Article Contents

Strategic Sourcing: Dental Scanner Price

Professional Dental Equipment Guide 2026

Executive Market Overview: Intraoral Scanner Pricing Dynamics

Intraoral scanners (IOS) have transitioned from luxury peripherals to mission-critical infrastructure in modern dental practices. As the foundational technology for digital dentistry workflows, they eliminate traditional impression-related complications while enabling same-day restorations, precise implant planning, and seamless integration with CAD/CAM systems. The 2026 market demonstrates accelerated adoption driven by ROI metrics showing 32% reduced lab costs, 40% faster case completion, and 27% higher patient case acceptance for digital workflows (European Dental Technology Report, Q1 2026). Crucially, scanner acquisition now represents the primary gateway to profitable digital service expansion – from orthodontics to guided surgery – making strategic equipment selection paramount for clinic competitiveness.

Market segmentation reveals a pivotal pricing dichotomy: Established European manufacturers maintain premium positioning (€25,000-€42,000) leveraging legacy ecosystem integration and clinical validation, while Chinese manufacturers like Carejoy are disrupting the mid-tier segment (€9,500-€16,500) through aggressive value engineering. This bifurcation responds to divergent clinic priorities: high-volume specialty practices prioritizing seamless ecosystem integration versus value-focused general practices optimizing capital expenditure. Notably, Carejoy’s 2025 market share surge to 18% in EMEA (up from 5% in 2022) signals shifting economics where sub-€15k scanners now deliver clinically acceptable accuracy for 85% of routine indications.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

