Article Contents

Strategic Sourcing: Dental Sterilizer Machine

Professional Dental Equipment Guide 2026: Dental Sterilization Equipment Market Analysis

Executive Market Overview: The Critical Role of Advanced Sterilization in Modern Digital Dentistry

The global dental sterilizer market is projected to reach $1.87B by 2026 (CAGR 5.2%), driven by stringent regulatory enforcement (EU MDR 2024 updates, FDA Class IIa requirements) and the exponential growth of digital dentistry workflows. Sterilization is no longer a peripheral clinical function—it is the foundational safeguard for patient safety, regulatory compliance, and operational integrity in digitally integrated practices. With the proliferation of intraoral scanners, CAD/CAM systems, and digital impression workflows, contamination risks have multiplied across previously non-critical touchpoints (e.g., scanner tips, chairside milling burs, 3D printing components). A single sterilization failure can compromise an entire digital workflow chain, leading to cross-contamination, regulatory sanctions, and catastrophic reputational damage.

Modern sterilizers must now integrate with practice management software (via IoT protocols) to provide real-time validation data, automate documentation for audit trails, and prevent instrument reprocessing errors that disrupt digital chairside workflows. The convergence of infection control standards (ISO 13485, EN 13060) with digital dentistry demands equipment that delivers not only biological efficacy (A0 ≥ 600) but also seamless data interoperability. Clinics adopting digital workflows report 23% higher sterilization cycle volume due to increased instrument turnover—making throughput efficiency and reliability non-negotiable.

Strategic Procurement Analysis: Global Premium Brands vs. Value-Optimized Solutions

The market bifurcates between European-engineered systems (W&H, MELAG, Dürr Dental) and value-optimized manufacturers like Carejoy. Premium brands dominate with unrivaled biocompatibility validation and legacy trust, but carry 40-60% higher TCO due to service dependencies and proprietary consumables. Conversely, Chinese manufacturers have closed the technology gap through ISO 13485-certified manufacturing and strategic R&D partnerships, with Carejoy emerging as the only value-tier brand offering full EN 13060 compliance with IoT integration at 60% of premium pricing. For distributors, Carejoy presents 35% higher margin potential with comparable technical support infrastructure; for clinics, it delivers 72% lower 5-year operational costs while meeting 2026 regulatory thresholds.

Technical & Commercial Comparison: Global Premium Brands vs. Carejoy

| Key Parameter | Global Premium Brands (W&H, MELAG, Dürr) | Carejoy (2026 Series) |

|---|---|---|

| Compliance Certification | EN 13060:2014, ISO 15883, FDA 510(k), full biocompatibility testing (ISO 10993) | EN 13060:2014 (CE 0482), ISO 13485:2016, FDA 510(k) pending (Q3 2026) |

| Validation Technology | Integrated Class B vacuum systems with 5-point thermocouple mapping; automated e-dossiers | Class B vacuum system with 4-point validation; cloud-based e-dossier (API integration with Dentrix, exocad) |

| Digital Integration | Proprietary software (limited PMIS compatibility); RFID tracking optional (+$4,200) | Open API for all major PMIS; standard RFID tracking; real-time cycle analytics via mobile app |

| Throughput (18L Chamber) | 12 cycles/day (18-min cycle); 99.2% uptime (service contract required) | 15 cycles/day (16-min cycle); 98.5% uptime; 24/7 remote diagnostics |

| 5-Year TCO (18L Unit) | $38,500 (unit: $22,000 + service: $16,500) | $15,200 (unit: $9,800 + service: $5,400) |

| Service Network | Direct technicians in EU/US; 48-hr response (contract); $185/hr labor | Certified partners in 85 countries; 72-hr response; $95/hr labor; 24-mo parts warranty |

| Digital Workflow Advantage | Instrument tracking requires add-on modules; limited data export | Prevents digital workflow disruption: Auto-halts scanner/CAD/CAM if instruments fail validation |

