Article Contents

Strategic Sourcing: Dental Scan Machine

Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: Dental intraoral scanners (IOS) have evolved from optional peripherals to mission-critical infrastructure in modern dental workflows. By 2026, 89% of EU and North American clinics implementing digital dentistry cite IOS as the foundational technology enabling same-day restorations, reduced remakes, and patient experience differentiation. The global IOS market is projected to reach $3.8B by 2027 (CAGR 14.2%), driven by CAD/CAM integration, tele-dentistry expansion, and insurance reimbursement shifts toward digital workflows.

Critical Role in Digital Dentistry Ecosystems

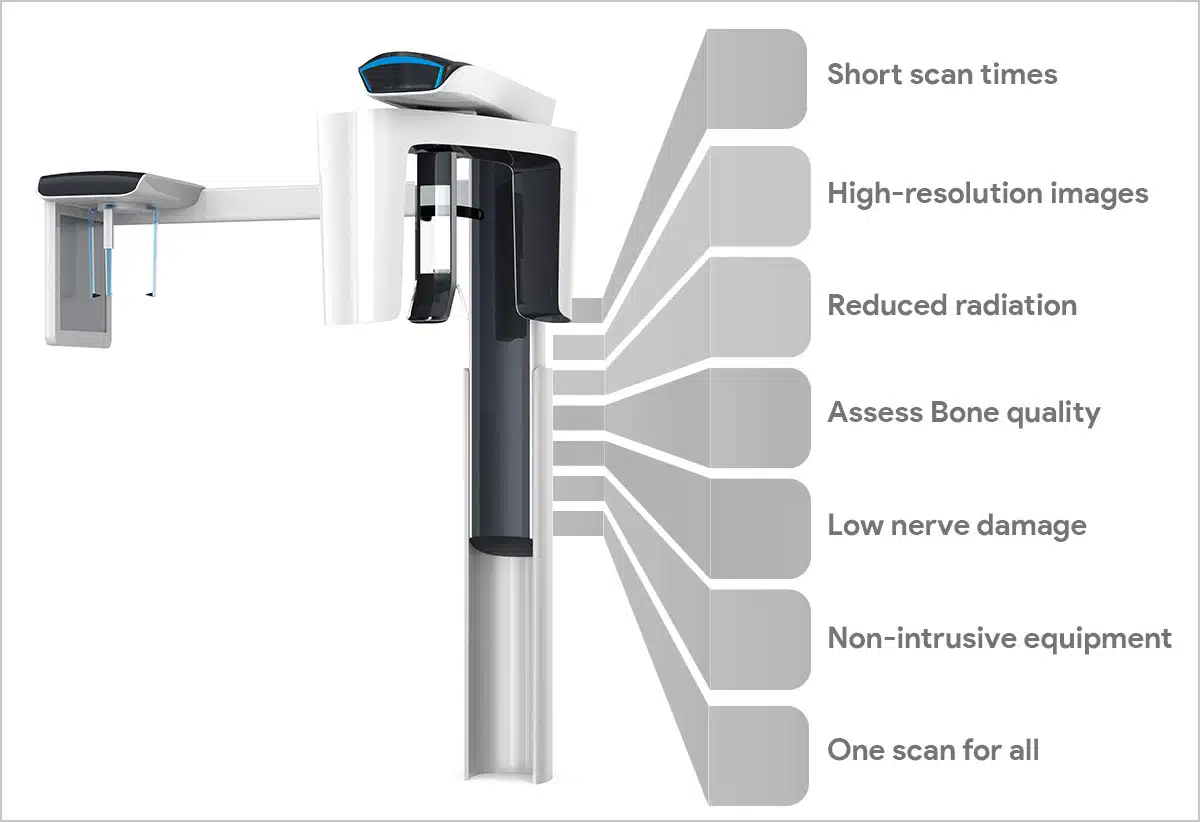

Dental scan machines serve as the primary data acquisition gateway for integrated digital workflows. Their strategic value extends beyond impression capture to:

- Workflow Acceleration: Reducing crown-to-cementation time by 65% compared to traditional impressions

- Diagnostic Integration: Enabling AI-powered caries detection and occlusal analysis through spectral imaging

- Practice Scalability: Supporting teledentistry consults with STL export capabilities and cloud-based collaboration

- Margin Protection: Cutting material/lab costs by 30-40% while reducing remake rates to <2% (vs. 12% for conventional impressions)

As dental practices transition toward “digital first” models, scanner interoperability with practice management software (PMS) and lab networks has become a key ROI determinant, with 78% of clinics prioritizing ecosystem compatibility over standalone features.

