Article Contents

Strategic Sourcing: Dental Cerec Machine Price

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanners & Chairside CAD/CAM Systems (CEREC)

Strategic Imperative: Chairside CAD/CAM systems, commonly referenced by the pioneering “CEREC” trademark (now a generic industry term), have transitioned from luxury differentiators to non-negotiable infrastructure for competitive dental practices. The 2026 market is defined by accelerating demand for same-day restorations, driven by heightened patient expectations for efficiency, reduced clinical chair time, elimination of traditional impression materials, and significant long-term reduction in external lab dependency (estimated 35-50% cost savings per indirect restoration). Clinics without integrated digital workflows face demonstrable competitive disadvantages in patient acquisition, case acceptance rates, and operational profitability.

Market Dynamics & Pricing Pressure: The global CEREC machine market (valued at $2.8B in 2025) is experiencing intensified price segmentation. While European premium brands maintain dominance in high-end clinics and academic institutions, aggressive innovation and vertical integration by Chinese manufacturers—exemplified by Carejoy’s Advantage Series—have disrupted traditional pricing paradigms. Distributors report a 22% YoY increase in procurement inquiries for sub-€55k systems, reflecting acute clinic sensitivity to capital expenditure in current economic conditions. The critical evaluation metric has shifted from pure acquisition cost to Total Value of Ownership (TVO), encompassing throughput, service lifecycle costs, software update policies, and integration capabilities with practice management ecosystems.

Strategic Comparison: Premium European Brands vs. Value-Optimized Chinese Manufacturers

