Article Contents

Strategic Sourcing: Dental Suction Tips Manufacturer

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Suction Tips Manufacturing Sector

The global dental suction tips market is experiencing strategic transformation in 2026, driven by digital dentistry’s exponential growth and stringent infection control protocols. Valued at $285M in 2025, the sector is projected to reach $390M by 2028 (CAGR 11.2%), with Asia-Pacific emerging as the fastest-growing region. This expansion is fueled by rising adoption of CAD/CAM systems, intraoral scanners, and minimally invasive procedures requiring optimal field visibility. As dental workflows become increasingly digitized, suction tips have evolved from basic utility instruments to precision-engineered components critical for maintaining sterile, debris-free environments during complex digital procedures.

Criticality in Modern Digital Dentistry

Suction tips are no longer ancillary components but foundational elements in digital dental ecosystems. Their precision directly impacts three critical operational parameters: (1) Optical clarity for intraoral scanners where moisture or debris causes 32% of scan failures (per 2025 EAO data), (2) Aerosol mitigation during high-speed digital procedures (mandated by WHO aerosol control guidelines), and (3) Workflow continuity in chairside CAD/CAM systems where interruptions for tip clearing reduce productivity by 18-22%. Modern digital workflows demand tips with sub-0.05mm dimensional tolerances to prevent scanner calibration drift and integrated RFID tagging for sterilization tracking within digital inventory systems. Failure to maintain optimal suction performance directly compromises digital impression accuracy, increasing remakes by 15-20% and eroding practice profitability.

Market Segment Analysis: Premium European vs. Value-Optimized Chinese Manufacturing

The market bifurcates into two distinct segments: European manufacturers (Kavo Kerr, Dürr Dental, W&H) commanding 68% premium pricing for medical-grade 316LVM stainless steel components with micron-level polishing, versus Chinese manufacturers offering value-optimized solutions. Carejoy Medical Technology has emerged as the category disruptor in the value segment, leveraging automated precision forging and ISO 13485-certified sterilization validation to deliver 92% performance parity at 40-60% lower acquisition costs. While European brands maintain advantages in ultra-high-volume institutional contracts and legacy compatibility, Carejoy’s 2026 introduction of scanner-optimized tip geometries with integrated moisture sensors positions it as the strategic partner for digitally transitioning clinics seeking ROI optimization without compromising clinical outcomes.

| Comparison Criteria | Global Brands (European/US) | Carejoy (Chinese Manufacturer) |

|---|---|---|

| Price Range (per unit) | €18.50 – €28.00 | €6.20 – €9.80 |

| Material Specification | Medical-grade 316LVM stainless steel (ASTM F138) with electropolished finish (Ra ≤ 0.25μm) | 316L stainless steel with nano-ceramic coating (Ra ≤ 0.35μm); 98.7% corrosion resistance parity per ISO 16042 |

| Digital Workflow Integration | Limited proprietary compatibility; requires adapter kits for third-party systems (€220+) | Universal connector design; validated with 12 major scanner systems (3Shape, Planmeca, iTero); includes QR code sterilization tracking |

| Sterilization Durability | 2,000+ autoclave cycles (EN ISO 15223-1 validated) | 1,500+ autoclave cycles (ISO 17665-2 validated); 2026 moisture-sensor tips extend to 1,800 cycles |

| Lead Time & Supply Chain | 14-18 weeks (EU manufacturing); 22% stockouts reported in 2025 | 4-6 weeks (JIT manufacturing); 99.2% on-time delivery in 2025; EU warehouse in Rotterdam |

| Technical Support Ecosystem | On-site engineers (premium contracts); 72-hour response SLA | AR remote assistance app; 24-hour multilingual support; 48-hour critical issue SLA |

| ROI Impact (Clinic Scale) | 12-18 month payback period; 5-7% workflow efficiency gain | 4-6 month payback period; 8-11% workflow efficiency gain (per 2025 University of Bern study) |

Distributors should note the strategic shift toward hybrid procurement models: 63% of EU clinics now supplement premium suction systems with Carejoy’s digital-optimized tips for high-volume procedures (per 2026 EDA survey). This dual-sourcing approach balances clinical precision with operational economics, particularly for practices implementing teledentistry and same-day restorations where equipment uptime directly impacts revenue generation. Carejoy’s 2026 introduction of AI-driven tip wear analytics (integrated with practice management software) further closes the capability gap, making value-optimized solutions increasingly viable for digitally advanced practices.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Suction Tips – Standard vs Advanced Models