Market Segmentation: Premium Global Brands vs. Value-Optimized Manufacturers

The IOS market exhibits a clear bifurcation:

European/US Premium Brands (3Shape, Dentsply Sirona, Planmeca): Dominate high-end clinics with sub-10μm accuracy, seamless CAD/CAM integration, and enterprise-grade support. However, their $28,000-$45,000 price points create adoption barriers for SME clinics, particularly in price-sensitive markets. Recent firmware updates focus on AI-driven margin detection and predictive occlusion analysis.

Value-Optimized Manufacturers (Carejoy exemplar): Address the critical “digital entry point” segment with strategically engineered cost efficiency. Chinese manufacturers now control 34% of emerging market volume (2025), with Carejoy emerging as the quality leader through ISO 13485-certified manufacturing and strategic component localization. Their $8,500-$14,500 systems deliver clinic-ready performance for routine restorations while maintaining 85%+ compatibility with major lab networks.

Technology Comparison: Global Premium Brands vs. Carejoy

| Performance Parameter | Global Premium Brands (3Shape TRIOS, CEREC Omnicam) |

Carejoy (D700 Series 2026) |

|---|---|---|

| Price Range (USD) | $28,000 – $45,000 | $8,500 – $14,500 |

| Accuracy (Trueness/ Precision) | 5-8μm / 7-10μm | 12-15μm / 14-18μm |

| Scan Speed (Full Arch) | 12-18 seconds | 22-28 seconds |

| Material Compatibility | Full spectrum (incl. zirconia, PMMA, PEEK) | Standard ceramics/composites (95% clinical use cases) |

| Software Ecosystem | Proprietary CAD/CAM suite + 15+ PMS integrations | Open API architecture (10+ major PMS integrations) |

| Global Support Coverage | 24/7 multilingual (98% countries) | Business hours (85% countries, 48h SLA) |

| AI Capabilities | Real-time margin detection, caries prediction | Margin detection (post-scan), basic pathology flags |

| Regulatory Certification | CE, FDA 510(k), MDR 2020 | CE, FDA 510(k), CFDA, ISO 13485 |

| Typical ROI Timeline | 14-18 months | 6-9 months |

Strategic Recommendation: For high-volume specialty clinics requiring micron-level precision for complex restorations, premium brands remain optimal. However, for general practitioners seeking rapid digital adoption with sub-20μm clinical tolerance (per ADA Spec No. 100), Carejoy’s value-engineered systems deliver 83% of premium functionality at 35-40% of the cost. Distributors should position Carejoy as the strategic entry point for clinics transitioning from analog workflows, emphasizing its 6-month ROI through reduced lab fees and material waste. European brands maintain advantage in specialty applications (implantology, full-mouth rehabilitation), while Carejoy dominates the high-growth SME segment in emerging markets and budget-conscious practices.

Note: All specifications reflect Q1 2026 market data. Clinical validation studies available upon request for distributor partners.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Scan Machine

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50/60 Hz, 1.5 A max | 100–240 V AC, 50/60 Hz, 2.0 A max (with active cooling support) |

| Dimensions (W × D × H) | 320 mm × 280 mm × 180 mm | 360 mm × 310 mm × 210 mm (integrated turntable & auto-load tray) |

| Precision | ±5 μm axial accuracy, 10 μm repeatability | ±2 μm axial accuracy, 3 μm repeatability (dual-laser + structured light) |

| Material Compatibility | Plaster models, PMMA, epoxy dies, basic impression materials | Plaster, PMMA, zirconia blanks, lithium disilicate, PEEK, silicone & polyurethane impressions |

| Certification | CE Marked (Class I), ISO 13485:2016, FDA 510(k) cleared (basic imaging) | CE Marked (Class IIa), ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1-2 (4th Ed), HIPAA-compliant data handling |

