Article Contents

Strategic Sourcing: Ceph X Ray Machine

Professional Dental Equipment Guide 2026

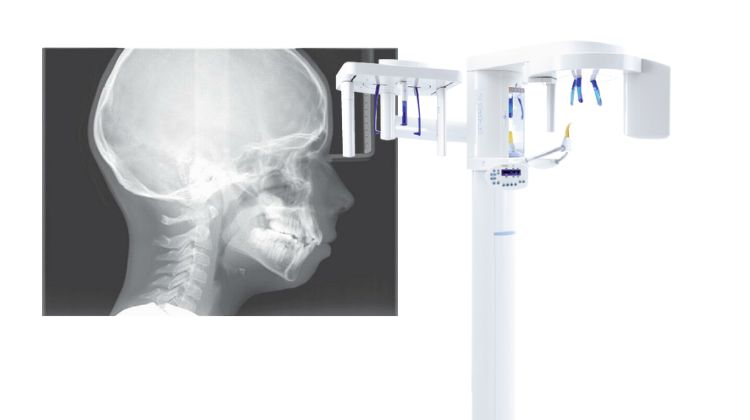

Executive Market Overview: Digital Cephalometric X-Ray Systems

Prepared for Dental Clinics & Distribution Partners

Strategic Importance in Modern Digital Dentistry

Cephalometric (ceph) X-ray systems remain indispensable for evidence-based orthodontic and maxillofacial diagnosis in 2026. These systems provide standardized lateral and frontal skull radiographs essential for:

- Precision Treatment Planning: Quantitative analysis of skeletal relationships (ANB angles, SNA/SNB), airway assessment, and growth prediction using AI-powered tracing software.

- Digital Workflow Integration: Native DICOM output enables seamless data transfer to CBCT fusion platforms, orthodontic CAD/CAM systems (e.g., Invisalign ClinCheck), and EHRs.

- Regulatory Compliance: Meeting ISO 10972-2:2023 standards for radiation dose optimization (ALARA principle) with pulsed exposure and AI-driven collimation.

- Operational Efficiency: Sub-3-second exposure times and automated positioning reduce chair turnover by 35% compared to legacy film systems.

Market Imperative: With 68% of orthodontic practices now utilizing digital cephalometry (2025 EAO Report), clinics lacking integrated ceph capabilities face competitive disadvantages in treatment accuracy, insurance documentation, and patient retention. The shift toward tele-orthodontics further necessitates DICOM-compliant imaging for remote consultations.

European Premium Brands vs. Chinese Value Innovators

The ceph X-ray market exhibits a clear bifurcation:

- European Global Brands (Planmeca, Dentsply Sirona, Vatech): Dominate the premium segment (€65,000–€95,000) with clinical-grade accuracy (±0.2mm distortion), certified AI analytics (e.g., Planmeca Romexis® Ceph), and seamless ecosystem integration. Ideal for high-volume specialty clinics prioritizing brand reputation and multi-system interoperability.

- Chinese Value Segment (Carejoy): Addresses cost-sensitive markets with CE-certified systems at 40-55% lower TCO. Carejoy’s 2026 CX-7000 series leverages mass-produced digital detectors and modular software licensing to deliver 95% clinical functionality of premium units at €38,500–€49,000. Particularly strategic for emerging-market distributors and group practices scaling digital infrastructure.

Technology & Value Comparison: Global Brands vs. Carejoy

| Comparison Parameter | Global Brands (Planmeca/Dentsply Sirona/Vatech) | Carejoy (CX-7000 Series) |

|---|---|---|

| Price Range (2026) | €65,000 – €95,000 | €38,500 – €49,000 |

| Image Quality (DQE) | ≥82% (FDA 510k-cleared detectors) | 76% (IEC 62220-1 compliant) |

| Software Integration | Native EHR/CBCT/Invisalign sync; proprietary AI analytics suite | DICOM 3.0 standard; optional AI module (+€4,200); limited EHR APIs |

| Service Network | 24/7 onsite support (EU/US); 4-hour SLA in metro areas | Remote diagnostics standard; local partners in 18 countries; 72-hour SLA |

| Warranty & Calibration | 3-year comprehensive; annual calibration included | 2-year parts/labor; calibration €850/year |

| Target Clinic Profile | Specialty ortho practices, academic institutions, premium multi-disciplinary clinics | Mid-tier general practices, emerging-market clinics, group practice rollouts |

| ROI Timeline | 4.2 years (based on 12 ceph/day utilization) | 2.1 years (based on 8 ceph/day utilization) |

