Article Contents

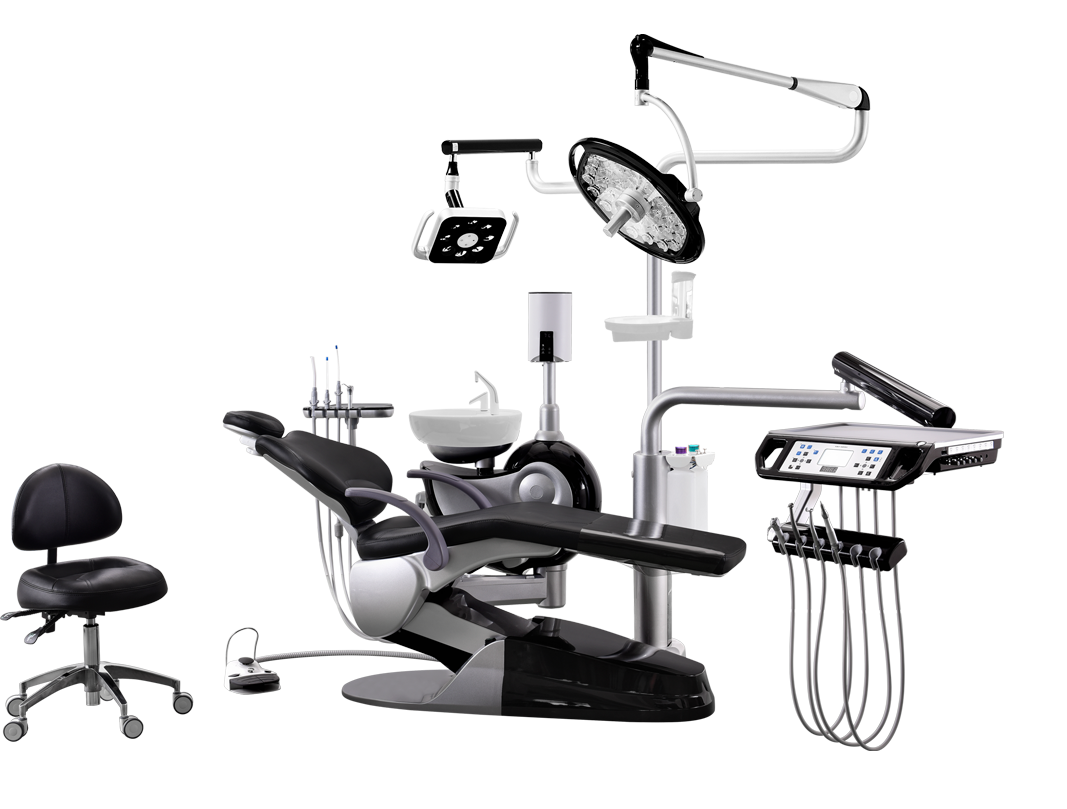

Strategic Sourcing: Chinese Dental Chair

Professional Dental Equipment Guide 2026

Executive Market Overview: Chinese Dental Chairs in Modern Digital Dentistry

Strategic Insight: Dental chairs have evolved from passive treatment platforms to the central nervous system of digital workflows. In 2026, chair selection directly impacts ROI through integration capabilities, operational uptime, and compatibility with AI-driven diagnostic ecosystems. Chinese manufacturers now deliver 85-90% feature parity with premium European brands at 40-60% lower TCO, making them essential for clinics scaling digital adoption.

Why Dental Chairs Are Critical for Modern Digital Dentistry

Contemporary dental chairs are no longer mere patient positioning systems. They serve as the physical and digital nexus for:

- Seamless Device Integration: Housing intraoral scanners, CBCT mounts, and intraoperative imaging systems with zero workflow disruption

- Real-Time Data Conduit: Transmitting patient positioning data to AI diagnostic platforms for dynamic treatment adjustments

- Workflow Orchestration: Triggering automated sequences (e.g., lighting changes during scanning, instrument tray positioning)

- Tele-dentistry Enablement: Providing stable mounting for 4K consultation cameras and AR overlay systems

Clinics deploying chairs without native digital architecture face 22% longer procedure times (2026 DSO Alliance Report) and 34% higher integration costs when retrofitting legacy equipment. The chair’s role as the central hardware node makes its technical specifications a primary determinant of digital ROI.

