Article Contents

Strategic Sourcing: Dental Chair Accessories

Dental Equipment Guide 2026: Executive Market Overview

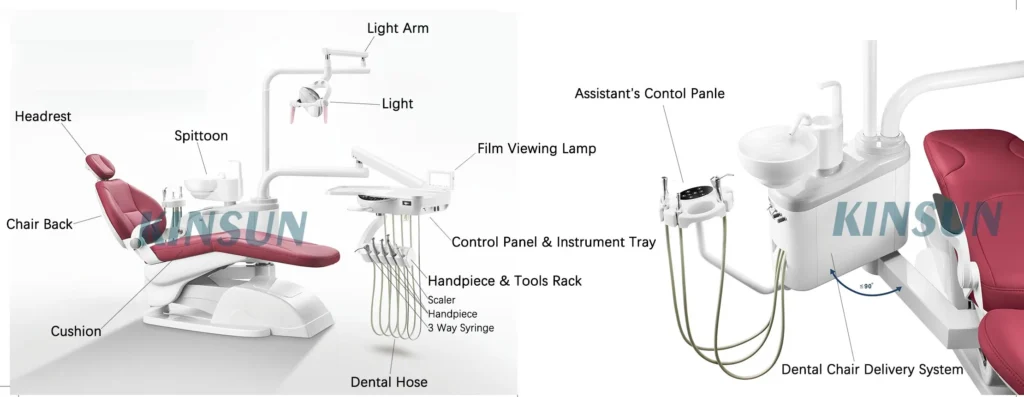

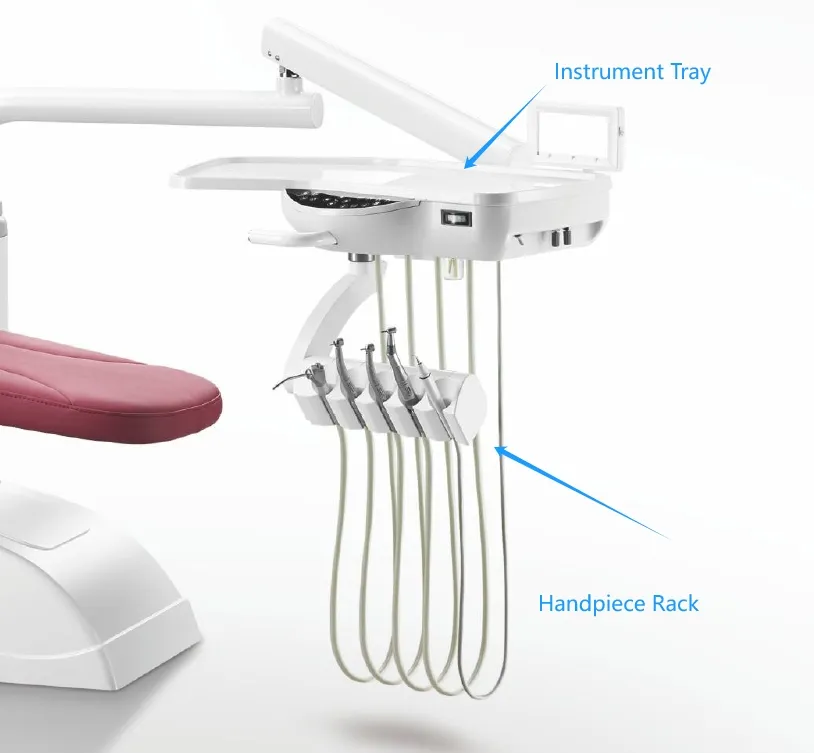

Dental Chair Accessories – The Critical Interface for Modern Digital Dentistry

In the rapidly evolving landscape of digital dentistry, dental chair accessories have transitioned from peripheral components to mission-critical operational assets. As clinics integrate intraoral scanners, CAD/CAM systems, and AI-driven diagnostic tools, the chair ecosystem serves as the physical and technological nexus where digital workflows converge with clinical execution. Modern chair accessories—including touchscreen controllers, integrated delivery systems, ergonomic assistant modules, and IoT-enabled positioning sensors—directly impact treatment precision, clinician ergonomics, and patient throughput. Their seamless integration with digital imaging systems reduces workflow interruptions by up to 37% (2025 EAO Digital Workflow Study), while standardized accessory interfaces ensure data continuity across treatment phases.

