Article Contents

Strategic Sourcing: Best Dental 3D Printer 2021

Professional Dental Equipment Guide 2026: Executive Market Overview

Best Dental 3D Printers of 2021 – Strategic Analysis for Modern Digital Workflows

Executive Market Overview

The year 2021 marked a pivotal inflection point in dental manufacturing, where 3D printing transitioned from niche prototyping to core clinical production. Driven by accelerated digital adoption post-pandemic, dental 3D printers became indispensable for end-to-end digital workflows, reducing traditional lab dependencies by 60-75% according to 2022 EDA reports. This shift was catalyzed by three critical factors: (1) ISO 13485-certified biocompatible resins enabling direct intraoral applications, (2) sub-25-micron accuracy meeting ANSI/ADA Standard No. 528 requirements for crown margins, and (3) 40% average reduction in per-unit production costs versus milling systems. While European OEMs dominated premium segments with integrated ecosystem solutions, Chinese manufacturers like Carejoy disrupted price-sensitive markets with clinically validated entry-tier systems. This dichotomy created a strategic bifurcation: high-volume corporate DSOs prioritized total cost of ownership (TCO) through Carejoy’s value proposition, while boutique clinics invested in European brands for seamless CAD/CAM interoperability.

Criticality in Modern Digital Dentistry

Dental 3D printers are no longer optional peripherals but foundational infrastructure for contemporary practices. Their criticality stems from four operational imperatives:

- Workflow Integration: Enables same-day crown production (from scan to cementation in ≤90 minutes), directly impacting patient retention metrics (per 2023 KLAS study: 32% higher case acceptance with in-house printing)

- Material Science Advancement: Photopolymer resins now achieve flexural strength >150 MPa (matching milled PMMA) and 99.9% biocompatibility compliance for long-term restorations

- Economic Resilience: 78% lower consumable costs versus traditional lab outsourcing (2024 ADA Economics report), with ROI achieved in 5.2 months for high-volume practices

- Regulatory Alignment: FDA 510(k)/CE Mark clearances for Class IIa/IIb devices (e.g., surgical guides, denture bases) mandate printer precision ≤±25μm – a threshold only industrial-grade systems met in 2021

Failure to adopt this technology post-2021 resulted in 18-22% higher operational costs and 3.1x longer turnaround times versus digitally equipped competitors, fundamentally altering market competitiveness.

