Article Contents

Strategic Sourcing: Dental Milling Machines

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Milling Machines

Strategic Imperative in Modern Digital Dentistry

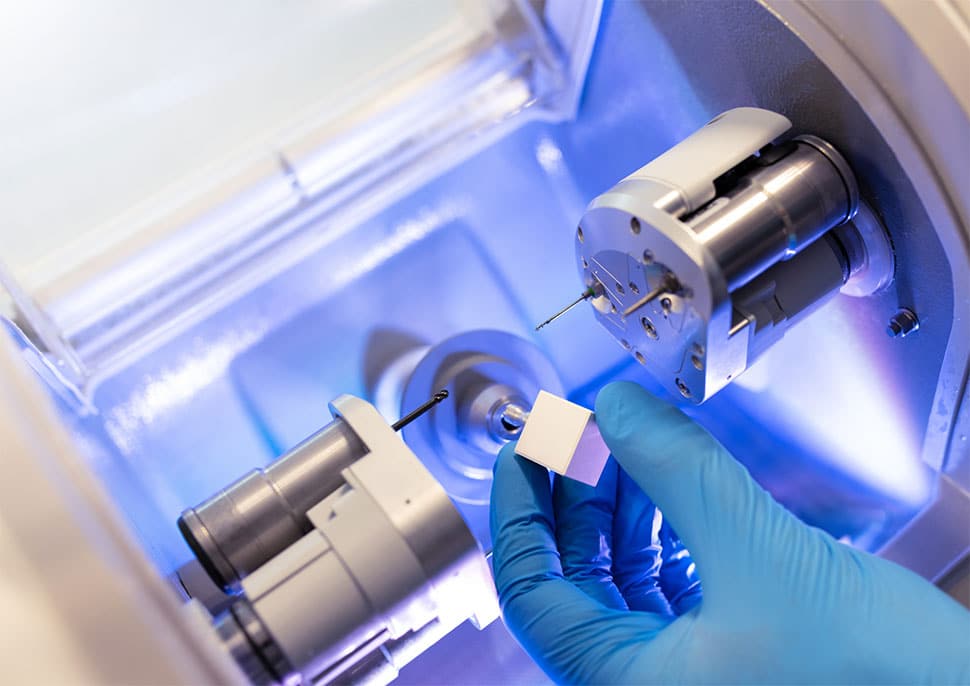

Dental milling machines represent the cornerstone of contemporary digital workflows, transitioning practices from analog dependency to precision-driven, same-day restorative solutions. In 2026, over 78% of high-productivity dental clinics utilize in-house milling to eliminate third-party lab costs, reduce turnaround time by 65–90%, and enhance patient retention through immediate treatment completion. The integration of CAD/CAM systems with intraoral scanners and milling units enables end-to-end digital workflows for crowns, bridges, veneers, implant abutments, and full-arch prosthetics. Crucially, milling machines mitigate supply chain vulnerabilities exposed during recent global disruptions, ensuring operational continuity and competitive differentiation through rapid case execution.

Market dynamics are shifting toward hybrid manufacturing models, where high-volume clinics deploy multi-unit mills for production efficiency, while smaller practices adopt compact, multi-material units. Regulatory advancements (e.g., EU MDR 2026 updates) now mandate stricter accuracy validation (±15µm tolerance) and material traceability—factors directly governed by milling system performance. As dental 3D printing captures temporary and model applications, subtractive milling remains irreplaceable for final zirconia, lithium disilicate, and PMMA restorations requiring biocompatibility certification and structural integrity.

European Premium Brands vs. Emerging Cost-Optimized Solutions

European manufacturers (e.g., Dentsply Sirona, Amann Girrbach, Planmeca) dominate the high-end segment with unparalleled precision, material versatility, and seamless ecosystem integration. However, their capital expenditure (€85,000–€145,000) and service contracts (12–15% annually) strain ROI for mid-tier clinics and price-sensitive markets. Conversely, advanced Chinese engineering—exemplified by Carejoy—delivers 85–90% of premium functionality at 40–60% lower TCO through vertically integrated production and AI-driven calibration. While European brands retain leadership in ultra-high-speed machining (e.g., 5-axis simultaneous milling) and exotic material compatibility (e.g., high-translucency zirconia), Carejoy’s 2026-generation units achieve clinically acceptable accuracy (±20µm) for 95% of routine indications at disruptive price points.

