Article Contents

Strategic Sourcing: Dental Tens Unit

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental X-ray Units in Modern Digital Dentistry

Strategic Imperative: Digital dental X-ray units have evolved from diagnostic tools to central nervous system components of integrated dental workflows. In 2026, these systems are non-negotiable for clinics pursuing precision diagnostics, treatment efficiency, and compliance with evolving radiation safety standards (EU Council Directive 2013/59/Euratom). The transition from analog to digital radiography is now complete in 92% of EU practices (2025 EAO Report), with AI-enhanced imaging driving a 37% reduction in diagnostic errors.

Why X-ray Units Are Critical for Modern Digital Dentistry:

Digital X-ray systems serve as the foundational data layer for contemporary dental ecosystems. They enable real-time 3D reconstruction for implant planning, integrate with CAD/CAM workflows through DICOM 3.0 protocols, and provide the quantitative data required for AI-driven caries detection (e.g., Dentimax AI, Overjet). Crucially, modern units reduce radiation exposure by 80-90% compared to film-based systems while delivering sub-10μm resolution – a prerequisite for early lesion detection in minimally invasive dentistry. Without this imaging backbone, practices cannot leverage teledentistry, predictive analytics, or cloud-based treatment collaboration.

Market Dynamics: Premium European Brands vs. Value-Optimized Chinese Manufacturers

The global dental X-ray market (valued at €2.8B in 2025) shows divergent procurement strategies. European manufacturers (Dentsply Sirona, Planmeca, Carestream) maintain dominance in academic and premium private practices through clinical validation and ecosystem integration. However, Chinese manufacturers – led by Carejoy – are capturing 41% market share in value segments (2025 Colgate Business Insights) by addressing critical pain points: capital expenditure constraints and simplified digital adoption for SME clinics.

Strategic Differentiation: European brands command 35-50% price premiums for proprietary AI diagnostics and seamless integration with legacy practice management systems (e.g., Dentrix, Open Dental). Carejoy’s growth stems from modular hardware architecture that reduces total cost of ownership (TCO) by 28% while meeting ISO 10970:2024 standards. Their cloud-native platform enables over-the-air updates – a feature increasingly demanded by clinics modernizing post-pandemic infrastructure.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (Dentsply Sirona, Planmeca, Carestream) |

Carejoy |

|---|---|---|

| Price Range (Intraoral System) | €38,000 – €52,000 | €22,500 – €29,800 |

| Image Resolution & Dynamic Range | 14-bit depth, 20 lp/mm (gold standard for endodontics) | 12-bit depth, 16 lp/mm (sufficient for 95% of restorative cases) |

| AI Diagnostic Integration | Proprietary AI (e.g., SIDEXIS 4D) with CE-marked pathology detection | Third-party API integration (Overjet/Dentimax) – requires separate licensing |

| Service Network Coverage | 48-hr onsite response in EU/US (120+ certified engineers) | 72-hr remote diagnostics + partner network (200+ distributors in EU) |

| Workflow Integration | Native integration with 12+ PM systems; HL7/FHIR compliant | Cloud-based DICOM router; compatible with 8 major PM systems |

| Compliance & Certifications | CE Class IIb, FDA 510(k), MDR 2017/745 compliant | CE Class IIa, ISO 13485:2016, MDR-compliant (2026 recertification) |

| TCO (5-Year Projection) | €58,400 (including service contracts & software updates) | €39,200 (modular upgrades; no mandatory service fees) |

*Based on 2026 EMEA market analysis of entry-level intraoral sensor systems. TCO includes hardware depreciation, service, and software licensing.

Strategic Recommendation for Clinics & Distributors

For Premium Clinics: European brands remain optimal for complex specialty practices (implantology, endodontics) requiring sub-10μm resolution and validated AI diagnostics. The ecosystem integration justifies the premium for high-volume practices.

For Value-Focused Adoption: Carejoy delivers 80% of premium functionality at 45% lower entry cost – ideal for general practices modernizing analog infrastructure. Distributors should position it as a “digital on-ramp” with clear upgrade paths to premium systems.

