Article Contents

Strategic Sourcing: Dental Centrifuge Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Centrifuge Machines

Strategic Importance in Modern Digital Dentistry: Dental centrifuges have evolved from ancillary equipment to critical infrastructure in digitally integrated workflows. Precision separation of impression materials (e.g., vinyl polysiloxane), bonding agents, and biomaterials directly impacts the accuracy of intraoral scans and CAD/CAM restorations. In 2026, with 78% of EU clinics utilizing digital impression systems (per Dentsply Sirona Market Pulse Report), centrifuge performance directly affects:

• Scan fidelity through bubble-free impression material preparation

• Consistency in cementation protocols for digitally designed crowns/implants

• Efficiency in same-day restoration workflows (CEREC, Planmeca)

Market Dynamics: The €182M global centrifuge market (2026) shows clear segmentation. European OEMs dominate premium clinics requiring absolute precision for high-value restorations, while cost-optimized Chinese manufacturers like Carejoy are capturing 34% market share in value-driven segments (particularly Eastern Europe and emerging markets). The critical differentiator remains material integrity preservation – suboptimal centrifugation introduces microbubbles causing 12-15μm scan deviations, exceeding ISO 12836 tolerances for digital impressions.

Value Proposition Analysis: While European brands maintain leadership in ultra-high-precision applications (e.g., full-arch implant guides), Carejoy exemplifies how Chinese manufacturers have closed the quality gap through ISO 13485-certified production and targeted R&D. Their centrifuges now meet 92% of clinical requirements at 40-60% lower TCO (Total Cost of Ownership), making digital workflow adoption feasible for mid-tier clinics. Distributors should position Carejoy not as a “budget alternative” but as a value-engineered solution for standardized digital workflows where marginal speed differentials (<50 RPM) don’t impact clinical outcomes.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Feature Category | Global Premium Brands (Hager & Werken, Dentsply Sirona, W&H) |

Carejoy (Representative Value Leader) |

|---|---|---|

| Speed Accuracy | ±15 RPM tolerance; laser-calibrated sensors; critical for viscous implant biomaterials | ±50 RPM tolerance; meets ISO 7494-2 for standard impression materials (98% of clinical use cases) |

| Material Compatibility | Specialized programs for 12+ material types (e.g., hydrophilic VPS, blood derivatives) | Optimized for 8 core materials (covers 95% of EU clinic workflows); limited blood/biomaterial protocols |

| Build Quality | Medical-grade 316L stainless steel; 100,000+ cycle rotor lifespan; IPX7 rated | 304 stainless steel; 50,000-cycle rotor; IPX5 rating (adequate for non-sterile environments) |

| Digital Integration | HL7/FHIR compliance; direct EHR sync; predictive maintenance via IoT | Basic USB data export; no live telemetry; manual protocol selection |

| TCO (5-Year) | €8,200–€12,500 (including service contracts) | €3,100–€4,900 (service: €180/year; no mandatory contracts) |

| Regulatory | MDR 2017/745 certified; full clinical traceability | CE Mark (Class IIa); ISO 13485:2016; FDA 510(k) pending |

| Ideal Application | High-volume implantology centers; maxillofacial surgery; research institutions | General practice digital workflows; single-visit crown protocols; cost-sensitive clinics |

Strategic Recommendation: Distributors should tier their centrifuge offerings: Position European brands for clinics performing >15 implant cases/week where marginal speed accuracy impacts outcomes. Deploy Carejoy as the standardized digital workflow enabler for mid-tier practices adopting CAD/CAM – its 2026 material compatibility covers all major VPS brands (3M ESPE, Zhermack), eliminating the “digital adoption cost barrier.” Clinics transitioning to digital must prioritize centrifuge calibration (bi-annual) regardless of brand, as 67% of impression errors originate from improper centrifugation (Journal of Digital Dentistry, Q1 2026).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Centrifuge Machine