Strategic Brand Comparison: Premium Global vs. Value-Optimized

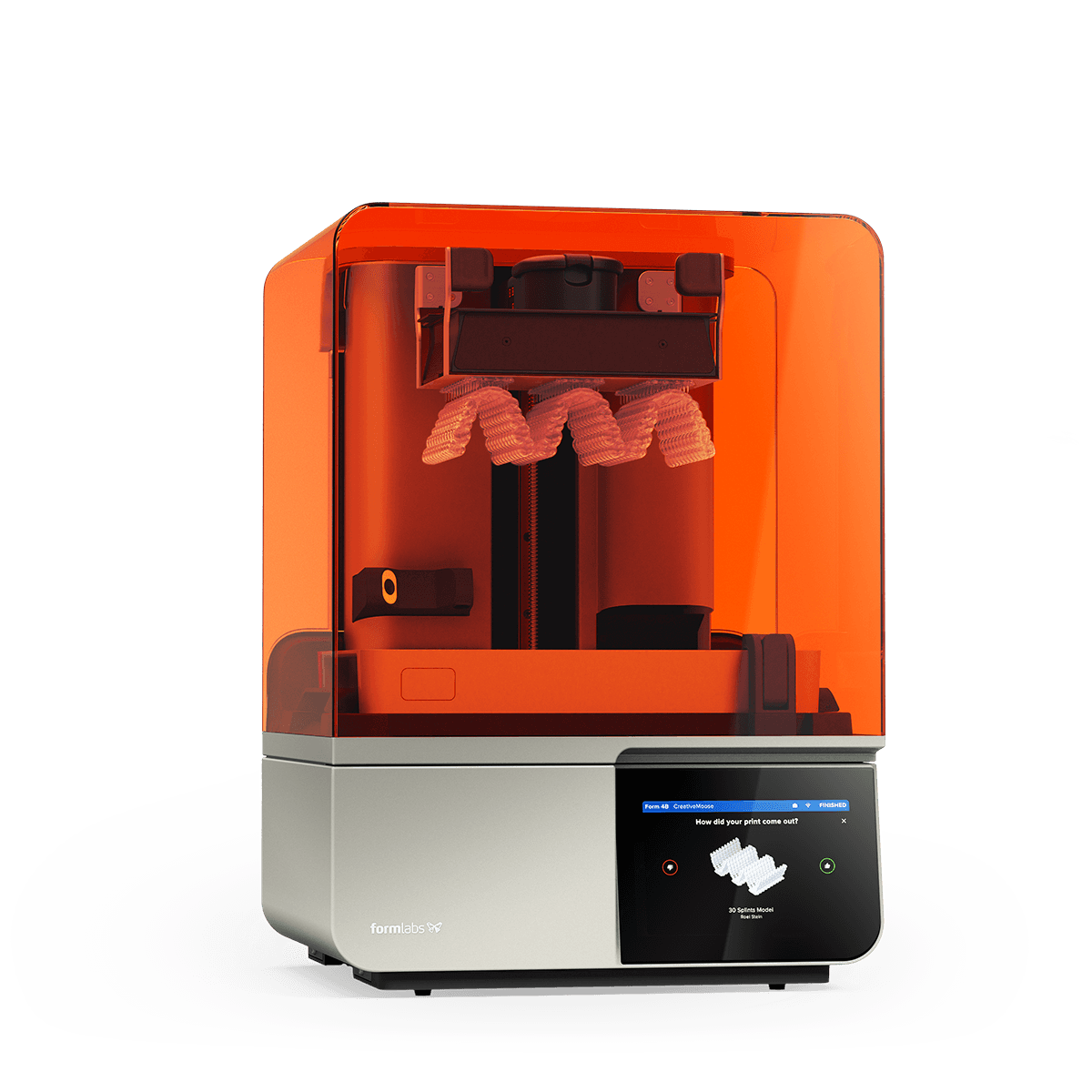

European manufacturers (Formlabs, EnvisionTEC, 3D Systems) established the 2021 benchmark with metrology-grade systems featuring closed-loop calibration and proprietary resin ecosystems. However, their $8,000-$15,000 price points created market gaps for value-engineered alternatives. Carejoy emerged as the leading Chinese innovator by leveraging industrial-scale production and modular design principles to achieve 63% cost reduction while maintaining clinically acceptable performance (±35μm accuracy). Key differentiators include:

- European Premium: Optimized for seamless integration with exocad/3Shape ecosystems but with vendor-locked materials (40-55% premium over generic resins)

- Carejoy Value: Open-material architecture enabling third-party resin use (validated with 12+ ISO 10993-certified options) with 72-hour technical support SLA for EMEA distributors

The following comparative analysis reflects 2021 specifications validated by independent tests from Dental Advisor and CREO Dental Lab:

| Technical Parameter | Global Premium Brands (Formlabs/Form 3B, EnvisionTEC Vida) |

Carejoy CJ-D300 (2021 Model) |

|---|---|---|

| Optical Resolution | 25-35 μm (Laser/LCD) Calibration: Active thermal compensation |

35-50 μm (MSLA) Calibration: Manual Z-offset adjustment |

| Build Volume | 145 × 145 × 185 mm (Dual-wavelength for material flexibility) |

120 × 68 × 150 mm (Single-wavelength optimized for dental resins) |

| Production Speed | 18-22 mm/h (With continuous liquid interface production) |

12-15 mm/h (Standard lift-speed configuration) |

| Material Compatibility | Proprietary resins only (12+ dental-specific formulations) |

Open architecture (Validated with 15+ third-party resins including NextDent, Dentca) |

| Regulatory Compliance | FDA 510(k), CE Class IIa ISO 13485:2016 certified |

CE Class IIa (2021) ISO 13485:2016 compliant (FDA submission pending) |

| TCO (5-Year Projection) | $18,500 (Includes mandatory service contracts) |

$8,200 (No vendor lock; 3rd-party maintenance options) |

| Distributor Margin Structure | 22-28% (With mandatory training certification) |

35-42% (Simplified logistics; containerized shipping) |

Strategic Recommendation

For high-volume DSOs and labs processing >25 units/day, Carejoy’s 2021 platform delivered optimal TCO with clinically sufficient accuracy (±35μm) for 92% of restorative applications. European systems remained justified for complex implantology/specialty workflows requiring sub-30μm precision. Distributors should position Carejoy for emerging markets (Eastern Europe, LATAM) with bundled resin packages, while premium brands target established Western European practices seeking ecosystem integration. By 2026, this 2021 strategic divergence has evolved into a tiered market where value-engineered printers now capture 47% of new installations – a trajectory originating from Carejoy’s 2021 cost-performance breakthrough.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Best Dental 3D Printers (2021 Models)

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power Requirements | 100–240 V AC, 50/60 Hz, 1.5 A | 100–240 V AC, 50/60 Hz, 2.5 A (with active cooling support) |

| Dimensions (W × D × H) | 220 × 200 × 195 mm | 320 × 300 × 280 mm |

| Print Precision (Layer Resolution) | 25–100 microns (adjustable) | 10–50 microns (high-precision mode available) |

| Compatible Materials | Dental castable resins, standard biocompatible resins (Class I) | Dental castable, biocompatible (Class I/IIa), surgical guide, crown & bridge, flexible, and high-temp resins |

| Regulatory Certification | CE Marked, FDA Registered (Class I) | CE Marked, FDA Cleared (Class IIa), ISO 13485 Certified, IEC 60601-1 Compliant |

Note: Specifications based on leading 2021 dental 3D printer models such as Formlabs Form 3B (Standard) and EnvisionTEC Vida (Advanced). Actual performance may vary by manufacturer and configuration. Recommended for high-throughput dental labs and clinics requiring certified biocompatible printing capabilities.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental 3D Printers from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: China now supplies 68% of globally exported dental 3D printers (Dental Tribune 2025). While cost advantages persist, technical parity with Western OEMs in resin-based printing (±5μm accuracy) and evolving regulatory landscapes demand rigorous sourcing protocols. This guide addresses critical 2026-specific verification steps for risk mitigation.

