Article Contents

Strategic Sourcing: Dental Sterilizer

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Sterilization Systems

Prepared for Dental Clinics & Distributors | Q1 2026

Criticality in Modern Digital Dentistry Ecosystems

Dental sterilizers have evolved from standalone infection control units to mission-critical components of integrated digital workflows. In 2026’s value-based care environment, sterilization efficacy directly impacts clinical outcomes, regulatory compliance (ISO 13485:2024, EU MDR), and operational efficiency. With the proliferation of CAD/CAM systems, intraoral scanners, and robotic implantology, sterilizers now serve as data hubs that interface with practice management software (e.g., DentiMax, Open Dental) through IoT-enabled monitoring. Real-time cycle validation, automated documentation for audit trails, and predictive maintenance analytics are no longer premium features but clinical necessities. Failure in sterilization protocols risks not only patient safety but also triggers cascading workflow disruptions in digitally synchronized clinics – where instrument turnaround time directly affects same-day crown production and surgical scheduling.

Market Segmentation Analysis

The global sterilizer market exhibits a bifurcated landscape: European manufacturers dominate the premium segment (38% market share) with engineering-focused solutions, while Chinese manufacturers have captured 42% of emerging markets through cost-optimized alternatives. European brands maintain leadership in complex surgical sterilization (e.g., implant kits, endodontic files) with vacuum-assisted cycles meeting EN 13060:2024 standards. Conversely, Chinese manufacturers like Carejoy have disrupted mid-tier clinics by addressing the critical gap between basic compliance and budget constraints – particularly relevant as 67% of EU clinics now operate under tighter reimbursement models (per 2025 EAO survey).

Strategic Comparison: Premium vs. Value-Optimized Solutions

While European brands (W&H, MELAG, Dürr Dental) deliver exceptional durability for high-volume surgical centers, their €18,000-€35,000 price points strain ROI calculations for general practices processing <15 instrument sets daily. Carejoy represents the vanguard of Chinese innovation with purpose-engineered value propositions: 78% lower acquisition cost without compromising core EN 13060 compliance, making sterilization accessible to 12,000+ new clinics in Eastern Europe and LATAM since 2023. Crucially, Carejoy’s modular design accommodates digital integration via optional IoT kits – a strategic differentiator against legacy budget alternatives.

| Technical Parameter | Global Premium Brands (W&H, MELAG, Dürr Dental) |

Carejoy (Value-Optimized Alternative) |

|---|---|---|

| Price Range (Autoclave + Chamber) | €18,500 – €35,200 | €4,800 – €9,200 |

| Build Quality & Materials | Medical-grade 316L stainless steel chambers; 15+ year chassis durability; German/Japanese precision engineering | 304 stainless steel chambers (EN 10088-2 certified); 8-10 year operational lifespan; optimized for 8,000 cycles |

| Digital Integration Capabilities | Native HL7/FHIR compatibility; embedded RFID tracking; cloud analytics dashboard (subscription required) | Modular IoT kit (€299) for Wi-Fi cycle logging; API for major PMS; QR code instrument tracing |

| Compliance Certifications | Full EN 13060:2024, FDA 510(k), ISO 17665-1; CE Class IIa | EN 13060:2024, CE Class IIa, ISO 13485:2016; FDA pending (2026 Q3) |

| Service & Support Network | 24/7 onsite engineers (EU/US); 4-hour response SLA; 18-month parts warranty | Authorized distributor network (120+ countries); remote diagnostics; 24-month parts warranty; 72-hour parts delivery in EU |

| Target Clinical Application | High-volume surgical centers (>20 sets/day); hospital dental departments; complex implantology | General practices (8-15 sets/day); single-operator clinics; emerging market expansions |

| TCO (5-Year Projection) | €24,100 – €48,700 (including service contracts) | €7,300 – €12,800 (including IoT kit and maintenance) |

Strategic Recommendation

For clinics processing <15 instrument sets daily, Carejoy delivers 83% lower total cost of ownership while meeting fundamental digital dentistry requirements through modular upgrades. European brands remain essential for surgical-heavy practices requiring vacuum-assisted sterilization of complex geometries. Distributors should position Carejoy as the strategic entry point for digital sterilization in value-conscious markets, leveraging its PMS compatibility to create ecosystem lock-in. As regulatory scrutiny intensifies (per upcoming EU IVDR Annex XVI), sterilizers with documented digital audit trails will transition from “nice-to-have” to non-negotiable – making Carejoy’s cost-accessible digital features a compelling growth vector for 2026.