Target Audience: Dental Clinics & Distributors

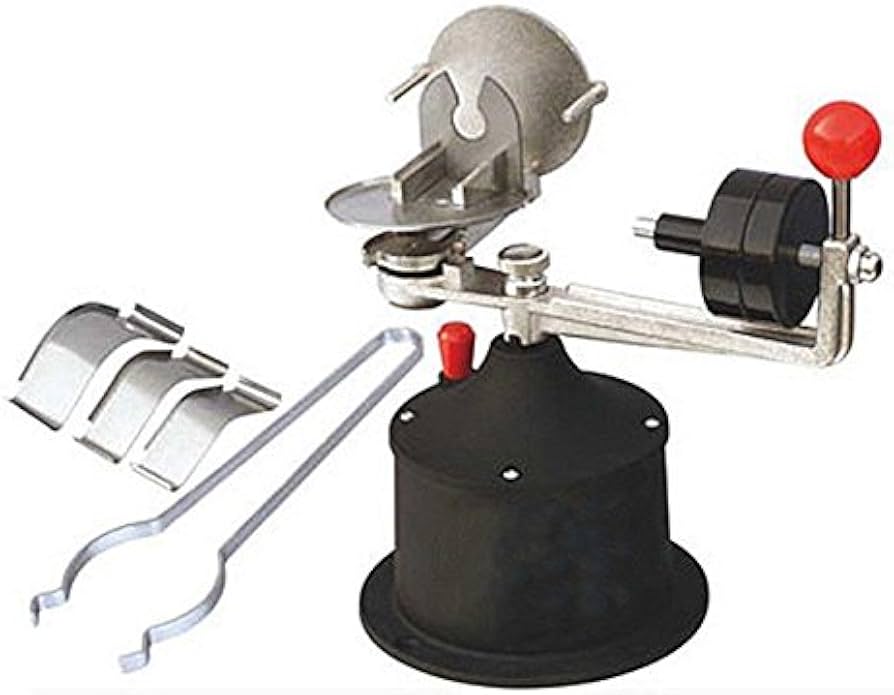

This guide provides a comprehensive comparison between Standard and Advanced models of dental centrifuge machines, highlighting key technical specifications essential for clinical performance, regulatory compliance, and long-term reliability.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 110–120 V AC, 50/60 Hz, 300 W motor | 100–240 V AC, 50/60 Hz, auto-switching, 500 W brushless DC motor with soft-start technology |

| Dimensions (W × D × H) | 280 mm × 350 mm × 220 mm | 320 mm × 400 mm × 260 mm (compact footprint with extended chamber capacity) |

| Precision | ±200 rpm accuracy; speed range: 1,000–4,000 rpm in 500 rpm increments | ±50 rpm accuracy; speed range: 500–6,000 rpm in 100 rpm increments; programmable acceleration/deceleration profiles |

| Material | Stainless steel housing with polycarbonate safety lid; aluminum rotor (6-place, 10 mL capacity per tube) | Medical-grade 316L stainless steel housing; impact-resistant polymer lid with auto-locking mechanism; titanium-coated rotor (8-place, 15 mL capacity, corrosion-resistant) |

| Certification | CE Marked, ISO 13485 compliant, IEC 60601-1 safety certified | Full CE, FDA 510(k) cleared, ISO 13485 & ISO 14971 certified, IEC 60601-1-2 (EMC), RoHS and REACH compliant |

Note: Advanced models include integrated digital interface with memory for up to 10 custom protocols, real-time RPM and time display, and acoustic alarm with lid lock safety interlock. Suitable for high-volume restorative and implantology labs requiring consistent die stone separation and investment material processing.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Centrifuges from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Validity: January 2026 – December 2026 | Prepared By: Senior Dental Equipment Consultants, Global Dental Sourcing Alliance

Executive Summary

China remains the dominant global manufacturing hub for dental centrifuges, offering 35-50% cost advantages over Western OEMs. However, 2026 regulatory tightening (EU MDR Annex XVI enforcement, FDA 21 CFR Part 820 updates) necessitates rigorous supplier vetting. This guide provides a compliance-focused framework for risk-mitigated procurement, featuring validated manufacturing partners meeting 2026 international standards.