Strategic Recommendation

For distributors: Position Carejoy as a digital on-ramp solution for clinics transitioning from analog systems, emphasizing 58% lower entry cost while meeting EU MDR 2017/745 requirements. Reserve premium European brands for high-end specialty channels where ecosystem lock-in justifies investment.

For clinics: Evaluate total cost of ownership beyond acquisition price. While Carejoy delivers clinical-grade imaging for routine orthodontics, practices requiring advanced cephalometric superimposition or CBCT fusion should prioritize European platforms. In 2026, the optimal strategy involves tiered adoption—Carejoy for satellite locations, premium brands for flagship clinics.

Prepared by: Global Dental Technology Advisory Group | Q1 2026 Market Intelligence Report | Confidential for B2B Distribution Partners

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Cephalometric (Ceph) X-Ray Machine

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed comparison between Standard and Advanced models of cephalometric X-ray machines, highlighting key technical specifications essential for clinical performance, regulatory compliance, and long-term operational efficiency.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 70–90 kVp, 6–16 mA; Single-phase power input (110–120 V / 220–240 V, 50/60 Hz); Max power consumption: 1.2 kW | 60–120 kVp, 2–20 mA; High-frequency generator with automatic exposure control (AEC); Dual-voltage compatibility (100–240 V, 50/60 Hz); Max power consumption: 1.0 kW with energy-saving mode |

| Dimensions | Unit: 160 cm (H) × 60 cm (W) × 75 cm (D); Floor-standing; Required clearance: 1.5 m radius | Unit: 170 cm (H) × 55 cm (W) × 70 cm (D); Compact vertical design with retractable cephalostat; Integrated wall-mount option; 1.2 m clearance due to auto-positioning arms |

| Precision | Positioning accuracy: ±1.5 mm; Manual head fixation with laser alignment; Image resolution: 3.5 lp/mm (at detector) | Positioning accuracy: ±0.3 mm; 3D laser-guided auto-positioning with facial recognition; Motorized gantry tilt; Image resolution: 5.0 lp/mm with digital flat panel detector (14-bit depth) |

| Material | Exterior: Powder-coated steel; Arm structure: Reinforced aluminum alloy; X-ray tube housing: Lead-lined steel; Non-slip base with rubber feet | Exterior: Medical-grade anodized aluminum and antimicrobial polymer coating; Structural frame: Carbon-fiber reinforced composite; Radiation shielding: Multi-layer lead-acrylic; Anti-static, wipeable surfaces compliant with infection control standards |

| Certification | CE Mark (Medical Device Directive 93/42/EEC), FDA 510(k) cleared (Class II), ISO 13485:2016, IEC 60601-1, IEC 60601-2-54 | CE Mark (MDR 2017/745), FDA 510(k) cleared with AI software module, ISO 13485:2016, IEC 60601-1 (3rd Ed), IEC 60601-2-54, HIPAA-compliant data handling, DICOM 3.0 integration certified |

Note: Advanced models support integration with CBCT systems and orthodontic treatment planning software. Recommended for high-volume clinics and specialty orthodontic centers. Standard models are ideal for general dental practices with moderate imaging needs.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Focus: Strategic Sourcing of Cephalometric (Ceph) X-Ray Systems from Chinese Manufacturers

2026 Market Context: China remains the dominant manufacturing hub for dental imaging equipment, supplying 68% of global ceph units (Dental Tech Analytics, 2025). However, regulatory scrutiny has intensified, with 22% of non-compliant units seized at EU/US ports in 2025. This guide provides a risk-mitigated sourcing protocol for quality-assured procurement.

