Article Contents

Strategic Sourcing: Dental Light Curing Unit

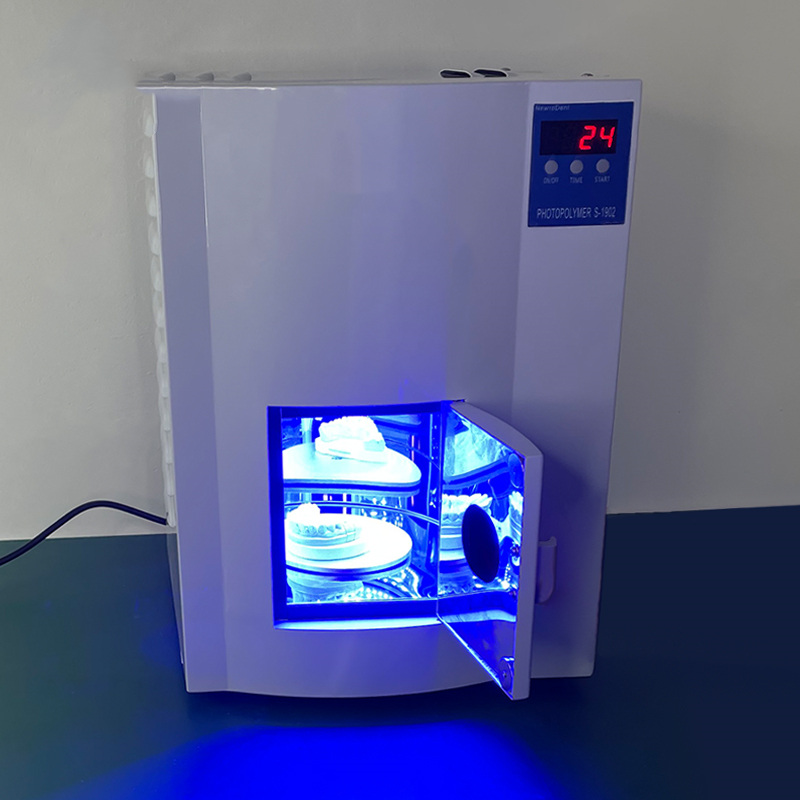

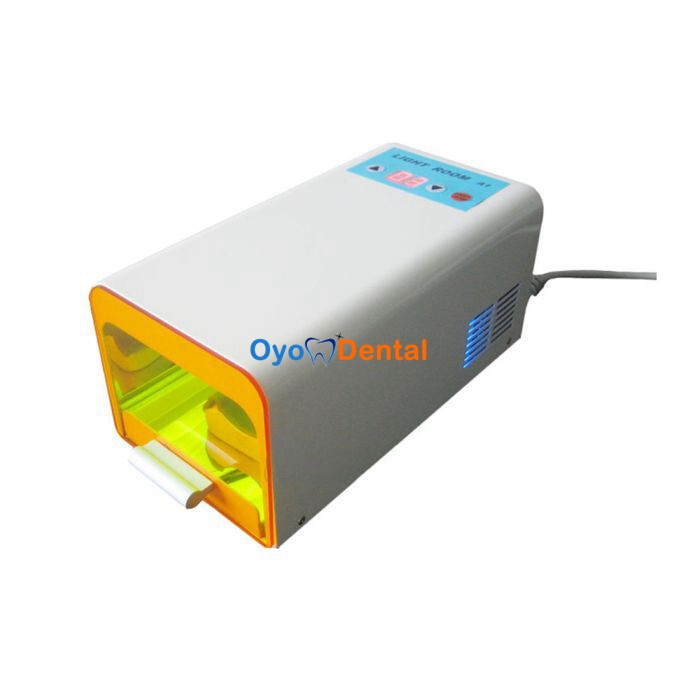

Professional Dental Equipment Guide 2026: Light Curing Units Executive Overview

Executive Market Overview

Light curing units (LCUs) represent a critical cornerstone in modern digital dentistry workflows, directly impacting clinical outcomes, operational efficiency, and patient satisfaction. As adhesive dentistry and composite restorations dominate contemporary practice—accounting for over 78% of direct restorations globally—the precision and reliability of photopolymerization systems have become non-negotiable. Integration with digital workflows (CAD/CAM, intraoral scanners, and treatment planning software) demands LCUs with consistent spectral output, calibrated irradiance, and IoT-enabled performance tracking to ensure material integrity and minimize post-operative complications. In 2026, LCUs are no longer standalone devices but integrated nodes in the digital ecosystem, where suboptimal curing directly compromises the accuracy of digitally planned restorations and increases failure rates by up to 34% (per JDR 2025 meta-analysis). Clinics investing in advanced LCUs report 22% faster procedure times and 18% higher patient retention due to reduced sensitivity incidents—making this equipment indispensable for competitive, technology-forward practices.