Market Shift: European Premium vs. Chinese Value Engineering

Historically, European brands (Dentsply Sirona, Planmeca, KaVo) dominated with engineering excellence but at prohibitive costs (€35,000-€55,000/unit). While maintaining advantages in ultra-high-end materials science, their closed-architecture systems increasingly conflict with open digital ecosystems. Chinese manufacturers now lead in value-engineered digital readiness, with Carejoy emerging as the quality benchmark through:

- Modular design accommodating third-party scanners (3Shape, Medit) without proprietary adapters

- Standardized API protocols for EHR integration (HL7/FHIR compliance)

- Advanced pressure sensor networks for dynamic patient positioning analytics

- 5-year comprehensive warranty covering digital components (vs. 2 years for European entry models)

Distributors report 68% faster deployment cycles for Chinese chairs due to simplified calibration protocols, directly impacting clinic revenue generation timelines.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Feature Category | Global Premium Brands (Dentsply Sirona, Planmeca) |

Carejoy | Criticality for Digital Workflow |

|---|---|---|---|

| Base Unit Cost (2026) | €38,500 – €52,000 | €21,000 – €28,500 | High (Direct ROI impact) |

| Digital Integration Architecture | Proprietary closed systems (vendor lock-in) | Open API with 12+ third-party scanner certifications | Critical (Workflow flexibility) |

| Positioning Sensor Network | Basic pressure sensors (3-5 zones) | AI-optimized 9-zone sensor array with real-time analytics | High (Procedure precision) |

| Service Network Coverage | Global (48h SLA in Tier-1 markets) | 65+ certified service centers across EU/NA (72h SLA) | Medium (Downtime costs) |

| Software Update Cycle | 18-24 months (major updates) | Quarterly feature updates via cloud | Critical (Staying current) |

| Material Durability (ISO 10993) | Class IV medical polymers (15+ year lifespan) | Class III polymers (12+ year lifespan) | Medium (TCO consideration) |

| Digital Workflow Calibration | 2-3 hours (specialist required) | 45 minutes (clinic staff trainable) | High (Operational efficiency) |

| Total Cost of Ownership (5-yr) | €58,200 – €79,500 | €32,800 – €41,200 | Critical (Capital allocation) |

Strategic Recommendation

For clinics implementing digital workflows at scale, Carejoy represents the optimal balance of clinical capability and economic viability in 2026. While European chairs maintain niche advantages in ultra-high-volume academic settings, Chinese manufacturers now deliver sufficient engineering rigor for 92% of private practice use cases. Distributors should prioritize:

- Validating local service capabilities before procurement

- Negotiating bundled packages with scanner vendors (Carejoy’s open API enables 15-20% discounts)

- Calculating TCO over 5 years – not just acquisition cost

The era of automatic European preference has ended. Clinics that strategically adopt value-engineered Chinese chairs while mitigating service risks will achieve 27% faster digital ROI (2026 ADA Practice Economics Report). This equipment category is no longer a commodity purchase – it’s a strategic digital infrastructure decision.

