Article Contents

Strategic Sourcing: Dental Lab Milling Machine For Sale

Dental Equipment Guide 2026: Executive Market Overview

The Strategic Imperative of Dental Lab Milling Machines in Digital Dentistry

Dental lab milling machines represent the cornerstone of modern digital dentistry workflows, enabling the precise, efficient production of crowns, bridges, inlays, onlays, and full-arch restorations. As intraoral scanning adoption surpasses 78% globally (2025 DSO Alliance Report), the demand for integrated CAD/CAM manufacturing solutions has intensified. These systems eliminate traditional laboratory bottlenecks, reduce human error by 40-60%, and accelerate case turnaround to under 24 hours – critical for patient satisfaction and practice scalability. Clinics without in-house milling capabilities face margin compression through outsourcing fees (averaging $85-$120 per unit) and extended treatment cycles, directly impacting competitive positioning in value-based care models.

Why Milling Machines Are Non-Negotiable for Modern Practices: Integration with AI-driven design software, biocompatible material versatility (zirconia, PMMA, composite blocks), and compliance with ISO 13485:2016 standards make these systems essential for delivering same-day dentistry, reducing remakes by 30%, and capturing premium restorative revenue streams. The ROI threshold has fallen to 14 months for high-volume clinics (20+ units/week).

Market Segmentation: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The global milling machine market bifurcates into two strategic procurement paths:

European Premium Segment (Sirona/CEREC, Amann Girrbach, Planmeca): Dominates high-end clinics with micron-level precision (5-10μm) and seamless ecosystem integration. However, acquisition costs ($85,000-$145,000) and proprietary consumables create significant TCO burdens. Service contracts average 12% of equipment value annually, with 72-hour response times outside major EU/US metro areas. Ideal for flagship practices prioritizing brand prestige over margin optimization.