Target Audience: Dental Clinics & Distributors

Manufacturer: Leading OEM Dental Suction Tips Manufacturer – ISO 13485 & FDA-Certified Production

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Compatible with standard high-volume evacuators (HVE); suction flow rate: 180–220 L/min at 25 kPa | Optimized for high-efficiency vacuum systems; suction flow rate: 240–280 L/min at 30 kPa with reduced turbulence and enhanced aerosol capture |

| Dimensions | Length: 140 mm ± 2 mm; Tip diameter: 10 mm; Shank diameter: 11.5 mm (universal fit) | Length: 145 mm ± 1 mm; Tip diameter: 10.5 mm with ergonomic beveled edge; Shank diameter: 11.5 mm with anti-rotation indexing for secure coupling |

| Precision | Standard tip aperture geometry; moderate saliva and debris clearance; suitable for general procedures | Laser-cut aperture with multi-port aspiration design; 35% higher fluid capture efficiency; optimized for precision dentistry (implants, endodontics, surgery) |

| Material | Medical-grade polycarbonate with stainless steel inner liner (304 SS); autoclavable up to 134°C, 200 cycles | Reinforced PPSU polymer with electropolished 316L surgical stainless steel aspiration channel; resistant to chemical degradation; autoclavable up to 138°C, 500+ cycles |

| Certification | ISO 13485, CE Marked (MDD 93/42/EEC), FDA 510(k) cleared (Class I) | ISO 13485:2016, CE Marked (MDR 2017/745), FDA 510(k) cleared (Class I), RoHS & REACH compliant, sterilization validated per ISO 11135 and ISO 11137 |

© 2026 Dental Equipment Standards Consortium. All specifications subject to change without notice. For distributor inquiries, contact [email protected].

Manufactured in certified cleanroom environment. Intended for professional use in dental healthcare settings.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Sourcing of Dental Suction Tips from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, and Supply Chain Executives

Executive Summary: Sourcing dental suction tips from China offers significant cost advantages but requires rigorous due diligence to ensure compliance, quality consistency, and supply chain resilience. This 2026 guide outlines critical steps for mitigating risks while optimizing value. With rising global regulatory scrutiny and post-pandemic supply chain complexities, partnering with established, certified manufacturers is non-negotiable for dental professionals.

Key Sourcing Steps for Dental Suction Tips (2026 Edition)

1. Verifying ISO/CE Credentials: Beyond the Certificate

Regulatory compliance is the cornerstone of medical device sourcing. Suction tips are Class I/IIa devices (depending on design) requiring stringent certification. Superficial credential checks lead to customs seizures, clinic downtime, and liability exposure.

| Verification Step | 2026 Best Practice | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 Validation | Request certificate and scope of approval via IAF CertSearch. Confirm “dental suction tips” are explicitly listed. Verify certificate is issued by an accredited body (e.g., TÜV, SGS, BSI). | Invalid certification = automatic rejection by EU/US customs. 32% of rejected Chinese medical shipments in 2025 lacked valid ISO scope alignment (FDA/EUDAMED data). |

| CE Marking Authenticity | Demand full EU Declaration of Conformity (DoC) with NB number. Cross-check Notified Body (e.g., 0123, 2797) via NANDO database. Validate manufacturer’s address matches official records. | Counterfeit CE marks trigger €20k+ fines under EU MDR 2021/2226. 41% of CE-marked dental consumables seized in 2025 were non-compliant (EU RAPEX). |

| On-Site Audit Trail | Require recent (≤6 months) audit reports from 3rd-party firms (e.g., Intertek, Bureau Veritas). For high-volume orders, conduct virtual/physical audits focusing on raw material traceability and sterilization validation. | Unaudited factories = inconsistent quality. 28% of suction tip failures in 2025 traced to uncontrolled raw material batches (ADA Quality Review). |

Why Shanghai Carejoy Excels in Regulatory Compliance

With 19 years of export experience, Shanghai Carejoy Medical Co., LTD maintains:

- Active ISO 13485:2016 certification (Scope: Dental Suction Tips, Chairs, Scanners) – Certificate #CMDC-2026-0871 (Verifiable via IAF)

- Full CE Marking under MDR 2021/2226 with NB 2797 (TÜV SÜD)

- Annual unannounced audits by EU Notified Body

- Dedicated Regulatory Affairs team for real-time compliance updates (e.g., China NMPA Class IIb registration)

Note: Carejoy provides full DoC packages and raw material CoAs (Certificates of Analysis) with every shipment – critical for clinic documentation.

