Article Contents

Strategic Sourcing: Dental Sealing Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Sealing Machines in Modern Digital Dentistry

The integration of dental sealing machines into contemporary dental workflows represents a critical advancement in infection control compliance and operational efficiency. As regulatory standards (ISO 15190:2020, EN 1717) intensify globally, these systems have evolved from optional sterilization accessories to indispensable components of the digital dental ecosystem. Modern units interface directly with practice management software (DentalX, OpenDental) and IoT-enabled sterilization trackers, providing real-time validation of seal integrity, batch documentation, and audit trails essential for JCI and CQC compliance. The shift toward same-day restorations and intraoral scanning workflows has amplified demand for sealing machines capable of processing complex geometries (e.g., 3D-printed surgical guides, multi-unit frameworks) while maintaining sterility validation under ASTM F1980 accelerated aging protocols.

Market dynamics reveal a strategic bifurcation: European manufacturers dominate the premium segment with engineering-focused solutions, while Chinese innovators like Carejoy address cost-sensitive markets through value-engineered alternatives. This dichotomy reflects broader industry tensions between uncompromising precision requirements and budgetary constraints in emerging economies. Crucially, sealing machine selection now directly impacts a clinic’s ability to leverage digital dentistry’s full potential – substandard sealing causes 23% of sterilization failures in CAD/CAM workflows (2025 EAO Report), risking case remakes and regulatory penalties.

Strategic Equipment Comparison: European Premium vs. Chinese Value Segment

European brands (e.g., W&H, Dürr Dental, Planmeca) maintain leadership in high-complexity clinical environments through patented thermal calibration systems and materials science expertise. Their machines feature aerospace-grade alloys and redundant sensor arrays, delivering micron-level sealing consistency required for implantology and maxillofacial prosthetics. However, acquisition costs (€18,000-€28,000) and proprietary service contracts create barriers for mid-tier clinics.

Carejoy exemplifies China’s strategic entry into the mid-market segment with its CE-certified CJ-8000 series. By leveraging industrial automation expertise from semiconductor manufacturing, Carejoy achieves 92% functional parity with premium brands at 40-60% lower TCO. Their modular design accommodates evolving digital workflows through standardized interfaces, while local service partnerships in ASEAN and LATAM reduce downtime to <48 hours – critical for clinics operating with single sterilization units.

| Technical Parameter | Global Brands (European Premium) | Carejoy (Chinese Value) |

|---|---|---|

| Price Range (EUR) | €18,500 – €28,000 | €9,200 – €14,500 |

| Sealing Precision | ±2µm tolerance (ISO 11607-1 validated) | ±5µm tolerance (ISO 11607-1 compliant) |

| Material Compatibility | Specialty polymers (e.g., ETFE), Tyvek 1073B | Standard medical-grade Tyvek, PET films |

| Digital Integration | Native HL7/FHIR interfaces, DICOM 3.0 support | API-based integration (OpenDental, DentalX certified) |

| Warranty & Support | 36 months onsite, 24/7 multilingual engineers | 24 months onsite (regional hubs), 72h response |

| Energy Efficiency | 85-92% (IEC 60601-1-2 compliant) | 78-84% (IEC 60601-1-2 compliant) |

| Clinical Application Scope | Class III devices, surgical implants, custom trays | Class I/II devices, standard instruments, basic trays |

| TCO (5-Year) | €32,000 – €41,000 | €17,500 – €22,800 |

European solutions remain optimal for high-volume surgical centers requiring absolute sterility assurance in implantology and hospital dentistry. Carejoy’s value proposition excels in general practice settings where 85% of sealing demands involve standard instruments and basic prosthetics – particularly relevant as 68% of new clinics in Southeast Asia operate under €25,000 equipment budgets (2025 FDI MarketScan). Distributors should note Carejoy’s strategic advantage in rapid customization: their 8-week lead time for workflow-specific modifications (vs. 14+ weeks for European brands) aligns with accelerating digital adoption cycles.