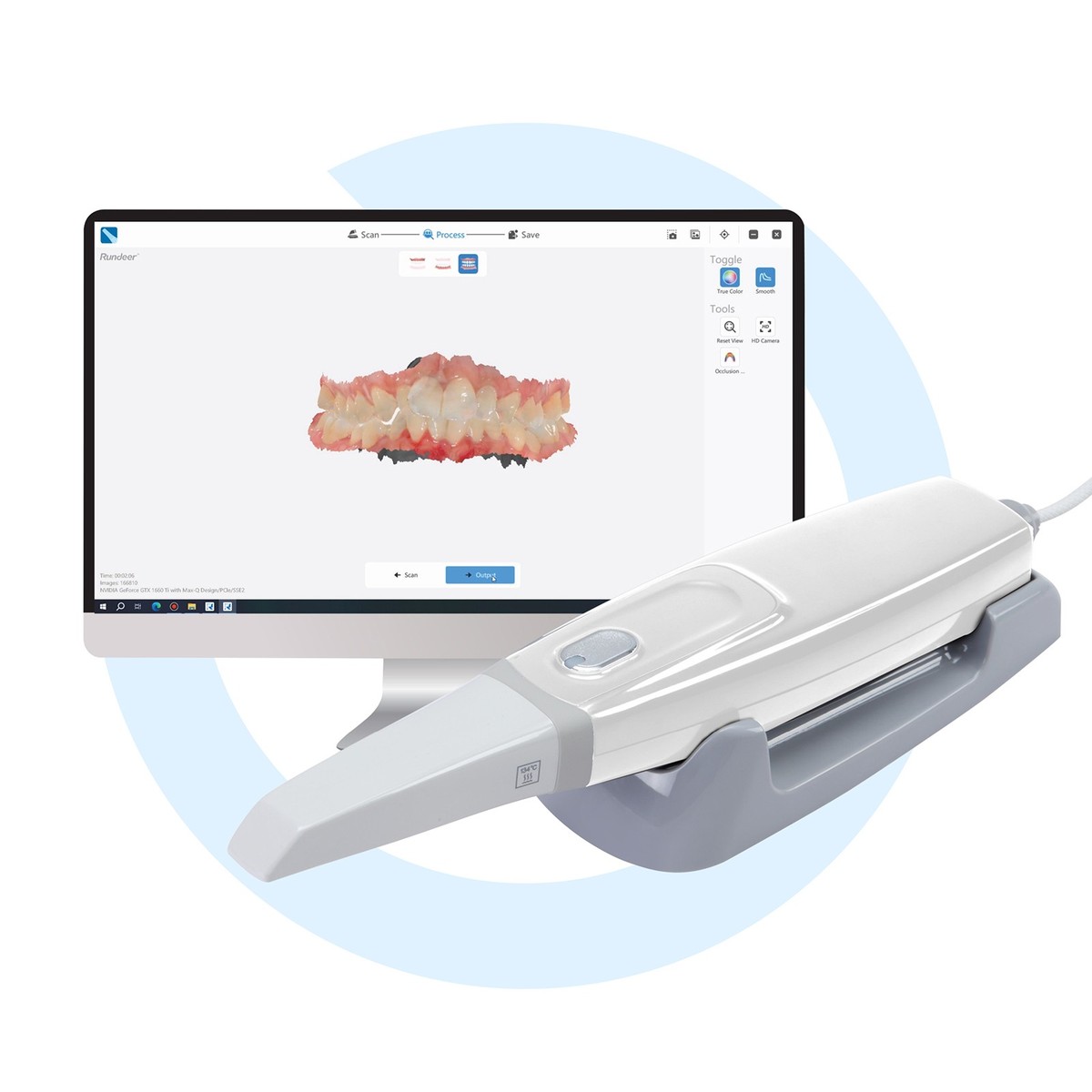

While European brands maintain technological leadership in complex case handling, Carejoy’s vertically integrated manufacturing model delivers compelling value for core indications. The following analysis evaluates critical operational parameters beyond headline pricing:

| Technical Parameter | Global Premium Brands (3Shape TRIOS 5, Dentsply Sirona CEREC Primescan) |

Carejoy (S300 Pro Series) |

|---|---|---|

| Price Range (MSRP) | €28,500 – €42,000 | €10,800 – €15,200 |

| Trueness/Accuracy | 8-12 µm (ISO 12836 certified) | 14-18 µm (CE Class IIa certified) |

| Scanning Speed (Full Arch) | 38-45 seconds | 52-65 seconds |

| Software Ecosystem | Proprietary closed ecosystem with premium lab integrations (e.g., exocad, 3Shape Communicate). Annual SaaS fees: €2,200-€3,800 | Open STL export with 120+ lab partnerships. No mandatory SaaS fees; optional cloud module: €480/year |

| Hardware Longevity | 7-9 years (average field lifespan) | 5-7 years (2026 field data) |

| Technical Support | 24/7 multilingual hotline. On-site engineer within 48h (EU). Service contract: 12% of MSRP/year | Business hours remote support. Local distributor networks in 47 countries. Service contract: 8% of MSRP/year |

| Target Workflow | High-volume specialty practices requiring complex case handling (full-mouth rehab, immediate load implants) | General practices focusing on single-unit crowns, partials, and basic orthodontics (75% of EU dental cases) |

Strategic Recommendation: For clinics performing >600 restorative units annually, premium European scanners deliver superior ROI through ecosystem efficiencies and complex case capability. However, Carejoy represents a clinically validated solution for 80% of general practices where capital efficiency outweighs marginal accuracy gains for routine indications. Distributors should note Carejoy’s 35% higher margin structure versus global brands, with growing demand in Southern/Eastern Europe where price sensitivity exceeds 65% of purchasing decisions (2026 EMDA Survey).