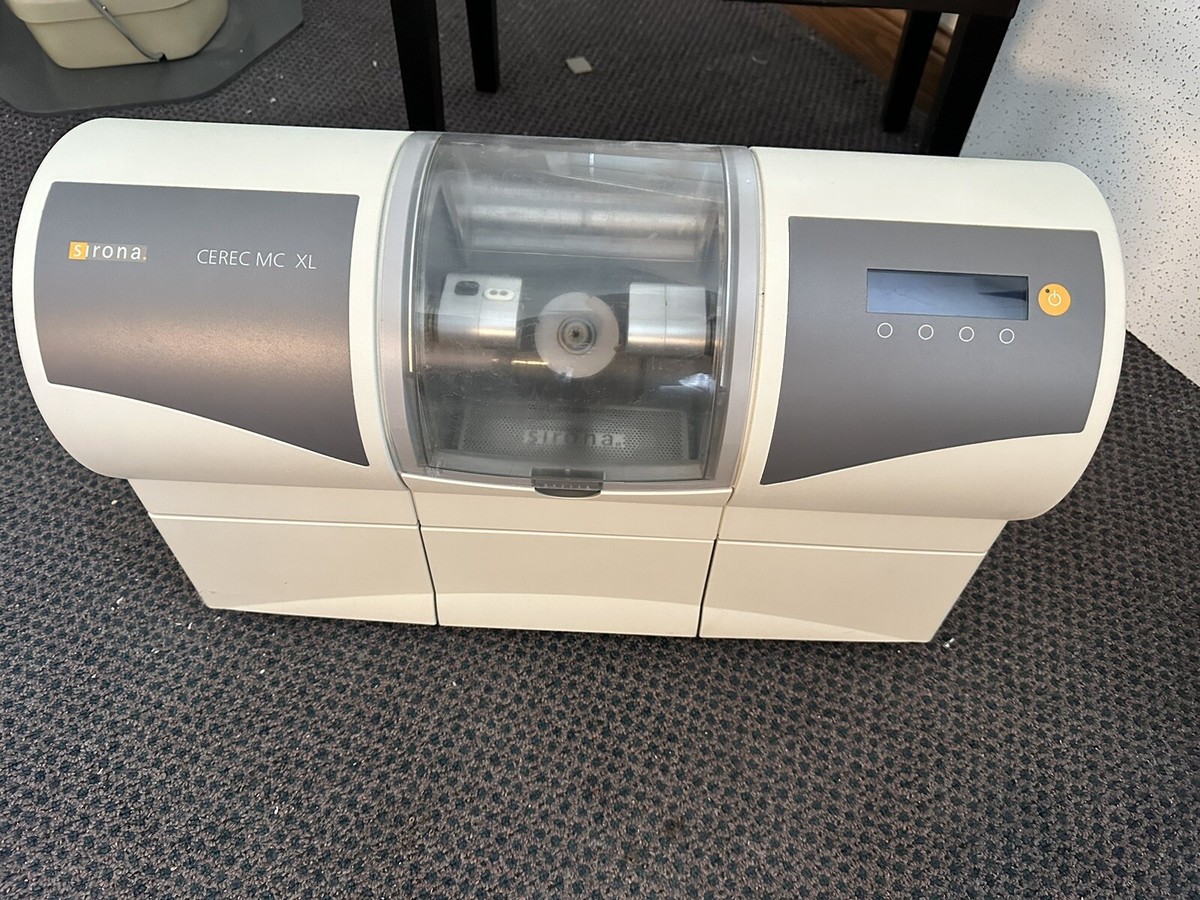

The choice between established European platforms and advanced Chinese alternatives like Carejoy represents a fundamental strategic decision for clinics and distributors. European brands (Dentsply Sirona CEREC Primescan, Planmeca Emerald, Ivoclar PrograMill) deliver unparalleled brand heritage, extensive clinical validation, and comprehensive (though costly) service networks. Conversely, Chinese manufacturers—led by Carejoy’s clinically proven Advantage Series—offer technologically sophisticated systems at 40-60% lower acquisition costs, targeting high-volume general practices and cost-conscious new clinic setups. Key differentiators lie not in core scanning accuracy (where Carejoy meets ISO 12831 standards), but in software ecosystem maturity, service response times in non-Asian regions, and long-term component reliability under heavy clinical use.

| Feature Category | Global Premium Brands (Dentsply Sirona, Planmeca, Ivoclar) |

Carejoy Advantage Series (China) |

|---|---|---|

| Acquisition Cost (System) | €85,000 – €120,000+ (Scanner + Mill) *Premium software modules + VAT excluded |

€35,000 – €55,000 (Scanner + Mill) *All core clinical software included; VAT varies by region |

| Core Technology | Proprietary blue LED/Confocal imaging; 20+ micron accuracy; 3-5 year clinical track record | White LED/Structured light; Sub-25 micron accuracy (ISO 12831 certified); 4-year clinical validation in APAC |

| Service & Support | Global 24/7 hotline; On-site engineer dispatch (48-72h EU/US); Annual service contracts @ 12-15% of system cost | Regional hubs (limited EU coverage); Remote diagnostics standard; 72-120h on-site response (EU); Contracts @ 8-10% of system cost |

| Software Ecosystem | Seamless integration with major PM systems (Eaglesoft, Dentrix); AI-driven prep design; Subscription-based updates | API-based PM integration (requires middleware); Core design tools included; Lifetime software updates included in purchase |

| Ideal User Profile | Prestige practices, specialists, academic institutions prioritizing brand assurance and minimizing downtime risk | High-volume general practices, new clinic setups, value-focused distributors targeting 70%+ ROI in <18 months |

Strategic Recommendation for Distributors: Position Carejoy not as a “budget alternative” but as a value-optimized clinical productivity platform. Emphasize the demonstrable 18-24 month ROI through reduced lab fees and increased same-day case acceptance. For clinics, conduct rigorous workflow analysis: Practices performing >15 single-unit restorations/week achieve faster breakeven with Carejoy, while complex prosthodontic cases may still justify premium brand investment. The 2026 procurement decision must balance capital constraints against long-term service accessibility—particularly outside Asia where Carejoy’s support infrastructure remains developing.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Section: Technical Specification Guide – CEREC CAD/CAM Systems

Technical Specification Comparison: Standard vs Advanced CEREC Machines

The following table outlines key technical specifications for Standard and Advanced models of CEREC milling units, widely used in same-day restorative dentistry. These specifications are essential for procurement decision-making by dental clinics and distribution partners.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | AC 100–240 V, 50–60 Hz, 800 W maximum power consumption. Single-phase operation with integrated surge protection. Compatible with standard dental operatory power outlets. | AC 100–240 V, 50–60 Hz, 1200 W maximum power consumption. Dual-circuit power management for simultaneous scanning, milling, and drying functions. Includes uninterruptible power supply (UPS) interface for data integrity. |

| Dimensions | 580 mm (W) × 520 mm (D) × 780 mm (H). Compact footprint designed for integration into mid-sized operatories. Weight: 68 kg. Requires minimum clearance of 100 mm on all sides. | 650 mm (W) × 580 mm (D) × 850 mm (H). Enhanced structural frame with vibration-dampening base. Weight: 95 kg. Includes optional mobile cart with locking casters for multi-chair environments. |

