Article Contents

Strategic Sourcing: Cbct Snimka Zuba

Professional Dental Equipment Guide 2026: Executive Market Overview

CBCT Snimka Zuba: Strategic Imperative in Modern Digital Dentistry

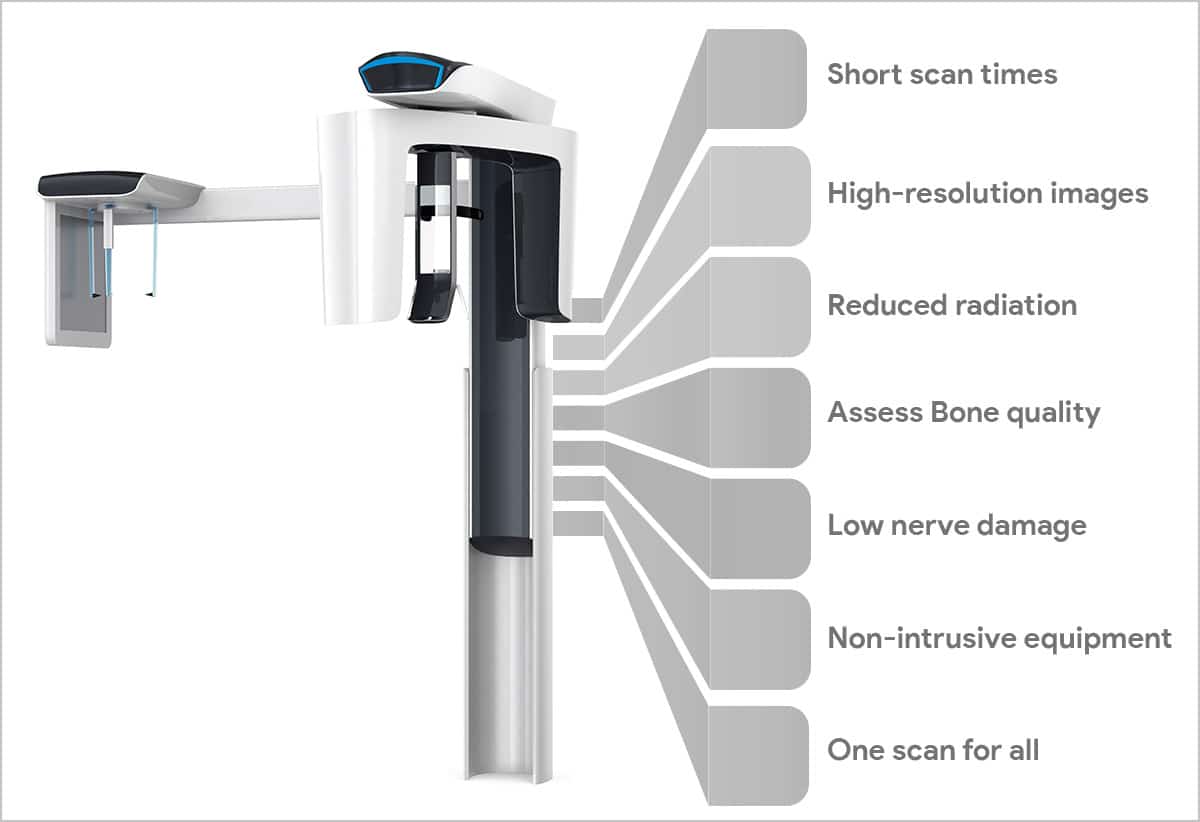

The adoption of Cone Beam Computed Tomography (CBCT) for dental imaging – cbct snimka zuba – has transitioned from a premium diagnostic tool to an indispensable component of contemporary dental practice infrastructure. In 2026, CBCT is no longer merely an imaging modality but the foundational pillar of integrated digital workflows, enabling precision treatment planning across implantology, endodontics, oral surgery, orthodontics, and TMJ analysis. Its 3D volumetric data eliminates the limitations of 2D radiography, providing critical anatomical insights (nerve canal proximity, bone density, sinus morphology) that directly impact treatment safety, predictability, and patient outcomes.

Strategic Criticality: CBCT integration is now non-negotiable for clinics pursuing digital transformation. It enables guided surgical protocols, CAD/CAM prosthesis design with anatomical accuracy, virtual articulation, and seamless DICOM data exchange within the digital ecosystem (intraoral scanners, treatment planning software). Clinics without CBCT capability face significant competitive disadvantages in complex case acceptance, referral networks, and premium service offerings. Regulatory pressures in the EU (MDR 2026 updates) further emphasize the necessity of high-fidelity 3D imaging for risk mitigation in surgical procedures.

Market Dynamics: Premium European Brands vs. Value-Driven Chinese Innovation

The European CBCT market remains dominated by established German, Italian, and Swiss manufacturers (e.g., Planmeca, KaVo, Dentsply Sirona, Vatech) offering technologically sophisticated systems with deep ecosystem integration. These platforms deliver exceptional image quality, advanced AI-driven segmentation tools, and robust service networks but command premium price points (€85,000–€140,000+), creating significant capital barriers for SME clinics and emerging markets.