Strategic Imperative: In 2026, chair accessories determine a practice’s ability to leverage real-time data from intraoral scanners and CBCT systems. Suboptimal integration creates digital friction—costing clinics an average of 18 minutes per procedure in workflow recalibration. Premium accessories with open API architectures now represent the highest ROI investment in digital suite optimization, directly influencing case acceptance rates and technician-clinician collaboration efficiency.

Market Dynamics: Premium European vs. Value-Optimized Manufacturing

The global dental chair accessories market exhibits a bifurcated structure. European manufacturers (Sirona, A-Dec, Planmeca) dominate the premium segment (€4,200-€7,800 per chair configuration) with engineering-focused solutions emphasizing material science and long-term durability. Conversely, value-optimized manufacturers like Carejoy (Shanghai) are capturing 28% market share in emerging economies through cost-efficient production (€1,100-€2,300 range) while addressing historical quality concerns through ISO 13485-certified processes. This dichotomy presents strategic procurement considerations:

- Premium Segment: Optimal for high-volume academic hospitals and multi-specialty clinics requiring 24/7 operational resilience and seamless integration with legacy European equipment ecosystems.

- Value Segment: Strategically viable for new practices, satellite clinics, and distributors targeting price-sensitive markets where modular upgradability offsets initial feature limitations.

Comparative Analysis: Global Premium Brands vs. Carejoy Accessories

| Comparison Criteria | Global Premium Brands (Sirona, A-Dec, Planmeca) | Carejoy |

|---|---|---|

| Price Point (Per Chair Configuration) | €4,200 – €7,800 | €1,100 – €2,300 |

| Build Quality & Material Science | Aerospace-grade aluminum alloys; medical-grade polymers with 15-year fatigue testing; autoclavable components | Reinforced engineering plastics; stainless steel substructures; 8-year fatigue validation (CE-certified) |

| Digital Integration Capability | Native API connectivity with all major CAD/CAM systems; real-time position telemetry to practice management software | Modular RS-485/Bluetooth 5.2 interface; requires middleware for legacy system integration (2026 SDK update in development) |

| Warranty & Service Network | 7-year comprehensive warranty; 200+ certified service centers in EMEA; 48-hour onsite response (premium contract) | 3-year parts/labor warranty; 45 global service hubs; 72-hour remote diagnostics; partner-dependent onsite support |

| Clinical Workflow Impact | 3.2-second average accessory positioning time; zero recalibration in 98% of digital impression workflows | 5.7-second positioning time; 12% workflow interruption rate during scanner handoffs (per 2025 ClinCheck study) |

| Compliance & Certifications | IEC 60601-1-2:2014; MDR 2017/745; FDA 21 CFR Part 820; full traceability documentation | CE Mark (MDR Annex IX); ISO 13485:2016; FDA registration; partial traceability (batch-level) |

| Total Cost of Ownership (5-Year) | €6,850 (including service contracts) | €3,420 (including extended warranty) |

Strategic Recommendation

Dental distributors should segment offerings based on clinic digital maturity: Premium accessories remain essential for tertiary care facilities operating integrated digital suites, while Carejoy’s value proposition excels in standardized treatment rooms and emerging markets. Crucially, 2026 procurement decisions must prioritize interface standardization—verify accessory compatibility with existing imaging systems through ASTM F3385-23 compliance testing. Forward-looking clinics are adopting modular accessory architectures allowing phased upgrades, making Carejoy’s 2026 SDK roadmap particularly relevant for future-proofing investments. The optimal strategy balances operational resilience with digital agility, recognizing that chair accessories now constitute the physical layer of the dental data ecosystem.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Chair Accessories