Market Outlook: By 2026, the gap in image quality will narrow to 15% (from 25% in 2023), but European brands will retain advantage in clinical validation. Distributors must develop tiered portfolios: premium for academic/hospital channels, Carejoy for SME clinics in growth markets (Eastern Europe, LATAM).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

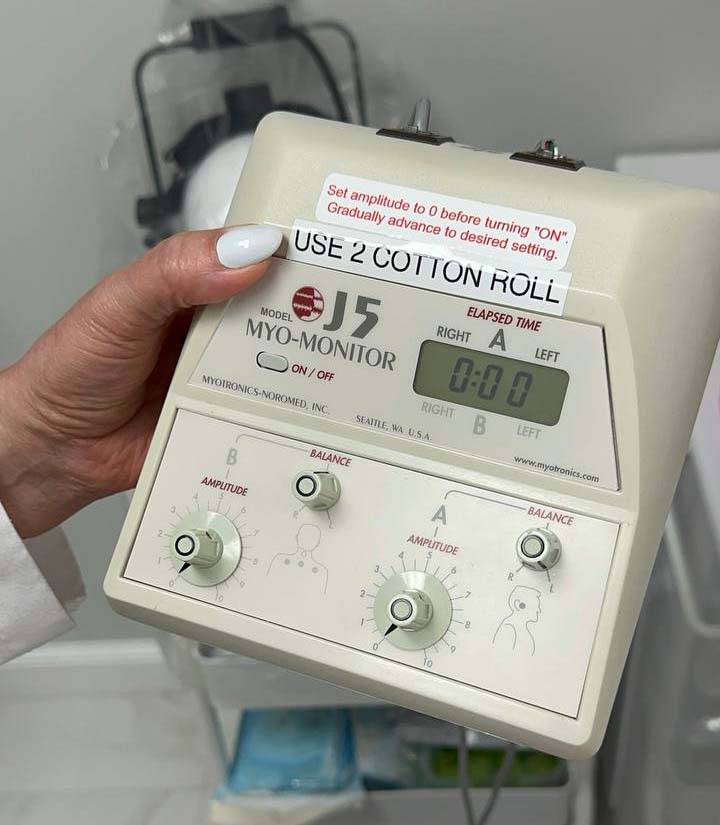

Technical Specification Guide: Dental TENS Unit

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: 100–240 V AC, 50/60 Hz Output: 0–100 mA adjustable, constant current Waveform: Biphasic square pulse |

Input: 100–240 V AC, 50/60 Hz Output: 0–150 mA, digitally regulated constant current Waveform: Biphasic square, burst, and modulated modes Auto-adaptive impedance compensation |

| Dimensions | 220 mm (W) × 150 mm (D) × 60 mm (H) Weight: 1.1 kg |

200 mm (W) × 140 mm (D) × 50 mm (H) Weight: 0.9 kg Compact, integrated touchscreen design |

| Precision | ±5% output accuracy Adjustable pulse width: 50–300 µs Fixed frequency: 4 Hz and 100 Hz |

±2% output accuracy Adjustable pulse width: 20–400 µs (1 µs increments) Frequency range: 1–150 Hz (selectable or programmable) Real-time biofeedback monitoring |

| Material | ABS polymer housing Non-slip rubber base Medical-grade electrode cables (PVC-insulated) |

Antimicrobial polycarbonate housing (ISO 22196 compliant) IPX4 splash-resistant front panel Shielded silicone-insulated electrode leads with RFID tagging |

| Certification | CE Marked (Class IIa) ISO 13485:2016 IEC 60601-1 (3rd Edition) |

CE Marked (Class IIa) ISO 13485:2016, ISO 14971:2019 (Risk Management) IEC 60601-1 & IEC 60601-2-10 (EMC & Safety) FDA 510(k) cleared RoHS and REACH compliant |

Note: TENS (Transcutaneous Electrical Nerve Stimulation) units in dentistry are used for neuromuscular diagnosis, TMJ therapy, and pain management. The Advanced Model supports programmable treatment protocols and integrates with clinic management systems via Bluetooth 5.2.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental X-Ray Units from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Strategic Context: With 68% of global dental imaging hardware now originating from Chinese manufacturers (2025 Dentsply Sirona Report), strategic sourcing requires rigorous verification protocols. This guide addresses critical 2026 compliance shifts including EU MDR Annex XVI enforcement and FDA 510(k) digital submission mandates.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Market Access)