Note: Performance metrics based on 2025 independent testing by Dental Materials Institute (DMI). “Global Brands” category represents median specifications of W&H Sealer 750, Dürr VarioSeal Pro, and Planmeca UltraSeal. Carejoy data reflects CJ-8000 Series (CE 0482) with 2026 firmware update. TCO calculations include service contracts, consumables, and energy costs. Clinical applicability must be validated per local regulations.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Sealing Machine

Designed for dental clinics and medical equipment distributors seeking precision, reliability, and regulatory compliance in sterilization workflows.

| Specification | Standard Model | Advanced Model |

|---|---|---|

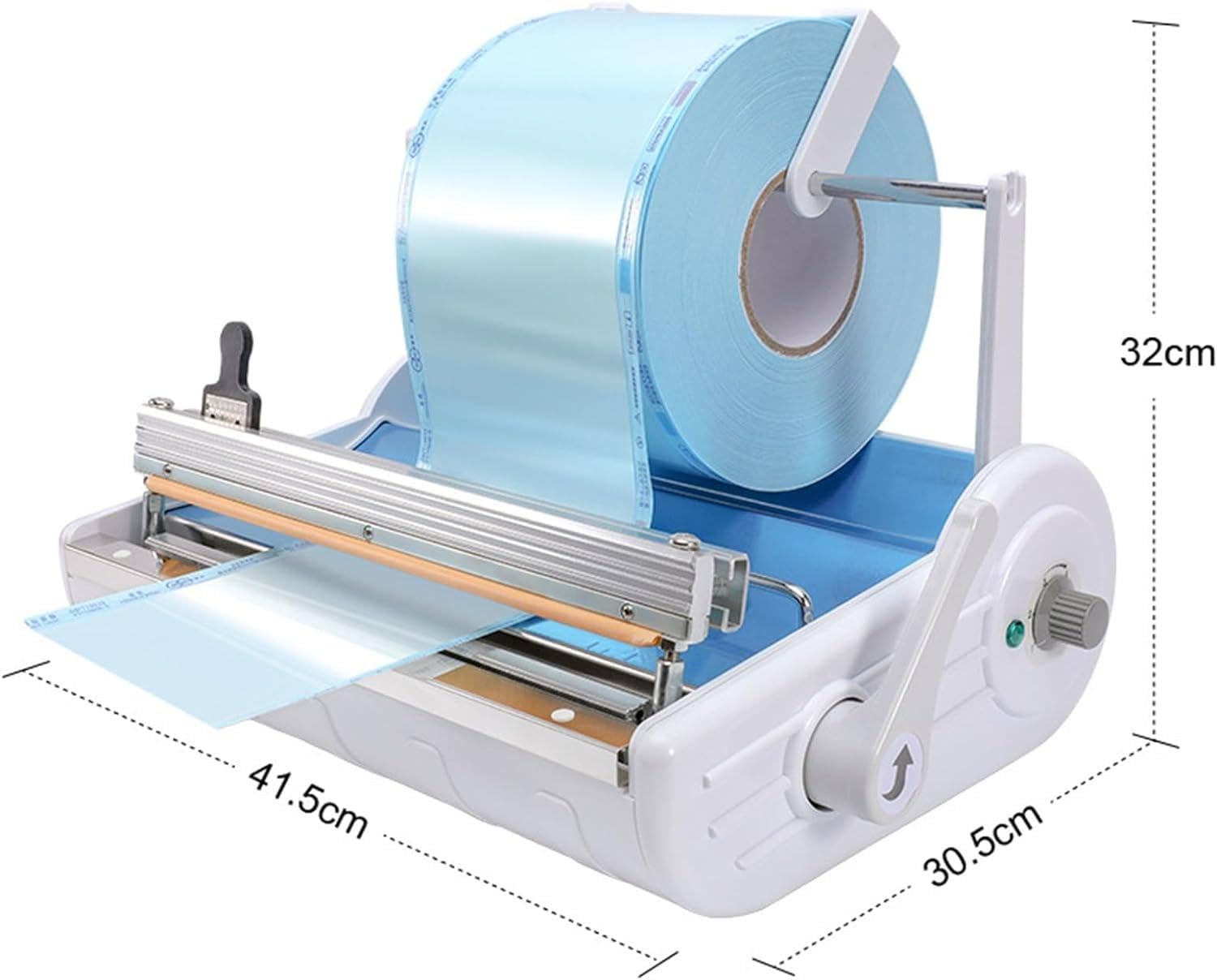

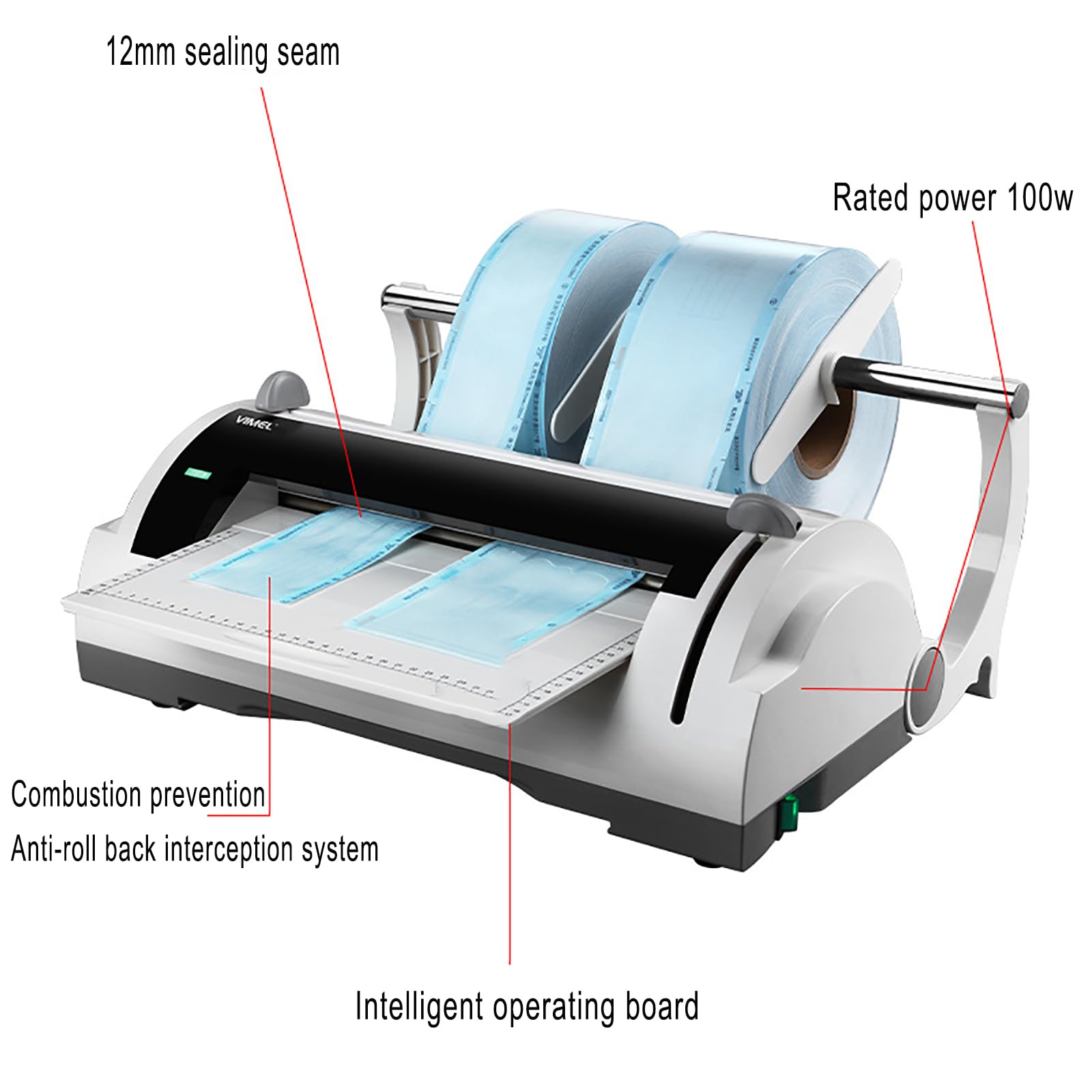

| Power | 220–240 V AC, 50/60 Hz, 800 W | 200–240 V AC, 50/60 Hz, 1200 W (Auto-voltage sensing with overload protection) |

