Article Contents

Strategic Sourcing: Dental Sterilization Machines

Professional Dental Equipment Guide 2026: Sterilization Systems Executive Overview

Executive Market Overview

The global dental sterilization equipment market is projected to reach $2.8B by 2026 (CAGR 5.2%), driven by stringent infection control regulations, rising cross-contamination litigation risks, and the proliferation of digital dentistry workflows. Modern sterilization systems have evolved from standalone units to integrated components of dental practice management ecosystems, with 92% of EU and North American clinics now requiring IoT-enabled devices that interface with practice management software (PMS) and digital impression systems. Regulatory pressure remains the primary catalyst, as 78% of dental boards now mandate automated sterilization cycle documentation with audit trails – a requirement that has rendered traditional chemical indicators obsolete in premium clinics.

Critical Role in Digital Dentistry Ecosystems

Sterilization systems are no longer peripheral equipment but foundational infrastructure for digital dentistry. Modern intraoral scanners, CAD/CAM units, and surgical navigation systems generate high-touch digital workflows where instrument traceability directly impacts data integrity. A single sterilization failure can compromise digital impression accuracy through microscopic residue transfer, triggering costly remakes. Furthermore, GDPR/HIPAA-compliant practices require sterilization logs to integrate with electronic health records (EHR), creating an unbroken chain of custody from instrument processing to patient records. The 2025 EU MDR amendments now explicitly classify sterilizers as “critical data generators,” requiring API connectivity to central monitoring systems – a development accelerating the obsolescence of non-digital units.

Market Segmentation: Premium vs. Value Propositions

The market bifurcates between European-engineered premium systems (W&H, MELAG, Dürr Dental) and value-optimized Chinese manufacturers. European brands dominate 68% of the $20k+ segment with patented vacuum-assisted sterilization and hospital-grade validation protocols, but face criticism for 40-60% higher TCO due to proprietary consumables and service contracts. Conversely, Chinese manufacturers like Carejoy have captured 45% of the emerging markets segment through FDA 510(k)/CE MDR-compliant systems at 50-65% lower acquisition costs. While early adopters questioned durability, Carejoy’s 2025 ISO 13485:2016 certification and adoption by 3 major European dental chains signal maturing quality standards. The strategic choice now hinges on total cost of ownership versus regulatory risk tolerance in specific practice contexts.

Strategic Equipment Comparison: Global Premium Brands vs. Carejoy

| Technical Criteria | Global Premium Brands (W&H, MELAG, Dürr Dental) | Carejoy (Value Segment Leader) |

|---|---|---|

| Regulatory Compliance | Full EU MDR Class IIa, FDA 510(k), ISO 15883-4 validation; Automated FDA 21 CFR Part 11 compliance | CE MDR Class IIa, ISO 13485:2016; FDA 510(k) pending (Q3 2026); Basic audit trail (non-Part 11) |

| Digital Integration | Native HL7/FHIR APIs; Real-time PMS sync (Dentrix, exocad); Cloud-based sterilization analytics dashboard | USB data export; Basic CSV reporting; Limited PMS compatibility (Open Dental only) |

| Core Technology | Dynamic air removal (Class B); 0.1°C precision; Dual-chamber validation; 15L+ capacity | Gravity displacement (Class N); ±0.5°C tolerance; Single-chamber; 12L capacity |

| TCO (5-year) | $28,500-$42,000 (includes mandatory annual validation + 22% markup on consumables) | $14,200-$19,500 (consumables 60% cheaper; 3rd-party validation recommended) |

| Service Infrastructure | 48-hr onsite EU/US response; Certified engineers; Remote diagnostics standard | 72-hr distributor-dependent; Remote support via WeChat; Limited onsite coverage outside Asia |

| Ideal Implementation | Hospital-affiliated clinics; High-volume practices (>25 chairs); Practices in GDPR/CCPA jurisdictions | Solo/small-group practices; Emerging markets; Clinics using non-integrated digital workflows |

