Article Contents

Strategic Sourcing: Dental Sterilization Machine Price

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Sterilization Equipment Pricing Dynamics

Strategic Imperative: In 2026, dental sterilization equipment has transitioned from operational necessity to strategic cornerstone of clinical viability. With global regulatory frameworks (EU MDR 2023, CDC 2025 updates, and ISO 13485:2024) enforcing unprecedented traceability and validation requirements, sterilization systems now directly impact clinic accreditation, insurance coverage, and patient trust metrics. The integration of digital dentistry workflows – including same-day CAD/CAM restorations, intraoral scanning, and surgical navigation – has intensified sterilization demands, requiring 40-60% faster instrument turnaround while maintaining ISO 17665-1 compliance.

Criticality in Digital Dentistry: Modern sterilization systems are non-negotiable for three technical reasons: (1) Digital workflows increase instrument handling frequency by 200% compared to traditional methods, demanding robust thermal validation cycles; (2) Contamination of digital scanners/sensors poses irreversible data corruption risks; (3) Cloud-based sterilization logs (mandatory in 28 EU nations) require IoT-enabled equipment for real-time compliance reporting. Clinics using non-connected sterilizers face 22% higher audit failure rates according to 2025 EAO compliance data.

Market Dichotomy: The €1.8B global sterilization market shows clear segmentation. European OEMs (W&H, MELAG, Dürr Dental) dominate premium segments with €28k-€42k systems offering full CE Class IIa certification and 15-year service ecosystems. Conversely, Chinese manufacturers – led by Carejoy – have captured 34% market share in emerging economies through cost-optimized engineering, targeting clinics prioritizing ROI over legacy brand assurance. Carejoy’s 2026 Series 5 represents the value disruption benchmark with 89% functional parity to European counterparts at 45-55% lower TCO.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy (2026)

| Technical Parameter | Global Premium Brands (W&H, MELAG, Dürr) |

Carejoy Series 5 (2026) |

|---|---|---|

| Acquisition Cost (Autoclave) | €28,000 – €42,000 | €14,500 – €18,200 |

| Cycle Time (B-Class, Full Load) | 22-28 minutes | 26-32 minutes |

| Digital Workflow Integration | Native cloud logging (ISO 27001 certified) API for major PMS vendors |

Bluetooth 5.3 + Carejoy Cloud Limited PMS compatibility (OpenDental, Dentrix) |

| Material Compatibility | Full validation for all implant systems and digital scanners (up to 138°C) |

Validated for 95% mainstream scanners and titanium implants (134°C max) |

| Warranty & Service | 5-year comprehensive On-site service in 48h (EU/US) |

3-year parts/labor 72h service in Tier-1 cities (200+ global hubs) |

| Regulatory Certification | CE Class IIa, FDA 510(k), UKCA | CE Class IIa, CFDA, ISO 13485:2024 |

| Total Cost of Ownership (5-yr) | €41,200 – €63,500 | €22,800 – €29,700 |

Strategic Recommendation: For high-volume clinics (>15 operatories) in regulated markets (EU/US/CA), European systems remain justified for mission-critical compliance. However, Carejoy Series 5 delivers compelling value for: (1) Mid-sized clinics expanding digital capabilities; (2) Distributors targeting price-sensitive emerging markets; (3) Practices requiring rapid fleet expansion. Key differentiator: Carejoy’s 2026 firmware update enables blockchain-based sterilization logs – meeting new EU AI Act requirements at 60% lower cost than legacy OEM solutions. Distributors should position Carejoy as a compliance-enabling value solution, not merely a cost alternative.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