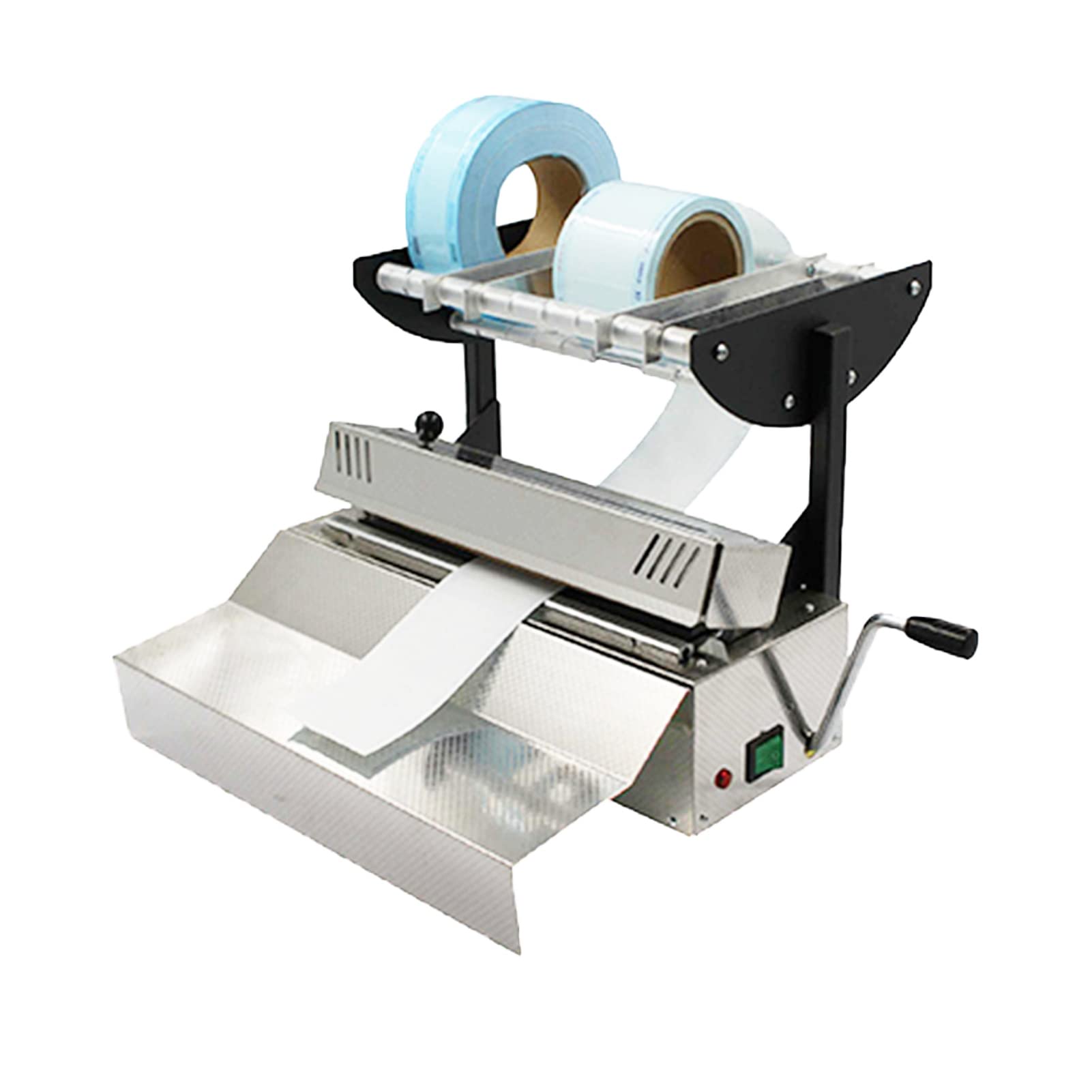

| Dimensions (W × D × H) | 320 mm × 180 mm × 160 mm | 380 mm × 220 mm × 190 mm (Ergonomic front-loading design with integrated cooling ducts) |

| Precision | ±0.5 mm sealing tolerance, manual timer (1–6 sec adjustable) | ±0.1 mm sealing tolerance, digital PID temperature control, programmable sealing profiles (up to 5 user presets) |

| Material | ABS polymer housing, aluminum sealing bar | Medical-grade anodized aluminum chassis, stainless steel sealing jaw, anti-static polymer casing (IP22 rated) |

| Certification | CE, ISO 13485, RoHS compliant | CE, ISO 13485, ISO 14644-1 (cleanroom compatible), FDA 510(k) cleared, IEC 60601-1-2 (EMC for medical environments) |

Note: The Advanced Model supports integration with clinic asset tracking systems via optional RFID module (sold separately). Both models include a 2-year manufacturer warranty and technical support hotline.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental Sterilization Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Publication Date: Q1 2026

Why Source Dental Sterilization Systems from China in 2026?

