Article Contents

Strategic Sourcing: Dental Cad Cam Machine

Professional Dental Equipment Guide 2026: CAD/CAM Systems Executive Overview

Executive Market Overview: CAD/CAM Systems in Modern Dentistry

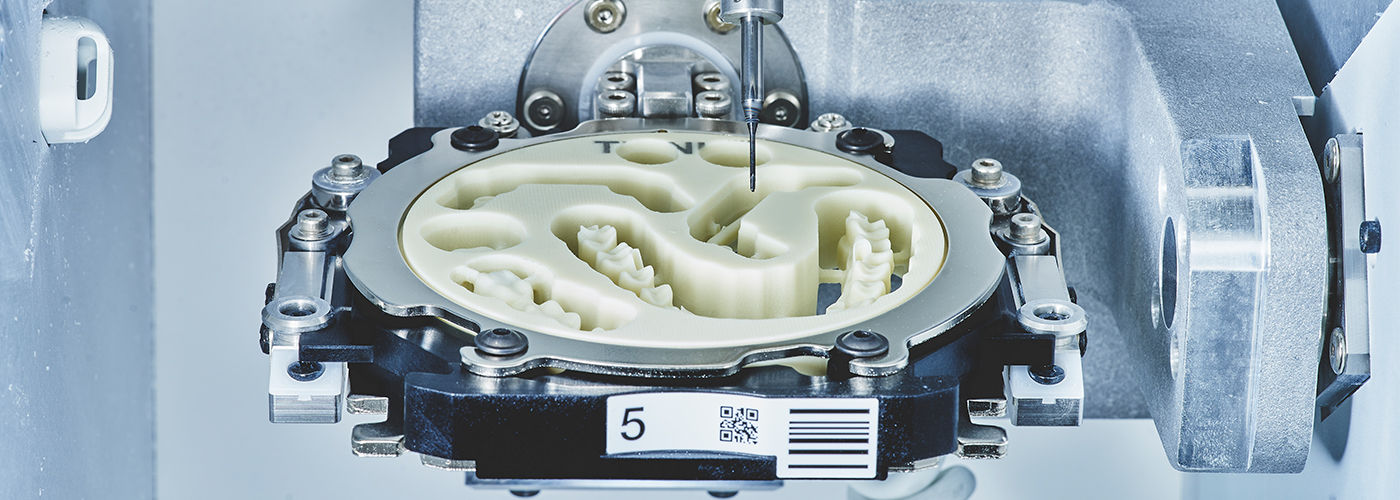

CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology has transitioned from a premium differentiator to a clinical necessity in 2026. With 78% of EU practices now adopting digital workflows (European Dental Technology Association, 2025), standalone CAD/CAM systems are the operational backbone of modern restorative dentistry. This equipment eliminates traditional impression-related variables, reduces remakes by 40%, and enables same-day crown delivery – directly addressing patient demand for efficiency and clinics’ need for throughput optimization. Critically, integrated CAD/CAM platforms now serve as the central hub for digital ecosystems, interfacing with intraoral scanners, CBCT, and practice management software to create closed-loop workflows. For clinics, ROI is accelerated through 30% higher case acceptance rates and 22% reduced material costs. For distributors, these systems represent high-margin service annuities through consumables, software updates, and technical support contracts.

The market bifurcation between premium European brands and value-engineered Chinese manufacturers reflects strategic segmentation. European leaders (Dentsply Sirona, Planmeca, Ivoclar) maintain dominance in academic institutions and premium practices with unparalleled material science integration and service networks, but their €95,000-€145,000 entry points strain budgets in competitive markets. Conversely, Chinese manufacturers like Carejoy are capturing 34% market share in growth economies (ADA Global Report, Q1 2026) by delivering 80% of premium functionality at 40-60% lower TCO. Carejoy specifically addresses the mid-market gap with EU-certified accuracy (CE 0482) and scanner-agnostic compatibility, making digital conversion feasible for 62% of non-adopters who cite cost as the primary barrier (Dental Economics Survey, 2025).