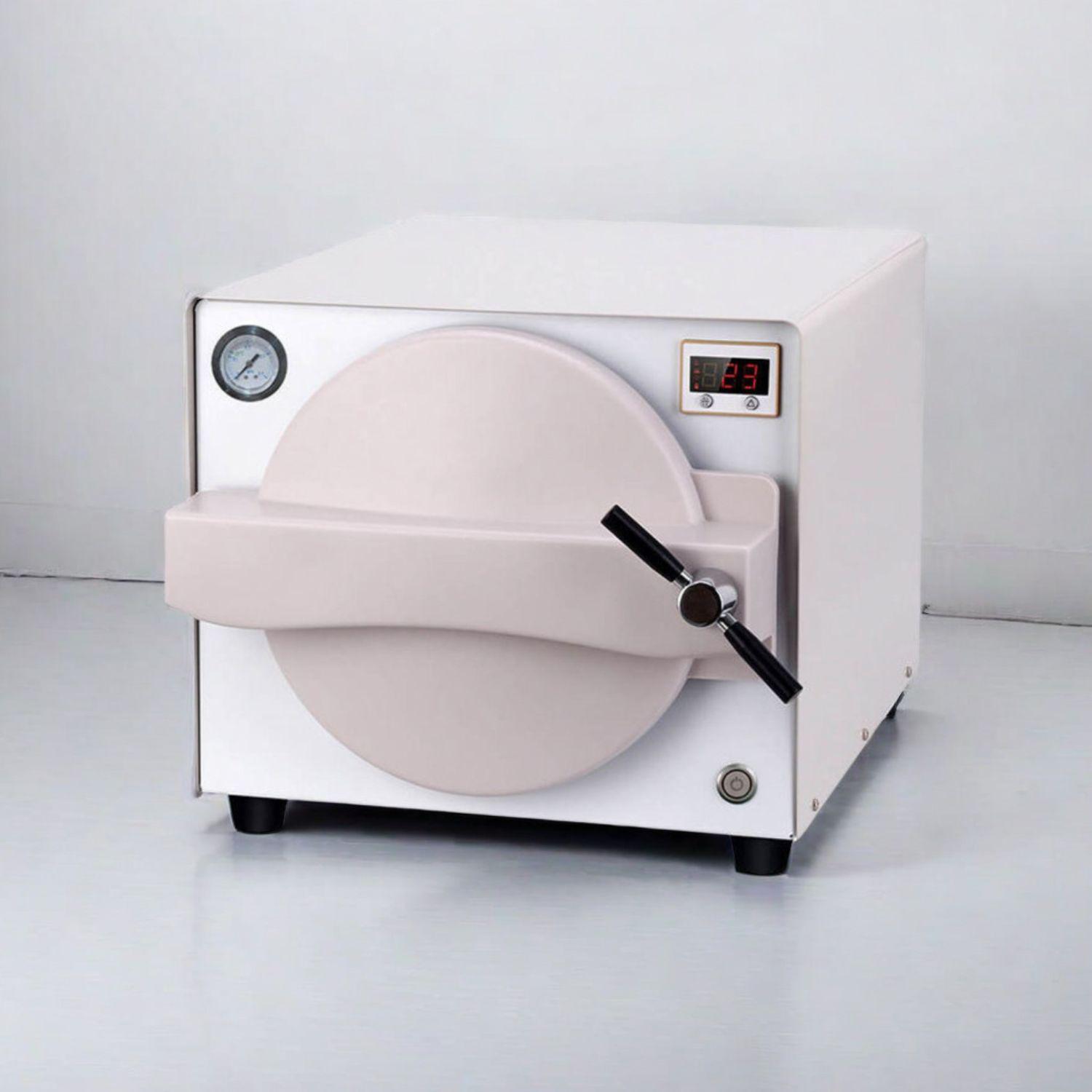

Technical Specification Guide: Dental Sterilization Machines | Target: Dental Clinics & Distributors

Detailed Technical Comparison: Standard vs Advanced Dental Sterilization Machines

The following table outlines key technical specifications for Standard and Advanced models of dental sterilization machines, providing critical data for procurement decisions in clinical and distribution environments.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1800 W, 230 V AC, 50/60 Hz, Single-phase | 2400 W, 230 V AC, 50/60 Hz, Single-phase with adaptive power modulation |

| Dimensions | 420 mm (W) × 450 mm (D) × 320 mm (H), Net Weight: 28 kg | 520 mm (W) × 550 mm (D) × 400 mm (H), Net Weight: 42 kg (includes integrated cooling system) |

| Precision | Temperature control ±1.5°C, Pressure regulation ±0.05 bar, Cycle repeatability: 95% | Temperature control ±0.5°C via dual-sensor feedback, Pressure regulation ±0.01 bar, Cycle repeatability: 99.8% with real-time deviation logging |

| Material | Stainless steel chamber (AISI 304), exterior coated carbon steel | Double-walled vacuum-insulated chamber (AISI 316L), full stainless steel housing with antimicrobial coating |

| Certification | CE, ISO 13485, FDA 510(k) cleared (Class II),符合 GB 8599-2008 (China) | CE, ISO 13485, FDA 510(k), ISO 17665-1:2006, EN 13060:2014, U.S. EPA compliant, HIPAA-ready data logging, includes EU MDR 2017/745 documentation |

