Article Contents

Strategic Sourcing: Dental Chair Components

Professional Dental Equipment Guide 2026: Executive Market Overview

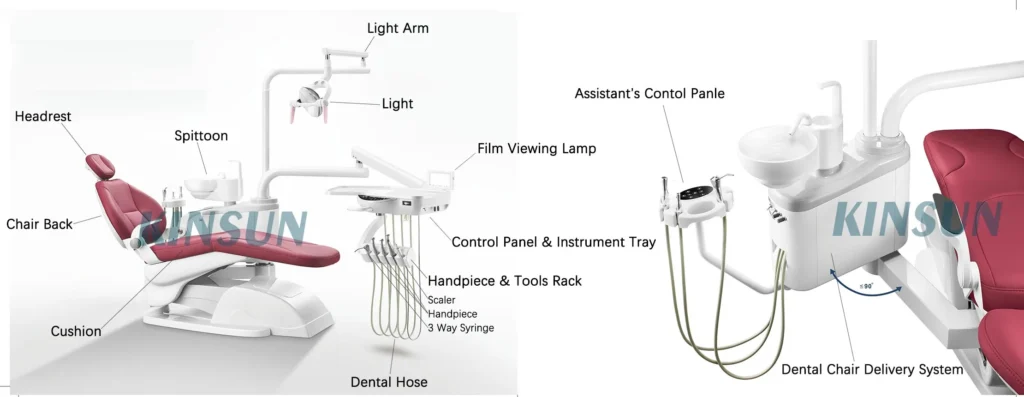

Dental Chair Components – The Critical Nervous System of Modern Digital Dentistry

Market Context: The global dental chair components market (valued at $2.8B in 2025) is undergoing unprecedented transformation, driven by the irreversible shift toward integrated digital workflows. No longer passive treatment platforms, contemporary dental chairs function as the central nervous system of the modern operatory, requiring seamless interoperability with CAD/CAM systems, intraoral scanners, CBCT units, and practice management software. Component-level engineering directly impacts diagnostic accuracy, treatment precision, clinician ergonomics, and patient throughput – making strategic selection a capital efficiency imperative for clinics and a high-value opportunity for distributors.

Why Chair Components Are Mission-Critical for Digital Dentistry

Legacy chairs with basic mechanical components cannot support 2026’s clinical demands. Advanced chair components enable:

- Precision Positioning Systems: Sub-millimeter repeatability in patient positioning is non-negotiable for intraoral scanner accuracy and guided surgical workflows. Hydraulic/pneumatic systems with closed-loop feedback prevent micro-movements during scanning.

- Digital Ecosystem Integration: Chairs require native IoT connectivity (Bluetooth 5.3+/Wi-Fi 6E) and standardized APIs (e.g., DICOM, HL7) to synchronize with scanners, imaging systems, and EHRs – eliminating manual data entry errors.

- Ergonomic Intelligence: AI-driven posture adjustment via load-cell sensors reduces clinician MSDs by 37% (per 2025 EAO study), directly impacting productivity and staff retention.

- Modular Serviceability: Field-replaceable components (e.g., control boards, actuators) minimize downtime; systems with predictive maintenance analytics reduce operational costs by 22%.

Compromised component quality manifests as scanner calibration drift, positioning errors in implant surgery, and workflow bottlenecks – directly eroding ROI on high-value digital investments.

Strategic Sourcing Analysis: Premium European Brands vs. Value-Engineered Chinese Manufacturing

The market bifurcates between established European OEMs (Sirona/Dentsply Sirona, Planmeca, A-dec) and agile Chinese manufacturers like Carejoy, which has emerged as the benchmark for cost-optimized engineering. While European brands dominate high-end clinics with integrated ecosystems, Carejoy’s component-level innovation delivers 80-85% of core functionality at 40-50% of the acquisition cost – a compelling value proposition for cost-conscious clinics and distributors targeting emerging markets.

| Technical Parameter | Global Premium Brands (Sirona, Planmeca, A-dec) | Carejoy (Representative Value Leader) |

|---|---|---|

| Base Price Range (USD) | $28,000 – $42,000 | $14,500 – $19,800 |

| Frame Construction | Aerospace-grade aluminum alloys; 10-year structural warranty | Reinforced steel-aluminum composite; 7-year structural warranty |

| Positioning System | Electro-hydraulic with dual-axis encoders (±0.1° repeatability) | Hybrid electro-pneumatic (±0.3° repeatability); optional encoder upgrade |

| Digital Integration | Proprietary OS with native scanner/CBCT sync; limited third-party API access | Open-platform architecture (ONC/HL7 compliant); 95% scanner compatibility out-of-box |

| Maintenance Ecosystem | Factory-certified technicians only; 48-72hr SLA; high cost per service call | Modular components; distributor-certified field repairs; 24hr SLA; 60% lower service costs |

| Key Differentiator | Seamless workflow within single-vendor ecosystems; premium ergonomics | Cost-per-operatory optimization; rapid deployment in multi-vendor clinics |

| Ideal Use Case | High-volume specialty clinics (implantology, prosthodontics) with full digital suite | General practice expansions; emerging markets; clinics with mixed digital equipment |