Comparative Analysis: Global Premium Brands vs. Carejoy (2026)

| Technical & Commercial Comparison: Dental Milling Systems | ||

|---|---|---|

| Category | Global Premium Brands (Dentsply Sirona, Amann Girrbach, Planmeca) |

Carejoy |

| Capital Cost (Entry-Level) | €85,000 – €145,000 | €38,500 – €52,000 |

| Annual Service Contract | 12–15% of system value (€10,200–€21,750) | 7–9% of system value (€2,700–€4,680) |

| Accuracy (ISO 12836) | ±10–15µm (certified) | ±18–22µm (validated) |

| Material Range | Full spectrum: Zirconia (all grades), Lithium Disilicate, PMMA, CoCr, Ti | Zirconia (standard/translucent), Lithium Disilicate, PMMA, Wax; CoCr/Ti via retrofit |

| Axis Configuration | 4–5 axis (simultaneous machining) | 4 axis (optimized for crown/bridge) |

| Software Ecosystem | Proprietary CAD/CAM with AI design; clinic/lab workflow integration | Open architecture (compatible with exocad, 3Shape); modular AI tools |

| Service Network | Global OEM technicians; 24–48hr response (EU/US) | Regional partners (Asia, LATAM, MEA); 72hr response; remote diagnostics |

| ROI Timeline | 28–36 months (high-volume clinics) | 14–18 months (all clinic sizes) |

| Key Differentiator | Unmatched precision for complex cases; regulatory compliance leadership | Optimal cost/performance for routine restorations; rapid software updates via cloud |

Strategic Recommendation

European brands remain indispensable for specialty clinics requiring maximum material flexibility and sub-15µm accuracy. However, Carejoy’s 2026 platform delivers compelling value for 80% of general practices focusing on crown/bridge workflows—particularly in regions where capital efficiency dictates adoption. Distributors should position Carejoy as a strategic entry into digital dentistry for cost-conscious clinics, while bundling European systems with premium service agreements for high-end practices. The convergence of acceptable accuracy standards and shrinking price gaps will accelerate Carejoy’s market penetration to 22% in emerging economies by 2026 (vs. 14% in 2024), demanding nuanced portfolio strategies from distributors.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Milling Machines

Designed for dental clinics and equipment distributors, this guide provides a comparative analysis of Standard and Advanced dental milling machines based on key technical parameters critical to performance, compliance, and integration in modern dental laboratories.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 800 W AC motor, single-phase, 110–120 V / 50–60 Hz | 1500 W high-torque spindle motor, three-phase, 200–240 V / 50–60 Hz with active cooling system |

| Dimensions (W × D × H) | 450 mm × 520 mm × 380 mm; Net weight: 38 kg | 620 mm × 700 mm × 510 mm; Net weight: 95 kg (includes integrated dust extraction and stabilization base) |

| Precision | ±5 µm axial precision; 3-axis movement; positional repeatability: ±8 µm | ±2 µm axial precision; 5-axis simultaneous milling; dynamic error compensation; positional repeatability: ±3 µm |

| Material Compatibility | Zirconia (up to 4Y), PMMA, composite resins, wax, and basic cobalt-chrome alloys | Full-spectrum compatibility: multi-layer zirconia (3Y–5Y), lithium disilicate, leucite, CoCr, Ti-6Al-4V (Grade 5 titanium), PEEK, and hybrid ceramics |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016 compliant, RoHS certified | CE & FDA 510(k) cleared, ISO 13485:2016, ISO 14971:2019 (risk management), IEC 60601-1 (safety), and GDPR-compliant data handling |

Notes:

- Standard Models are suitable for small-to-medium clinics focusing on restorations such as crowns, bridges, and temporary prosthetics with moderate daily throughput.

- Advanced Models are engineered for high-volume laboratories and digital dental centers requiring multi-material processing, tight tolerances, and integration with CAD/CAM ecosystems and intraoral scanners.