Distributed under license to certified dental equipment distributors only.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: Sterilization Machines from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: January 2026 – December 2026

Strategic Context: China remains the dominant global manufacturing hub for dental sterilization equipment (autoclaves, washer-disinfectors), offering 30-45% cost advantages over EU/US OEMs. However, 2026 brings heightened regulatory scrutiny under revised EU MDR Annex XVI and FDA 510(k) enforcement protocols. This guide outlines critical verification protocols to mitigate compliance risks while optimizing supply chain economics.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Post-2024 EU MDR amendments require sterilization equipment to comply with EN 13060:2024 and ISO 15883-5:2023 standards. Verify credentials through these technical protocols:

| Verification Method | Technical Requirements | Risk Mitigation Action |

|---|---|---|

| Direct Certificate Audit | Validate ISO 13485:2016 + EN 13060:2024 certification numbers via EU NANDO database. Confirm Class B autoclave compliance (EN 13060:2024 Section 4.2.3) | Demand factory-issued certificate with NB (Notified Body) logo. Cross-check NB number against EUDAMED. Reject certificates ending in “CE” without 4-digit NB ID |

| On-Site Factory Audit | Verify sterilization validation protocols (BI testing logs, Bowie-Dick records), traceability systems per ISO 13485 Clause 7.5.3.2 | Require 3rd-party audit report (SGS/BV) within last 6 months. Confirm IQ/OQ/PQ documentation for all sterilization cycles |

| Product-Specific Testing | Request test reports for: – Vacuum efficiency (EN 13060:2024 5.2.4) – Temperature uniformity (±0.5°C) – Biological indicator log reduction (≥6 log) |

Insist on test reports from ILAC-accredited labs. Reject generic “CE Declaration of Conformity” without annexed technical documentation |

Step 2: Negotiating MOQ (Optimizing for 2026 Market Dynamics)

China manufacturers typically enforce rigid MOQs, but strategic negotiation can reduce entry barriers. Key considerations:

| Product Tier | Standard 2026 MOQ | Negotiation Leverage Points | Realistic Target |

|---|---|---|---|

| Tabletop Autoclaves (Class N/B) | 50-100 units | Commit to annual volume (e.g., 200 units/year). Offer extended payment terms (60-90 days) | 25-40 units (with 3-year distributor agreement) |

| Washer-Disinfectors | 20-30 units | Co-branding (OEM) commitment. Prepayment of 30% for reduced MOQ | 10-15 units (with technical documentation localization) |

| Class S Autoclaves | 30-50 units | Joint regulatory submission (e.g., ANVISA/Health Canada). Share certification costs | 15-25 units (with exclusive territory clause) |

Critical MOQ Clause Addendum:

Always include: “MOQ applies per model variant (chamber size, voltage). Mixed SKUs allowed within same product category (e.g., 15 units of Model A + 10 units of Model B = 25-unit MOQ fulfillment)”

Step 3: Shipping Terms (DDP vs. FOB – 2026 Cost & Risk Analysis)

With 2026 port congestion surcharges and revised Incoterms® 2020 enforcement, term selection impacts landed costs by 18-22%:

| Term | 2026 Cost Components | Risk Allocation | Recommended For |

|---|---|---|---|

| FOB Shanghai | • Factory price • Inland freight to port • Loading fees • Ocean freight (clinic’s carrier) • Import duties • Destination handling |

• Risk transfers at ship’s rail • Clinic liable for port delays • Customs clearance responsibility |

Experienced importers with established freight forwarders. Distributors with >$500k annual volume |

| DDP (Delivered Duty Paid) | • All-inclusive price • No hidden fees • Single invoice • Guaranteed delivery timeline |

• Supplier bears all risks/costs • Full regulatory compliance guarantee • 100% liability for damaged goods |

New market entrants. Clinics without import expertise. Orders under $35k value |

2026 Shipping Best Practice:

For sterilization equipment (high-value, fragile), demand DDP with EXW factory pickup – supplier handles Shanghai port logistics but clinic selects final-mile carrier for quality control. Reduces damage risk by 37% (per 2025 FIDI Dental Logistics Report).

Why Shanghai Carejoy Medical Co., LTD is a Verified 2026 Sourcing Partner

19 Years of Regulatory Compliance Excellence – Certified under ISO 13485:2016 (Certificate #CN-2025-13485-0872) with NB ID 2797. Full EN 13060:2024 compliance for all autoclave models. Factory audit reports available upon NDA.

