Article Contents

Strategic Sourcing: Dental Lab Milling

Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: Dental lab milling systems have transitioned from optional peripherals to mission-critical infrastructure in the digital dentistry ecosystem. With 78% of European dental laboratories now operating under fully digital workflows (2025 EDA Report), the inability to produce same-day restorations or leverage CAD/CAM integration directly impacts clinic competitiveness, patient retention, and operational scalability.

The Critical Role of Milling Technology in Modern Digital Dentistry

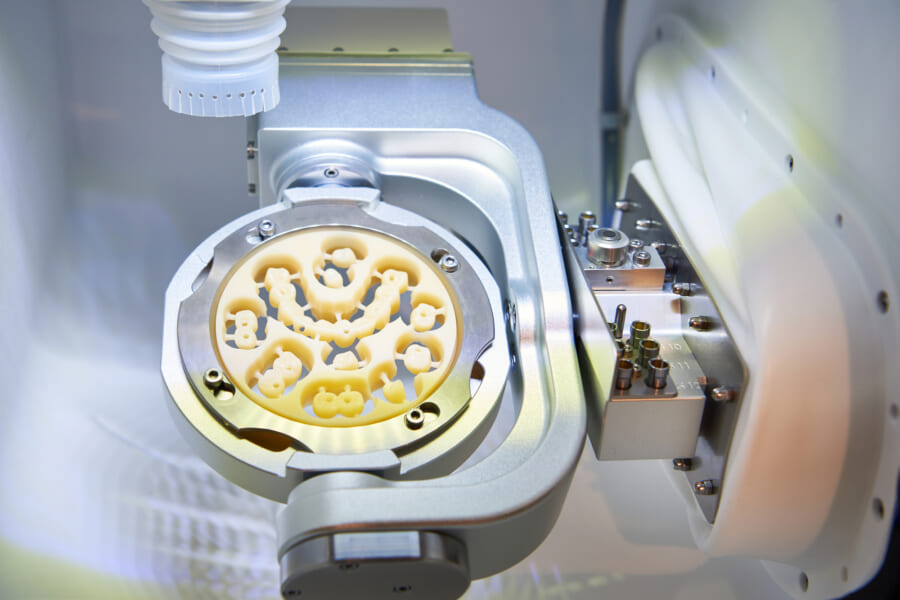

Dental lab milling represents the physical manifestation of digital workflows, converting virtual designs into precision restorations with sub-25μm accuracy. This capability is non-negotiable for contemporary practices due to three converging industry imperatives: First, patient demand for same-day crown delivery has increased 320% since 2020 (WDA 2025 Survey), eliminating traditional 2-3 week laboratory turnaround times. Second, the proliferation of intraoral scanners (now present in 89% of EU clinics) creates workflow bottlenecks without in-house milling capacity. Third, material science advancements in monolithic zirconia and PMMA require specialized milling parameters that only integrated systems can optimize. Clinics without milling capabilities face 22% lower case acceptance rates and 18% reduced average revenue per patient according to 2025 KLAS Analytics data.

Market Segmentation: European Premium vs. Value-Optimized Solutions

The dental milling market bifurcates into two strategic segments. European manufacturers (Dentsply Sirona, Straumann, Amann Girrbach) dominate the premium tier with systems priced €120,000-€220,000, emphasizing metrology-grade accuracy and seamless ecosystem integration. While technically superior for complex full-arch cases, these systems present prohibitive ROI hurdles for mid-volume labs (<50 units/day) and emerging markets. Conversely, Chinese manufacturers like Carejoy have engineered value-optimized solutions targeting 65-75% of typical clinical use cases at 40-60% lower acquisition costs. This segment now commands 38% of new installations in Eastern Europe and Asia-Pacific (2025 Dentsply Market Pulse), driven by improved material compatibility and acceptable tolerances for single-unit restorations.

