like Carejoy) may accept lower MOQs for white-label units if you provide UI specifications 90 days pre-production.

Step 3: Shipping Terms & Logistics Risk Management

Technical Imperative: CBCT systems require climate-controlled transport (20-25°C, 40-60% RH) and shock monitoring. DDP (Delivered Duty Paid) is strongly recommended for first-time importers.

| Term | Cost Components Included | Technical Risk Exposure | Recommended For |

|---|---|---|---|

| FOB Shanghai | Factory loading + main freight | Customs clearance delays (risk of humidity damage); calibration void if mishandled during transshipment | Experienced distributors with in-country logistics partners |

| DDP Your Clinic | All costs to final destination (incl. import duties, VAT, last-mile delivery) | Supplier bears calibration recertification costs if environmental thresholds breached | 95% of clinics; all first-time buyers (2026 industry standard) |

Critical Clause: Insist on real-time IoT sensor monitoring (e.g., ShockWatch® 2) with data accessible via cloud portal. Reject shipments exceeding 5G impact threshold during transit.

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

As a vertically integrated manufacturer with 19 years of FDA/CE/NMPA-compliant production, Carejoy exemplifies the sourcing standards outlined in this protocol:

- Regulatory Assurance: Direct NMPA Class III registration (Registration No. 国械注准20233060085) + EU MDR-compliant CE (NB 0482) with in-house QA team

- MOQ Flexibility: 2-unit minimum for standard CBCT configurations; 1-unit acceptance for clinics with service contract commitment

- Logistics Excellence: DDP shipping with AI-driven route optimization and IoT environmental monitoring included at no extra cost

- Technical Edge: Factory-direct engineering support for calibration validation (NIST-traceable) and AI software updates

For Technical Procurement Consultation:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai 200431, China

📧 [email protected]

💬 WhatsApp: +86 159 5127 6160

Request 2026 CBCT Datasheet (Model CJ-CBCT8000) with ISO 13485:2016 audit report

Compliance Disclaimer

This guide reflects regulatory requirements as of Q1 2026. Always verify current standards through official channels (EU Commission, NMPA, FDA). Shanghai Carejoy is presented as an exemplar of compliant manufacturing practices – inclusion does not constitute endorsement by this publication. Conduct independent due diligence prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs When Purchasing the Best CBCT Machine in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Key Considerations & Recommendations |

|---|---|

| 1. What voltage requirements should I verify before installing a CBCT machine in my clinic? |

Most modern CBCT systems operate on standard 110–120V (North America) or 220–240V (Europe, Asia, and other regions). However, high-end 3D imaging units may require dedicated 208V or 240V circuits with stable power supply.

Recommendation: Confirm voltage compatibility with your facility’s electrical infrastructure. Ensure grounding and surge protection are in place. Always consult the manufacturer’s technical specifications and involve a certified electrician during site preparation. |

| 2. How accessible are spare parts for CBCT machines, and what is the average lead time? |

Spare parts availability varies significantly by manufacturer and region. Leading brands (e.g., Carestream, Planmeca, Vatech, KaVo) maintain regional distribution hubs for faster logistics. Critical components such as X-ray tubes, sensors, and gantry motors may have lead times of 2–6 weeks if not in local stock.

Recommendation: Prioritize suppliers with established local or regional spare parts warehouses. Request a spare parts catalog and lead time matrix before purchase. Consider stocking high-failure-rate components (e.g., X-ray tubes) as part of a preventive maintenance strategy. |

| 3. What does the installation process for a CBCT machine involve, and is professional setup required? |

Installation is a multi-phase process including site assessment, radiation shielding verification, electrical setup, machine calibration, and software integration. Most manufacturers require certified biomedical engineers or factory-trained technicians to perform installation to ensure compliance with regulatory standards (e.g., FDA, CE, ISO 13485).

Recommendation: Confirm whether installation is included in the purchase price. Ensure your clinic meets minimum space, ventilation, and radiation safety requirements. Schedule installation during low-traffic hours to minimize clinic disruption. |

| 4. What warranty coverage is standard for CBCT machines in 2026, and what does it include? |

The industry standard is a 2-year comprehensive warranty covering parts, labor, and software updates. Some premium models offer 3-year warranties or optional extended service plans. Coverage typically excludes consumables (e.g., filters) and damage from power surges or improper use.

Recommendation: Review warranty terms for on-site response time (e.g., 48–72 hours), remote diagnostics support, and software update frequency. Consider upgrading to an extended warranty with preventive maintenance for mission-critical units. |

| 5. Are software updates and service support included during the warranty period? |

In 2026, most OEMs include lifetime basic software updates and remote technical support during the warranty term. Advanced features (e.g., AI-assisted diagnostics, implant planning modules) may require separate licensing. Post-warranty, support is typically offered via annual service contracts.

Recommendation: Verify if cloud integration, DICOM compatibility, and cybersecurity patches are included. Ensure the manufacturer provides multilingual support and integrates with major practice management systems (e.g., Dentrix, Open Dental). |

Need a Quote for Best Cbct Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160