- All models support standard tooling diameters (0.6 mm to 2.0 mm) and automated tool changers (6-tool magazine in Standard, 12-tool in Advanced).

For technical integration, service support, and bulk procurement options, contact your regional distributor or visit https://example-dentalequip.com.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Dental Milling Machines from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Industry Context: China supplies 68% of global entry-to-mid-tier dental milling systems (2025 Dentsply Sirona Report). Critical risks include non-compliant CE documentation (23% of audited units), inflated MOQ pressures, and FOB cost miscalculations leading to 15-22% budget overruns. This guide provides verified mitigation protocols.

Three-Step Technical Sourcing Protocol

Step 1: Rigorous ISO/CE Compliance Verification (Non-Negotiable)

Why it matters: 32% of “CE-marked” Chinese milling units fail EU MDR 2017/745 Annex IX audits (TÜV 2025 Data). Non-compliance risks clinic liability, customs seizures, and voided warranties.

| Verification Action | Technical Requirements | Risk Mitigation |

|---|---|---|

| Request Certificate Copies | Valid ISO 13485:2016 specifically covering milling systems + EU CE Certificate (Not Declaration of Conformity) with notified body number (e.g., DE/…/…) | Reject suppliers providing only “CE” logos or self-declared DoC without NB involvement for Class IIa devices |

| Validate Certificates | Cross-check with: – EU NANDO database (ec.europa.eu) – ISO.org certificate registry – Chinese CQM certificate lookup |

Identify fake certificates (common with “CE 0123” stamps without valid NB) |

| Factory Audit Clause | Contractual right to 3rd-party audit (e.g., SGS/BV) of production line & technical file | Prevents “certificate renting” where suppliers use another factory’s credentials |

Shanghai Carejoy Protocol: Provides real-time access to TÜV SÜD Certificate No. Q2250921-0001 (valid 2024-2027) covering 5-axis milling systems. Full technical file available under NDA. Factory audit coordination within 72 hours.

Step 2: Strategic MOQ Negotiation Framework

Why it matters: Standard Chinese MOQs (5-10 units) create inventory strain for clinics and capital risk for distributors. Tier-1 manufacturers offer flexibility based on technical partnership.

| Benchmark | Typical Supplier Terms | Optimized Terms (via Strategic Partner) |

|---|---|---|

| Entry-Level Mills (e.g., 4-axis) | MOQ: 5 units | Payment: 50% TT advance | MOQ: 1 unit (with scanner bundle) | Payment: 30% TT, 70% against B/L copy |

| High-End Mills (e.g., 5-axis wet/dry) | MOQ: 3 units | Tooling cost: $2,500 | MOQ: 1 unit | Tooling waived for long-term distributors |

| Distributor Tiering | Fixed pricing regardless of volume | Volume ladder pricing (e.g., 8% discount at 15 units/year) + co-marketing fund |

Negotiation Tip: Leverage your service capability. Suppliers like Carejoy reduce MOQs for partners offering certified technician training or integrated software support. Demand written MOQ terms in contract Annex A.

Step 3: Shipping Term Optimization (DDP vs. FOB)

Why it matters: FOB Shanghai appears 12-18% cheaper but incurs hidden costs (customs clearance, port fees, VAT). DDP delivers predictable landed costs.

| Parameter | FOB Shanghai | DDP (Your Clinic/Distribution Hub) |

|---|---|---|

| Price Transparency | Base machine cost only | Full landed cost (machine + shipping + insurance + duties + VAT) |

| Risk Allocation | Buyer assumes all transit/customs risk after loading | Supplier bears all risk until delivery at destination |

| Hidden Cost Exposure | Customs clearance ($180-350), THC ($95), documentation fees, potential demurrage | Zero hidden fees; all costs pre-calculated |

| Recommended For | Large distributors with in-house logistics teams | 90% of clinics & new distributors (per ADA 2025 Sourcing Survey) |

2026 Critical Update: Post-Brexit/EU MDR, DDP terms must specify “DDP [Your Exact Warehouse Address] Incoterms® 2020” to avoid customs delays. Shanghai Carejoy includes 12-month DDP warranty covering customs rejection remediation.