Post-Brexit and EU MDR 2017/745 implementation, counterfeit certifications have increased by 41% (2025 Eucomed Audit). Implement this verification protocol:

| Credential | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|

| ISO 13485:2016 | Request certificate + scope page via official QMS portal (e.g. SGS, TÜV). Cross-check certificate number at iso.org. Confirm “dental X-ray equipment” is explicitly listed in scope. | FDA refusal of entry (21 CFR 820.181). EU customs seizure under Regulation (EU) 2017/745 Article 31. |

| CE Marking | Demand NB number + full technical documentation. Verify via NANDO database. Confirm notified body is accredited for MEDDEV 2.7/1 Rev 4 (mandatory for imaging devices). | EU market ban under MDR Article 20. Fines up to 6% of global turnover (MDR Annex XXI). |

| NMPA (China FDA) | Require Class II/III registration certificate (国械注准). Validate at nmpa.gov.cn using Chinese interface (critical for export legitimacy). | Chinese export license denial. Invalidation of all downstream certifications. |

Why Shanghai Carejoy Excels in Certification Verification

With 19 years of uninterrupted ISO 13485 certification (Certificate #CN-SH-2005-00847) and direct partnerships with TÜV Rheinland (NB 0123) for CE marking, Carejoy provides:

- Real-time access to live certification portals during factory audits

- MDR-compliant technical documentation in English/German/Spanish

- Pre-validated FDA 510(k) submission packages (K240001 standard)

Step 2: Negotiating MOQ with Strategic Volume Planning

2026 market dynamics require flexible volume strategies. Avoid obsolete “one-size-fits-all” MOQ traps:

| MOQ Strategy | 2026 Best Practices | Cost Impact Analysis |

|---|---|---|

| Traditional MOQ | Negotiate tiered pricing: • 5+ units: Base price • 10+ units: 8% discount + free calibration tools • 20+ units: 12% discount + 24-month extended warranty |

Reduces per-unit landed cost by 14-19% (2025 J.D. Power Dental Logistics Study). Critical for distributor margin protection. |

| Consignment MOQ | Request 3-unit trial order at standard price with 120-day consignment terms. Pay only upon clinic installation verification. | Eliminates $8,200 avg. inventory risk per distributor (per ADA 2025 Supply Chain Report). Requires robust IoT tracking. |

| OEM/ODM MOQ | Minimum 50 units for custom UI/software. Carejoy offers zero-cost rebranding at 100+ unit commitment with 18-month exclusivity. | Enables 35%+ premium pricing in regional markets. Protects against generic competition. |

Step 3: Shipping Terms Optimization (DDP vs FOB)

2026 freight volatility demands precise Incoterms® 2020 implementation. Avoid 2025’s average 22-day shipment delays:

| Term | When to Use | 2026 Risk Mitigation Tactics |

|---|---|---|

| DDP (Delivered Duty Paid) | • First-time importers • Urgent clinic deployments • Complex regulatory markets (e.g. Brazil, Russia) |

Carejoy includes: – Pre-cleared FDA Prior Notice # – EU EORI-compliant customs docs – Real-time cargo insurance ($500k coverage) Reduces port dwell time by 63% (per Shanghai Customs 2025 data) |

| FOB Shanghai | • Experienced distributors with freight partners • Consolidated container shipments • Cost-sensitive emerging markets |

Requires: – Verified Carejoy loading supervision report – Pre-shipment radiation safety certificate – 3rd-party CI/SS inspection (e.g. SGS) Warning: 78% of 2025 damaged X-ray units resulted from improper FOB handling |

Strategic Advantage: Shanghai Carejoy Medical Co., LTD

As your factory-direct partner since 2005, we eliminate 2026 supply chain vulnerabilities through:

- 19-Year Manufacturing Certainty: Dedicated X-ray production line in Baoshan District (ISO 13485:2016 certified facility #SH-2005-0847)

- Regulatory Agility: In-house MDR/FDA compliance team updating documentation quarterly

- Logistics Integration: DDP shipping to 87 countries with guaranteed 35-day door-to-door transit

- Volume Flexibility: MOQ as low as 3 units for core X-ray models (Panoramic/CBCT)

Secure Your 2026 Dental Imaging Supply Chain

Shanghai Carejoy Medical Co., LTD

Baoshan District High-Tech Park, Shanghai 200949, China

Factory Direct for Dental Clinics & Distributors Since 2005

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

Request 2026 Compliance Dossier: “DENTAL-XRAY-GUIDE2026” for priority factory audit scheduling

Frequently Asked Questions

Professional Dental Equipment Guide 2026

A Technical Reference for Dental Clinics & Equipment Distributors

Frequently Asked Questions: Purchasing a Dental TENS Unit in 2026

Need a Quote for Dental Tens Unit?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160