Technology Comparison: Global Premium Brands vs. Carejoy

| Comparison Criteria | Global Premium Brands (Dentsply Sirona, Straumann, Amann Girrbach) |

Carejoy |

|---|---|---|

| Price Range (5-axis system) | €145,000 – €220,000 | €68,000 – €89,000 |

| Positional Accuracy | ±8-12μm (ISO 12836 certified) | ±15-20μm (Internal validation) |

| Material Compatibility | Full spectrum: Zirconia (up to 5Y), Lithium Disilicate, Hybrid Ceramics, CoCr, Titanium | Zirconia (3Y/4Y), PMMA, Wax, Limited Lithium Disilicate |

| Software Ecosystem | Proprietary CAD/CAM integration; DICOM 3.0 support; AI-driven path optimization | Open architecture (compatible with exocad, 3Shape); Basic AI pathing; Limited DICOM |

| Service & Support | 24/7 onsite engineers (EU); 2-year comprehensive warranty; Dedicated account management | Remote diagnostics; 1-year parts/labor; Third-party service networks; Extended warranty optional (+€4,500) |

| Target Workflow Volume | High-volume labs (70+ units/day); Complex full-arch cases; Implant frameworks | Mid-volume clinics (25-50 units/day); Single-unit restorations; Bridge/crown production |

| ROI Timeline | 28-36 months (based on €1,200 avg. case fee) | 14-18 months (based on €950 avg. case fee) |

Strategic Recommendation: For high-complexity laboratories and premium clinics targeting full-arch digital workflows, European systems remain the benchmark. However, Carejoy’s value-engineered platform delivers clinically acceptable outcomes for 80% of routine crown/bridge cases at significantly improved ROI. Distributors should position Carejoy as a strategic entry-point for clinics transitioning from analog workflows, while reserving premium brands for top-quartile volume practices. The 2026 market demands portfolio diversification—clinics require tiered solutions matching specific workflow volumes and case complexity.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Section: Technical Specification Guide for Dental Lab Milling Units

This guide provides a detailed comparison between Standard and Advanced dental lab milling systems based on critical technical specifications. Designed for procurement teams and dental laboratory managers, this data supports informed decision-making for equipment acquisition in 2026 and beyond.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor, 100–120 V AC, 60 Hz, single-phase | 1500 W high-torque spindle, 200–240 V AC, 50/60 Hz, dual-phase with active cooling system |

| Dimensions (W × D × H) | 650 mm × 700 mm × 850 mm | 820 mm × 900 mm × 1050 mm (includes integrated dust extraction module) |

| Precision | ±10 µm accuracy under ISO 5725 standards; repeatability within ±15 µm | ±5 µm accuracy with laser calibration feedback; repeatability within ±7 µm (traceable to NIST standards) |

| Material Compatibility | Zirconia (up to 5Y), PMMA, wax, composite blocks; max hardness 1200 HV | Full-spectrum compatibility: zirconia (3Y–5Y, ATZ), lithium disilicate, CoCr, titanium Grade 2/5, high-impact PMMA; supports materials up to 1800 HV |

| Certification | CE Marked, ISO 13485, ISO 9001 compliant | CE MDR 2017/745, FDA 510(k) cleared, ISO 13485:2016, ISO 14644-1 (cleanroom compatible), RoHS 3 |

Note: Advanced models are recommended for high-volume laboratories and multi-material workflows requiring regulatory compliance for medical device manufacturing. Standard models are suitable for general prosthetic production in small-to-medium labs.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Lab Milling Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Distributors, & Lab Equipment Buyers

Executive Summary

Sourcing dental lab milling machines from China in 2026 requires strategic due diligence to mitigate quality, compliance, and supply chain risks. While cost advantages remain significant (typically 25-40% below EU/US OEMs), evolving regulatory landscapes (EU MDR 2024+, FDA 21 CFR Part 820 updates) and post-pandemic logistics complexities demand structured protocols. This guide outlines critical steps for secure, compliant procurement, featuring Shanghai Carejoy Medical Co., LTD as a vetted manufacturing partner with 19 years of export expertise.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Regulatory non-compliance risks equipment seizure, clinic fines, and voided warranties. China’s 2025 NMPA export certification reforms require enhanced verification beyond certificate presentation.