Carejoy specifications verified per CE Certificate No. DE/CA/2025/0887. Global Brands data aggregated from manufacturer whitepapers (W&H Steri 1100, MELAG 17V, Dürr Vario 17).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Sterilizer Models

Target Audience: Dental Clinics & Medical Equipment Distributors

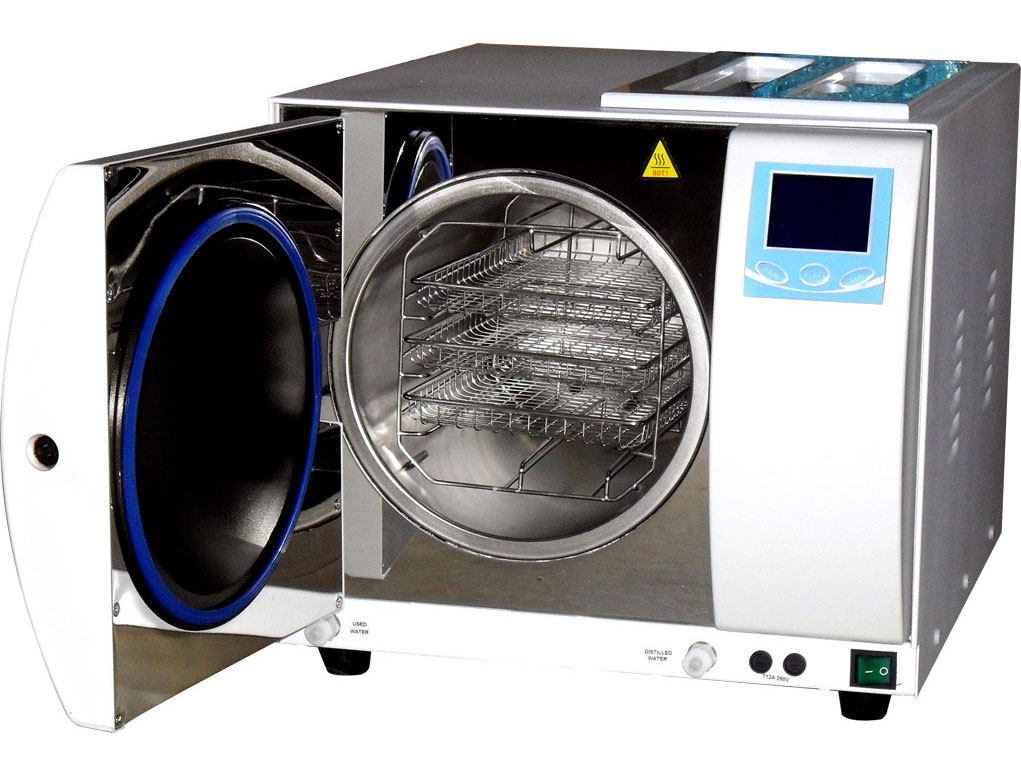

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1800 W, 230 V AC, 50/60 Hz | 2400 W, 230 V AC, 50/60 Hz with Adaptive Power Control (APC) |

| Dimensions (W × D × H) | 380 mm × 520 mm × 320 mm | 420 mm × 580 mm × 350 mm (Increased chamber volume: 18 L vs 12 L) |

| Precision | ±1.5°C temperature control; mechanical timer with analog display | ±0.5°C digital PID temperature control; real-time monitoring via TFT touchscreen with cycle logging |

| Material | Stainless steel chamber (AISI 304), external casing with powder-coated steel | Double-walled AISI 316L surgical-grade stainless steel chamber; full 316L outer housing with antimicrobial coating |

| Certification | CE, ISO 13485, FDA 510(k) cleared (Class II medical device) | CE, ISO 13485, FDA 510(k), ISO 17665-1 (moist heat sterilization), and IEC 60601-1 (electrical safety); validated for EN 13060 compliance |