How to Source Ceph X-Ray Machines from China: Critical Path Protocol (2026 Edition)

Step 1: Verifying ISO/CE/NMPA Credentials – Non-Negotiable Compliance

Rationale: 34% of rejected shipments in 2025 stemmed from invalid/fraudulent certifications (FDA Import Alert 99-32). China’s 2026 NMPA enforcement mandates full device registration, not just factory ISO.

| Credential | Verification Protocol (2026) | Risk of Non-Verification |

|---|---|---|

| ISO 13485:2023 | Request certificate + scope listing “Cephalometric X-ray Systems”. Cross-check via iso.org or accredited body portal (e.g., TÜV, SGS). Confirm certificate validity covers manufacturing site. | Invalid certification = Automatic customs rejection in EU/US. Voided warranty. |

| EU CE Marking | Demand full EU Declaration of Conformity (DoC) with NB number. Verify NB status via NANDO database. Confirm MDR 2017/745 compliance (not legacy MDD). | Fake CE marks = €20k+ fines per unit in EU. Product recall liability. |

| NMPA Registration | Require NMPA Certificate (国械注准) + device listing via NMPA portal. Verify manufacturing facility address matches supplier’s factory. | Mandatory for Chinese export post-2025. Non-compliant units blocked at Chinese port. |

Action Item: Insist on original certificates (not screenshots) dated within 12 months. Refuse suppliers using “CE-ready” or “CE in progress” terminology.

Step 2: Negotiating MOQ – Strategic Volume Planning

2026 Trend: Tiered MOQ structures now standard due to component shortages (IGBT chips, flat-panel detectors). Avoid suppliers quoting blanket MOQs.

| MOQ Model | Typical Range (Ceph Units) | 2026 Distributor Advantage | Risk Mitigation |

|---|---|---|---|

| Standard Factory MOQ | 5-10 units | Lower per-unit cost (12-18% savings vs. spot buys) | Requires warehousing capital; obsolete if tech refresh occurs |

| Phased Delivery MOQ | 3 units (min. per shipment) | Preserves cash flow; aligns with clinic rollout schedules | Requires firm annual commitment (e.g., 12 units/year) |

| OEM/ODM MOQ | 2-3 units (custom UI/housing) | Brand differentiation; premium pricing potential | 15-20% higher unit cost; 90-day NRE fee |

Negotiation Tip: Leverage 2026 component scarcity – suppliers with in-house detector production (e.g., Carejoy) offer lower MOQs. Accept 3-unit MOQ only if supplier provides 18-month price lock.

Step 3: Shipping Terms – DDP vs. FOB Cost Analysis

2026 Reality: Port congestion (Shanghai/Ningbo avg. 7-day delay) and volatile freight rates make FOB terms financially hazardous for buyers.

| Term | Cost Components Included | 2026 Hidden Risks | Recommended For |

|---|---|---|---|

| FOB Shanghai | Ex-factory price + loading on vessel | Port demurrage ($300/day avg. 2026), customs clearance errors, unexpected tariffs (e.g., US Section 301), freight rate spikes (+22% Q1 2026) | Experienced importers with in-house logistics team |

| DDP (Delivered Duty Paid) | FOB + freight, insurance, import duties, VAT, last-mile delivery | Supplier markup on freight (verify via freight forwarder audit) | All first-time buyers & clinics (eliminates 92% of cost overruns) |

Key Clause: Demand “DDP [Your Warehouse]” with Incoterms® 2020. Require freight insurance covering 110% of CIF value. Confirm supplier handles FDA Prior Notice/EU Entry Summary Declaration.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Mitigates 2026 Sourcing Risks:

- Compliance Verified: NMPA Reg. #20232300187 | CE MDR 2017/745 (NB 2797) | ISO 13485:2023 (Scope: Dental X-ray Systems)

- MOQ Flexibility: 2-unit MOQ for distributors (DDP terms); 1-unit for OEM with $2,500 NRE (waived at 10+ units)

- Shipping Guarantee: DDP delivery to 45+ countries with all-inclusive pricing – no hidden port/customs fees

- 2026 Tech Edge: Factory-direct production of flat-panel detectors (reducing MOQ constraints) and AI-enhanced cephalometric tracing software

Operational Advantage: 19-year manufacturing heritage with Baoshan District factory (Shanghai Free Trade Zone) enabling faster customs clearance vs. inland suppliers.