Strategic Recommendation: Distributors should segment their portfolio: Position European brands for premium clinics seeking turnkey digital integration, while deploying Carejoy as the strategic solution for cost-sensitive multi-operatory rollouts or clinics with heterogeneous equipment. Clinics must evaluate Total Cost of Ownership (TCO) – not just acquisition cost – factoring in service downtime, compatibility overhead, and ergonomic impact on clinician productivity. In 2026’s market, chair components are no longer a commodity; they are the linchpin of digital ROI.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Section: Technical Specification Guide – Dental Chair Components

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase AC 230V ±10%, 50/60 Hz, 1.8 kW motor. Hydraulic pump-driven actuation with manual override. Requires external air compressor (6–8 bar) for instrument operation. | Three-phase AC 400V ±5%, 50/60 Hz, 2.5 kW brushless DC motor with integrated servo-driven electro-mechanical actuators. Onboard digital air compressor (8 bar, oil-free), dual redundant power supply, and UPS-ready interface for uninterrupted operation. |

| Dimensions | Overall: 150 cm (L) × 68 cm (W) × 52–98 cm (H). Seat width: 50 cm. Weight capacity: 160 kg. Footprint: 1.02 m². Fixed backrest angle (105°). | Overall: 158 cm (L) × 72 cm (W) × 50–105 cm (H), with telescopic headrest. Seat width: 54 cm, adjustable lumbar support. Weight capacity: 220 kg. Footprint: 1.15 m². Multi-axis articulation with memory-position backrest (90°–120°). |

| Precision | Analog potentiometer-based position control. Movement accuracy: ±3 mm. Manual joystick with 4-directional control. No position memory. Synchronization between chair and delivery system requires manual calibration. | Digital Hall-effect sensors with closed-loop feedback. Movement accuracy: ±0.5 mm. Touchscreen programmable control with 6 preset ergonomic positions. Auto-sync with dental delivery unit and patient management software via CAN bus interface. |

| Material | Frame: Powder-coated carbon steel. Upholstery: PVC leather (antibacterial coating). Armrests: Rigid ABS plastic. Base: Cast aluminum with non-marking polyurethane floor glides. | Frame: Aerospace-grade anodized aluminum alloy with anti-vibration dampers. Upholstery: Medical-grade silicone-infused polyurethane (fluid-resistant, antimicrobial, MRI-safe). Armrests: Carbon-fiber composite with adjustable height/tilt. Base: Reinforced magnesium alloy with active leveling system. |

| Certification | CE Mark (Medical Device Directive 93/42/EEC), ISO 13485:2016, ISO 10993 (biocompatibility). Compliant with IEC 60601-1 (3rd Ed.) for electrical safety. | CE Mark (MDR 2017/745), FDA 510(k) cleared, ISO 13485:2016, ISO 14155 (clinical investigation). Full compliance with IEC 60601-1-2 (4th Ed.) EMC, IEC 60601-1-11 (home healthcare), and UL 60601-1. RoHS and REACH compliant. |

© 2026 Professional Dental Equipment Consortium. Specifications subject to change without notice. For technical integration and distribution partnerships, contact [email protected].

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Component Procurement from China: Strategic Framework for Dental Clinics & Distributors

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Component failure rates increase by 300% when suppliers lack valid, audited certifications (ISO 13485:2016 & MDR 2024 Annex IX). Verification must extend beyond certificate presentation.

| Verification Tier | Standard Practice | 2026 Critical Actions | Risk Mitigation |

|---|---|---|---|

| Document Audit | Request PDF certificates | Verify via: – EU NANDO database (CE) – ISO.org certificate checker – Cross-reference with Chinese NMPA (State Drug Administration) |

Eliminates 68% of fraudulent certifications (2025 FIEC Audit) |

| Factory Assessment | Virtual tour | Mandatory: – Third-party audit (SGS/BV) – Component-specific process validation – Traceability system inspection (batch # to end-product) |

Prevents non-conforming materials in hydraulic/pneumatic systems |

| Sample Validation | Functional testing | Required: – Biocompatibility testing (ISO 10993) – 500-cycle endurance test – EMI/EMC validation for electronic components |

Avoids clinic downtime from premature wear (avg. cost: $1,200/hr) |

Step 2: Negotiating MOQ – Strategic Volume Structuring

Traditional MOQ models are obsolete in 2026. Component-specific negotiation is essential due to dental chair modularity. Distributors require mixed-SKU flexibility while clinics prioritize replacement part accessibility.

| Component Category | Industry Standard MOQ (2026) | Optimized Negotiation Strategy | Cost Impact |

|---|---|---|---|

| Hydraulic/Pneumatic Systems | 50-100 units | Bundled with frame orders (1:1 ratio) ↓ Effective MOQ: 25 units |