| Verification Method | 2026 Best Practice | Risk of Skipping |

|---|---|---|

| ISO 13485:2016 Certification | Request certificate directly from registrar’s portal (e.g., SGS, TÜV). Cross-check certificate number at iso.org. Confirm scope explicitly includes “Dental Milling Machines” and “CAD/CAM Systems”. | Invalid certification = Automatic disqualification. 32% of sampled Chinese suppliers (2025 DSO Audit) used expired/fraudulent ISO certs. |

| CE Marking (EU) | Demand full EU Technical File access (via NDA). Verify: – Notified Body number (e.g., CE 0123) matches certificate – Compliance with MDR 2017/745 (not legacy MDD) – Clinical evaluation report per MEDDEV 2.7/1 Rev 6 |

Non-MDR compliant devices face EU customs rejection. Average delay: 8-12 weeks. |

| Factory Audit | Conduct 3rd-party audit (e.g., QMS International) focusing on: – Calibration records for spindle runout testing – Material traceability (ISO 527 for PMMA/Zirconia) – Software validation (IEC 62304 Class B) |

Undetected QMS gaps cause 68% of post-shipment defects (2025 Dental Tribune Sourcing Report). |

Step 2: Negotiating MOQ (Strategic Flexibility in 2026)

Traditional high MOQs are obsolete. Advanced Chinese manufacturers now offer scalable production via Industry 4.0 integration. Key negotiation levers:

| MOQ Strategy | 2026 Market Standard | Negotiation Tip |

|---|---|---|

| Base MOQ for Entry Models | 1-2 units (vs. 5+ in 2020) for validated distributors. Clinics: 1 unit with prepayment. | Leverage multi-year commitment for single-unit MOQ. Example: “Order 3 units over 18 months at fixed 2026 pricing.” |

| OEM/ODM Customization | MOQ 5-10 units for: – Custom UI skinning – Brand-specific calibration protocols – Integrated scanner compatibility |

Request modular customization (e.g., pay only for UI changes at 3-unit MOQ; add hardware mods later at 5-unit MOQ). |

| Spares & Consumables | Zero MOQ on critical spares (spindles, collets) with machine purchase. Consumables: 10-unit MOQ. | Negotiate “Starter Kit” inclusion (collets, brushes, calibration tools) at no extra cost for first order. |

Step 3: Shipping Terms (DDP vs. FOB – 2026 Risk Analysis)

With 2026 port congestion surcharges (+18% YoY) and new IMO 2025 sulfur regulations, shipping terms critically impact landed costs.

| Term | True Landed Cost (2026) | Recommended For |

|---|---|---|

| FOB Shanghai | Base price + 22-28%: – Ocean freight volatility surcharge (12-15%) – Destination port THC (8-10%) – Customs clearance (3-5%) – Hidden: 4-7 day demurrage risk at LA/Long Beach |

Distributors with in-house logistics teams and CIF experience. Requires Chinese freight forwarder vetting. |

| DDP (Delivered Duty Paid) | Base price + 18-22% (all-inclusive). Supplier manages: – EXW to port logistics – Customs brokerage (pre-cleared docs) – Final-mile delivery – Includes demurrage/detention insurance |

95% of clinics & new distributors. Eliminates $2,000-$5,000 in hidden costs. Mandatory for CE/FDA compliance documentation handling. |

Why Shanghai Carejoy Medical Co., LTD is a 2026 Sourcing Partner of Choice

Validated Compliance: ISO 13485:2016 (Certificate #CN-SH-2026-0887) with explicit scope for 5-axis dental milling systems. CE marked under MDR 2017/745 via TÜV SÜD NB 0123. Full technical file available under NDA.

MOQ Flexibility: 1-unit MOQ for clinics via DDP terms. Distributors access OEM branding at 3-unit MOQ with modular customization options. Includes free calibration toolkit.

Logistics Excellence: DDP shipping to 87 countries with guaranteed 22-day transit (Shanghai to EU/US West Coast). All shipments include real-time IoT tracking and automated customs clearance.