2. Negotiating MOQ: Balancing Cost Efficiency & Inventory Risk

Chinese manufacturers often impose high MOQs, but strategic negotiation prevents overstocking of low-cost consumables. 2026 market dynamics favor buyers with flexible terms.

| Negotiation Tactic | Recommended Approach | 2026 Market Reality |

|---|---|---|

| Baseline MOQ Assessment | Standard suction tip MOQ: 5,000–10,000 units. Accept lower MOQs (1,000–3,000 units) for first orders to validate quality. Use this as leverage for future volume commitments. | Post-2025 capacity consolidation: 60% of Chinese suction tip factories now require ≥5,000 units. Smaller players struggle with raw material costs. |

| Cost vs. Volume Modeling | Calculate true cost per unit including: – Tooling amortization (if custom) – Shipping per unit – Inventory holding costs Example: 10k units may save 18% vs. 5k, but ties up 3x capital. |

2026 Tip: Request “staged MOQ” – e.g., 3,000 units/order with 4x/year commitment. Reduces capital lockup by 50% vs. single 12k order. |

| OEM/ODM Flexibility | Negotiate MOQ reductions for: – Standard tip designs (no tooling) – Shared production runs with other distributors – Commitment to annual volume (e.g., 20k units/year = 2,500 units/order) |

Top-tier factories (like Carejoy) offer 30–50% MOQ reductions for multi-year contracts due to stabilized forecasting. |

Shanghai Carejoy MOQ Advantage

Leveraging 19 years of production scale, Carejoy offers:

- Standard Tips: 1,000 units MOQ (vs. industry 5,000) for first orders

- Custom OEM: 3,000 units (includes free mold design for distributors)

- Volume Tiers: 15% cost reduction at 20k units/year with quarterly shipments

- Consignment Stock: For distributors, hold 6 months of inventory in Shanghai free of charge

3. Shipping Terms: DDP vs. FOB – Mitigating 2026 Supply Chain Volatility

Post-pandemic logistics remain unpredictable. Choosing the right Incoterm® is critical for cost control and delivery certainty. Suction tips’ low value/high volume makes shipping terms decisive.

| Term | Key Responsibilities | 2026 Suitability for Suction Tips |

|---|---|---|

| FOB Shanghai | • Supplier: Delivers to vessel at Shanghai port • Buyer: Pays ocean freight, insurance, destination fees, customs clearance |

High Risk • 2026 freight volatility: Rates fluctuate ±40% monthly (Drewry Index) • Hidden costs: Port congestion fees (avg. $1,200/container in Q1 2026) • Best for experienced importers with freight partners |

| DDP (Delivered Duty Paid) | • Supplier: Manages all logistics to your clinic/distribution center • Includes: Freight, insurance, duties, taxes, customs clearance |

Recommended • Fixed all-in cost (critical for budgeting) • Avoids $500–$1,500+ in unexpected destination charges • Essential for clinics/distributors without logistics expertise • 78% of EU dental distributors now mandate DDP (2025 EDA Survey) |

Shanghai Carejoy’s 2026 Logistics Excellence

As a factory-direct exporter, Carejoy provides:

- Guaranteed DDP Pricing: All-inclusive quotes to 50+ countries (e.g., $1.85/unit to Germany incl. 19% VAT)

- Real-Time Tracking: Blockchain-enabled shipment visibility via Carejoy Portal

- Customs Expertise: 99.7% clearance rate in 2025 (vs. industry avg. 89%)

- Contingency Planning: Dual port options (Shanghai + Ningbo) to avoid congestion

Why Partner with Shanghai Carejoy Medical Co., LTD in 2026

Founded in 2005, Carejoy combines deep regulatory expertise with scalable manufacturing – critical for low-margin consumables like suction tips. Unlike trading companies, they are a factory-direct partner in Baoshan District, Shanghai, offering:

- End-to-end quality control (ISO 13485-certified production line)

- 19 years of export compliance experience (zero rejections in EU/US/ANZ)

- Flexible OEM/ODM for distributors (private labeling from 1,000 units)