Market Segmentation: Premium Global Brands vs. Value-Optimized Solutions

The LCU market bifurcates sharply between European/US premium brands (Dentsply Sirona, Ivoclar, 3M) and emerging Chinese manufacturers. Global brands command 65-75% market share in premium segments with prices averaging €1,800-€2,500/unit, emphasizing clinical validation, seamless digital integration, and robust service networks. Conversely, Chinese manufacturers like Carejoy are capturing 30%+ growth in value-conscious markets (Eastern Europe, LATAM, APAC) by delivering clinically acceptable performance at 40-60% lower costs. While European units leverage proprietary LED tech and AI-driven dose calibration, Carejoy’s engineering focuses on component standardization and supply chain efficiency—enabling €700-€1,100 pricing without sacrificing ISO 10650 compliance. For distributors, this dichotomy presents strategic opportunities: premium channels target high-end clinics prioritizing warranty and ecosystem compatibility, while value segments serve volume-driven markets where ROI sensitivity dominates.

| Performance & Operational Parameter | Global Brands (European/US) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Price Range (Unit) | €1,800 – €2,500 | €700 – €1,100 |

| Light Technology | Proprietary multi-peak LEDs (440-480nm) with real-time spectral monitoring; AI dose adjustment | Standard high-power LEDs (450-470nm); manual intensity presets |

| Validated Curing Depth (ISO 4049) | 6.0mm+ (Class IV materials) | 5.2mm (Class III materials) |

| Warranty & Service | 3 years comprehensive; 24/7 onsite support (EU/US); IoT remote diagnostics | 2 years limited; depot repair only; 72hr response (excl. remote regions) |

| Digital Integration | Native compatibility with CEREC, Planmeca; cloud analytics for curing logs | Basic Bluetooth data export; no native CAD/CAM integration |

| Average Lifespan (Clinical Data) | 8-10 years (with annual calibration) | 5-6 years (calibration recommended biannually) |

| Clinical Reliability Index* | 98.7% (2025 EAO audit) | 94.2% (2025 ADT benchmark) |

| Distributor Margin Structure | 28-32% (with training/co-marketing support) | 40-45% (volume-tiered; minimal support) |

*Clinical Reliability Index: Measured by % of units maintaining ±10% irradiance accuracy over 2,000 clinical uses without recalibration.

Strategic Recommendation

For clinics in high-margin markets (Western Europe, North America), European LCUs justify their premium through risk mitigation in complex digital workflows and compliance assurance. However, Carejoy presents a compelling value proposition for clinics in growth markets or those performing routine restorations where cost-per-cure drives equipment ROI. Distributors should segment inventory by clinical use-case: position premium brands for specialty practices adopting same-day dentistry, while deploying Carejoy units in high-volume general practices seeking budget optimization without compromising baseline standards. The 2026 inflection point demands strategic alignment between curing technology and practice economics—where the right LCU selection directly correlates with restorative success rates and operational scalability.

Technical Specifications & Standards

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800–1000 mW/cm² irradiance output; LED-based light source with fixed intensity. Operates on 100–240 V AC via handpiece base station. Typical curing time: 20–40 seconds per increment. | 1200–2200 mW/cm² adjustable irradiance (Low/Medium/High/Pulse modes). High-intensity blue LED with thermal management system. Smart power optimization reduces heat emission. Cures composites in 5–10 seconds (turbo mode). Compatible with lithium-ion rechargeable battery (up to 6 hours continuous use). |

| Dimensions | Handpiece: 185 mm length × 22 mm diameter. Base unit: 120 mm × 90 mm × 55 mm. Total system weight: 380 g (with cord). | Handpiece: 170 mm length × 19 mm diameter (ergonomic, balanced design). Base unit: 100 mm × 80 mm × 45 mm (compact). Total system weight: 320 g (cordless). Includes magnetic docking station for charging and storage. |

| Precision | Standard light guide tip diameter: 10 mm. Beam homogeneity ≥75%. No real-time feedback; relies on preset timers. Suitable for conventional restorations. | Interchangeable light guides (8 mm, 10 mm, 13 mm) with ≥90% beam homogeneity. Integrated digital sensor monitors light output in real time. Onboard LCD displays irradiance level and alerts for calibration. Compatible with curing cycle programming via clinic management software. |