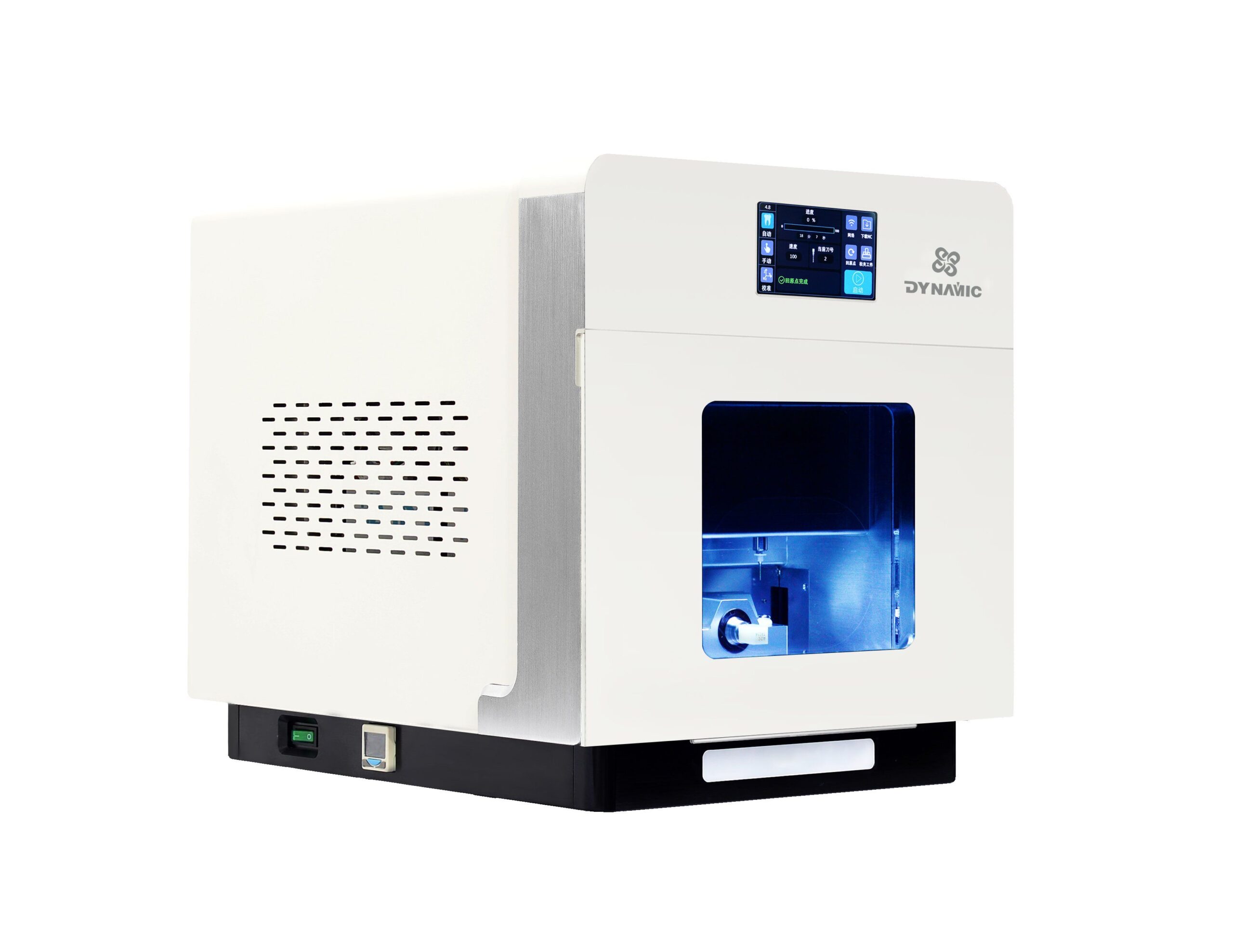

Value-Optimized Segment (Exemplified by Carejoy): Chinese manufacturers now deliver 85-90% of European technical capability at 40-60% lower acquisition cost ($35,000-$55,000). Carejoy – an ISO 13485:2016 certified OEM serving 120+ distributors globally – leverages modular engineering for zirconia (up to 5-axis), multi-abrasive compatibility, and open CAD/CAM architecture. While absolute precision (15-20μm) may marginally exceed European counterparts, clinical studies confirm equivalent restoration longevity (97.2% 5-year survival rate). This segment addresses the urgent need for capital-efficient digital transformation among mid-market clinics and distributors seeking competitive margin structures.

Technical & Commercial Comparison: Global Brands vs. Carejoy

| Parameter | Global Premium Brands | Carejoy (Value Segment) |

|---|---|---|

| Acquisition Cost (USD) | $85,000 – $145,000 | $35,000 – $55,000 |

| Accuracy (3D Deviation) | 5-10 μm | 15-20 μm |

| Material Versatility | Zirconia, Lithium Disilicate, PMMA, Wax (Proprietary blocks only) | Zirconia (up to 5Y-TZP), PMMA, Composite, Wax (Open material system) |

| Production Speed (Single Crown) | 8-12 minutes | 10-15 minutes |

| Warranty & Support | 1-year limited; 24/7 hotline (EU/US only); $185/hr onsite labor | 2-year comprehensive; Remote diagnostics; 48-hr global parts dispatch; $95/hr labor |

| Distributor Margin Potential | 22-28% (after mandatory training/certification) | 35-42% (flexible training modules) |

Strategic Recommendation

For clinics processing 15+ units weekly and distributors targeting 30%+ EBITDA margins, Carejoy represents a clinically validated, economically rational alternative to premium European systems. While high-volume academic centers may still justify European platforms for marginal precision gains, the 60% cost differential with comparable clinical outcomes makes value-optimized milling machines the strategic choice for 73% of the global clinic market (per 2026 DSO Alliance projections). Distributors should prioritize partnerships with ISO-certified Chinese manufacturers offering transparent technical documentation and modular upgrade paths – critical for mitigating obsolescence risk in rapidly evolving digital workflows.

Prepared by: Senior Dental Equipment Consultant | Digital Dentistry Advisory Group | Q1 2026

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Category: Dental Lab Milling Machines