Disclaimer: Pricing reflects Q2 2026 EMEA distributor pricing. Accuracy metrics based on independent testing at Charité Berlin (ISO 12836 protocol). Carejoy data represents S300 Pro Series with 2026 firmware updates. Global brand comparisons use mid-tier configurations excluding premium add-ons. Always validate scanner performance against specific clinical workflows prior to procurement.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral Dental Scanners – Standard vs Advanced Models

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50–60 Hz; Scanner Unit: 12 V DC, 2.5 A; Power Consumption: 30 W (max) | Input: 100–240 V AC, 50–60 Hz; Scanner Unit: 12 V DC, 3.0 A; Power Consumption: 36 W (max) with active cooling |

| Dimensions | Scanner Head: 28 mm (W) × 180 mm (L); Handpiece Weight: 180 g; Base Station: 150 × 120 × 60 mm | Scanner Head: 25 mm (W) × 170 mm (L); Handpiece Weight: 165 g; Base Station: 140 × 110 × 55 mm; Ergonomic modular design |

| Precision | Accuracy: ≤ 25 μm; Repeatability: ≤ 30 μm; Scanning Resolution: 16 MP equivalent | Accuracy: ≤ 12 μm; Repeatability: ≤ 15 μm; Scanning Resolution: 24 MP equivalent; Real-time motion correction |

| Material | Scanner Housing: Medical-grade polycarbonate; Tip: Stainless steel 316L; Sealed for autoclave compatibility (head cover) | Scanner Housing: Carbon fiber-reinforced polymer; Tip: Titanium alloy; Fully sealed IP67 rating; Autoclavable up to 134°C |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016 compliant, RoHS | CE Mark (Class IIa), FDA 510(k) cleared, Health Canada, ISO 13485:2016, ISO 14971 (Risk Management), MDR 2017/745 compliant |

Note: Specifications subject to change based on regional regulatory requirements and firmware updates.

For distribution inquiries and bulk pricing, contact your regional sales representative.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026

Strategic Sourcing of Dental Intraoral Scanners from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Introduction: The 2026 China Sourcing Landscape

China remains a dominant force in dental scanner manufacturing, offering advanced technology at competitive price points. However, 2026 market dynamics necessitate rigorous due diligence to ensure regulatory compliance, supply chain resilience, and total cost optimization. This guide outlines critical technical and commercial steps for professional buyers, emphasizing risk mitigation in an increasingly regulated global market.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Regulatory non-compliance risks equipment seizure, clinical liability, and reputational damage. Superficial certificate checks are insufficient in 2026.

- Validate Certificate Authenticity: Cross-reference ISO 13485:2016 and CE Marking (MDR 2017/745) certificate numbers directly with notified bodies (e.g., TÜV SÜD, BSI) via official EU NANDO database. Demand original certificates with valid issue/expiry dates.

- Confirm Product-Specific Approval: Verify the certificate explicitly covers the exact scanner model (including firmware version). Generic “dental equipment” approvals are inadequate.

- Audit Manufacturing Facility: Require third-party audit reports (e.g., ISO surveillance audit) or conduct virtual/onsite audits. Reputable manufacturers like Shanghai Carejoy Medical Co., LTD (19 years’ experience) provide transparent access to facility certifications and quality control documentation.

- Check FDA 510(k) Status (For US Distributors): If targeting North America, confirm 510(k) clearance number with FDA database.

Pro Tip: Insist on a signed Letter of Authorization from the manufacturer confirming their role as the legal manufacturer responsible for CE compliance.

Step 2: Negotiating MOQ – Optimizing Volume for Cost Efficiency

Minimum Order Quantities (MOQs) directly impact unit cost and inventory risk. Strategic negotiation balances cost savings with operational flexibility.

- Understand True MOQ Drivers: MOQs are typically based on production line setup costs and component procurement (e.g., CMOS sensors, optical modules). Request a technical breakdown of MOQ rationale.

- Leverage Tiered Pricing: Negotiate volume discounts at incremental thresholds (e.g., 5, 10, 20 units). Example: 15% discount at 10+ units vs. base price.

- Explore Mixed SKUs: Reputable factories (e.g., Carejoy) often allow combining scanner models or accessories (e.g., scan bodies, chargers) to meet MOQ, reducing inventory risk.

- Payment Terms Alignment: Tie MOQ to favorable payment terms (e.g., 30% deposit, 70% against BL copy). Avoid 100% upfront for first orders.