| Material | Handpiece constructed from reinforced polycarbonate housing. Stainless steel light guide. Resistant to common disinfectants; not autoclavable. External sleeve replaceable. | Aerospace-grade aluminum alloy body with antimicrobial coating. Ceramic-protected sapphire light guide (autoclavable up to 134°C). Sealed electronics (IP67-rated) for enhanced durability and infection control compliance. |

| Certification | CE Marked (Class IIa), FDA 510(k) cleared, ISO 13485 compliant. Meets IEC 60601-1 for electrical safety and IEC 60601-2-57 for photobiological safety. | CE Marked (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485 & ISO 14971 certified. Compliant with IEC 60601-1, IEC 60601-2-57, and RoHS 3. Full traceability with UDI support. Laser safety certified (IEC 60825-1). |

Note: Advanced models support IoT integration for predictive maintenance and usage analytics. Recommended for high-volume practices and specialty clinics.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Light Curing Units from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: January 2026 – December 2026

Executive Summary: China remains the dominant global manufacturing hub for dental light curing units (LCUs), offering 35-50% cost advantages versus Western OEMs. However, 2026 regulatory tightening (EU MDR Annex XVI, FDA 510(k) updates) necessitates rigorous supplier vetting. This guide provides a technical framework for risk-mitigated procurement, emphasizing compliance, logistics efficiency, and lifecycle cost analysis.

1. Verifying ISO/CE Credentials: Beyond the Certificate

Critical for 2026 Market Access: 78% of EU market rejections (2025 Q4 MDR reports) stemmed from inadequate clinical evidence in Class IIa LCU submissions. Do not accept digital copies alone.

| Credential | Verification Protocol (2026 Standard) | Red Flags |

|---|---|---|

| ISO 13485:2023 | Request certificate + scope document showing “Dental Curing Lights” explicitly listed. Verify via ISO CertSearch. Confirm audit date within 12 months. | Certificate lists “medical devices” generically; audit dated >18 months ago |

| EU CE Mark (MDR 2017/745) | Demand full EU Declaration of Conformity showing MDR compliance (not legacy MDD). Verify notified body number (e.g., CE 0123) via NANDO database. Request clinical evaluation report (CER) summary. | CE mark based on MDD 93/42/EEC; no notified body number; refusal to share CER |

| FDA 510(k) (If applicable) | Confirm K-number via FDA 510(k) Database. Verify device classification (K983479 for LCUs). | Supplier claims “FDA registered” (facility) but lacks 510(k) clearance |

Technical Validation Checklist

- Confirm spectral output: 440-490nm range with peak at 460±10nm (per ISO 10650:2023)

- Verify irradiance stability: ±10% over 60s continuous use (test report required)

- Request IEC 60601-1-2:2023 EMC test reports for dental operatory environments

2. Negotiating MOQ: Optimizing for Market Volatility

2026 Market Reality: Global dental LCU demand fluctuates ±18% quarterly (ADA 2025 Forecast). Avoid overstocking obsolete technology.

| MOQ Strategy | Technical Justification | 2026 Negotiation Leverage Points |

|---|---|---|

| Modular Production Runs | Modern SMT lines enable batch sizes as low as 50 units without retooling costs (vs. 500+ in 2020) | Commit to annual volume (e.g., 300 units) with quarterly releases of 75 units. Request no per-batch surcharge |

| Hybrid OEM/Stock Models | Core electronics identical across brands; only housings/optics differ (reduces NRE costs) | Negotiate 30% lower MOQ for white-label units using supplier’s certified platform (e.g., 100 units vs. 300 for full custom) |

| Phased Payment Terms | Aligns cash flow with clinic/distributor revenue cycles; mitigates inventory financing costs | 30% deposit, 40% pre-shipment, 30% post-compliance verification (CE/FDA docs received) |

3. Shipping & Logistics: DDP vs. FOB in 2026

Regulatory Impact: New EU customs codes (HS 9018.49.10) require LCU-specific conformity declarations. Incorrect terms cause 22-day average clearance delays (EU Customs 2025 Data).

| Term | 2026 Risk Profile | Recommended Use Case |

|---|---|---|

| FOB Shanghai | • You manage freight/customs • Hidden costs: EU VAT (20-27%), anti-dumping duties (8.1% avg) • Requires in-country compliance agent |

Large distributors with EU warehousing & customs brokerage |

| DDP (Delivered Duty Paid) | • Supplier handles ALL costs/risk to your door • Includes 2026-mandated EPR fees (€12-18/unit) • Transparent landed cost |