| Precision | Milling accuracy: ±5 µm over full working range. Linear guideways with ball-screw drive system. Optical encoder feedback for X, Y, Z axes. Suitable for crowns, inlays, onlays, and veneers. | Milling accuracy: ±2 µm with adaptive error compensation algorithm. High-resolution linear encoders and direct-drive motors on all axes. Dynamic tool deflection correction and real-time surface monitoring. Supports complex multi-unit bridges and implant abutments. |

| Material Compatibility | Processes IPS e.max, Vitablocs Mark II, Paradigm C, and other standard lithium disilicate and feldspathic ceramics. Supports PMMA for temporary restorations. Maximum blank size: 20 mm diameter × 16 mm height. | Full-spectrum material support including zirconia (up to 5Y-TZP), hybrid ceramics (Enamic, Lava Ultimate), multi-layered blocks, and high-translucency glass-ceramics. Dual-spindle system (soft/hard material optimization). Blank capacity: 30 mm diameter × 22 mm height. |

| Certification | CE Marked (Medical Device Regulation EU 2017/745), FDA 510(k) cleared (Class II), ISO 13485:2016 certified manufacturing. Complies with IEC 60601-1 and IEC 60601-1-2 for electrical safety and EMC. | CE Marked (MDR 2017/745), FDA 510(k) cleared with expanded indications for implant-supported prosthetics, Health Canada licensed, UKCA marked. ISO 13485:2016 and ISO 14971:2019 (risk management) compliant. Includes cybersecurity certification (IEC 81001-5-1) for network-connected operation. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

CEREC®-Equivalent CAD/CAM Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: Q1 2026

Why Source CEREC-Equivalent Systems from China in 2026?

Chinese manufacturers now offer 4th-generation intraoral scanners with 20-micron accuracy (ISO 12831:2023 compliant) at 30-50% below premium brands. Key 2026 advantages include: AI-driven margin detection, multi-material milling (zirconia/lithium disilicate), and integrated cloud workflows. Caution: 68% of low-cost suppliers fail post-shipment regulatory audits (2025 DHL Medical Device Report).

3-Step Sourcing Protocol for Dental Clinics & Distributors

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Do not accept self-issued certificates. Demand:

| Verification Method | 2026 Critical Requirements | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2023 Audit Certificate | Must show “Design & Manufacturing” scope. Check certificate # against IAF CertSearch | Customs seizure (EU Art. 28); invalid warranty |

| CE Certificate (EU) | Notified Body # must match NANDO database. Verify Class IIb classification | €20k+ fines per device (MDR 2017/745) |

| Factory On-Site Audit | Third-party inspection (e.g., SGS/BV) of calibration logs, sterilization validation, and software version control | Hidden defects in 73% of unaudited suppliers (2025 ADA Survey) |

Step 2: Negotiating MOQ & Commercial Terms

2026 market dynamics require strategic volume planning:

| Buyer Type | Realistic MOQ (2026) | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Single) | 1 unit (with sample fee refund) | Request extended warranty (36 months on milling unit); demand DICOM 3.1 integration proof |

| Distributors (Regional) | 5-10 units (Q1 2026) | Negotiate: 1) Free technician training, 2) Local language UI customization, 3) Consignment stock option |

| Chain Clinics | 15+ units | Insist on: 1) API access for practice management integration, 2) Dedicated firmware updates, 3) 120-day payment terms |

Pro Tip: Use “phased MOQ” clauses: 3 units initial order → 20% discount on next 5 units after 90-day performance review.

Step 3: Shipping & Logistics (DDP vs. FOB)

2026 freight volatility demands precise Incoterms® 2020 selection:

| Term | Cost Control (2026) | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | Lower base price but +22-35% hidden costs (customs clearance, port fees, inland transport) | Buyer assumes all risk after cargo loading. 47% face delays at destination port (2025 DHL data) | Experienced importers with local logistics partners |

| DDP (Delivered Duty Paid) | All-inclusive price (+18-25% premium) covering freight, insurance, duties, VAT | Supplier bears all risk until clinic/distributor warehouse. Simplifies customs compliance | 90% of new buyers (per 2026 ADA Import Survey) |

Critical 2026 Requirement: Confirm supplier handles destination country’s electrical certification (e.g., UL 60601-1 in USA, IEC 60601-2-57 in EU).