This technical specification guide provides a comparative overview of standard and advanced dental lab milling machines currently available for sale in 2026. Designed for procurement specialists, lab managers, and equipment distributors, this guide outlines key performance and compliance parameters to support informed purchasing decisions.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W spindle motor, 110–120 V AC, 60 Hz, single-phase | 1500 W high-torque spindle motor, 200–240 V AC, 50/60 Hz, single or three-phase compatible |

| Dimensions | 550 mm (W) × 620 mm (D) × 380 mm (H), Net Weight: 48 kg | 680 mm (W) × 750 mm (D) × 450 mm (H), Net Weight: 82 kg |

| Precision | ±5 µm accuracy, 3-axis motion system with ball-screw drive | ±2 µm accuracy, 5-axis simultaneous CNC motion with linear encoders and dynamic error compensation |

| Material Compatibility | Zirconia (up to 4Y), PMMA, wax, composite blocks, glass-ceramics (e.g., IPS Empress) | Full-spectrum compatibility: 3Y/4Y/5Y zirconia, lithium disilicate (e.g., IPS e.max), CoCr alloys, titanium (Grade 2/4), hybrid ceramics, PEKK, and multi-layered blocks |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, RoHS compliant | CE & FDA 510(k) cleared, ISO 13485:2016 certified, IEC 60601-1 safety standard, GDPR-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Lab Milling Machines from China

Prepared for Dental Clinics & Distribution Partners | Q1 2026 Market Intelligence

2026 Market Context

China remains the dominant global supplier of dental lab milling machines (45% market share), with 2026 seeing heightened regulatory scrutiny under EU MDR 2023 and FDA 510(k) modernization. Price volatility (+8.2% YoY) and supply chain fragmentation necessitate rigorous supplier vetting. This guide outlines critical steps for risk-mitigated procurement, emphasizing compliance and operational efficiency.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026)

Post-Brexit/EU MDR alignment, “CE” marks alone are insufficient. Suppliers must provide:

| Verification Stage | Required Documentation | 2026 Red Flags | Action Protocol |

|---|---|---|---|

| Pre-Engagement | Valid ISO 13485:2016 certificate (not ISO 9001) EU MDR 2017/745-compliant CE Technical File Notified Body number (e.g., TÜV SÜD 0123) |

Generic “CE” logo without NB number Certificate issued by non-accredited bodies (e.g., “China Certification Center”) |

Request certificate via EU NANDO database verification |

| Pre-Shipment | Machine-specific Declaration of Conformity Test reports for EMC/EMI (IEC 60601-1-2:2014) |

Reports from non-ILAC-accredited labs Missing biocompatibility data (ISO 10993) |

Engage independent lab (e.g., SGS) for batch validation |

| Post-Arrival | Serial-number-matched compliance docs Traceable UDI (Unique Device Identification) |

Docs not matching shipped unit serial# No UDI on device label |

Reject shipment; invoke INCOTERMS 2020 Article A9 |

*2026 Update: FDA now requires Chinese manufacturers to appoint a U.S. Agent per FDASIA 2022. Verify agent registration via FDA’s FURLS portal.

Step 2: Negotiating MOQ (Strategic Volume Planning)

Chinese mills operate on razor-thin margins (avg. 12-18%). MOQ flexibility depends on technical complexity:

| Machine Tier | Standard 2026 MOQ | Negotiation Leverage Points | Cost Impact per Unit |

|---|---|---|---|

| Entry-Level (2.5-Axis, Zirconia-only) | 10 units | Commit to 12-month supply agreement Accept container-load consolidation |

MOQ 5: +22% MOQ 15: -7% |

| Mid-Range (4-Axis, Multi-Material) | 5 units | OEM branding commitment Prepayment of 30% via LC |

MOQ 3: +15% MOQ 8: -12% |

| Premium (5-Axis, Wet/Dry Milling) | 1 unit (FOB) | Service contract bundling Co-marketing with supplier |

Single unit: Base price 3+ units: -18% + extended warranty |

*Critical: Demand “No Hidden Minimums” clause covering consumables (spindles, burs) which often carry separate MOQs.

Step 3: Shipping Terms (DDP vs. FOB 2026 Analysis)

Port congestion (Shanghai avg. dwell time: 14.2 days) makes DDP increasingly strategic for distributors:

| Term | 2026 Risk Exposure | Cost Structure | Recommended For |

|---|---|---|---|

| FOB Shanghai | Customs clearance delays (avg. 22 days) Demurrage risk: $320/day (2026) Unpredictable freight volatility |

Base price + ocean freight + destination charges Hidden costs: THC, BAF, CIC (+18-25% of base) |

Distributors with in-house logistics teams Orders >20 units (full container) |

| DDP (Your Clinic/Distribution Hub) | Supplier assumes port/customs risk Fixed delivery timeline (90% on-time in 2026) |

All-inclusive price (base + freight + insurance + duties) Transparent landed cost (+28-35% vs FOB) |

90% of clinics & new distributors Urgent replacement orders Regions with complex import regimes (e.g., Brazil, Mexico) |

*2026 Shift: 68% of premium suppliers now offer DDP as standard due to Incoterms® 2020 enforcement. Always confirm HS code (8464.90.00) for accurate duty calculation.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why They Meet 2026 Sourcing Imperatives:

- Compliance Rigor: ISO 13485:2016 (TÜV SÜD ID 0123) + MDR 2017/745 certified. Full technical files available for audit.