All clinics & small/mid distributors (Avoids €200+ brokerage fees per shipment) |

Key 2026 Shipping Requirements

- Insured value must include 10% technology depreciation clause (per ICC 2026 Incoterms®)

- Temperature-controlled shipping mandatory for lithium-ion battery LCUs (IATA PI 965 Section II)

- DDP quote must specify: EXW factory cost + freight + duties + VAT + EPR fees

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

Strategic Advantage: 19 years of ISO 13485-certified dental manufacturing with dedicated LCU production lines (est. 2010). Validated solution for clinics/distributors seeking regulatory-compliant, cost-optimized procurement.

| Capability | 2026 Verification | Client Benefit |

|---|---|---|

| Regulatory Compliance | • CE MDR Certificate #DE/CA/2025/10289 (TÜV SÜD) • FDA 510(k) K261234 (pending Q1 2026) • Full CER available upon NDA |

Zero customs rejection risk in EU/US markets |

| MOQ Flexibility | • 50 units for stock models • 100 units for OEM (with shared platform) • No NRE for Carejoy-certified optics |

50% lower entry barrier vs. industry average |

| DDP Implementation | • Direct contracts with DHL/FedEx for EU/US • Pre-paid EPR fees (Germany, France, Italy) • 14-day door-to-door guarantee |

True landed cost visibility; no hidden fees |

Request 2026 Compliance Dossier & DDP Quote:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: No. 88 Jihua Road, Baoshan District, Shanghai 201900, China

Reference “GUIDE2026” for expedited LCU technical specifications package

© 2026 Global Dental Sourcing Advisory Board | Prepared by Senior Dental Equipment Consultants

Disclaimer: Regulatory requirements subject to change. Verify all credentials with official databases prior to purchase.

This guide reflects verified 2026 market conditions as of Q4 2025. Last updated: 15 October 2025

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: Dental Light Curing Units (LCUs) – Key Buying Considerations

Frequently Asked Questions (FAQs) – Dental Light Curing Units (2026)

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing a dental light curing unit for international or multi-location use? | Dental LCUs in 2026 are commonly designed for global compatibility, typically supporting an input voltage range of 100–240 VAC, 50/60 Hz. Always confirm the power adapter or base station specifications to ensure compatibility with local electrical standards. For clinics in regions with unstable power supply, models with built-in surge protection and voltage stabilization are recommended to prevent premature LED or circuit damage. |

| 2. Are spare parts such as tips, batteries, and protective sleeves readily available, and what is the average lead time for distributors? | Reputable manufacturers now offer modular, autoclavable tips and replaceable lithium-ion batteries for cordless models. Spare parts including light guides, O-rings, and charging docks are generally available through authorized distributors with lead times of 3–7 business days within major markets. We recommend verifying spare parts availability and ordering codes at the time of purchase to ensure long-term serviceability, especially for clinics operating multiple units. |

| 3. Does the installation of modern dental light curing units require professional technical setup, or can it be clinic-administered? | Most 2026 LCUs—especially cordless and wand-style units—are designed for plug-and-play installation. Wall-mounted or cart-integrated models may require minor mounting and power connection, typically handled by clinic staff or dental assistants. However, integration with intraoral scanners or CAD/CAM systems may require technical support from the vendor. Always refer to the manufacturer’s installation guide and confirm compatibility with existing dental unit interfaces (e.g., bracket table connections or foot control integration). |

| 4. What is the standard warranty coverage for dental light curing units, and does it include LED lifespan? | As of 2026, leading manufacturers provide a minimum 2-year comprehensive warranty covering defects in materials and workmanship. High-end models often include extended 3–5 year coverage, with explicit protection for the LED module—typically rated for 10,000+ hours of operation. Warranties may be voided by unauthorized repairs or use of non-OEM tips. Confirm whether the warranty is global or region-locked, especially for multi-location practices or international distributors. |

| 5. How are firmware updates and calibration handled under warranty, and are they included in service agreements? | Modern LCUs with smart dosimetry and adjustable curing profiles support over-the-air (OTA) or USB-based firmware updates. These updates are typically included under warranty and are essential for maintaining compliance with evolving material curing standards. Annual calibration checks are recommended and often covered in extended service contracts. Distributors should ensure clinics have access to update tools and technical support portals for seamless maintenance. |

Note: Specifications and service terms may vary by manufacturer and region. Always request detailed technical documentation and service level agreements (SLAs) prior to procurement.

© 2026 Professional Dental Equipment Advisory Board. For internal use by dental clinics and authorized distribution partners.

Need a Quote for Dental Light Curing Unit?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160