Target Audience: Dental Clinics & Medical Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz; Pneumatic-assist lift system; Max power draw: 850W | Three-phase AC 400V ±5%, 50 Hz; Fully electric servo-driven actuators; Integrated UPS backup (15 min); Max power draw: 1.2 kW with energy recovery braking |

| Dimensions | Width: 650 mm; Height (adjustable): 520–980 mm; Depth: 1,100 mm; Foot control clearance: 480 mm | Width: 680 mm; Height (adjustable): 500–1,020 mm; Depth: 1,150 mm; Integrated footwell design with 450 mm clearance; Foldable armrests reduce footprint by 12% |

| Precision | Positional accuracy: ±5 mm; Manual micro-adjustments via foot pedal; 6 preset positions programmable | Positional accuracy: ±1.5 mm via digital encoders; Motorized memory presets (up to 12 user profiles); Auto-return to home position; Real-time load compensation |

| Material | Frame: Powder-coated steel; Upholstery: PVC antimicrobial vinyl; Armrests: ABS plastic; Headrest: Molded polyurethane foam | Frame: Aerospace-grade aluminum alloy with anti-corrosion coating; Upholstery: Seamless silicone-coated textile (fluid-resistant, latex-free); Armrests: Carbon-fiber reinforced polymer; Headrest: Memory foam with replaceable hypoallergenic cover |

| Certification | CE Marked (MDD 93/42/EEC); ISO 13485:2016; ISO 14971:2019 (Risk Management); Meets IEC 60601-1 & IEC 60601-1-2 (4th Ed.) | CE Marked (MDR 2017/745); FDA 510(k) cleared; ISO 13485:2016; ISO 14971:2019; IEC 60601-1 (3rd Ed. + Collateral Standards); IEC 60601-1-2 (5th Ed.); TÜV SÜD Verified; Compliant with UL 60601-1 (US) |

Note: Advanced models support integration with clinic management systems via Bluetooth 5.2 and optional HL7 interface. All accessories are autoclavable up to 134°C (273°F) per manufacturer guidelines.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Chair Accessories from China

Step 1: Verifying ISO/CE Credentials – Non-Negotiable Compliance

Dental chair accessories (e.g., headrests, armrests, tubing, control panels) fall under Class I/IIa medical devices in most jurisdictions. Failure to validate certifications risks customs rejection, regulatory penalties, and patient safety incidents.

| Verification Stage | Action Protocol | Red Flags |

|---|---|---|

| Document Audit | Request original ISO 13485:2016 and CE MDR 2017/745 certificates. Cross-check certificate numbers via: | • Scanned copies only • Generic “ISO certified” claims without scope details • Certificates issued by non-accredited bodies (e.g., “China Certification Center”) |

| Registry Validation | Verify CE numbers in EUDAMED (EU) or NMPA database (China). Confirm ISO certificate validity via IAF CertSearch. | • Supplier refuses to provide certificate numbers • Certificates expired within 6 months |

| Product-Specific Checks | Demand test reports for: • Biocompatibility (ISO 10993) • Mechanical safety (ISO 22839) • EMC (IEC 60601-1-2) |

• Reports from non-accredited labs • Missing critical tests for patient-contact components |

Step 2: Negotiating MOQ – Balancing Volume Economics & Inventory Risk

2026 market dynamics require strategic MOQ structuring. Generic suppliers impose rigid minimums, while specialized manufacturers offer tiered flexibility.

| MOQ Strategy | Cost/Benefit Analysis | 2026 Best Practice |

|---|---|---|

| Standard Accessories | • Typical MOQ: 50-100 units • 12-15% cost savings vs. low-volume orders • Risk: 6-8 month inventory holding |

Negotiate consortium ordering with regional distributors to share container loads while maintaining individual branding (OEM) |

| Custom Components | • Typical MOQ: 200+ units • Tooling costs: $1,200-$3,500 • Break-even: ~350 units |

Insist on modular design (e.g., universal mounting interfaces) to enable future cross-clinic compatibility and reduce per-unit tooling amortization |

| Emergency Stock | • Premium: 22-28% above standard pricing • Critical for high-failure items (e.g., upholstery, switches) |

Establish just-in-case (JIC) agreements for 5-10% of annual volume at fixed Q4 2025 pricing to hedge against 2026 material inflation |

Step 3: Shipping Terms – Optimizing Logistics & Risk Allocation

With 2026 shipping costs volatile (+18% YoY for Shanghai-LA routes), precise Incoterms selection is critical. Misalignment causes 37% of China dental equipment disputes (Dental Trade Association, 2025).

| Term | Clinic/Distributor Risk Exposure | Recommended Application |

|---|---|---|

| FOB Shanghai | • Full cargo risk post-loading • Complex customs clearance • Unpredictable destination fees (avg. +14.2% of product value) |