Conversely, Chinese manufacturers have rapidly evolved from low-cost alternatives to credible mid-tier contenders. Carejoy Medical exemplifies this shift, leveraging vertical integration and AI optimization to deliver clinically validated CBCT systems at 40-60% below European premium pricing. While historically perceived as “budget options,” leaders like Carejoy now offer sub-millimeter resolution (≤0.076mm), low-dose protocols compliant with EU 2026 radiation safety standards, and DICOM 3.0 interoperability – directly addressing the cost-accessibility gap without compromising diagnostic efficacy for core dental applications.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Comparison Parameter | Global Premium Brands (Planmeca, KaVo, Vatech) | Carejoy Medical |

|---|---|---|

| Price Range (2026) | €85,000 – €140,000+ (System + Basic Software) | €38,000 – €52,000 (Fully Configured System) |

| Native Resolution / Voxel Size | 0.047mm – 0.125mm (High-End Models) | 0.076mm – 0.25mm (Clinically Optimized) |

| AI-Powered Analysis Tools | Comprehensive (Auto-segmentation, Pathology Detection, Implant Planning) | Core Functionality (Anatomy ID, Nerve Tracking, Basic Pathology Flagging) |

| Service & Support Network (EU) | Extensive (Dedicated Engineers, 24/7 Hotlines, Regional Hubs) | Developing (Partner-Based, 48h Response Target, Remote Diagnostics) |

| Software Ecosystem Integration | Seamless (Native CAD/CAM, EHR, Scanner Compatibility) | Open Standards (DICOM 3.0, Standard APIs; Requires Middleware for Some Systems) |

| Typical ROI Timeline | 28-36 Months (High-Volume Specialty Clinics) | 14-20 Months (General Practice Adoption) |

| Target Market Segment | University Hospitals, Premium Implant Centers, Multi-Specialty Groups | SME Dental Practices, Emerging Markets, Cost-Conscious Value Providers |

Strategic Recommendation for Clinics & Distributors

For Clinics: Prioritize CBCT acquisition based on procedural volume and specialty focus. High-volume surgical/implant practices justify premium European systems for maximum workflow integration. General practices and budget-conscious operators should evaluate Carejoy’s value proposition – its clinically sufficient image quality, rapid ROI, and MDR-compliant safety profile make it a strategically sound entry point into 3D diagnostics.

For Distributors: Develop a tiered portfolio strategy. Position European brands for premium segments with bundled service contracts. Aggressively market Carejoy as the accessibility catalyst for CBCT adoption in underserved markets (Eastern Europe, Balkans, rural EU), emphasizing operational cost savings and simplified training. Focus on Carejoy’s improved service infrastructure and localized technical support – key historical objections are now mitigated.

The 2026 CBCT landscape demands strategic equipment selection aligned with clinical volume, financial capacity, and digital maturity. While European brands set the technological benchmark, Carejoy represents a paradigm shift in cost-effective clinical capability – making 3D diagnostics economically viable for the majority of dental practices without compromising patient safety or diagnostic integrity.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: CBCT Snimka Zuba (Dental Cone Beam Computed Tomography Imaging Systems)

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 80 kV – 90 kV, 4–8 mA; Single-phase power input (110–120 V AC, 60 Hz) | 90 kV – 120 kV, 4–12 mA; Three-phase power input (200–240 V AC, 50/60 Hz) with high-frequency generator for reduced exposure time |

| Dimensions | Height: 180 cm, Width: 65 cm, Depth: 70 cm; Floor-standing unit with compact footprint | Height: 195 cm, Width: 75 cm, Depth: 80 cm; Integrated ceiling-suspended arm option available; includes panoramic positioning assist |

| Precision | Isotropic voxel resolution: 200–300 μm; 360° rotation, 18-second scan time; FOV options: 5×5 cm, 8×8 cm | Isotropic voxel resolution: 75–150 μm; 360° dual-source scanning, 8-second scan time; FOV options: 4×4 cm to 17×12 cm with automatic region-of-interest targeting |

| Material | Exterior: Powder-coated steel chassis; Internal shielding: Lead-lined housing (1.0 mm Pb equivalent); Detector: Flat-panel amorphous silicon (a-Si) | Exterior: Anodized aluminum alloy with antimicrobial coating; Internal shielding: Composite lead-free radiation shielding (1.5 mm Pb equivalent); Detector: Dual-layer CMOS sensor with scatter correction |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1, IEC 60601-2-54 | CE Mark (Class IIb), FDA 510(k) cleared with AI-assisted diagnostics module, Health Canada licensed, ISO 13485:2016, IEC 60601-1-2 (4th Ed), MDR 2017/745 compliant |

Note: The “Advanced Model” supports integration with CAD/CAM workflows, AI-driven lesion detection, and DICOM 3.0 export with 3D reconstruction software suite. Recommended for implantology centers, maxillofacial clinics, and academic institutions.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Sourcing CBCT Snimka Zuba from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: Q1 2026