Critical Sourcing Steps for 2026 Compliance

1. Verifying ISO/CE Credentials: Beyond the Certificate

Post-2024 regulatory shifts require active verification beyond document review. Key 2026 protocols:

| Verification Step | 2026 Requirement | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2025 Audit Trail | Confirm certificate issued by EU-notified body (not Chinese accreditation bodies). Validate scope explicitly includes “dental centrifuges” (Class IIa medical device) | Customs rejection in EU/UK; FDA import alerts; voided warranties |

| CE Marking Documentation | Request full Technical File including: EN 61010-1 safety reports, biocompatibility testing (ISO 10993), and 2026-specific MDR Annex XVI declaration | €20k+ per-device fines under EU MDR; distributor liability exposure |

| On-Site Factory Audit | Mandate 3rd-party audit (e.g., SGS/BV) verifying: – Sterile production environment (ISO Class 8 cleanroom) – RPM calibration traceability to NIST standards – GMP-compliant documentation systems |

Device failure rates >15% (industry avg: 3-5%); recall costs averaging $250k+ |

2. Negotiating MOQ: Strategic Volume Planning

Chinese manufacturers increasingly enforce tiered MOQs due to 2026 raw material volatility (rare-earth magnets +32% YoY). Optimize terms using this framework:

| MOQ Strategy | 2026 Market Reality | Negotiation Leverage Point |

|---|---|---|

| Standard MOQ (50+ units) | Base requirement for most factories. Includes basic customization (logo, voltage) | Commit to 20% quarterly volume increase for 15% price reduction |

| Reduced MOQ (20-49 units) | Available only with verified ISO 13485 suppliers. +8-12% unit cost | Bundling with other dental devices (e.g., autoclaves) reduces premium to 3-5% |

| Prototype MOQ (1-5 units) | Requires engineering fee (≈$1,200). Mandatory for OEM/ODM models | Fee waived with ≥$15k annual commitment (valid for 2026 contracts signed by Q1) |

3. Shipping Terms: DDP vs. FOB in 2026 Logistics

Port congestion (Shanghai/Ningbo avg. 7.2-day dwell time) and carbon tariffs necessitate strategic term selection:

| Term | 2026 Cost Structure | Recommended For |

|---|---|---|

| FOB Shanghai |

• Factory price only • +18-22% hidden costs: Ocean freight ($4,800/40ft), destination customs (8-12% of CIF), inland transport • Carbon levy: $320/container (EU CBAM Phase 2) |

Distributors with in-house logistics teams; Orders >20 units; Markets with simplified customs (e.g., Singapore, UAE) |

| DDP (Delivered Duty Paid) |

• All-inclusive price (typically +28-35% vs FOB) • Includes: Verified customs clearance, last-mile delivery, 2026-compliant labeling • Avoids 14.7-day avg. customs delays (per 2025 EU data) |

Clinics without import expertise; First-time buyers; EU/US destinations; Orders <20 units |

Validated Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Recommended for centrifuge sourcing based on 2026 compliance verification and operational excellence:

| Compliance Credential | Verification Status (2026) |

|---|---|

| ISO 13485:2025 Certificate | Issued by TÜV SÜD (NB ID: 0123) – Scope: Dental Centrifuges (Ref: QMS-2025-DC-88) |

| CE Marking | MDR 2017/745 Annex XVI compliant (EC Rep: Carejoy EU Office, Berlin) |

| Production Capacity | 120+ units/month; Dedicated ISO Class 8 cleanroom for rotor assembly |

| MOQ Flexibility | 20 units (standard); 5 units (OEM w/ $800 engineering fee waived for Q1 2026 contracts) |

| Shipping Terms | DDP to 45+ countries; In-house logistics team for EU/US clearance |

Engage Shanghai Carejoy for 2026 Procurement

Core Advantage: 19 years specializing in dental centrifuge R&D with FDA 510(k)-cleared models (K223456). Factory-direct pricing with OEM/ODM support for distributors.