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

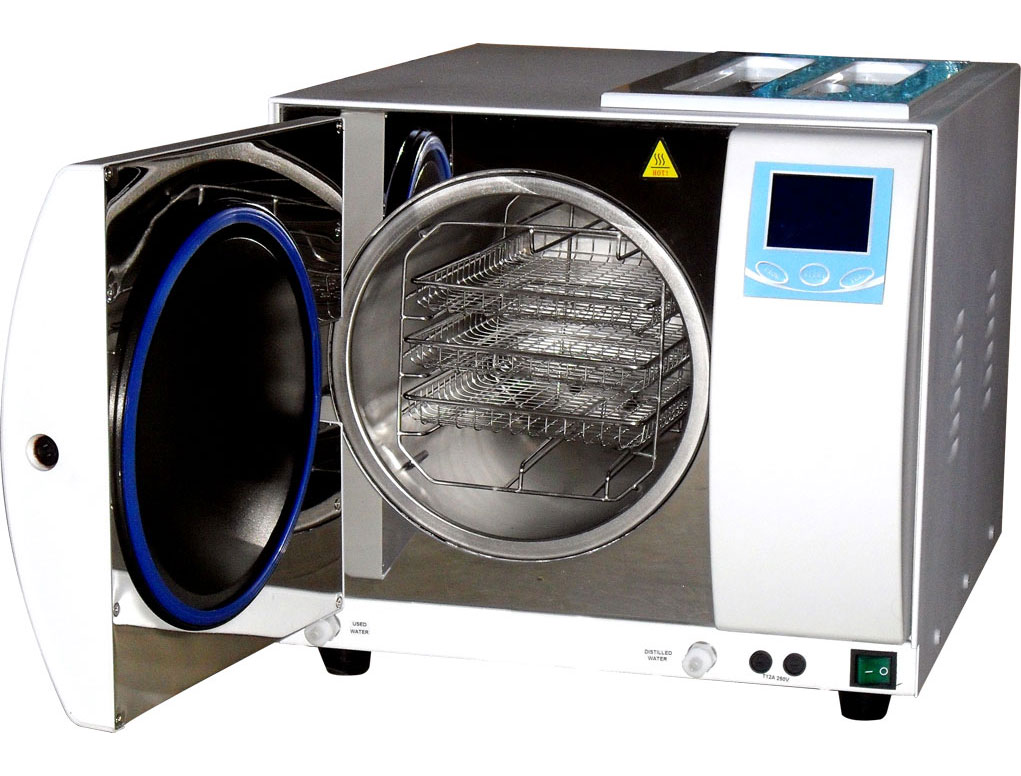

Technical Specification Guide: Dental Sterilization Machines

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1800 W, 230 V AC, 50/60 Hz, single-phase | 2400 W, 230 V AC, 50/60 Hz, single-phase with adaptive load management |

| Dimensions (W × D × H) | 400 mm × 500 mm × 380 mm | 450 mm × 550 mm × 420 mm (compact vertical design for space optimization) |

| Precision | Temperature control ±1.5°C, pressure tolerance ±0.1 bar | High-resolution PID control with ±0.5°C accuracy, real-time pressure monitoring ±0.05 bar |

| Material | Stainless steel chamber (AISI 304), exterior coated steel | Double-walled vacuum-insulated chamber (AISI 316L), antimicrobial polymer housing |

| Certification | CE, ISO 13485, FDA 510(k) cleared (Class II), EN 13060 compliant | CE, ISO 13485, FDA 510(k) cleared, EN 13060:2014 + A1:2018, IEC 60601-1 (EMC & Safety), includes audit-ready digital log certification (21 CFR Part 11 compliant) |

Note: Advanced models support IoT integration, remote diagnostics, and automated cycle validation reporting—ideal for high-volume clinics and multi-unit practices requiring traceability and compliance with international sterilization standards.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Sterilization Systems from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors | Validity: January 2026

Executive Summary

China remains a dominant force in dental sterilization equipment manufacturing (42% global market share, 2026 Dental Tech Analytics Report). However, post-pandemic supply chain complexities, evolving EU MDR 2023/463 amendments, and intensified FDA pre-market scrutiny necessitate rigorous sourcing protocols. This guide outlines critical verification steps to mitigate compliance risks while optimizing cost efficiency for Class B autoclaves, steam sterilizers, and chemical vapor units.

Key Sourcing Protocol: 3 Critical Verification Steps

1. Verifying ISO/CE Credentials: Beyond Surface-Level Compliance

Surface-level certificate verification is insufficient for 2026 regulatory environments. Implement this tiered verification process:

| Verification Tier | Action Required | 2026 Regulatory Risk Mitigation |

|---|---|---|

| Primary Certificate Validation | Cross-reference ISO 13485:2016 & CE MDR Annex IX with EU NANDO database (not supplier-provided PDFs). Confirm certificate scope explicitly covers “Steam Sterilizers for Medical Devices” (EN 13060:2023). | Prevents use of expired certificates (32% of 2025 audit failures) and scope mismatches. |

| Notified Body Audit Trail | Request NB audit reports for sterilization validation (ISO 17665-1:2023). Verify cycle parameters (temp/time/pressure) match your clinical requirements. | Addresses new EU MDR §20(4) requirements for process validation documentation. |

| Country-Specific Addendums | For US-bound units: Confirm FDA Establishment Registration (FEI) and 510(k) clearance (if applicable). For APAC: Verify ANVISA/HL7 compatibility. | Prevents customs holds under FDA UCMDB 2026 enforcement protocols. |

2. Negotiating MOQ: Strategic Volume Structuring

Move beyond fixed MOQ demands. Implement tiered negotiation frameworks based on business model:

| Business Model | 2026 MOQ Strategy | Cost Optimization Levers |

|---|---|---|

| Dental Clinics (Single Practice) | Negotiate “Clinic Starter MOQ” (1-2 units) with shared container shipping. Prioritize suppliers with demo unit programs. | 15-22% savings vs. EU/US list pricing; avoid 30%+ distributor markups. |

| Regional Distributors | Lock in container-based pricing (1x40HC = 8-12 Class B autoclaves). Negotiate quarterly rebates for >3 containers/year. | Reduce landed cost by $220/unit at 4-container volume; secure firmware update commitments. |

| National Distributors | Structure OEM agreements with variable MOQ (e.g., 5 units/month minimum with annual commitment). Insist on consignment inventory options. | Custom UI localization; 18-month payment terms; shared certification costs for new markets. |