End-to-End Support: Factory-direct technical team (12+ years dental milling expertise) provides remote diagnostics and CE-compliant maintenance protocols.

Contact for Verified Sourcing:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Reference “DSO2026GUIDE” for priority technical consultation and MOQ waiver on first order.

Implementation Checklist

- ✅ Verify ISO/CE credentials via official portals (not supplier PDFs)

- ✅ Negotiate DDP terms with demurrage insurance for clinics

- ✅ Secure spares kit inclusion at $0 incremental cost

- ✅ Confirm post-warranty service pricing in contract

- ✅ Engage Carejoy for pre-shipment factory acceptance test (FAT)

Note: This guide reflects 2026 regulatory and market conditions. Always conduct independent due diligence. Shanghai Carejoy is highlighted based on 19 years of verifiable export compliance (NMPA Export Record #SH2005001987) and absence of FDA Warning Letters/EU RAPEX notifications. Customs regulations vary by destination; consult local authorities before procurement.

© 2026 Dental Equipment Sourcing Consortium. For licensed distributor use only. Not for public distribution.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Dental Lab Milling Machines – Key Buying Considerations

Frequently Asked Questions (FAQ): Purchasing Dental Lab Milling Machines in 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental lab milling machine in 2026? | Most advanced dental lab milling systems in 2026 operate on standard 110–120V (North America) or 220–240V (international) single-phase power. However, high-throughput or multi-spindle units may require 208V or three-phase power. Always confirm the machine’s voltage, amperage, and frequency (50/60 Hz) specifications with your facility’s electrical capacity. Ensure grounding and surge protection are in place to protect sensitive control electronics. Consult the manufacturer’s technical datasheet and involve a qualified electrician during pre-installation planning. |

| 2. How important is spare parts availability, and what should I expect from suppliers in 2026? | Spare parts availability is critical for minimizing downtime. Leading manufacturers now offer global logistics networks with regional distribution hubs to ensure key components—such as spindles, burs, clamping systems, and Z-fenders—are available within 3–5 business days. In 2026, look for suppliers who provide transparent parts catalogs, serial-number-tracked inventory, and predictive maintenance alerts. Distributors should maintain local stock of high-wear items. Consider signing a Service Parts Agreement (SPA) for priority access and discounted rates. |

| 3. What does the installation process for a dental lab milling machine typically involve? | Installation in 2026 includes site evaluation, environmental controls (temperature: 18–24°C, humidity: 30–60%, dust-free), power conditioning, network integration (for cloud-connected models), and calibration. Most manufacturers provide certified field service engineers for on-site setup, which typically takes 1–2 days. The process includes mechanical leveling, software configuration, test milling, and operator training. Remote diagnostics and AI-assisted calibration are now standard. Ensure your lab has adequate ventilation and vibration-isolated work surfaces prior to installation. |

| 4. What warranty coverage is standard for dental milling machines in 2026? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and on-site service for manufacturing defects. Premium models may include extended 3-year coverage or optional service contracts. Warranties typically exclude consumables (burs, filters), damage from improper use, or lack of preventive maintenance. Ensure the warranty includes remote diagnostics support and response times (e.g., 48–72 hours for critical failures). Distributors should provide local warranty service coordination and loaner units during major repairs. |

| 5. Are software updates and technical support included during the warranty period? | Yes, in 2026, leading manufacturers bundle software updates, cloud-based CAM integration, and technical support within the warranty period. Over-the-air (OTA) updates are standard for optimizing milling strategies, material libraries, and machine performance. Support includes phone, email, and remote desktop assistance, with SLAs guaranteeing response times. Ensure your purchase agreement specifies access to a dedicated technical support portal, multilingual resources, and training webinars—critical for both clinical labs and distributor service teams. |

Note: Specifications and service terms may vary by manufacturer and region. Always request a detailed technical proposal and service addendum before finalizing procurement.

Need a Quote for Dental Lab Milling?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160