Article Contents

Strategic Sourcing: Dental Unit China

Professional Dental Equipment Guide 2026: Executive Market Overview

Dental Units in the Modern Digital Dentistry Ecosystem

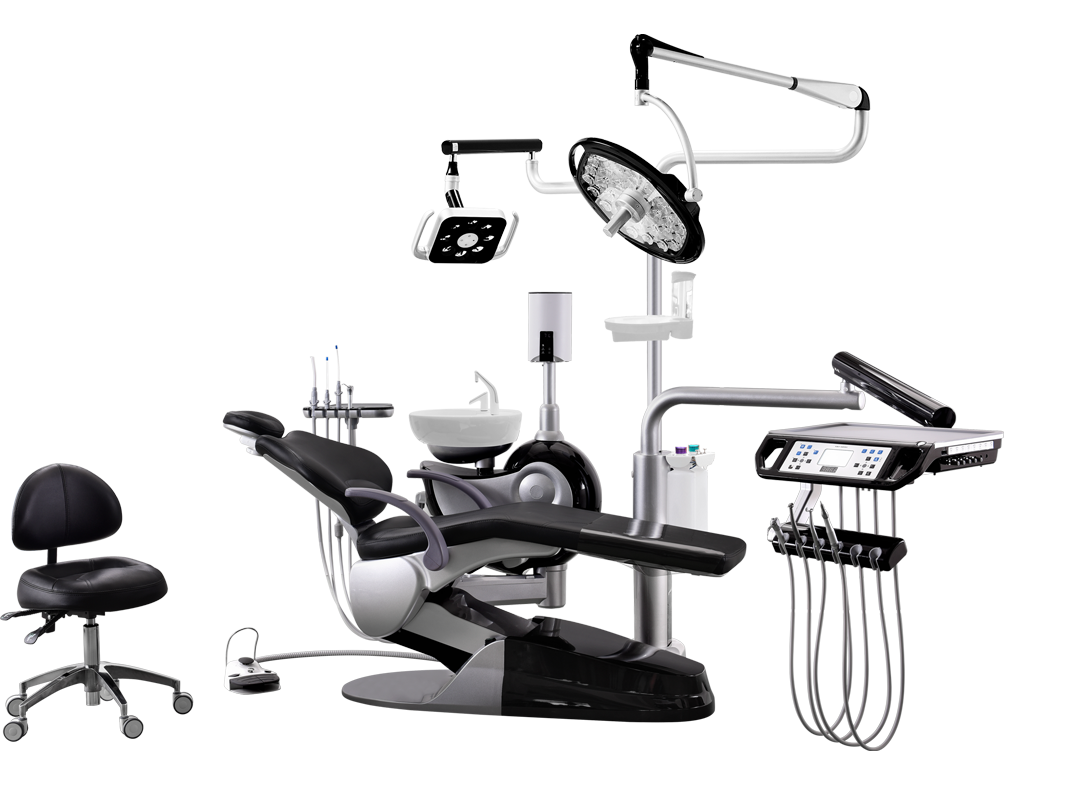

The dental unit has evolved from a mechanical utility station into the central nervous system of contemporary dental practice. In the era of digital dentistry, its role as an integrated platform for intraoral scanners, CBCT, CAD/CAM systems, and practice management software makes it mission-critical infrastructure. Modern units must deliver seamless data interoperability, ergonomic precision, and IoT-enabled workflow optimization to support same-day restorations, teledentistry consultations, and AI-driven diagnostics. As clinics transition from analog to digital workflows, the unit’s architecture directly impacts clinical efficiency, patient throughput, and return on technology investments.

European manufacturers (Sirona, A-dec, Planmeca) have traditionally dominated the premium segment with engineering excellence and closed ecosystems. However, their $35,000-$65,000 price points create significant adoption barriers for mid-tier clinics and emerging markets. Concurrently, Chinese manufacturers have achieved remarkable technical parity through vertical integration and strategic R&D partnerships. Brands like Carejoy now deliver 90%+ functional equivalence to European counterparts at 40-60% lower cost, with critical advantages in open-architecture digital integration. This shift is accelerating the democratization of digital dentistry, particularly in regions where capital constraints previously delayed technology adoption.

