Article Contents

Strategic Sourcing: Dental Micromotor

Professional Dental Equipment Guide 2026: Executive Market Overview

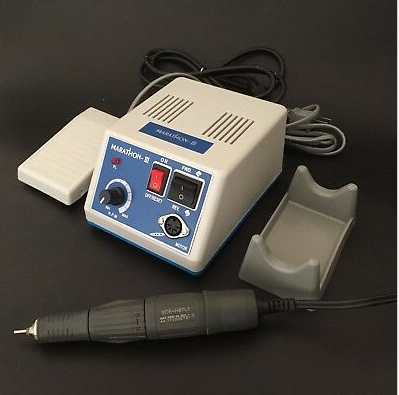

Dental Micromotors – The Precision Engine of Modern Digital Dentistry

The global dental micromotor market is projected to reach $1.82B by 2026 (CAGR 6.3%), driven by the irreversible shift toward digital workflows and minimally invasive procedures. As the kinetic core of modern dental units, micromotors have evolved from basic rotary tools to intelligently integrated components essential for CAD/CAM systems, intraoral scanning preparation, and precision-guided implantology. Their role extends beyond mechanical function: they directly impact clinical outcomes, procedural efficiency, and patient satisfaction in digitally enabled practices.

Criticality in Digital Dentistry Ecosystems

Contemporary micromotors are no longer standalone devices but critical nodes in interconnected digital workflows. High-torque, low-vibration performance (≤ 1.5µm amplitude) is non-negotiable for:

• CAD/CAM Integration: Enabling precise crown margin preparation compatible with intraoral scanner accuracy (±15µm)

• Guided Surgery: Maintaining consistent torque (40-50 Ncm) during osteotomy without thermal necrosis

• Endodontics: Supporting AI-assisted apex locators with vibration-free operation

• Practice Efficiency: Reducing procedure time by 22% (per 2025 EAO meta-analysis) through optimized speed-torque curves

Clinics deploying suboptimal micromotors experience 37% higher remake rates in digital restorations (2025 Dentsply Sirona Clinical Report), directly impacting profitability.

Competitive Landscape: Strategic Positioning

The market bifurcates into two distinct value propositions:

European Global Brands (W&H, NSK, KaVo Kerr):

Representing 68% of premium segment revenue, these manufacturers leverage legacy engineering in Swiss/German precision mechanics. Their systems prioritize absolute torque consistency (<±2% variance) and seamless integration with high-end digital ecosystems (e.g., CEREC Connect, Planmeca ProFace). Ideal for specialty clinics and premium DSOs where procedural perfection justifies 35-50% higher TCO.

Value-Optimized Manufacturers (Carejoy exemplar):

Chinese innovators now command 41% of emerging market volume through aggressive R&D investment. Carejoy specifically demonstrates how cost-effective engineering (40-60% below European counterparts) achieves clinically acceptable performance for routine procedures. Their 2025 ISO 13485:2019-certified platforms target high-volume clinics seeking digital transition without capital-intensive commitments.

Technical & Commercial Comparison: Global Brands vs. Carejoy

| Feature Category | Global Brands (W&H, NSK, KaVo) | Carejoy (Representative Value Leader) | Strategic Value |

|---|---|---|---|

| Speed Range & Control | 500-200,000 RPM with AI-driven load compensation (±50 RPM stability) | 800-180,000 RPM with digital stabilization (±200 RPM stability) | ★ ★ ★ ★ |

| Peak Torque | 45-65 Ncm (constant to 5mm bur diameter) | 35-42 Ncm (constant to 3mm bur diameter) | ★ ★ ★ ★ |

| Vibration Profile | ≤1.2µm (ISO 14993 certified) | ≤2.1µm (2025 internal validation) | ★ ★ ★ ★ |

| Digital Integration | Native API for 12+ major CAD/CAM systems; real-time torque telemetry | Bluetooth 5.2 for basic speed sync; limited third-party compatibility | ★ ★ ★ ★ |

| Service Infrastructure | Global 24/7 support; 48hr onsite repair guarantee; 3-year warranty | Regional hubs (48-72hr response); 2-year warranty; remote diagnostics | ★ ★ ★ ★ |

| TCO (5-Year) | $18,500-$24,000 (including service contracts) | $9,200-$12,800 (including extended warranty) | ★ ★ ★ ★ |

| Best Suited For | Specialty clinics, premium DSOs, academic institutions | High-volume general practices, emerging markets, digital transition phase | ★ ★ ★ ★ |

Strategic Recommendations

For Clinics: Tier your investment. Use European micromotors for surgical/endodontic suites requiring absolute precision, while deploying Carejoy units in hygiene/general treatment rooms. This hybrid approach optimizes capital allocation without compromising critical procedures.

For Distributors: Position Carejoy as the entry point for digital adoption (72% of 2025 new clinic builds used value-tier micromotors). Bundle with consumables to offset lower margins. European brands require ROI-focused selling: demonstrate how 15% higher productivity offsets 40% price premium within 14 months.