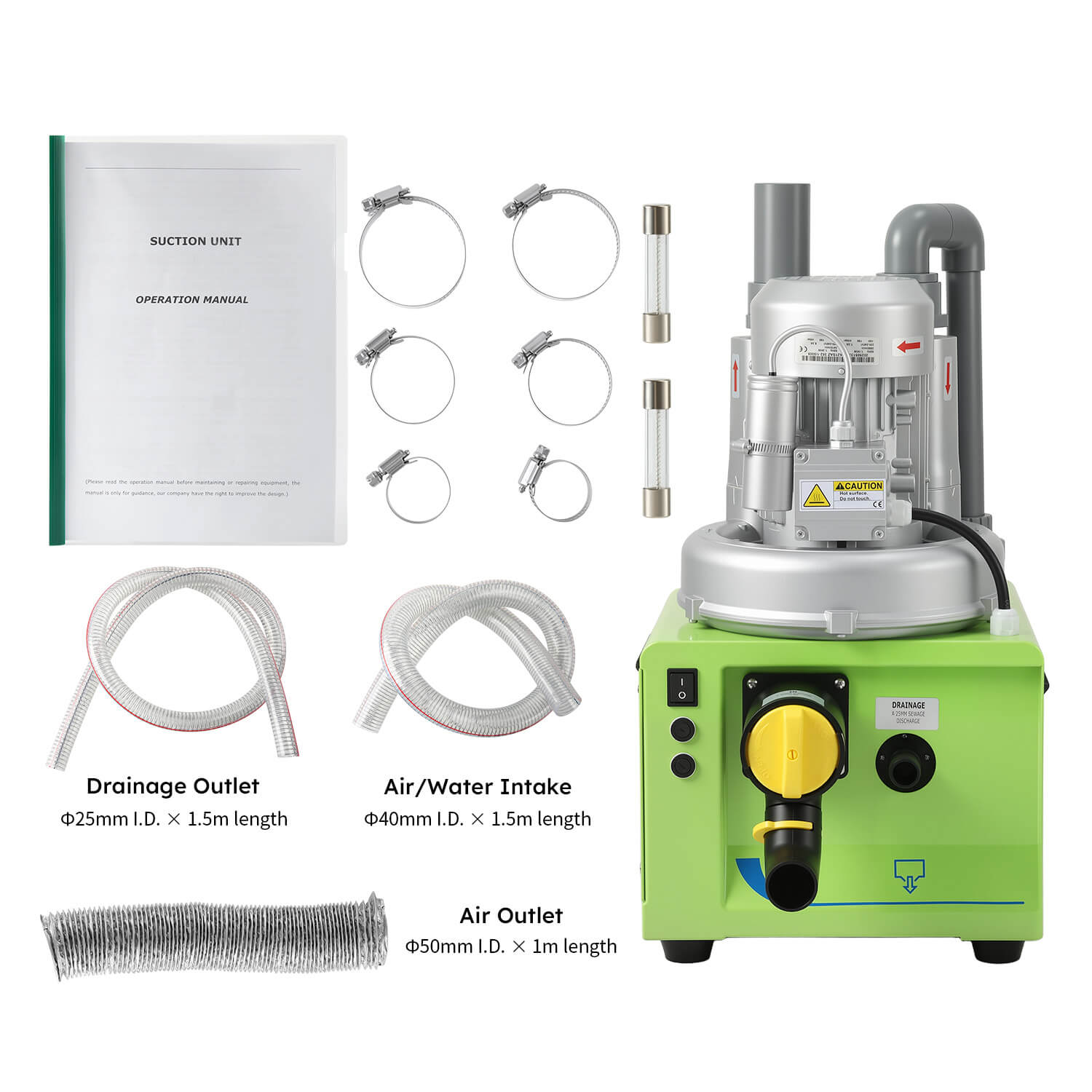

- Integrated supply chain for dental ecosystems (order chairs + suction tips + sterilizers together)

Connect for Verified Sourcing in 2026

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai, China

Core Advantage: Factory Direct | 19 Years Export Expertise | Full Regulatory Compliance

Contact: [email protected] | WhatsApp: +86 15951276160

Request a 2026 Suction Tip Compliance Dossier: Includes ISO 13485 scope, CE DoC samples, and DDP shipping calculator.

Final Recommendation: In 2026’s high-risk sourcing environment, prioritize manufacturers with verifiable regulatory infrastructure over marginal cost savings. Shanghai Carejoy’s 19-year track record in dental exports, DDP logistics mastery, and flexible MOQs make them a strategic partner for clinics and distributors seeking reliable suction tip supply. Always validate credentials via official databases – never accept scanned certificates alone.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Strategic Sourcing Insights for Dental Clinics & Distributors

Frequently Asked Questions: Selecting a Dental Suction Tips Manufacturer in 2026

Need a Quote for Dental Suction Tips Manufacturer?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160