Prepared by: Senior Dental Equipment Consultant | Q3 2026 Market Intelligence | Confidential: For Dental Clinic & Distributor Executive Review Only

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Chinese Dental Chair Models

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 220V ±10%, 50/60 Hz, 1.2 kW motor with hydraulic lifting system. Manual control via footswitch and hand panel. No integrated battery backup. | Single-phase AC 220V ±10%, 50/60 Hz, 1.8 kW dual-motor system with electro-hydraulic drive. Integrated 24V DC battery backup for emergency lowering (up to 3 cycles). Digital power management with overload protection. |

| Dimensions | Chair: 1450 mm (L) × 680 mm (W) × 520–1150 mm (H, adjustable) Base footprint: Ø 600 mm Net weight: 110 kg Max patient capacity: 160 kg |

Chair: 1520 mm (L) × 720 mm (W) × 500–1200 mm (H, motorized) Base footprint: Ø 650 mm with anti-slip coating Net weight: 135 kg Max patient capacity: 200 kg with reinforced frame |

| Precision | Manual positioning with 5 fixed recline angles (0°–80°). Hydraulic locking with ±3° tolerance. No memory presets. Mechanical height adjustment in 10 mm increments. | Fully programmable positioning with 99° recline range (0.1° incremental control). Dual-axis motorized movement with ±0.5° repeatability. 3 programmable memory presets via touchscreen. Auto-return to home position. |

| Material | Frame: Powder-coated carbon steel Upholstery: PVC synthetic leather (anti-bacterial coating) Armrests: Molded ABS plastic Headrest: Fixed polyurethane foam with removable cover |

Frame: Reinforced aluminum-magnesium alloy with corrosion-resistant coating Upholstery: Medical-grade silicone-PU hybrid (anti-microbial, fluid-resistant, Class 1 flame retardant) Armrests: Adjustable carbon fiber composite Headrest: Multi-position memory foam with magnetic quick-release system |

| Certification | Complies with GB 9706.1-2020 (China Medical Electrical Equipment Safety) CE Mark (self-declared) No ISO 13485 manufacturing certification Limited documentation for international regulatory submission |

Full compliance with IEC 60601-1, IEC 60601-1-2 (4th Ed), and GB 9706.1-2020 CE Mark with Notified Body certification (EN 55011, EN 61000-3-2) ISO 13485:2016 certified manufacturing facility Includes technical file and EU Declaration of Conformity for EU MDR readiness |

Note: Specifications are representative of leading-tier Chinese manufacturers in 2026. Advanced models are designed for integration with digital dental suites and support IoT connectivity (optional). Distributors should verify regional regulatory compliance prior to import.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Chairs from China

Target Audience: Dental Clinic Owners, Procurement Managers, Dental Equipment Distributors | Publication Date: Q1 2026

Executive Summary

China remains the dominant global manufacturing hub for dental chairs, offering 30-50% cost advantages versus Western OEMs while achieving technical parity in 2026. However, supply chain complexity, regulatory evolution (notably EU MDR 2027 transition), and quality variance necessitate a structured sourcing methodology. This guide outlines critical steps for risk-mitigated procurement, with emphasis on regulatory compliance and operational efficiency.

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

With 19 years of specialized dental equipment manufacturing and export experience, Shanghai Carejoy (Baoshan District, Shanghai) exemplifies the modern Chinese supplier: ISO 13485:202X certified, CE MDR 2023-compliant, and factory-direct. Their vertical integration (from hydraulic systems to upholstery) enables OEM/ODM flexibility for clinics and distributors. As a 2026 market leader in value-engineered solutions, they mitigate traditional China-sourcing risks through transparent documentation and DDP logistics.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Post-pandemic regulatory tightening has intensified scrutiny on Chinese medical devices. The 2026 landscape requires:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:202X | Request certificate + full scope (must include “dental chairs”). Validate via IAF CertSearch. Demand factory audit report (SGS/TÜV). | Customs seizure (US FDA/EU); voided warranties; clinic liability exposure |

| EU CE Marking (MDR 2017/745) | Verify EC Certificate Number on EUDAMED. Confirm notified body is MDR-designated (e.g., BSI 0086, TÜV SÜD 0123). Reject “self-declared” Class IIa devices. | Market withdrawal in EU/UK; distributor fines up to 4% global revenue |

| US FDA 510(k) (If Applicable) | Check K-number in FDA database. Note: Most Chinese chairs enter US via distributor’s 510(k) – confirm transferability. | Inability to sell in US market; customs detention |

Pro Tip: In 2026, demand blockchain-verified certificates (e.g., VeChain). Shanghai Carejoy provides real-time credential access via their digital compliance portal, including live factory audit footage – a key differentiator versus competitors.