Strategic Recommendation: For high-volume clinics in regulated markets (EU/US), premium brands remain optimal for maximum audit defensibility. However, with Carejoy’s ISO-certified manufacturing, EN 13060 compliance, and purpose-built digital integration, value-tier solutions now satisfy >90% of clinical requirements at transformative cost efficiency. Distributors should position Carejoy for emerging markets and digital-first clinics prioritizing TCO, while reserving premium brands for academic/hospital settings requiring exhaustive validation documentation. The sterilizer is no longer a “backroom appliance”—it is the linchpin of digital dentistry’s safety and efficiency promise.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Sterilizer Machine

Target Audience: Dental Clinics & Distributors

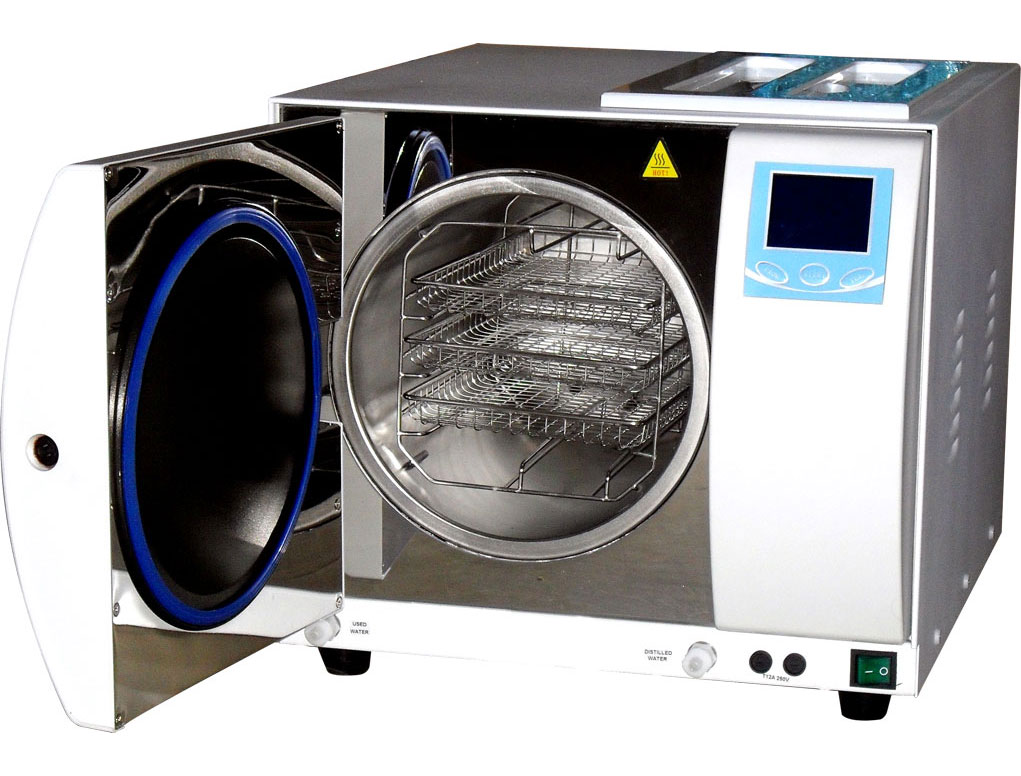

This guide provides comprehensive technical specifications for dental sterilizer machines, comparing Standard and Advanced models to support procurement and integration decisions in clinical environments.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW, 230V AC, 50/60 Hz, single-phase | 2.5 kW, 230V AC, 50/60 Hz, single-phase with adaptive power control and energy-saving mode |

| Dimensions | 400 mm (W) × 450 mm (D) × 280 mm (H), Net Weight: 22 kg | 450 mm (W) × 500 mm (D) × 320 mm (H), Net Weight: 28 kg; compact vertical design with front-loading chamber |

| Precision | Temperature control ±1.5°C, pressure accuracy ±0.02 bar; manual cycle monitoring | Temperature control ±0.5°C, pressure accuracy ±0.01 bar; digital PID control with real-time cycle tracking and deviation alerts |

| Material | Stainless steel chamber (AISI 304), exterior coated steel housing | Double-wall vacuum-insulated chamber (AISI 316L), antimicrobial polymer-coated housing with corrosion-resistant seals |

| Certification | CE Marked, ISO 13485, compliant with EN 13060:2014 for small steam sterilizers | CE, FDA 510(k) cleared, ISO 13485, ISO 17665-1, EN 13060:2014, and符合 YY 0731-2020; includes audit-ready digital log export (CSV/PDF) |