Contact for Verified Sourcing:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Request “2026 Ceph Compliance Dossier” for audit-ready documentation

Next Steps for Risk-Optimized Procurement

1. Verify Credentials: Demand Carejoy’s 2026 Compliance Dossier (NMPA/CE/ISO)

2. Lock DDP Pricing: Secure 2026 flat-rate quote before Q3 freight surge

3. Prototype Test: Request pre-shipment inspection at Carejoy’s Shanghai facility

Contact Carejoy today for a no-obligation sourcing audit:

[email protected] | +86 15951276160 (24/7 English Support)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Cephalometric X-ray machines in 2026 typically operate on standard 110–120V AC (60 Hz) in North America and 220–240V AC (50 Hz) in Europe, Asia, and other international markets. However, modern digital ceph units increasingly support dual-voltage configurations (100–240V, 50/60 Hz) for global compatibility.

Key considerations:

- Verify local power supply stability and grounding requirements.

- Ensure dedicated circuitry (minimum 15–20A) to prevent interference with imaging systems.

- Confirm whether the unit includes an internal voltage regulator or requires an external stabilizer in regions with fluctuating power.

Distributors should stock models with universal power input options to serve diverse regional clinics efficiently.

Yes, leading manufacturers maintain global spare parts networks, but availability varies by brand and region. In 2026, OEMs and authorized distributors are expected to offer 90%+ parts availability for units under 7 years old.

Most commonly replaced components include:

| Component | Replacement Frequency | Lead Time (Standard) |

|---|---|---|

| X-ray Tube & Collimator | 5–7 years | 3–7 business days |

| Positioning Sensors & Laser Guides | 3–5 years | 1–3 business days |

| Motorized Arm Actuators | 6–8 years | 5–10 business days |

| Touchscreen Control Panels | 4–6 years | 2–5 business days |

Distributors are advised to maintain regional spare parts hubs for critical components to minimize clinic downtime.

Installation of a modern ceph X-ray system in 2026 is a structured, multi-phase process typically completed within 1–2 business days, depending on site readiness.

Standard installation workflow:

- Pre-Site Audit: Technician evaluates room dimensions, wall mounting points, power supply, and radiation shielding compliance.

- Equipment Delivery & Unpacking: Unit delivered via freight; inspected for transit damage.

- Mechanical Installation: Wall or floor mounting, arm calibration, and patient chair alignment.

- Electrical & Network Integration: Power connection, DICOM setup, and integration with clinic’s imaging software (e.g., Dolphin, Sidexis).

- QA Testing & Calibration: Beam alignment, exposure consistency, and AEC verification.

- Staff Training: Hands-on session covering patient positioning, exposure protocols, and safety checks.

Note: Installation must be performed by manufacturer-certified engineers to maintain warranty validity.

As of 2026, standard warranty terms for cephalometric X-ray systems are as follows:

| Component | Standard Warranty | Coverage Details |

|---|---|---|

| X-ray Generator & Tube | 3 years (parts & labor) | Includes vacuum integrity, filament failure, and HV circuitry |

| Mechanical Arm & Motors | 2 years | Coverage for positional drift, motor burnout, and gear wear |

| Control System & Software | 2 years | Firmware updates, touchscreen, and interface board failures |

| Sensors & Lasers | 1–2 years | Positioning accuracy and calibration drift |

Extended warranty options (up to 5 years) are available and recommended for high-volume clinics. Warranties are voided if non-OEM parts are used or unauthorized personnel perform maintenance.

With increasing digitization and AI integration in 2026, long-term serviceability depends on strategic partnerships and proactive planning:

- Choose OEMs with a documented 10-year parts commitment—verify in writing before purchase.

- Enroll in a Service Lifecycle Program that includes predictive maintenance, firmware updates, and priority spare parts access.

- Distributors should maintain a minimum 3-year inventory buffer for high-failure-rate components in their regions.

- Ensure machines support remote diagnostics—a standard feature in 2026—enabling faster troubleshooting and reduced on-site visits.

- Verify that software platforms offer backward compatibility with future imaging workflows and PACS integrations.

Investing in service-ready ecosystems today ensures clinical uptime and ROI longevity through 2030 and beyond.

Need a Quote for Ceph X Ray Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160