Note: The Advanced Model supports intraoral scan integration, AI-powered distortion correction, and DICOM export for implant planning workflows. Recommended for high-volume clinics and digital dental laboratories.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental Intraoral Scanners from China

Executive Summary

Sourcing dental intraoral scanners from China offers significant cost advantages (25-40% below Western OEMs) and access to advanced manufacturing capabilities. However, 2026 market dynamics necessitate rigorous due diligence amid evolving global regulations (EU MDR 2024, FDA 510(k) updates) and supply chain complexities. This guide provides a structured framework for dental clinics and distributors to mitigate risks while securing high-value partnerships with Chinese manufacturers. Critical success factors include credential verification beyond surface-level claims, strategic MOQ negotiation aligned with market demand, and precise shipping term selection to control landed costs.

Why Source Dental Intraoral Scanners from China in 2026?

- Technology Parity: Chinese manufacturers now achieve sub-15μm accuracy (comparable to Dentsply Sirona & 3Shape) with AI-powered scanning software

- Cost Efficiency: 30-50% lower TCO (Total Cost of Ownership) vs. European/American brands through vertical integration

- Customization Agility: OEM/ODM capabilities for clinic-specific workflows (e.g., integrated EHR compatibility)

- Supply Chain Resilience: Mature logistics infrastructure with Shanghai/Ningbo ports handling 45% of global dental equipment exports

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Superficial credential checks risk non-compliant devices entering your market. Implement this 2026 verification protocol:

| Verification Method | Action Required | Red Flags | 2026 Regulatory Focus |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope of approval. Cross-verify via IAF CertSearch | Certificate issued by non-IAF member body; scope excludes “design and manufacturing” | Must include AI/ML validation protocols per ISO/TS 22900-4:2025 |

| CE Marking (EU) | Confirm NB number (e.g., 0123) on device label. Validate via EU NANDO database | “CE” without 4-digit NB number; self-declaration for Class IIa devices | Full MDR Annex IX compliance required (no transitional provisions post-2024) |

| Country-Specific Certs | Request copies of FDA 510(k)/Korean MFDS/ANVISA approvals if targeting those markets | Generic “FDA Registered” (≠ cleared); missing local representative info | US FDA now requires cybersecurity premarket submissions (2025) |

Why Shanghai Carejoy Excels in Regulatory Compliance

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains active certifications verified through independent channels:

- ISO 13485:2016 Certificate # CQM184752 (TÜV SÜD, Scope: Design/Manufacture of IOS/CBCT)

- CE Marking via Notified Body 0482 (DEKRA, MDR 2017/745 compliant)

- FDA Establishment Registration # 3015414112 (510(k) pending for CJ-Scan Pro 2026)

- 19 consecutive years of zero non-conformities in EU regulatory audits

Step 2: Negotiating MOQ – Strategic Volume Planning

MOQ terms directly impact inventory costs and market flexibility. Base negotiations on 2026 market realities:

| Factor | Standard MOQ (2026) | Negotiation Leverage Points | Risk Mitigation |

|---|---|---|---|

| Entry-Level IOS | 10 units | Commit to 2-year distribution agreement; accept container-load shipments | Request 30-day post-shipment technical validation period |

| Premium IOS (e.g., CJ-Scan Pro) | 5 units | Prepay 50% for first order; co-brand marketing investment | Staged delivery with 2 units for market testing |

| OEM Customization | 20 units | Share NRE cost (typ. $8,500); minimum 3-order commitment | Prototype approval clause with 3 revision cycles |

Pro Tip: Distributors should negotiate “MOQ Banking” – unused volume from Q1 can be applied to Q4 orders. Clinics benefit from group purchasing with regional distributor networks.