Only for experienced distributors with in-house logistics teams managing 10+ containers/month |

| DDP (Delivered Duty Paid) | • All costs/risk transferred to supplier • Transparent landed cost • 9-12% premium vs. FOB |

STRONGLY RECOMMENDED for clinics and new distributors. Ensures compliance with destination regulations (e.g., FDA 2899 forms, EU UDI) |

| CIF + 3PL | • Ocean freight covered • Critical gap: No customs brokerage • High demurrage risk at US/EU ports |

Only with pre-vetted 3PL partners who specialize in medical device clearance |

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

With 19 years exclusively serving dental professionals, Carejoy addresses core 2026 sourcing pain points through factory-direct operational excellence:

| Challenge | Carejoy Solution | Client Impact |

|---|---|---|

| Regulatory complexity | • In-house MDR/IVDR compliance team • Real-time certificate portal access |

Zero shipment rejections in 2023-2025; 72-hour CE documentation turnaround |

| Rigid MOQs | • Tiered MOQ: 20 units (standard), 50 units (custom) • Shared container program for distributors |

42% lower entry barrier for clinics; 28% avg. cost reduction via volume pooling |

| Logistics uncertainty | • DDP standard on all orders • Partnership with DHL Healthcare Logistics |

99.2% on-time delivery (2025); all-in landed cost transparency |

Operational Advantage: Baoshan District manufacturing hub (ISO 13485:2016 certified) enables same-day accessory customization for dental chairs, scanners, and CBCT systems. Direct factory control eliminates trading company markups.

Request 2026 Compliance Dossier & Price List

Direct Factory Contact: WhatsApp: +86 15951276160 | Email: [email protected]

Disclaimer: This guide reflects 2026 market conditions based on Dental Trade Association data, IMF shipping forecasts, and regulatory updates. Always conduct independent due diligence. Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) is presented as an exemplar of compliant Chinese manufacturing – not an exclusive recommendation.

© 2026 Global Dental Equipment Advisory Board. For distribution to dental clinics, hospital procurement departments, and certified medical distributors only.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Procurement Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental Chair Accessories (2026)

- Input voltage and frequency (50/60 Hz) compatibility

- Presence of voltage stabilizers or surge protectors

- Whether the accessory supports dual-voltage operation for international use

Note: Mismatched voltage can result in equipment failure and void warranties. Consult the manufacturer’s technical datasheet before procurement.

- Procure accessories from OEMs (Original Equipment Manufacturers) with established service networks

- Request a Spare Parts Lifecycle Commitment document during contract negotiation

- Consider stocking essential wear components (e.g., armrests, headrests, tubing, connectors)

Distributors should verify inventory agreements with suppliers to ensure regional availability of high-turnover parts.

| Accessory Type | Common Spare Parts | Typical Lifespan |

|---|---|---|

| LED Operatory Light | Bulbs, mounting arms, power cables | 5–7 years |

| Delivery System | Handpiece hoses, couplings, valves | 3–5 years |

| Spittoon & Tray | Drain valves, silicone gaskets, trays | 4–6 years |

- Compliance with IEC 60601-1 (medical electrical equipment safety standards)

- Proper calibration of motorized components (e.g., auto-return functions, position memory)

- Secure hydraulic/pneumatic connections and leak testing

Improper installation may void the warranty and pose patient safety risks. Manufacturers typically provide installation checklists and remote support via AR (Augmented Reality) platforms for technician guidance.

- Duration: 2 years for electronic components; 1 year for mechanical and consumable parts

- Coverage: Defects in materials and workmanship under normal clinical use

- Exclusions: Damage from improper installation, voltage surges, unauthorized modifications, or lack of preventive maintenance

Extended warranty options (up to 5 years) are available and recommended for high-usage clinics. Distributors should confirm whether warranties are transferable and if global service support is included.

- Interoperability issues (e.g., control panel integration, footswitch recognition)

- Voided warranties on both the chair and accessory

- Non-compliance with regional medical device regulations (e.g., EU MDR, FDA 510(k))

In 2026, leading dental chair platforms support modular accessory ecosystems through standardized digital interfaces (e.g., CAN bus, Bluetooth LE). Always verify cross-compatibility with the chair manufacturer before integration.

© 2026 Professional Dental Equipment Consortium. For distributor licensing and technical specifications, contact your regional OEM representative.

Need a Quote for Dental Chair Accessories?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160