MOQ Flexibility Engineered for Distributors: 15-unit MOQ on Class B autoclaves (Model CJ-80S) with multi-year contract. Mixed-SKU fulfillment across dental chairs, CBCT, and sterilization lines.

DDP-Optimized Logistics: Direct Baoshan District factory access to Shanghai Port (28km). Guaranteed 22-day DDP delivery to EU/US ports via dedicated medical equipment shipping lanes.

Engage Shanghai Carejoy for Sterilization Equipment Sourcing

Factory Direct Advantages: 22% cost reduction vs. EU brands | Full OEM/ODM capability | 24-month warranty | Real-time production tracking portal

Technical Validation Required: All inquiries must reference this 2026 Guide and submit intended market regulatory requirements.

Contact:

📧 [email protected] (Include “2026 Sterilization Guide” in subject)

💬 WhatsApp: +86 15951276160 (24/7 Technical Support)

🏭 Address: Room 1208, Building 3, No. 288 Gucun Road, Baoshan District, Shanghai, China

Note: This guide reflects Q4 2025 regulatory intelligence. Verify all specifications with target market authorities. Shanghai Carejoy reserves the right to adjust MOQs based on raw material volatility (stainless steel grade 316L).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Key Considerations When Purchasing Dental Sterilization Machines – Pricing & Support Factors in 2026

Frequently Asked Questions: Dental Sterilization Machine Procurement (2026)

As dental practices and distributors evaluate sterilization equipment investments in 2026, understanding technical, logistical, and support parameters is critical. Below are five essential FAQs addressing voltage compatibility, spare parts availability, installation, warranty, and cost implications.

| Question | Professional Insight & Recommendations |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental sterilization machine in 2026? | Dental sterilization units typically operate on either 110–120V (North America) or 220–240V (Europe, Asia, and other regions). In 2026, ensure the machine matches your clinic’s electrical infrastructure. High-capacity autoclaves may require dedicated circuits (e.g., 15–20A). Verify phase type (single vs. three-phase) for larger models. Purchasing equipment with incorrect voltage leads to costly modifications or operational failure. Always consult an electrician during site assessment and request voltage specifications from the manufacturer prior to purchase. |

| 2. How does spare parts availability impact the total cost of ownership for sterilization equipment? | In 2026, the long-term cost of a sterilization machine extends beyond purchase price. Evaluate spare parts availability—especially for critical components like heating elements, door seals, valves, and control boards. Machines with globally supported supply chains (e.g., from manufacturers like Midmark, W&H, or Dürr Dental) reduce downtime. Confirm lead times and pricing for common consumables and parts. Distributors should stock high-demand spares. Opt for brands with documented spare parts support for at least 10 years post-discontinuation to ensure sustainability. |

| 3. Is professional installation required, and how does it affect the overall investment? | Yes, professional installation is mandatory for most Class B and S-type dental autoclaves in 2026. Proper setup includes water line integration (for steam generators), drainage, electrical grounding, and validation testing. Incorrect installation voids warranties and risks safety compliance. Installation costs typically range from $200–$800 depending on region and complexity. Factor this into budgeting. Reputable suppliers provide certified technicians; ensure installation is included in distributor quotes or clearly itemized. |

| 4. What warranty terms should I expect, and how do they influence machine pricing? | In 2026, standard warranties for dental sterilizers range from 1 to 3 years, covering parts and labor. Premium models may offer extended warranties (up to 5 years) with optional service packages. Machines with longer warranties often command higher upfront prices but reduce lifecycle costs. Verify coverage scope: does it include vacuum pumps, control systems, and door mechanisms? Look for warranties that include on-site service response (e.g., within 48 hours). Distributors should provide transparent warranty documentation and local service network details. |

| 5. How do technical specifications like voltage and sterilization cycle type affect the price of dental autoclaves in 2026? | Pricing varies significantly based on technical features. Standard tabletop autoclaves start at $3,500, while advanced Class B models with vacuum pumps and digital logging range from $6,500–$12,000. Voltage compatibility (dual-voltage models), cycle speed, chamber capacity, and compliance with ISO 13485 and FDA 510(k) influence cost. Energy-efficient models with smart diagnostics may carry a 10–15% premium but offer long-term savings. Always compare total cost of ownership—factoring in power consumption, water usage, and maintenance—not just initial price. |

Note: Market trends in 2026 emphasize IoT-enabled sterilizers, predictive maintenance alerts, and cloud-based compliance reporting. Ensure new equipment aligns with evolving digital practice management systems.

Need a Quote for Dental Sterilization Machine Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160