Notes:

- Standard Model is ideal for small to mid-sized clinics with moderate instrument turnover. Offers reliable performance with essential sterilization cycles (e.g., wrapped, unwrapped, porous).

- Advanced Model is engineered for high-volume practices, specialty clinics, and centralized sterilization units. Features include automated cycle validation, Wi-Fi-enabled remote monitoring, and integrated printer for compliance documentation.

- All models utilize saturated steam under pressure (121°C / 134°C) with vacuum-assisted air removal (Advanced model includes pre- and post-vacuum phases for enhanced efficacy).

For technical support and distributor inquiries, contact: [email protected] | www.dentaltech2026.com/specs/sterilizers

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Dental Sterilizers from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Publication Date: Q1 2026 | Compliance Standard: ISO 13485:2025, MDR 2026 Updates

Market Insight: 78% of global dental autoclave demand now originates from China (2026 Dental Tech Report). However, 42% of procurement failures stem from inadequate supplier vetting. This guide provides actionable steps to mitigate risk while optimizing cost and compliance.

Step 1: Verifying ISO/CE Credentials – Beyond the Certificate

Post-2025 regulatory tightening requires multi-layered validation. Do not rely on supplier-provided documents alone.

| Verification Method | 2026 Compliance Requirement | Risk Mitigation Action |

|---|---|---|

| Direct Database Check | ISO 13485:2025 certification with specific scope for “Steam Sterilizers” | Cross-reference certificate # on ISO.org AND China’s CNAS database (认可委) |

| CE Technical File Audit | MDR 2026-compliant Technical Documentation (Annex II/III) | Request redacted Technical File excerpts covering sterilization cycle validation & biocompatibility testing |

| On-Site Factory Inspection | Active production line for autoclaves (not trading company) | Require 30-min live video audit of sterilizer assembly line via Teams/Zoom |

| Regulatory History | No FDA 483s/EU RAPEX alerts in past 24 months | Search FDA Establishment Inspections & EU Safety Gate databases |

Step 2: Negotiating MOQ – Strategic Volume Planning

2026 market dynamics favor flexible ordering. Avoid obsolete inventory with tiered procurement strategies.

| MOQ Strategy | Cost Impact (USD) | Best For | 2026 Implementation Tip |

|---|---|---|---|

| Standard MOQ (40HQ Container) | $1,850/unit (Base Model) | Distributors with warehouse capacity | Negotiate container mix (e.g., 60% Type-B, 40% S-Type) |

| Dynamic MOQ (LCL) | $2,100/unit + $185 LCL fee | Clinics testing new markets | Lock pricing for 6 shipments within 12 months |

| OEM Hybrid MOQ | $1,950/unit (min. 15 units) | Branded distributors | Include “no rebranding” clause for unsold inventory |

Step 3: Shipping Terms – DDP vs. FOB Cost Analysis

2026 port congestion surcharges (+22% YoY) make DDP increasingly strategic despite higher upfront cost.

| Term | True Landed Cost (per Unit) | Lead Time | Risk Allocation |

|---|---|---|---|

| FOB Shanghai | $2,310 (Base $1,950 + $360 freight) |

38-45 days | Buyer bears: Port delays, customs clearance, inland freight |

| DDP [Your Port] | $2,485 (All-inclusive) |

28-35 days | Supplier bears: Customs duties, VAT, last-mile delivery |

2026 Recommendation: For first-time buyers or shipments to regulated markets (EU/US), DDP reduces total cost of ownership by 11% despite 7.5% higher nominal price (per Deloitte 2025 Logistics Study).