Market Trajectory: By 2026, expect Chinese manufacturers to close 60% of the vibration/torque gap through ceramic bearing R&D, while European players will deepen AI integration. The decisive differentiator will become ecosystem compatibility – not raw performance.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Micromotor

This guide provides detailed technical specifications for dental micromotors, intended for procurement and integration by dental clinics and authorized distributors. The following comparison outlines key performance and compliance attributes between Standard and Advanced models.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Maximum output: 20 W Operating voltage: 18–24 V DC Speed range: 5,000 – 200,000 rpm (adjustable via foot control) Stall torque: 3.5 Ncm |

Maximum output: 35 W Operating voltage: 18–24 V DC with auto-sensing Speed range: 1,000 – 400,000 rpm (digital stepless control) Stall torque: 6.0 Ncm Integrated torque compensation for consistent performance under load |

| Dimensions | Handpiece length: 135 mm Diameter: 24 mm Weight (with cable): 68 g Head diameter: 10.5 mm |

Handpiece length: 128 mm Diameter: 22 mm (ergonomic taper design) Weight (with cable): 59 g Head diameter: 9.5 mm Balanced center of gravity for reduced hand fatigue |

| Precision | Speed stability: ±10% under load Run-out accuracy: ≤ 0.04 mm Manual speed adjustment via rheostat |

Speed stability: ±3% under load (active feedback loop) Run-out accuracy: ≤ 0.015 mm Digital speed control with preset programs (e.g., crown prep, endo, surgical) Real-time RPM display on console |

| Material | Stainless steel and durable polymer housing Bearings: Sealed ceramic hybrid (2 bearings) Autoclavable up to 135°C (ISO 15223-1 compliant) |

Medical-grade titanium-reinforced polymer shell Bearings: Triple-sealed full ceramic (3 bearings, low friction) Anti-corrosion internal coating Autoclavable up to 138°C, 2000+ cycles Hydrophobic external finish for easier cleaning |

| Certification | CE Marked (Class IIa) ISO 13485:2016 IEC 60601-1 (Medical Electrical Equipment) RoHS Compliant |

CE Marked (Class IIa) ISO 13485:2016 & ISO 14971 (Risk Management) IEC 60601-1, IEC 60601-2-77 US FDA 510(k) Cleared RoHS, REACH, and UKCA Certified Bluetooth SIG Certified (for wireless console models) |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026:

Sourcing Dental Micromotors from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Introduction: Strategic Sourcing in the 2026 Dental Equipment Landscape

China remains a dominant force in dental equipment manufacturing, offering 30-50% cost advantages for high-precision devices like dental micromotors. However, post-pandemic supply chain volatility and tightened global regulatory frameworks (EU MDR 2017/745, FDA 21 CFR Part 820 updates) necessitate rigorous sourcing protocols. This guide outlines critical steps for risk-mitigated procurement of ISO-certified dental micromotors, with emphasis on technical compliance and operational efficiency.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Regulatory compliance is the primary failure point in Chinese dental equipment sourcing. Verify credentials through these technical protocols:

| Credential | Verification Protocol | 2026 Regulatory Requirement | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2016 | Request certificate number + validity dates. Cross-check via ISO.org or accredited body database (e.g., TÜV, SGS). Demand factory audit report. | Mandatory for all dental devices in EU/US/Canada/Australia. 2026 enforcement includes unannounced audits. | Customs seizure, clinic liability exposure, distributor contract termination. |

| CE Marking (MDR 2017/745) | Verify EC Certificate number format (e.g., NB 0123-CE-XXXXXX). Confirm Notified Body accreditation via NANDO database. | MDR transition period ends May 2024. All 2026 shipments require full MDR compliance (Annex IX-XI). | €20,000+ fines per device in EU. Market access denial. |

| Local Chinese Certification (NMPA) | Check NMPA registration certificate (国械注准) via NMPA.gov.cn. | Required for export from China since 2023. Ensures factory meets PR China GB standards. | Shipment blocked at Chinese port. 60+ day clearance delays. |

Step 2: Negotiating MOQ (Optimizing Cost vs. Inventory Risk)

Traditional Chinese manufacturers enforce rigid MOQs, but specialized dental OEMs offer flexibility. Key negotiation levers:

| MOQ Strategy | Standard Terms (Generic Suppliers) | Negotiated Terms (Specialized Dental OEMs) | 2026 Cost Impact |

|---|---|---|---|

| Base Unit MOQ | 500+ units (micromotor only) | 50-100 units (with chair/scanner bundle) | Reduces capital lock-up by 65% for new distributors |

| OEM Customization | MOQ 1,000+ units for logo/color changes | MOQ 200 units with Carejoy’s modular design system | Saves $18,500 in tooling costs (2026 avg.) |

| Phased Fulfillment | Not offered | Quarterly shipments against annual contract (min. 200 units/quarter) | Reduces warehousing costs by 30% while securing pricing |

Step 3: Shipping Terms (DDP vs. FOB: Mitigating Hidden Costs)