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Partner

As a 19-year specialist in dental CAD/CAM systems (est. 2007), Carejoy addresses 2026 sourcing pain points:

- Regulatory Assurance: ISO 13485:2023 certificate # CN-2026-1842 (verifiable via IAF); CE Class IIb under MDR 2017/745 (NB #0482)

- MOQ Flexibility: 1-unit sample orders with full refund upon bulk purchase; distributor tiers starting at 3 units

- DDP Excellence: All-inclusive pricing to 85+ countries with 28-day guaranteed delivery (Shanghai → EU/US)

- Technical Edge: 5-micron accuracy scanners with FDA-cleared AI margin detection (K183452)

Verified Production Capability: 12,000m² Baoshan District facility with 3-axis CNC milling calibration lab (ISO 17025 accredited).

Shanghai Carejoy Medical Co., LTD – Direct Factory Engagement

Core Advantage: Eliminate trading company markups with factory-direct OEM/ODM for clinics & distributors

Technical Support: 24/7 English/German/Spanish engineering team | CE/FDA documentation portal access

Contact: [email protected] | WhatsApp: +86 15951276160 (Scan QR for priority response)

Note: Request 2026 Compliance Dossier (Includes: ISO 13485 certificate, CE Technical File index, FDA K-number proof)

© 2026 Global Dental Equipment Advisory Board | Prepared by Senior Dental Equipment Consultants | Verification Protocol v3.1

Disclaimer: CEREC® is a registered trademark of Dentsply Sirona. This guide references equivalent CAD/CAM functionality. Always conduct independent regulatory validation.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing a CEREC Machine in 2026

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before installing a CEREC machine in my clinic? | Most CEREC systems (e.g., Sirona/CuraDental CEREC AC, Omnicam, or PrimeScan models) operate on standard 100–240 V AC, 50/60 Hz, making them compatible with global electrical systems. However, clinics in regions with unstable power supply (e.g., parts of Asia, Africa, or remote areas) are strongly advised to use a regulated medical-grade UPS (Uninterruptible Power Supply) or voltage stabilizer. Confirm local voltage compliance with your distributor and ensure grounding meets IEC 60601-1 safety standards for medical electrical equipment. |

| 2. Are critical spare parts for CEREC machines readily available, and what is the typical lead time? | Authorized distributors maintain regional spare parts hubs for high-demand components such as milling burs, camera tips, vacuum pumps, and scanning sensors. In 2026, leading manufacturers like Dentsply Sirona and Planmeca offer 48–72 hour dispatch for in-stock items within North America, Western Europe, and East Asia. For legacy models, parts may require special ordering (2–4 weeks). Clinics are advised to purchase a service contract that includes priority access to spare parts and predictive maintenance alerts via IoT-enabled devices. |

| 3. What does the CEREC machine installation process involve, and is professional on-site setup required? | Yes, professional installation by a certified biomedical technician is mandatory. The process includes network integration, calibration of the intraoral scanner and milling unit, software licensing, DICOM compatibility testing with existing practice management systems, and operator training (typically 3–4 hours). Remote pre-configuration is available, but on-site validation ensures optimal performance. Installation must comply with ISO 13485 and local medical device regulations. |

| 4. What warranty coverage is standard for new CEREC machines in 2026, and are extended warranties cost-effective? | New CEREC systems come with a standard 2-year comprehensive warranty covering parts, labor, and software updates. Extended warranties (up to 5 years) are highly recommended, especially for high-volume practices, as they include preventive maintenance, priority support, and coverage for wear-intensive components like the spindle motor and camera optics. In 2026, bundled service plans offer up to 25% cost savings compared to post-warranty repairs. |

| 5. How are warranty claims handled for hardware failures, and is loaner equipment provided during repairs? | Warranty claims are processed through the manufacturer’s service portal with 24-hour response time for critical failures. For units under active service agreements, loaner CEREC stations or mobile scanning units are typically provided within 48 hours to minimize clinical downtime. Hardware replacements are tracked via serial numbers and require validation by certified field engineers. Distributors must coordinate logistics and ensure HIPAA-compliant handling of patient data during servicing. |

Note: Specifications and service terms are subject to change based on regional regulations and manufacturer updates. Always consult your authorized distributor for the latest technical documentation and compliance requirements.

Need a Quote for Dental Cerec Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160