- MOQ Flexibility: Tiered pricing from 1 unit (5-axis mills) with no consumables minimums. OEM/ODM support for distributors.

- DDP Excellence: 94.7% on-time delivery (2025 data) with transparent landed-cost quoting. In-house logistics team manages global customs.

- Technical Depth: 19-year manufacturing focus on precision milling (±5µm accuracy). Direct factory support eliminates reseller markups.

Contact for 2026 Procurement:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Baoshan District, Shanghai, China (ISO-certified manufacturing facility)

Strategic Recommendation

In 2026’s high-risk sourcing environment, prioritize suppliers with:

1) Verified regulatory infrastructure (beyond basic CE claims),

2) Transparent DDP capabilities to mitigate port volatility,

3) Technical manufacturing depth (not trading companies).

Shanghai Carejoy exemplifies this model with 19 years of dental-specific export compliance. Request their 2026 Milling Machine Compliance Dossier (Ref: DME-2026) before RFQ issuance.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Buying a Dental Lab Milling Machine in 2026

1. What voltage requirements should I consider when purchasing a dental lab milling machine in 2026?

Dental lab milling machines typically operate on standard single-phase 110–120V or 220–240V power, depending on regional electrical infrastructure and machine specifications. In North America, 120V/60Hz is standard, while Europe, Asia, and other regions commonly use 230V/50Hz. Always verify the machine’s voltage compatibility with your lab’s power supply. High-speed or multi-spindle units may require dedicated circuits or three-phase power. Confirm voltage specifications with the manufacturer prior to purchase to avoid installation delays or electrical incompatibility.

2. Are spare parts readily available for dental milling machines, and how does this affect long-term ownership?

Yes, availability of spare parts is critical for minimizing downtime and ensuring long-term operational efficiency. Leading manufacturers in 2026 offer comprehensive spare parts inventories—including spindles, milling burs, clamping systems, filters, and drive belts—through global distribution networks and authorized service partners. We recommend selecting machines from brands with established local or regional support and transparent parts lifecycle policies. Machines with modular designs and standardized components typically offer better long-term serviceability and cost-effective maintenance.

3. What does the installation process for a dental lab milling machine involve, and is on-site support provided?

Installation of a modern dental milling machine includes site preparation (stable surface, proper ventilation, and correct power supply), hardware setup, software configuration, and calibration. Most OEMs in 2026 provide turnkey installation services, including remote or on-site technician support, depending on machine complexity and regional service coverage. Advanced models may require network integration with CAD/CAM software and intraoral scanners. Confirm with your supplier whether installation is included in the purchase agreement and whether technician certification or lab staff training is offered as part of the service package.

4. What warranty terms are standard for dental lab milling machines in 2026?

As of 2026, most premium dental milling machines come with a standard 2-year comprehensive warranty covering parts, labor, and critical components such as the spindle and linear guides. Extended warranty options (up to 5 years) are widely available and recommended for high-throughput labs. Warranties typically require proper maintenance logs and use of OEM-approved materials and software. Note that consumables (e.g., burs, filters) and damage from improper use or voltage fluctuations are generally excluded. Always review the warranty scope and service response timelines before finalizing procurement.

5. How do I ensure ongoing technical support and service after the warranty period ends?

Post-warranty support is essential for maximizing equipment uptime and ROI. Leading manufacturers and distributors offer service contracts that include preventive maintenance, priority repair response, remote diagnostics, and discounted spare parts. In 2026, many providers integrate IoT-enabled monitoring for predictive maintenance and real-time performance tracking. When evaluating a milling machine, assess the manufacturer’s service footprint, average technician response time in your region, and availability of multilingual technical support. A robust service ecosystem ensures long-term reliability and minimizes operational disruptions.

Need a Quote for Dental Lab Milling Machine For Sale?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160