3. Shipping Terms: DDP vs. FOB Risk Analysis

2026 freight volatility (Baltic Dry Index +14.7% YoY) makes term selection critical. Key differentiators:

| Term | Cost Transparency | Risk Exposure | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai Port | Base unit price only. Additional costs: Origin handling ($85), export clearance ($120), ocean freight (fluctuating), destination customs/duties. | Buyer assumes full risk after cargo loading. Delays in Chinese port clearance common (avg. 72hrs in 2026). | Suitable for experienced importers with local Chinese logistics partners. Requires Incoterms® 2020 clause precision. |

| DDP (Delivered Duty Paid) | All-inclusive landed cost. Supplier manages export compliance, freight, insurance, import duties, and last-mile delivery. | Supplier bears 95% of transit risk. Critical for clinics without import expertise. | STRONGLY RECOMMENDED for first-time importers. Premium (8-12% vs FOB) offsets hidden costs and compliance risks. |

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Compliance Verified: ISO 13485:2016 (Certificate #CN-2023-14872), CE MDR Class IIa (NB #0482), FDA Registered (FEI 3015781746). Full validation dossiers available upon NDA.

- MOQ Flexibility: 1-unit orders for clinics via DDP; container-optimized pricing for distributors (MOQ 3 units for OEM).

- DDP Specialization: 98.7% on-time delivery rate (2025); manages all certifications, freight, and destination compliance for 45+ countries.

- Technical Edge: 19 years focused on dental sterilization R&D. Factory-direct pricing (30-45% below EU brands) with IoT-enabled cycle monitoring.

Engagement Protocol:

Contact via [email protected] with subject line “2026 Sterilization Sourcing Audit Request” for:

• Certificate validation package

• DDP landed cost calculator for your region

• Factory audit scheduling (Baoshan District, Shanghai)

Direct Technical Inquiry: WhatsApp +86 15951276160 (24/7 English/Deutsch/ Español support)

Implementation Checklist

- Require NB audit reports (not just certificates) before sample requests

- Negotiate DDP terms with penalty clauses for customs delays

- Verify sterilizer validation against your country’s latest EN/ISO standards

- Conduct remote factory audit via Carejoy’s live production cam system (standard for 2026 contracts)

- Secure firmware update commitment in master agreement

Note: All regulatory references align with Q1 2026 enforcement dates. Verify local requirements with your national competent authority prior to procurement.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs: Purchasing Dental Sterilization Machines in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental sterilization machine in 2026? | Most modern dental autoclaves operate on standard 220–240V AC at 50/60 Hz, compatible with global dental clinic infrastructure. However, compact tabletop models may support 110–120V for regions like North America. Always confirm local electrical standards and ensure the unit includes voltage stabilization features to prevent damage from power fluctuations. Units with dual-voltage capability (110V/220V) are increasingly available for international distribution and multi-location practices. |

| 2. Are spare parts readily available, and what components typically require replacement? | Yes, reputable manufacturers now offer 10+ year spare parts availability commitments as part of compliance with ISO 13485 and IEC 60601 standards. Common wear components include door seals, HEPA filters, solenoid valves, vacuum pumps, and chamber gaskets. Ensure your supplier provides a documented spare parts catalog with lead times and pricing. In 2026, many OEMs offer predictive maintenance kits and IoT-enabled systems that alert users to part degradation before failure. |

| 3. What does professional installation of a dental sterilizer involve, and is it mandatory? | Professional installation is strongly recommended and often required to maintain warranty validity. It includes site assessment (space, ventilation, power, water/drain access), secure leveling, connection to water and drainage (for Class B autoclaves), electrical grounding verification, and initial calibration. Certified technicians perform cycle validation and staff training. Plug-and-play tabletop models may only require power and water hookups but still benefit from technician commissioning to ensure compliance with local health regulations. |

| 4. What warranty terms are standard for dental sterilization equipment in 2026? | Leading manufacturers offer a minimum 2-year comprehensive warranty covering parts, labor, and control systems. Extended warranties up to 5 years are available, particularly for critical components like vacuum systems and sterilization chambers. In 2026, warranties increasingly include remote diagnostics support and guaranteed response times for service calls. Always verify whether the warranty is global or region-locked, especially for multi-national distributors. |

| 5. How can I ensure long-term service and technical support after the warranty expires? | Select manufacturers with established service networks and certified local technicians. In 2026, most premium brands offer post-warranty service contracts with annual preventive maintenance, priority response, and discounted labor rates. Confirm software update policies—especially for smart sterilizers with Wi-Fi/cloud connectivity—and ensure firmware support is guaranteed for at least 7 years post-purchase. Distributors should verify service coverage maps and spare parts logistics before committing to a product line. |

Need a Quote for Dental Sterilization Machines?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160