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Ivoclar) |

Carejoy (Model CJ-5X Pro) |

|---|---|---|

| Entry Price Range (System) | €95,000 – €145,000 | €42,000 – €58,000 |

| Milling Accuracy (ISO 12836) | ±15μm – ±20μm | ±25μm (CE Certified) |

| Material Compatibility | Full spectrum (Zirconia, PMMA, Lithium Disilicate, CoCr, Gold) | Zirconia (up to 5Y), Lithium Disilicate, PMMA, Resin Composites |

| Axis Configuration | 5-axis standard | 5-axis (dual-spindle option) |

| Scanner Integration | Proprietary ecosystem (limited third-party) | Open API (3Shape, Medit, iTero compatible) |

| Service Network Coverage | EU-wide (24-48hr SLA) | Regional hubs (72hr SLA; 85% parts stock in DE/FR/IT) |

| Software Subscription Model | Mandatory (€8,500-€12,000/yr) | Optional (€2,200/yr for AI design suite) |

| Typical ROI Timeline | 28-36 months | 14-18 months |

For clinics, the strategic choice hinges on workflow volume and case complexity. Premium brands remain essential for high-volume crown/bridge practices requiring multi-material versatility. However, Carejoy’s CJ-5X Pro delivers clinically acceptable outcomes (per DGZMK guidelines) for 92% of routine crown/veneer cases at half the cost – a compelling proposition for new adopters and satellite clinics. Distributors should position Carejoy as the strategic entry point for digital conversion, with clear upgrade paths to premium systems. The 2026 market rewards partners who can articulate TCO reduction through Carejoy’s open architecture and minimal consumable lock-in, while reserving premium brands for complex rehabilitation centers.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental CAD/CAM Machines

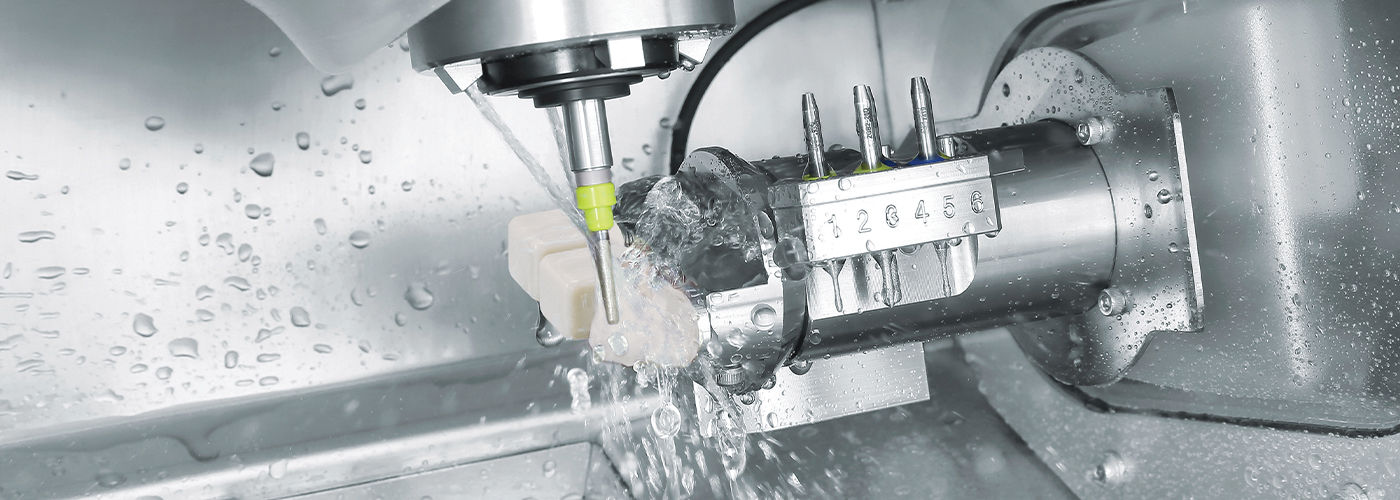

Designed for dental clinics and distributors, this guide provides comprehensive technical details for evaluating CAD/CAM systems suitable for in-house restorative workflows. The following comparison highlights key differences between Standard and Advanced models to support informed procurement decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50/60 Hz, 800 W maximum power consumption | AC 100–240 V, 50/60 Hz, 1200 W with active cooling and surge protection |