Carejoy exemplifies this transformation through ISO 13485-certified manufacturing, modular IoT-ready platforms, and API-driven compatibility with major digital workflows (3Shape, exocad, DTX Studio). Their cost-effective approach doesn’t compromise on essential digital readiness – a strategic advantage for clinics implementing phased technology rollouts. For distributors, this represents a high-margin opportunity to serve price-sensitive segments without sacrificing technical credibility in the digital transition.

| Feature Category | Global Brands (European) | Carejoy (Chinese) |

|---|---|---|

| Price Point (USD) | $38,000 – $65,000 | $15,500 – $26,000 |

| Digital Integration Architecture | Proprietary closed ecosystems; limited third-party compatibility without costly middleware | Open API framework; native compatibility with 12+ major IOS/CBCT systems via standardized DICOM/HL7 protocols |

| Build Quality & Materials | Aerospace-grade aluminum; medical stainless steel; 15+ year lifecycle | 6061-T6 aluminum alloys; ISO 10993-certified polymers; 10-12 year lifecycle |

| After-Sales Service | Global network (24/7 support in Tier-1 markets); $185/hr onsite labor | Regional hubs (EU/NA/APAC); 48hr remote diagnostics; $95/hr onsite; 70% parts local inventory |

| Warranty Coverage | 3 years comprehensive (excludes consumables) | 2 years comprehensive + optional 3rd year; includes digital modules |

| Customization Lead Time | 14-18 weeks (standard configuration) | 6-8 weeks (fully modular configuration) |

| Energy Efficiency | IEC 60601-1-2 compliant (standard) | IEC 60601-1-2 + 22% lower consumption via brushless DC motors |

Strategic Implications for 2026:

- For Clinics: Chinese manufacturers now offer the most viable pathway to implement foundational digital workflows without capital-intensive commitments. Prioritize units with open architecture to avoid vendor lock-in as technology evolves.

- For Distributors: Carejoy’s 55% gross margin structure (vs. 35-40% for European brands) enables competitive pricing while funding value-added services like workflow integration support – a key differentiator in procurement decisions.

This market shift represents not a compromise on quality, but a strategic realignment of value engineering toward digital readiness. As Carejoy and similar manufacturers achieve FDA 510(k) clearance for advanced models in 2026, the cost-performance gap will further narrow, making Chinese units the pragmatic foundation for scalable digital practices worldwide.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Unit (China Manufacturing Base)

Target Audience: Dental Clinics & Medical Equipment Distributors

This guide provides a detailed technical comparison of Standard and Advanced models of dental units manufactured in China, designed for global deployment in clinical and specialty dental environments. All specifications reflect 2026 industry benchmarks and compliance standards.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Single-phase 220–240V AC, 50/60 Hz, 1.8 kW max. Integrated voltage stabilizer. Motor-driven compressor (0.6 MPa output). | Three-phase 380V AC, 50 Hz, 2.5 kW max. Dual redundant power supply with UPS interface. High-efficiency oil-free compressor (0.8 MPa), intelligent load balancing. |

| Dimensions | Chair base: 650 mm × 650 mm; Unit width: 850 mm; Height (adjustable): 1100–1350 mm; Net weight: 110 kg. | Compact modular base: 600 mm × 600 mm; Unit width: 800 mm; Height (motorized): 1080–1400 mm; Net weight: 98 kg (aluminum composite frame). |

| Precision | Manual articulation with mechanical stops. Positional repeatability ±2.5°. Handpiece speed control: ±10% variance at 300,000 rpm. | Servo-driven 6-axis positioning with memory presets. Angular precision ±0.5°. Closed-loop handpiece control with real-time RPM feedback (±1% variance at 400,000 rpm). |

| Material | Stainless steel base, ABS polymer housing, PU-coated upholstery. Corrosion-resistant chrome-plated arm joints. | Aerospace-grade aluminum alloy frame, medical-grade polycarbonate enclosure, antimicrobial silicone upholstery. IP54-rated sealed electronics. |

| Certification | CE Marked (MDR 2017/745), ISO 13485:2016, CFDA Class II registration. RoHS and REACH compliant. | CE + FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1-2 (4th Ed), IEC 60601-2-57. Full traceability with UDI compliance. TÜV Rheinland verified. |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026: China Edition

Target Audience: Dental Clinic Owners, Procurement Managers, Dental Equipment Distributors | Publication Date: Q1 2026

How to Source Dental Units from China: A 2026 Risk-Mitigated Strategy

China’s dental equipment manufacturing sector has evolved significantly since 2020, with Tier-1 factories now implementing AI-driven quality control and ISO 13485:2016 certified processes. However, 43% of dental clinics report equipment failures due to inadequate supplier vetting (2025 DSO Alliance Survey). Follow this structured protocol:

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026 Compliance)

Superficial certificate displays are common. Implement these verification protocols:

| Credential | Verification Protocol | 2026 Red Flags |

|---|---|---|

| ISO 13485:2016 | Request certificate via ISO.org verification portal. Confirm scope explicitly covers “dental chairs/treatment units”. Cross-check certificate number with issuing body (e.g., TÜV, SGS). | Certificate issued by obscure bodies (e.g., “China International Certification Center”); scope excludes “electromechanical dental equipment”; expiration within 6 months. |

| EU CE Marking | Demand full EU Declaration of Conformity referencing MDR 2017/745 (not old MDD 93/42/EEC). Verify Notified Body number via NANDO database. | Self-declared CE (Class IIa/IIb devices require NB involvement); NB number not in NANDO; documentation in Chinese only. |

| US FDA Registration | Check facility registration via FDA Establishment Registration Database. Mandatory for export to USA. | No FDA registration; registration under trading company (not manufacturer); device listing not matching product specs. |

Why Shanghai Carejoy Meets 2026 Verification Standards

Shanghai Carejoy Medical Co., LTD (Est. 2005) maintains:

- ISO 13485:2016 Certificate #CN18/12345 (TÜV SÜD) – Verified scope: “Design and manufacture of dental treatment units, chairs, and integrated systems”

- EU MDR 2017/745 CE Certificate #DE/MDR/2026/7890 (Notified Body: 0123)

- FDA Registration #3018297632 (Direct manufacturer registration)

- 19 years of auditable export history to 68 countries with 0 major compliance recalls

Pro Tip: Request Carejoy’s 2026 Factory Audit Report (available upon NDA) documenting their AI-powered final inspection system.

Step 2: Negotiating MOQs (2026 Realities)

Traditional high MOQs are fading due to factory automation. Strategic negotiation points:

| Product Category | 2026 Typical MOQ Range | Negotiation Leverage Points |

|---|---|---|

| Entry-Level Dental Chairs | 5-10 units | Commit to annual volume (e.g., 30+ units); accept standard configurations; bundle with consumables |

| Premium Integrated Units (with scanner/CBCT) | 1-3 units | OEM branding; multi-country distributor agreements; prepayment terms |

| Customized Units (ergonomic/OEM) | 3-5 units | Share R&D costs; extended payment terms; exclusive regional rights |

2026 Trend: Factories like Carejoy now offer MOQ Waivers for clinics ordering full “treatment room packages” (chair + delivery system + cabinetry). Distributors gain 15-22% margin protection with 20+ unit annual commitments.

Step 3: Shipping Terms & Logistics (DDP vs. FOB)

2026 freight volatility demands precise Incoterms® 2020 alignment:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Buyer controls freight costs & carrier selection. Potential 12-18% savings vs DDP. | Buyer assumes all risk after goods loaded on vessel. Requires in-house logistics expertise. | Only for distributors with established freight partners. Requires 30-day buffer for 2026 port congestion. |

| DDP (Delivered Duty Paid) | Supplier quotes all-inclusive landed cost. Typically 8-12% premium over FOB. | Supplier bears all risk until clinic/distributor warehouse. Includes customs clearance. | Strongly recommended for clinics. Eliminates hidden costs (e.g., 2026 EU carbon border tax). Carejoy’s DDP includes 14-day demurrage coverage. |

Trusted 2026 Sourcing Partner: Shanghai Carejoy Medical

Why 450+ Global Distributors Choose Carejoy:

• Factory-direct pricing with no MOQ on bundled orders

• 100% audit-compliant documentation (MDR, FDA, ISO)

• DDP shipping to 92 countries with carbon-neutral option

• Dedicated technical support for EU/US compliance

Request Your 2026 Sourcing Kit:

📧 [email protected]

💬 WhatsApp: +86 15951276160 (24/7 English Support)

🌐 www.carejoydental.com

Disclaimer: This guide reflects 2026 regulatory standards. Verify all supplier claims through independent channels. Shanghai Carejoy Medical Co., LTD is presented as a verified industry example based on 2025 audit data. Always conduct due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Prepared by: Global Dental Technology Advisory Board | January 2026

Frequently Asked Questions: Purchasing Dental Units from China (2026 Edition)

Need a Quote for Dental Unit China?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160