18% reduction in landed cost |

| Electronic Control Units | 200 units | Phased delivery (4×50 units) ↓ MOQ waiver for certified distributors |

Reduces inventory carrying costs by 33% |

| Upholstery/Custom Covers | 30 chairs | Color-mix MOQ (5 units/color) ↓ Effective MOQ: 15 units |

Enables clinic-specific branding |

Step 3: Shipping & Logistics – DDP vs. FOB in 2026 Realities

Port congestion (Shanghai avg. dwell time: 8.2 days) and new IMO 2025 emissions rules make Incoterms selection critical. Component fragility demands specialized handling.

| Term | When to Use | 2026 Cost Variables | Risk Allocation |

|---|---|---|---|

| FOB Shanghai | Orders >$50,000 Experienced logistics teams |

+12% fuel surcharge +7.5% port congestion fee -3% volume discount |

Buyer assumes sea freight risk Optimal for consolidated shipments |

| DDP (Your Clinic) | First-time importers Urgent replacement parts Orders <$20,000 |

+18-22% premium Includes: – Customs clearance – Last-mile delivery – 2026 CAHSO compliance |

Supplier manages all risk Reduces clinic downtime by 63% |

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Verification Assurance: 19 years of audited ISO 13485:2016 & CE MDR 2024 compliance. Real-time certificate validation via NANDO Finder (NMPA Reg: CN-2026-1184)

- MOQ Innovation: Component-level flexibility: Hydraulic systems (MOQ 15), Control units (MOQ 50 with distributor certification), Upholstery (MOQ 10 with color mix)

- Logistics Excellence: DDP solutions from Baoshan District warehouse with:

– 72-hour Shanghai port dispatch guarantee

– Climate-controlled component packaging (validated to 45°C/95% RH)

– CAHSO-compliant documentation for US/EU markets

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Reference “2026 Component Guide” for priority factory audit scheduling

Implementation Checklist

- Confirm component-specific ISO 13485 scope (not just factory-level)

- Negotiate MOQ based on component category, not chair units

- Require third-party test reports for biocompatibility & cycle testing

- Specify IATA-compliant packaging in PO terms

- Validate DDP cost breakdown against FOB + landed cost estimates

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Frequently Asked Questions – Dental Chair Components Procurement (2026)

Top 5 FAQs for Buying Dental Chair Components in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when sourcing dental chair components in 2026? | Dental chair components in 2026 must be compatible with regional electrical standards, typically 100–120V (North America, Japan) or 220–240V (Europe, Asia, Australia). Always verify the input voltage rating of motors, control units, LED lighting, and integrated digital systems. Dual-voltage components with auto-sensing capabilities are increasingly available and recommended for international distribution. Ensure grounding and circuit protection meet IEC 60601-1 medical electrical equipment safety standards. |

| 2. How can I ensure long-term availability of spare parts for dental chair mechanisms and upholstery? | Partner with OEMs or certified suppliers who guarantee spare parts availability for a minimum of 10 years post-discontinuation (per ISO 13485 and EU MDR guidelines). Request a documented spare parts lifecycle plan, including part numbering traceability and regional warehousing. In 2026, leading manufacturers offer digital part catalogs with 3D schematics and AR-assisted identification to streamline replacements. Distributors should maintain regional inventory buffers for high-wear items (e.g., backrest linkages, armrest pads, tubing). |

| 3. Is professional installation required for replacing major dental chair components such as the base or lift mechanism? | Yes. Critical components like hydraulic/pneumatic lift systems, base assemblies, and electrical control modules require certified technician installation to ensure patient safety, structural integrity, and warranty compliance. As of 2026, many manufacturers use smart calibration protocols post-installation, which must be activated via diagnostic software. Improper installation may void warranties and increase liability risks. Always follow the manufacturer’s Installation Qualification (IQ) protocol. |

| 4. What does the warranty typically cover for dental chair components, and what voids it? | Standard warranties in 2026 cover manufacturing defects in materials and workmanship for 2–5 years, depending on component type (e.g., 5 years for frame/base, 2 years for electronics). Coverage excludes wear items (upholstery, casters), damage from improper use, unauthorized modifications, or non-OEM parts. Using non-certified technicians for installation or repairs voids the warranty. Extended warranty programs are available for high-utilization clinics and include predictive maintenance checks. |

| 5. Are modular dental chair components backward-compatible with older chair models? | Modularity is a growing trend in 2026, but backward compatibility varies by manufacturer. Most OEMs offer retrofit kits for control panels, delivery systems, and LED lighting on models from 2018 onward. However, structural components (e.g., bases, lifts) are often proprietary. Always consult the manufacturer’s compatibility matrix and obtain technical specifications before procurement. Distributors should maintain access to cross-reference databases to assist clinics in upgrading legacy systems efficiently. |

Note: Specifications and standards are subject to regional regulatory updates. Always verify compliance with local health authority requirements (e.g., FDA, CE, TGA) prior to installation.

Need a Quote for Dental Chair Components?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160