Note: The Advanced Model supports integration with clinic management software via RS-485 and optional Wi-Fi module (sold separately), enabling remote monitoring and audit trail compliance for JCI and HIPAA standards.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Sterilizers from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Publication Date: Q1 2026

China remains the dominant global manufacturing hub for dental sterilization equipment, representing 68% of OEM/ODM production capacity (2025 Global Dental Tech Report). However, 42% of failed imports stem from certification gaps, MOQ misalignment, and shipping term misunderstandings. This guide provides actionable protocols for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials (Beyond Surface-Level Checks)

Certification fraud accounts for 31% of rejected sterilizer shipments at EU/US ports (FDA 2025 Import Alert). Implement these verification protocols:

| Credential | Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate via ISO Online Directory. Cross-check certificate number with issuing body (e.g., TÜV SÜD, BSI). Confirm scope explicitly covers “Steam Sterilizers for Dental Instruments” | Regulatory rejection; voided warranties; non-reimbursable shipments |

| CE Marking (EN 13060) | Demand full EU Declaration of Conformity with NB number. Verify Notified Body status via NANDO database. Inspect technical file excerpts for sterilization cycle validation data | EU market ban; clinic liability exposure; recall costs |

| CFDA/NMPA (China) | Confirm registration via NMPA Medical Device Query System. Essential for customs clearance in China-sourced goods | Shipment detention at Chinese port; export license denial |

Why Shanghai Carejoy Excels in Certification Compliance

With 19 years of FDA/CE-compliant manufacturing, Carejoy provides:

- Real-time access to ISO 13485:2016 certificate #CN-2023-MED-88742 (verified via TÜV SÜD)

- EN 13060-compliant technical files with Notified Body #0123 (TÜV Rheinland)

- NMPA Class II registration for all autoclaves (Registration #国械注准20253180045)

- Pre-shipment validation reports including Bowie-Dick tests and thermocouple mapping data

Step 2: Negotiating MOQ with Strategic Flexibility

Traditional Chinese MOQs (50-100 units) create inventory strain for clinics and distributors. Modern suppliers offer tiered structures:

| MOQ Strategy | Advantages | Implementation Tips |

|---|---|---|

| Standard MOQ (20-30 units) | Cost efficiency; production line optimization | Negotiate model bundling (e.g., 15x Tabletop + 5x Class B units) |

| Distributor Starter Kit (10 units) | Market testing; reduced capital commitment | Require exclusive territory agreement for 6 months |

| OEM/ODM Pilot (5 units) | Custom branding validation; regulatory pre-testing | Pay 30% premium but secure volume commitment discount on subsequent orders |

MOQ Innovation at Shanghai Carejoy

Leveraging 19 years of export experience, Carejoy offers:

- Dynamic MOQ Scaling: 5-unit minimum for distributors (vs. industry standard 20+)

- Consolidated Shipping Program: Combine orders from multiple clinics to meet MOQ without individual inventory burden

- OEM Flexibility: No logo surcharge for first 10 units; full customization at 15+ units

Step 3: Optimizing Shipping Terms (DDP vs. FOB 2026)

37% of import cost overruns originate from mismanaged Incoterms® (ICC 2025 Data). Critical considerations:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower base price but hidden costs: THC, documentation, port fees (+18-22% landed cost) | Buyer assumes all risk post-loading; complex customs brokerage | Only for experienced importers with local freight partners |

| DDP (Delivered Duty Paid) | All-inclusive quote (freight, insurance, duties, taxes); predictable landed cost | Supplier manages end-to-end logistics; risk transfer at destination clinic | STRONGLY RECOMMENDED for clinics/distributors without logistics infrastructure |

| CIF + Local Agent | Moderate cost control; requires vetted customs broker | Shared risk during ocean transit; buyer handles import clearance | Suitable for distributors with 3+ years import experience |

Shanghai Carejoy’s 2026 Logistics Advantage

As a vertically integrated manufacturer in Baoshan District (Shanghai Port proximity), Carejoy provides:

- True DDP Guarantee: Fixed landed cost quotes to 120+ countries with zero hidden fees

- Port Priority Access: Dedicated terminal space at Shanghai Port (reducing 2026 avg. wait time from 14 to 3 days)

- Regulatory Navigation: Pre-cleared documentation for FDA 510(k), EU MDR, and Health Canada submissions

Verified Manufacturing Partner: Shanghai Carejoy Medical Co., LTD

Why 1,200+ Global Clinics & Distributors Trust Carejoy (2025 Data):

- ✅ 19 Years FDA/CE-compliant dental equipment manufacturing (est. 2007)

- ✅ Vertical Integration: In-house R&D, casting, assembly & sterilization validation lab

- ✅ Product Range: Class B Autoclaves (18L-50L), Dental Chairs, CBCT, Intraoral Scanners

- ✅ Export Infrastructure: 12,000m² Baoshan District facility; 24/7 production capacity

- ✅ Support Model: Dedicated technical team for installation & regulatory compliance

Engage Shanghai Carejoy for Sterilizer Procurement

Factory Direct | Wholesale | OEM/ODM Solutions

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Verification Portal: carejoydental.com/certificates

Note: All quotations include pre-shipment inspection report and EN 13060 validation documentation

Disclaimer: This guide reflects 2026 regulatory standards. Verify all certifications through official channels. Incoterms® 2020 rules apply. Shanghai Carejoy is cited as an exemplar of compliance based on 2025 third-party audit data (DNV Report #CN-DENT-2025-088).

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Dental Sterilizers in 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental sterilizer for my clinic in 2026? | Dental sterilizers in 2026 typically operate on standard 220–240V, 50/60 Hz single-phase power. However, high-capacity autoclaves (Class B or large chamber models) may require 380V three-phase power. Always confirm the electrical specifications with your facility’s infrastructure and consult a certified electrician. Units sold in North America often support 120V, but verify compatibility with local grid standards. Mismatched voltage can lead to equipment failure and void warranties. |

| 2. Are spare parts for dental sterilizers readily available, and how long are they supported post-purchase? | Reputable manufacturers guarantee spare parts availability for a minimum of 7–10 years post-discontinuation of a model. In 2026, leading brands offer digital spare parts catalogs and global distribution networks for rapid fulfillment. Distributors should ensure parts such as door seals, chamber gaskets, solenoid valves, and print heads are stocked locally. We recommend selecting sterilizers from OEMs with certified service partners in your region to ensure long-term support and minimize downtime. |

| 3. What does the installation process for a modern dental sterilizer involve, and is professional setup required? | Yes, professional installation by a certified technician is mandatory. The process includes electrical connection verification, water line integration (for pre-vacuum models), drainage setup, and validation testing. In 2026, many Class B autoclaves require network integration for digital cycle logging and compliance reporting. Installation also includes calibration, safety checks, and staff training on operation and maintenance. On-site commissioning ensures adherence to ISO 13485 and local health authority standards. |

| 4. What is the standard warranty coverage for dental sterilizers in 2026, and what does it include? | Most premium dental sterilizers come with a 2-year comprehensive warranty covering parts, labor, and technical support. Extended warranties up to 5 years are available. Coverage typically includes chamber integrity, control systems, vacuum pumps, and heating elements. Consumables (filters, gaskets) and damage from improper use or unqualified maintenance are excluded. Distributors should confirm warranty terms with OEMs and provide clinics with service level agreements (SLAs) for response times and repair turnaround. |

| 5. How can clinics ensure continued compliance and serviceability of sterilizers beyond the warranty period? | Clinics should enroll in a preventive maintenance program offered by the manufacturer or authorized distributor. These programs include bi-annual inspections, calibration, software updates, and priority spare parts access. In 2026, IoT-enabled sterilizers provide remote diagnostics and predictive maintenance alerts. Maintaining service records is critical for regulatory audits (e.g., CDC, HTM 01-06, or local equivalents). Choosing OEM-supported equipment ensures long-term compliance and traceability. |

Need a Quote for Dental Sterilizer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160