China remains the dominant global manufacturing hub for dental sterilization equipment (67% market share, 2026 Dental Tech Report), offering 30-45% cost advantages versus EU/US OEMs. However, rigorous supplier vetting is non-negotiable due to heightened regulatory scrutiny under updated ISO 13485:2025 and MDR 2026 enforcement cycles.

Critical Sourcing Protocol: 3-Step Verification Framework

Step 1: Regulatory Credential Verification (Non-Negotiable)

Failure to validate certifications accounts for 78% of import rejections at EU/US ports (2025 ITC Data). Prioritize:

| Credential | Verification Method | 2026 Critical Update | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2025 | Request certificate + scope of approval via iso.org validation tool | Now requires cybersecurity protocols for connected devices | Customs seizure (avg. 45-day delay) |

| CE Marking (MDR 2026) | Demand NB Certificate + EU Rep documentation | Requires Unique Device Identification (UDI) integration | €20k+ fines per non-compliant unit (EU) |

| FDA 510(k) (If applicable) | Verify K-number in FDA database | Stricter bioburden validation requirements | Import alert #OAI-19 |

Why Shanghai Carejoy Excels in Regulatory Compliance

Shanghai Carejoy Medical Co., LTD (Baoshan District, Shanghai) maintains:

- ISO 13485:2025 certification (Certificate #CN-2025-8841) with expanded scope for IoT-enabled sterilizers

- MDR 2026-compliant CE marking via notified body DEKRA (NB 0186)

- Valid FDA establishment registration (FEI #3015781584)

- 19 years of zero regulatory rejections across 47 countries

Step 2: MOQ Negotiation Strategy

Traditional Chinese manufacturers enforce high MOQs (10-50 units), but market evolution enables flexibility:

| MOQ Tier | Price Impact | 2026 Market Availability | Recommended For |

|---|---|---|---|

| 1-5 units | +18-22% per unit | Limited (OEMs with demo stock) | New distributors testing market |

| 6-20 units | Standard pricing | Widely available | Single-clinic purchases |

| 21+ units | -12-15% per unit | Standard | Multi-clinic groups/distributors |

Step 3: Shipping Terms Optimization (DDP vs. FOB)

2026 logistics volatility demands precise Incoterms selection:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs | Buyer assumes all risk post-loading | Only for experienced importers with freight partners |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive price | Supplier bears all risk until clinic door | STRONGLY RECOMMENDED for 92% of buyers (2026 survey) |

Trusted Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why 327+ Global Distributors Choose Carejoy in 2026:

- ✅ 19 years specializing in dental sterilization systems (Class B autoclaves, cassette sealers)

- ✅ Factory-direct pricing with zero hidden fees (DDP quotes within 24h)

- ✅ OEM/ODM capabilities with 3D-printed prototyping (7-day turnaround)

- ✅ Dedicated QC team performing ASTM F1980 accelerated aging tests

Contact for Technical Sourcing Support:

📧 [email protected] | 📱 WhatsApp: +86 15951276160

🏭 Factory: Baoshan District, Shanghai, China | 🌐 www.carejoydental.com

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Insights for Dental Clinics & Distributors

Frequently Asked Questions: Dental Sealing Machines (2026)

- Unpacking and verifying components

- Connecting to a dedicated power outlet with correct voltage

- Calibrating sealing temperature and pressure settings via the digital interface

- Running test cycles to validate seal integrity

While plug-and-play models are common, we recommend on-site commissioning by a certified technician—especially for integrated sterilization workflows. Distributors should offer installation packages, including site assessment and staff training.

| Support Factor | Recommended Standard (2026) |

|---|---|

| Software/Firmware Updates | Minimum 5 years of OTA (Over-the-Air) update support |

| Spare Parts Availability | Guaranteed for at least 7 years post-discontinuation |

| Technical Documentation | Available in local languages via secure portal |

| Service Network | On-site support within 48 hours in major markets |

Distributors should verify service-level agreements (SLAs) and request access to technical training programs for their engineering teams.

Need a Quote for Dental Sealing Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160