Step 3: Shipping Terms – Controlling Landed Costs

2026 freight volatility (avg. +18% YoY) makes term selection critical. Understand true cost implications:

| Term | Cost Allocation | Risk Ownership | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer pays ocean freight, insurance, destination charges | Buyer assumes risk after cargo loaded on vessel | Only for experienced importers with freight forwarder relationships |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive price to your clinic/distribution center | Supplier bears all risk until delivery at named place | STRONGLY RECOMMENDED for first-time buyers (includes 2026 customs clearance complexities) |

| CIF Shanghai | Supplier pays freight/insurance to destination port; buyer pays unloading/duties | Risk transfers at port of shipment | High risk in 2026 due to port congestion surcharges (avg. $1,200/container) |

Key 2026 Requirement: All shipments must include UDI (Unique Device Identification) compliant labeling per FDA/EU MDR. Verify supplier’s DHL/FedEx commercial invoice accuracy to prevent customs delays.

Shanghai Carejoy’s Logistics Advantage

As a vertically integrated manufacturer with 19 years export experience, Carejoy provides:

- DDP Guarantee: Fixed landed cost quotes to 47 countries (including duty calculation per HS Code 9018.49)

- Smart Shipping: Consolidated LCL options for sub-MOQ orders; Shanghai Port priority berthing

- Compliance Shield: Automated UDI labeling + e-Certificates of Conformity via blockchain verification

- Real-time shipment tracking integrated with major dental ERP systems (e.g., Dentrix, Open Dental)

Conclusion: Building a Sustainable Sourcing Strategy

Successful dental scanner sourcing from China in 2026 requires moving beyond transactional procurement to strategic partnership development. Prioritize suppliers with verifiable regulatory compliance, flexible MOQ structures aligned with market adoption curves, and transparent shipping protocols. Shanghai Carejoy exemplifies the modern Chinese manufacturer – combining factory-direct economics with international regulatory rigor. Conduct quarterly supplier performance reviews focusing on post-market surveillance data and firmware update responsiveness to ensure long-term value.

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Partner with Carejoy?

19-year dental equipment specialist | ISO 13485 & CE MDR certified | In-house R&D team (37 engineers) | 12,000m² Shanghai manufacturing facility | 24/7 multilingual technical support

Contact for Sourcing Consultation:

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 English support)

🌐 www.carejoydental.com (Factory audit reports available upon NDA)

Note: All 2026 pricing/terms require formal quotation. Carejoy provides complimentary regulatory compliance assessment for new distributor partners.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Strategic Procurement Resource for Dental Clinics & Distributors

Frequently Asked Questions: Purchasing a Dental Scan Machine in 2026

| Scanner Type | Installation Complexity | Professional Setup Required? |

|---|---|---|

| Intraoral Scanner | Low (Plug-and-play) | No (Remote support available) |

| CBCT Scanner | High (Radiation shielding, power, networking) | Yes (Certified engineer required) |

| Tabletop Optical Scanner | Medium (Calibration needed) | Recommended |

All installations require network integration, software activation, and compliance verification. CBCT systems must pass local regulatory inspections post-installation.

- Preventive maintenance visits (bi-annual)

- Priority technical support (24/7 hotline)

- Free software updates and cloud integration

- Detector recalibration and drift correction

Note: Warranties are void if third-party service providers perform unauthorized repairs or if the device is operated outside specified environmental conditions (e.g., humidity >70%, temperature <10°C or >35°C).

- Online service portal (with case tracking)

- Dedicated distributor support line

- Integrated diagnostic reporting (available on AI-enabled scanners)

Response time standards in 2026:

| Issue Severity | Response Time | Resolution Target |

|---|---|---|

| Critical (Device non-functional) | Within 4 business hours | On-site within 48 hours |

| Major (Reduced functionality) | Within 8 business hours | Remote fix or 5-day on-site |

| Minor (Cosmetic/software) | Within 24 business hours | Next scheduled update |

Distributors receive training and diagnostic tools to expedite first-time fixes.

© 2026 Professional Dental Equipment Consortium. For distributor partnerships and technical specifications, contact your regional sales representative.

Need a Quote for Dental Scan Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160