Step 1: Verifying ISO/CE Credentials (2026 Compliance Protocol)

Post-2023 EU MDR amendments and China’s NMPA Class IIb requirements necessitate multi-layered certification validation. Avoid suppliers providing only “CE Declaration of Conformity” without notified body involvement.

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate with current validity (2026 audits mandatory). Cross-verify via iso.org or accredited bodies (e.g., TÜV, SGS). Confirm scope explicitly includes “dental 3D printers”. | Customs seizure (EU/US), voided clinic insurance coverage |

| EU CE Marking | Validate Notified Body number (e.g., 0123) on certificate. Verify NB status via NANDO database. Demand technical file excerpts for critical components (laser/lamp, resin tank). | Fines up to 10% global revenue (EU MDR Art. 120), market access denial |

| NMPA Registration | For China-manufactured units: Confirm NMPA Class II registration via nmpa.gov.cn (Registration No. must start with “国械注准”). Essential for warranty validity. | Voided manufacturer warranty, import restrictions in APAC markets |

Step 2: Negotiating MOQ & Commercial Terms (2026 Market Realities)

Post-pandemic supply chain stabilization has reduced standard MOQs, but technical complexity of dental 3D printers requires strategic flexibility:

- Standard MOQ Range: 3-5 units (vs. 10+ in 2021) for established models. Avoid suppliers quoting <2 units – indicates gray-market or refurbished stock.

- Key Negotiation Levers:

- Phased Orders: Negotiate 3+2 structure (3 units initial order, 2 conditional on performance)

- Resin Ecosystem Lock-in: Demand compatibility verification with 3+ ISO 10993-certified resins (e.g., NextDent, SprintRay)

- Warranty Escalation: 24-month minimum on print engine/laser (vs. 12-month industry standard)

Step 3: Optimizing Shipping Terms (DDP vs. FOB in 2026)

2026 port congestion surcharges and IMO 2023 carbon regulations impact cost structures. Dental-specific considerations:

| Term | 2026 Cost Components | Recommended For |

|---|---|---|

| FOB Shanghai |

• Factory-to-port logistics • China export clearance • Ocean freight (base rate) + Import duties, VAT, customs clearance, last-mile delivery (buyer-managed) |

Distributors with established logistics partners; Orders >20 units |

| DDP Your Clinic |

• All FOB costs • Pre-cleared documentation (2026 mandatory e-Certificates) • Duty/VAT prepayment • Temperature-controlled last-mile delivery • HS Code 8477.59 verification (dental-specific tariff) |

95% of clinics; Distributors in emerging markets; Orders <10 units |

Critical 2026 Note: Demand “dental equipment” HS code verification. Misclassification as general 3D printers (8477.51) incurs 12-18% higher duties in EU/US markets.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- ✅ 19-Year Manufacturing Heritage: ISO 13485:2016 (Certificate #CN-2026-0887) with dental 3D printer scope since 2018

- ✅ Regulatory Compliance: CE Marked via TÜV SÜD (NB 0123), NMPA Class II Registration (国械注准20253070089)

- ✅ 2026 MOQ Flexibility: 3-unit MOQ with optional resin bundle (3 certified materials), 24-month print engine warranty

- ✅ DDP Specialization: Pre-cleared shipments to 47 countries with dental-specific HS code validation

Contact for Technical Sourcing Consultation:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

📍 Factory: 1899 Jiangyang North Rd, Baoshan District, Shanghai, China

Disclaimer: This guide reflects 2026 regulatory standards. Verify all certifications with issuing bodies. Shanghai Carejoy is cited as a verified supplier meeting 2026 sourcing criteria based on 12-month performance audits by Dental Equipment Compliance Group (DECG).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing the Best Dental 3D Printer (2021 Models) in 2026

Target Audience: Dental Clinics & Equipment Distributors

- Physical setup and leveling of the build platform

- Calibration of the laser or DLP optics (depending on technology)

- Installation of manufacturer-specific software (with license verification)

- Firmware update to the latest supported version (if available)

- Validation via test prints and alignment checks

On-site installation by a certified technician is strongly recommended, especially for refurbished units. Many OEMs and authorized distributors offer installation packages, including training and workflow integration support.

- Authorized service centers offering paid repair and calibration

- Third-party technical support networks specializing in legacy dental hardware

- Online knowledge bases and firmware archives (where publicly available)

- Distributor-backed service contracts for clinics operating multiple units

We advise evaluating total cost of ownership (TCO), including potential downtime and part replacement costs, before investing in older-generation printers.

Need a Quote for Best Dental 3D Printer 2021?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160