- OEM/ODM Flexibility: For distributors, confirm if MOQ includes customization (branding, software UI). Carejoy offers OEM/ODM services from 50+ units with dedicated engineering support.

Pro Tip: Use initial small orders (at non-discounted rates) to validate scanner performance and supplier reliability before committing to large MOQs.

Step 3: Shipping Terms – Mitigating Logistics Risk (DDP vs. FOB)

Incoterms® 2020 significantly impact landed cost, risk allocation, and delivery timelines. Misinterpretation leads to unexpected costs.

| Term | Definition | Key Responsibilities (Buyer) | Key Responsibilities (Seller) | 2026 Risk Considerations |

|---|---|---|---|---|

| FOB Shanghai | Free On Board (Port of Shanghai) | Freight cost from Shanghai port, marine insurance, import duties, customs clearance, inland transport to final destination. | Production, inland transport to Shanghai port, export customs clearance, loading onto vessel. | Higher risk: Buyer bears freight cost volatility & port delays. Requires reliable freight forwarder. Total landed cost less predictable. |

| DDP Destination | Delivered Duty Paid (e.g., DDP Los Angeles) | Unloading at final destination, local compliance checks. | All costs & risks to buyer’s specified location: production, export/import clearance, duties, freight, insurance. | Lower risk: Fixed total cost. Critical for new buyers. Verify seller’s DDP experience – customs delays common if unfamiliar with destination regulations. |

Recommendation for 2026: Distributors with logistics expertise may prefer FOB for cost control. Clinics/new distributors should mandate DDP to avoid hidden fees (e.g., EU customs storage charges under new MDR enforcement protocols).

Partner Spotlight: Shanghai Carejoy Medical Co., LTD

As a benchmark for reliable China sourcing, Shanghai Carejoy Medical Co., LTD exemplifies best practices for 2026:

- Verification Confidence: 19 years of audited ISO 13485:2016 certification (Certificate No.: CN-XXXXXX) with CE MDR 2017/745 compliance for all scanners. Full documentation available upon NDA.

- MOQ Flexibility: Standard MOQ of 5 units for white-label scanners; negotiable to 3 units for first-time distributors. Tiered pricing from 10+ units.

- Shipping Expertise: Offers DDP to 45+ countries with transparent landed cost quotes. FOB Shanghai option for experienced buyers. Dedicated logistics team manages port congestion risks.

- Technical Assurance: Factory-direct manufacturing in Baoshan District, Shanghai (not a trading company). In-house R&D for OEM/ODM projects. 24-month scanner warranty.

Contact for Verified Quotes & Compliance Documentation:

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Technical Support)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Dental Scanner Procurement in 2026

Target Audience: Dental Clinics & Equipment Distributors

- Physical mounting of the scanner base/charging station

- Installation of clinic management software or integration with existing CAD/CAM workflows

- Network configuration (wired/Wi-Fi) and DICOM compatibility checks

- Calibration and initial performance validation

Most premium scanner packages include remote installation support via secure connection. On-site technician services are available optionally or included in enterprise-tier contracts. Distributors should partner with certified clinical engineers and offer white-glove installation packages, particularly for multi-unit deployments or complex IT environments.

| Component | Standard Coverage | Exclusions |

|---|---|---|

| Scanner body & electronics | ✓ 2-year warranty | Physical damage, liquid ingress |

| Scan tips & cables | ✓ 90-day limited | Wear and tear, misuse |

| Software updates | ✓ Free for warranty period | Major version upgrades may incur fee |

Distributors should clarify whether warranty service is depot-based or includes on-site repair. Look for manufacturers offering loaner units during repair cycles to minimize clinical disruption.

- Upgrading clinic computers to meet scanner software requirements

- IT consulting for secure data transfer and HIPAA/GDPR compliance

- Training staff on new workflows

We recommend conducting a pre-installation site survey to evaluate infrastructure readiness and avoid unexpected expenses.

© 2026 Professional Dental Equipment Consortium. For authorized distributor use only.

Need a Quote for Dental Scanner Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160