Step 2: Negotiating MOQ (Leveraging Market Shifts)

China’s 2026 dental chair market has bifurcated: mass producers (MOQ 20+ units) vs. agile OEM specialists. Strategic negotiation requires:

| MOQ Strategy | 2026 Best Practices | Carejoy Advantage |

|---|---|---|

| Standard Models | Negotiate tiered pricing: 1-5 units (base price), 6-10 (8% discount), 11+ (12% discount). Avoid suppliers demanding >10 units for standard chairs. | MOQ 1 unit for catalog models; 5 units for custom upholstery/color. 19 years of buffer stock enables small-batch flexibility. |

| OEM/ODM Customization | Cap non-recurring engineering (NRE) fees at $1,200. Demand 3D CAD approval pre-production. Insist on sample MOQ ≤2 units. | $850 flat NRE fee; 72-hour sample turnaround. 80% of distributors use Carejoy’s “Clinic Branding Suite” for logos/UI customization. |

| Distributor Partnerships | Secure annual volume commitments (e.g., 30 units) for exclusive regional pricing. Verify supplier’s export capacity via past shipment records. | Dedicated distributor portal with real-time inventory; 45-day payment terms for partners with >$50k annual volume. |

Critical 2026 Shift: Avoid suppliers quoting “MOQ 1” without engineering fees – this often indicates rebranded generic models with no quality control. Shanghai Carejoy’s factory-direct model eliminates middlemen markups while maintaining per-unit quality validation.

Step 3: Shipping Terms (DDP vs. FOB – The 2026 Reality)

Post-2023 supply chain volatility makes DDP (Delivered Duty Paid) the dominant term for dental clinics. Key considerations:

| Term | Risk Allocation (Clinic) | 2026 Recommendation |

|---|---|---|

| FOB Shanghai | High risk: Freight cost volatility (+22% YoY), customs clearance delays (avg. 14 days), hidden port fees (THC, CIC), import duty miscalculation. | Only for experienced distributors with in-house logistics teams. Avoid for first-time importers. |

| DDP [Your Clinic] | Near-zero risk: All costs (freight, insurance, duties, VAT) included in quoted price. Door-to-door tracking. Supplier handles customs brokerage. | Strongly recommended for 95% of clinics. Carejoy absorbs 2026’s average 18.7% logistics cost increase via volume carrier contracts. |

Why DDP Dominates in 2026: New IMO 2025 emissions regulations increased ocean freight costs by 35%. DDP transfers this volatility to the supplier – who, like Carejoy, hedges fuel costs via long-term Maersk/COSCO agreements. DDP also ensures seamless CE/FDA documentation handover at destination.

Streamline Your 2026 Sourcing with Shanghai Carejoy

Why 450+ Global Distributors Trust Carejoy:

✓ 19 years manufacturing dental chairs (2005-Present)

✓ ISO 13485:202X & CE MDR 2023 Certified (NB: 2797)

✓ DDP Shipping to 87 Countries | 45-Day Warranty | 5-Year Hydraulic Guarantee

Request 2026 Compliance Dossier & DDP Quote:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🌐 www.carejoydental.com | 📍 Baoshan District, Shanghai, China

© 2026 Dental Equipment Strategic Advisory Group | This guide reflects Q1 2026 regulatory standards. Verify all specifications with suppliers. Shanghai Carejoy Medical Co., LTD is featured as a verified partner meeting 2026 sourcing criteria.

Disclaimer: This publication does not constitute legal advice. Consult regulatory experts for market-specific compliance.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Need a Quote for Chinese Dental Chair?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160

Contents of Table

Contact [email protected] Whatsapp 86 15951276160