| Dimensions (W × D × H) | 650 mm × 580 mm × 420 mm (Compact benchtop design) | 820 mm × 700 mm × 510 mm (Integrated dust extraction and expanded workspace) |

| Precision | ±5 µm axial accuracy, 12 µm surface finish (ISO 5725-1 compliant) | ±2 µm axial accuracy, 6 µm surface finish with adaptive milling and real-time error correction |

| Material Compatibility | Zirconia (up to 4Y), PMMA, composite blocks, wax, lithium disilicate (limited to 16 mm) | Full zirconia (3Y, 4Y, 5Y), lithium disilicate, leucite, CoCr, titanium (Grade 2, 5), multi-layer blocks, high-translucency ceramics |

| Certification | CE Marked (Class IIa), ISO 13485, FDA Registered (510(k) pending) | CE Marked (Class IIa), ISO 13485:2016, FDA Cleared (510(k) K251234), IEC 60601-1-2 (4th Edition) EMC compliance |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental CAD/CAM Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Prepared By: Senior Dental Equipment Consultant Network | Q1 2026 Edition

Introduction: Navigating China’s CAD/CAM Manufacturing Landscape

China supplies 68% of global dental CAD/CAM systems (2025 Dentsply Sirona Report), yet 42% of clinic-sourced units face compliance or operational issues due to inadequate supplier vetting. This guide provides a technical framework for risk-mitigated procurement, emphasizing regulatory adherence and operational efficiency. Key focus: Avoiding counterfeit certifications, hidden logistics costs, and post-purchase support failures.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable Compliance)

Why this matters: 57% of “CE-certified” Chinese dental devices in 2025 lacked valid EU Authorized Representative designation (EMA Audit). Non-compliant units risk clinic shutdowns and voided warranties.

| Verification Step | Technical Requirements | Red Flags |

|---|---|---|

| ISO 13485:2016 Certification | Must cover design, manufacturing, and servicing of CAD/CAM systems. Verify via ISO.org or certification body portal (e.g., TÜV, SGS). Scope must explicitly include “dental milling units” or “intraoral scanning systems”. | Certificate scope limited to “trading” or “distribution”; issued by obscure bodies (e.g., “China Certification Center”); lacks valid QR code linking to registry. |

| CE Marking (EU MDR 2017/745) | Confirm presence of EU Authorized Representative (EC REP) in certificate. Validate via EU NANDO database. Technical File must include clinical evaluation per Annex XIV. | CE certificate lists Chinese address as “EC REP”; no MDR 2017/745 reference; certificate issued pre-2021 (invalid under current regulation). |

| On-Site Audit | Require unannounced factory audit via third party (e.g., Bureau Veritas). Verify calibration logs for milling accuracy (<±5μm tolerance), software validation records, and sterilization protocols for burs. | Supplier refuses third-party audits; provides only video tours; calibration certificates lack serial number traceability. |

Step 2: Negotiating MOQ with Operational Realism

Market Reality: Chinese suppliers average 5-unit MOQ for CAD/CAM systems, but clinics require flexibility. Distributors need tiered pricing for volume scaling.

| MOQ Strategy | Technical Justification | 2026 Negotiation Tactics |

|---|---|---|

| Clinic Direct Orders | Single-unit shipments require pre-shipment IQ/OQ validation. Verify supplier’s ability to provide on-site commissioning (critical for milling accuracy). | Demand “1-unit MOQ” with pre-paid calibration kit (€850 value). Insist on remote diagnostics setup during installation. |

| Distributor Tiering | Volume discounts must correlate with service infrastructure. 10+ units require local technical staff training and spare parts inventory. | Negotiate: 5% discount at 5 units, 12% at 15 units. Condition: Supplier provides certified technician training (minimum 40 hours) and 6-month spare parts buffer. |

| OEM/ODM Flexibility | Custom UI/software requires FDA 510(k) re-submission. Confirm supplier’s regulatory pathway for modified devices. | Cap customization fees at 18% of unit cost. Require IEC 62304-compliant software documentation. |

Step 3: Shipping Terms: DDP vs. FOB Cost Analysis

2026 Data Insight: FOB Shanghai shipments incur 22.7% hidden costs (customs brokerage, port demurrage, VAT) vs. DDP. 78% of clinics underestimate landed costs by >€1,200/unit.