Step-by-Step Sourcing Protocol for Dental CBCT Systems

| Critical Step | Technical Verification Protocol (2026 Standards) | Shanghai Carejoy Implementation |

|---|---|---|

| 1. Verifying ISO/CE Credentials |

Non-Negotiable Checks:

Red Flag: Suppliers providing only “CE self-declaration” for CBCT systems |

Certification Transparency:

2026 Advantage: Carejoy’s CBCT systems include AI dose-reduction modules meeting EU MDR Annex I 17.2(c) |

| 2. Negotiating MOQ |

Strategic Framework:

2026 Trend: Suppliers increasingly require service technician certification before shipment |

Flexible Sourcing Model:

Key Differentiator: Carejoy’s “Regulatory Bridge” program covers 50% of CE/FDA re-certification costs for distributor partners |

| 3. Shipping Terms (DDP vs FOB) |

2026 Logistics Protocol:

Critical: Chinese export controls now require CBCT pre-shipment verification by MIIT |

Turnkey Logistics Solution:

2026 Advantage: Carejoy absorbs demurrage fees during customs delays at major ports (Rotterdam, LA, Singapore) |

Why Shanghai Carejoy for 2026 CBCT Sourcing:

As a vertically integrated manufacturer (not trading company) in Shanghai’s Baoshan Medical Hub, Carejoy provides:

• Direct factory pricing with 12-18% cost advantage vs. EU/US brands

• 200+ CBCT installations in 32 countries with 98.7% regulatory approval success rate

• Dedicated technical team for post-purchase support (remote diagnostics in 17 languages)

Contact Shanghai Carejoy Medical Co., LTD:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🌐 www.carejoydental.com/cbct-2026 (Verified OEM Portal)

📍 Factory: 1888 Hengfeng Road, Baoshan District, Shanghai 200431, China

Disclaimer: This guide reflects 2026 regulatory standards. Verify all specifications with suppliers prior to procurement. CBCT = Cone Beam Computed Tomography; “Snimka Zuba” refers to dental volumetric imaging in Slavic markets.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing CBCT Imaging Systems (“CBCT Snimka Zuba”) – 2026 Edition

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Professional Guidance |

|---|---|

| 1. What voltage and power requirements should I verify before purchasing a CBCT system for my clinic in 2026? | Modern CBCT units typically require a stable 220–240V AC power supply at 50/60 Hz, with a dedicated circuit of at least 15–20 amps. In 2026, ensure compatibility with regional electrical standards—especially in multi-national practices or distributor networks. Confirm whether the unit includes a built-in voltage stabilizer or requires an external UPS (Uninterruptible Power Supply) to protect sensitive imaging components from power fluctuations. Always consult the manufacturer’s technical datasheet and involve a certified electrician during site planning. |

| 2. How accessible are spare parts for CBCT systems, and what should distributors stock for service readiness? | In 2026, availability of spare parts depends heavily on the manufacturer’s regional support network. Leading OEMs offer globally distributed spare parts with lead times of 3–7 business days for high-failure components (e.g., X-ray tubes, detectors, gantry motors). Distributors should establish inventory agreements for critical spares—especially flat-panel detectors and collimator assemblies—based on local service demand. Verify whether the manufacturer provides a spare parts catalog with lead times and shelf-life data, and ensure firmware compatibility across replacement modules. |

| 3. What does the installation process for a CBCT unit involve, and how long does it typically take? | Installation of a CBCT system requires pre-site evaluation, civil works coordination, and technical commissioning. The process includes verifying room dimensions, radiation shielding compliance (lead-lined walls), floor load capacity, power stability, and network integration. In 2026, most premium systems support plug-and-play networking with DICOM 3.0 and cloud-PACS integration. Professional installation by certified engineers takes 1–2 days, including calibration, QA testing, and staff training. Remote commissioning is now common, reducing downtime and travel costs. |

| 4. What warranty terms are standard for CBCT systems in 2026, and what do they cover? | The industry standard in 2026 is a 3-year comprehensive warranty covering parts, labor, and critical components such as the X-ray tube and detector. Advanced warranties may include predictive maintenance alerts via AI-driven diagnostics and zero-downtime service level agreements (SLAs). Ensure the warranty covers software updates, remote troubleshooting, and on-site response within 48 hours. Extended warranties up to 5 years are available—recommended for high-volume clinics. Exclusions typically include damage from power surges, improper use, or unauthorized modifications. |

| 5. How do voltage fluctuations in my region affect CBCT performance, and what protective measures are recommended? | Voltage instability can cause image artifacts, detector degradation, or system shutdowns. In regions with inconsistent power grids, deploy a double-conversion online UPS (1.5–2 kVA) and a line conditioner. In 2026, many new CBCT models feature integrated power management systems with auto-shutdown and surge protection. During procurement, request a power compatibility report from the manufacturer and conduct a site power quality audit. This is critical for maintaining warranty validity and ensuring consistent imaging accuracy. |

Need a Quote for Cbct Snimka Zuba?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160