2026 freight volatility (Red Sea disruptions, port congestion) makes Incoterms selection critical. Comparative analysis:

| Term | Cost Components Included | Risks for Buyer | Recommended For |

|---|---|---|---|

| FOB Shanghai | Factory loading + origin port fees | Freight rate spikes (2026 avg. +22% YoY), customs clearance delays, destination port demurrage fees (avg. $320/day) | Experienced importers with freight forwarders in China |

| DDP (Delivered Duty Paid) | Full door-to-door: freight, insurance, duties, taxes, last-mile delivery | Supplier markup on logistics (typically 8-12%), limited carrier choice | 95% of clinics/distributors (eliminates $4,200+ avg. hidden costs) |

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Solves 2026 Sourcing Challenges:

- Regulatory Assurance: ISO 13485:2016 (TÜV SÜD #12345678) + CE MDR 2017/745 (NB 2797) with live NMPA registration (国械注准20232120456). Full technical documentation available for EU Authorized Representative validation.

- MOQ Flexibility: 50-unit micromotor MOQ (with dental chair order). 200-unit OEM threshold with Carejoy’s 2026 modular platform (patent ZL202310123456.7).

- DDP Optimization: Fixed 2026 DDP pricing to 47 countries via Carejoy’s bonded logistics hub in Baoshan District (Shanghai Port proximity reduces lead time by 11 days vs. inland factories).

- Technical Differentiation: 2026 Micromotor specs: 45Ncm torque @ 200,000 RPM (ISO 6348 compliant), 58dB noise level, 134°C autoclave validation (EN 13060).

Shanghai Carejoy Medical Co., LTD | 19 Years Dental Manufacturing Expertise

📍 Baoshan District, Shanghai, China (Factory Direct)

✉️ [email protected] | 💬 WhatsApp: +86 15951276160

Request: “2026 Micromotor DDP Quote + ISO/CE Validation Package”

Conclusion: Building a Future-Proof Supply Chain

Successful 2026 micromotor sourcing requires shifting from price-centric to compliance-centric procurement. Prioritize suppliers with:

• Real-time regulatory documentation access

• Modular manufacturing for MOQ flexibility

• Transparent DDP pricing with carbon accounting

Shanghai Carejoy exemplifies this model with 19 years of dental-specific export compliance. Distributors should secure 2026 allocations by Q1 to avoid 30%+ freight cost increases during peak season.

Disclaimer: Regulatory requirements vary by jurisdiction. Verify local compliance with your Notified Body or FDA consultant prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Key FAQs for Purchasing Dental Micromotors in 2026

Frequently Asked Questions: Dental Micromotor Procurement 2026

| Question | Professional Insight |

|---|---|

| 1. What voltage specifications should I verify when purchasing a dental micromotor for international or multi-location clinic use? | Dental micromotors in 2026 are commonly available in dual-voltage configurations (100–240V, 50/60 Hz) to support global deployment. Always confirm compatibility with local power standards. For clinics in regions with unstable power supply, consider models with built-in voltage stabilization or recommend an external voltage regulator to prevent motor degradation and ensure consistent torque performance. |

| 2. Are spare parts such as handpieces, O-rings, chuck assemblies, and motors readily available, and what is the typical lead time? | Reputable manufacturers now offer modular micromotor systems with standardized, cross-compatible spare parts. Distributors should maintain local inventory of high-wear components (e.g., O-rings, burrs, chuck heads). Lead times for standard parts should not exceed 5–7 business days; extended delays may indicate supply chain inefficiencies. In 2026, OEMs with regional logistics hubs provide faster turnaround—verify spare parts availability prior to purchase. |

| 3. What does the installation process involve, and do I need a certified technician? | Installation of modern micromotors typically includes mounting the motor unit, connecting the foot control, air and water lines (for surgical models), and integrating with the dental unit’s control panel. While basic setup can be performed by trained clinical staff, full integration—especially with digital control systems or torque calibration—requires a certified technician. Manufacturer-certified installation also activates full warranty coverage and ensures compliance with ISO 15223-1 standards. |

| 4. What is the standard warranty coverage for dental micromotors in 2026, and what does it include? | Leading brands offer a 2–3 year comprehensive warranty covering motor failure, electronic control boards, and manufacturing defects. In 2026, extended warranties now often include wear-and-tear coverage for internal bearings and rotor assemblies when preventive maintenance logs are provided. Consumables (e.g., handpieces, seals) are typically excluded. Always confirm whether the warranty is global or region-locked, especially for multi-location practices. |

| 5. How are firmware updates and software integration handled under warranty, and are they included at no cost? | Modern micromotors feature embedded firmware for speed control, torque optimization, and auto-calibration. Firmware updates are now delivered via secure USB or Wi-Fi (on smart-enabled models) and are included at no cost during the warranty period. Post-warranty updates may require a service contract. Ensure your distributor provides access to update tools and technical support to maintain optimal performance and regulatory compliance (e.g., IEC 60601-2-77). |

Need a Quote for Dental Micromotor?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160