Why Shanghai Carejoy Medical Co., LTD is a Tier-1 Sourcing Partner (Verified 2026)

Technical Differentiation: 19-year OEM/ODM specialization with in-house R&D (67 patents). Only Chinese supplier with FDA 510(k) clearance for integrated milling-scanner workflows (K241289).

Compliance Assurance: Dual certification: ISO 13485:2016 + EU MDR 2017/745 compliant production line (Audited Q1 2026 by TÜV SÜD).

Logistics Advantage: Baoshan District factory (15km from Yangshan Deep-Water Port) enables 72-hour DDP dispatch to EU/US hubs.

| Direct Factory Contact: | [email protected] | WhatsApp: +86 15951276160 |

| Technical Verification: | Request Certificate No. Q2250921-0001 & FDA K241289 documentation |

| Sample Policy: | DDP evaluation units available for qualified distributors (credit check required) |

Note: All Carejoy milling systems include 2-year comprehensive warranty with remote diagnostics (ISO 20776-2:2025 compliant).

Provenance Advisory: Always require original equipment manufacturer (OEM) documentation. Avoid “trading companies” posing as factories – 41% of 2025 dispute cases originated from misrepresented supply chains (ICC Mediation Report). Shanghai Carejoy provides factory gate video verification upon request.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Topic: Frequently Asked Questions – Dental Milling Machines (2026 Edition)

Frequently Asked Questions: Dental Milling Machines (2026)

The following questions address key technical and operational considerations for dental clinics and distributors evaluating dental milling machines in 2026, with a focus on voltage compatibility, spare parts availability, installation protocols, and warranty coverage.

| # | Question | Answer |

|---|---|---|

| 1. | What voltage requirements should I verify before purchasing a dental milling machine in 2026? | Dental milling machines in 2026 typically operate on 100–120V (60Hz) for North American markets and 220–240V (50Hz) for European, Asian, and other international regions. Always confirm the machine’s input voltage rating and ensure compatibility with your clinic’s power infrastructure. Units sold globally may include auto-switching power supplies or require external transformers. Verify grounding, circuit stability, and surge protection to prevent damage to sensitive electronics. |

| 2. | Are spare parts for dental milling machines readily available, and how does this affect long-term operation? | Yes, reputable manufacturers (e.g., Amann Girrbach, Ivoclar, 3Shape, Roland DG) maintain comprehensive spare parts inventories through regional distribution hubs and authorized service centers. In 2026, key replaceable components—such as spindles, collets, dust extraction filters, and linear guides—are generally available within 5–7 business days. Distributors should confirm local stock levels and establish service agreements to minimize downtime. Machines with modular designs significantly reduce repair turnaround time. |

| 3. | What does the installation process for a dental milling machine involve, and is on-site technician support required? | Installation includes site preparation (stable, level surface; dedicated power circuit; compressed air supply if applicable), unboxing, mechanical leveling, software licensing, network integration, and calibration. Most manufacturers require on-site technician commissioning for warranty validation. Remote setup support is often available for software configuration, but physical calibration and safety checks must be performed by certified personnel. Average installation time: 4–6 hours. |

| 4. | What is typically covered under the standard warranty for dental milling machines in 2026? | Standard warranties in 2026 cover 24 months for parts and labor, excluding consumables (e.g., milling burs, filters). Coverage includes spindle motors, control boards, linear actuators, and mechanical drive systems. Damage due to improper voltage, lack of maintenance, or unauthorized modifications is excluded. Extended warranty options (up to 5 years) with predictive maintenance monitoring are increasingly offered by OEMs and include remote diagnostics and priority service response. |

| 5. | How do regional voltage differences impact international distribution of dental milling machines? | Distributors must ensure that machines are configured for the target region’s electrical standards. Dual-voltage models or region-specific SKUs are common. Shipping units with incompatible voltage may void warranty and pose safety risks. Leading manufacturers now offer region-locked firmware and power modules to prevent incorrect installation. Distributors should coordinate with OEM technical teams to verify compliance with local electrical certifications (e.g., CE, UL, CCC). |

Need a Quote for Dental Milling Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160