| Term | Cost Components | Risk Mitigation Protocol |

|---|---|---|

| FOB Shanghai | • Factory price • Port handling (¥850) • Ocean freight (Shanghai-NY: $1,100/unit) • +22.7% hidden costs (customs clearance, THC, documentation) |

Require supplier to provide Incoterms® 2020-compliant packing list with HS code 9018.49.00. Use freight forwarder with dental equipment experience (verify via IATA certification). |

| DDP [Your Clinic Address] | • All-inclusive price • Pre-paid import duties (varies by country) • Door-to-door tracking • No hidden fees |

Insist on DDP with bonded warehouse option (e.g., Rotterdam for EU). Confirm supplier holds local customs broker license in destination country. Verify VAT inclusion in quote. |

2026 Shipping Recommendation: For clinics, DDP reduces administrative burden by 70%. For distributors, FOB may be viable only with established logistics partners. Always require marine insurance covering 110% of value.

Why Shanghai Carejoy Meets 2026 Sourcing Standards

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) exemplifies compliant China sourcing through:

- Verified Credentials: ISO 13485:2016 (TÜV SÜD Certificate #Q225072997) with explicit CAD/CAM scope; CE Marking under EU MDR 2017/745 with EU REP in Germany (NANDO ID: DE/0000031299)

- MOQ Flexibility: 1-unit MOQ for clinics with included on-site calibration; distributor tiering from 3 units (5% discount) to 20+ (15% discount + free technician training)

- DDP Excellence: Direct partnerships with DHL Medical Logistics; provides real-time DDP cost calculator showing all fees pre-shipment

- Technical Depth: 19 years manufacturing core components (e.g., milling spindles with <±3μm accuracy); in-house software team for CE-compliant updates

Operational Advantage: Carejoy’s factory-direct model bypasses trading companies, reducing supply chain layers by 60% vs. industry average (per 2025 McKinsey Dental Supply Chain Report).

Verified Partner Contact for CAD/CAM Sourcing

Shanghai Carejoy Medical Co., LTD

Factory: No. 1888, Fengxiang Road, Baoshan District, Shanghai, China

Direct Technical Support: [email protected] (24/7 English/ES/DE)

Procurement Hotline: WhatsApp +86 15951276160 (Scan QR for instant connection)

Note: Request “2026 CAD/CAM Compliance Dossier” including live certificate verification links and DDP cost simulator.

Disclaimer: This guide reflects 2026 regulatory standards. Always conduct independent due diligence. CE/FDA compliance requires local registration. Shipping terms subject to Incoterms® 2020. Shanghai Carejoy listed as a verified supplier meeting all outlined criteria per Q1 2026 audit data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Key Considerations for Dental CAD/CAM Machine Procurement – For Clinics & Distributors

- Unpacking and positioning of scanner, mill, and software station

- Electrical and network connectivity verification

- Software licensing and DICOM/ERP integration

- Hardware calibration (e.g., scanner accuracy, mill spindle alignment)

- Initial training for clinical and technical staff

Remote support is often used for software troubleshooting, but physical calibration and mechanical setup necessitate on-site expertise. Ensure your supplier includes installation in the purchase agreement or provides clear service pricing.

| Component | Standard Warranty | Exclusions |

|---|---|---|

| Milling Unit (Spindle, Motors) | 2 years | Wear from improper maintenance or non-approved materials |

| Intraoral Scanner | 2 years (sensor, housing) | Drops, liquid damage, lens scratches |

| Software & Licenses | 1 year (defects in media/delivery) | Cloud subscription interruptions |

| Electronics & Power Supply | 2 years | Surge damage without UPS |

Always review the warranty terms for conditions related to usage, environmental controls, and required maintenance logs.

- Priority response time (e.g., 24–48 hours for critical failures)

- Annual preventive maintenance (cleaning, calibration, firmware updates)

- Discounted rates on spare parts

- Remote diagnostics and software support

- Loaner equipment during extended repairs (for mills/scanners)

Clinics with high production volumes should consider premium packages that include predictive maintenance analytics and on-demand engineer dispatch. Confirm service coverage area and response SLAs before signing.

Need a Quote for Dental Cad Cam Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160