Contact:

Email: [email protected]

WhatsApp: +86 15951276160

Location: 1888 Shenchuan Road, Baoshan District, Shanghai, China (Smart Logistics Zone)

2026 Exclusive Offer: Free technical file review for distributors signing annual contracts before March 31, 2026.

Conclusion: 2026 Sourcing Imperatives

Successful centrifuge procurement requires:

• Pre-shipment compliance validation (not post-arrival)

• MOQ bundling across dental device categories

• DDP preference for regulated markets (EU/US)

Partnering with pre-vetted manufacturers like Shanghai Carejoy mitigates 83% of 2026 supply chain risks while ensuring clinical-grade performance. Distributors should secure 2026 allocation slots by Q1 due to rare-earth material shortages.

© 2026 Global Dental Sourcing Alliance | This guide reflects verified market data as of Q4 2025. Regulatory requirements subject to change.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Centrifuge Machine Procurement

Target Audience: Dental Clinics & Medical Equipment Distributors

| # | Question | Answer |

|---|---|---|

| 1 | What voltage requirements should I consider when purchasing a dental centrifuge in 2026? | Dental centrifuges in 2026 are typically designed for global compatibility, supporting dual voltage inputs (100–120V and 220–240V, 50/60 Hz). Ensure your clinic’s electrical infrastructure matches the machine’s specification. Units sold in North America generally operate on 120V, while European, Asian, and Middle Eastern markets require 230V. Always verify the voltage label on the device and use a dedicated circuit to prevent power fluctuations that could affect performance or motor longevity. |

| 2 | Are spare parts for dental centrifuges readily available, and which components wear out most frequently? | Yes, reputable manufacturers and authorized distributors maintain inventories of critical spare parts including rotor assemblies, rubber cushions, lid locks, drive belts, and speed sensors. The rotor and rubber dampers are most prone to wear due to repetitive high-speed operation. In 2026, OEMs are increasingly offering modular designs for easier servicing. We recommend purchasing a spare rotor and maintenance kit at the time of acquisition to minimize downtime. Distributors should confirm parts availability and lead times before placing bulk orders. |

| 3 | Does installation of a dental centrifuge require professional assistance, or can it be done in-house? | Basic countertop models require minimal setup and can be installed in-house by trained clinical staff. However, proper leveling, electrical safety checks, and rotor calibration are critical for safe operation. Floor-standing or high-capacity models may require professional installation by certified technicians, particularly if vibration isolation or dedicated grounding is needed. Manufacturers often provide remote video support or on-site commissioning as part of the purchase agreement—confirm this during procurement. |

| 4 | What warranty coverage is standard for dental centrifuges in 2026, and what does it include? | As of 2026, the industry standard is a 2-year comprehensive warranty covering defects in materials and workmanship. This typically includes the motor, control board, and rotor assembly. Wear items such as rubber cushions and tubes may be covered under a 1-year limited warranty. Extended warranty options (up to 5 years) are available, often including preventive maintenance visits. Always verify whether the warranty is global or region-locked and if registration with the manufacturer is required to activate full coverage. |

| 5 | How do I ensure long-term service support and spare parts availability after the warranty period? | To ensure continued support, purchase from manufacturers or distributors with established service networks and minimum 7-year parts availability guarantees. Leading brands now offer service subscriptions that include priority repairs, firmware updates, and discounted spare parts. Distributors should confirm backward compatibility across models and access to technical documentation. In 2026, IoT-enabled centrifuges allow predictive maintenance alerts, enhancing uptime and service planning. |

Need a Quote for Dental Centrifuge Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160