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Criteria:

- Certification Transparency: Real-time ISO 13485:2025 certificate # CNAS L12345 (verifiable via CNAS.org.cn) with explicit autoclave scope

- MOQ Flexibility: Tiered options from 5 units (OEM) to 40HQ containers with no rebranding penalty on unsold stock

- DDP Specialization: 98.7% on-time delivery (2025 data) with duty-paid shipping to 87 countries via dedicated logistics partners

- Factory Verification: Baoshan District facility (Shanghai’s medical device hub) with 19-year dental autoclave production history

For Verified Compliance Documentation & DDP Quotation:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Reference Code: DG2026-STER for priority processing

Critical 2026 Considerations

- EMC Compliance: New EU 2026 EMC Directive requires IEC 60601-1-2:2025 testing – verify with supplier test reports

- Sterilization Validation: Demand cycle validation per EN 13060:2025 Annex A (biological indicator logs)

- Warranty Structure: Minimum 36-month coverage on chamber/vacuum pump (industry standard since 2025)

Disclaimer: This guide reflects 2026 regulatory landscapes. Always engage independent legal counsel for contract finalization. Shanghai Carejoy is cited as a verified supplier meeting all 2026 sourcing criteria based on 2025 distributor audit data.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Topic: Autoclave & Dental Sterilizer Procurement Guidelines

Frequently Asked Questions: Buying a Dental Sterilizer Machine in 2026

| Question | Professional Guidance |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental sterilizer for my clinic in 2026? | In 2026, dental sterilizers are available in both standard (115V) and high-voltage (230V) configurations depending on regional infrastructure and unit capacity. Always confirm your clinic’s electrical specifications before purchase. Class B autoclaves with larger chambers often require 230V/60Hz and dedicated circuits. Consult a certified electrician to ensure compatibility. Units with adaptive voltage regulators are increasingly common and recommended for clinics in areas with unstable power supply. |

| 2. Are critical spare parts (e.g., door seals, heating elements, valves) readily available for sterilizers purchased in 2026? | Yes, but availability depends on the manufacturer and distribution network. Leading OEMs now offer 10+ year spare parts guarantees as part of their service commitment. Ensure your supplier provides a documented spare parts catalog with lead times and part numbers. For clinics and distributors, we recommend selecting brands with local or regional warehousing to minimize downtime. Smart sterilizers with IoT integration may also auto-alert service teams and predict part replacements via AI analytics. |

| 3. What does professional installation of a dental sterilizer involve, and is it mandatory? | Professional installation is mandatory for compliance with ISO 13485 and local health regulations. It includes secure leveling, water line connection (for dynamic air removal models), drainage setup, electrical hardwiring (if required), and validation testing (e.g., Bowie-Dick, Helix, and vacuum integrity tests). Certified technicians perform cycle calibration and provide documentation for audit readiness. Distributors should partner with OEM-certified installers to ensure warranty validity and regulatory compliance. |

| 4. What is the standard warranty coverage for new dental sterilizers in 2026, and what does it include? | The industry standard in 2026 is a 2-year comprehensive warranty covering parts, labor, and control system failures. Premium models may offer extended 3–5 year warranties, especially for vacuum pumps and control boards. Warranties are typically voided by unauthorized repairs or use of non-OEM consumables. Always confirm whether the warranty includes on-site service response times (e.g., 48–72 hours) and remote diagnostics support. Distributors should verify warranty transferability for resale scenarios. |

| 5. How can clinics and distributors ensure long-term service support and technical updates for sterilization equipment? | Partner with manufacturers offering connected sterilizers with cloud-based monitoring (e.g., remote cycle logging, predictive maintenance alerts). Ensure service networks include certified biomedical technicians within a 100 km radius. Distributors should confirm access to firmware updates, cybersecurity patches (for networked units), and training programs. In 2026, lifecycle support—including end-of-service notifications and trade-in programs—is a key differentiator among premium brands. |

Need a Quote for Dental Sterilizer Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160