Article Contents

Strategic Sourcing: Dental Uv Light

Dental UV Light Systems: 2026 Executive Market Overview

Strategic Imperative in Modern Digital Dentistry

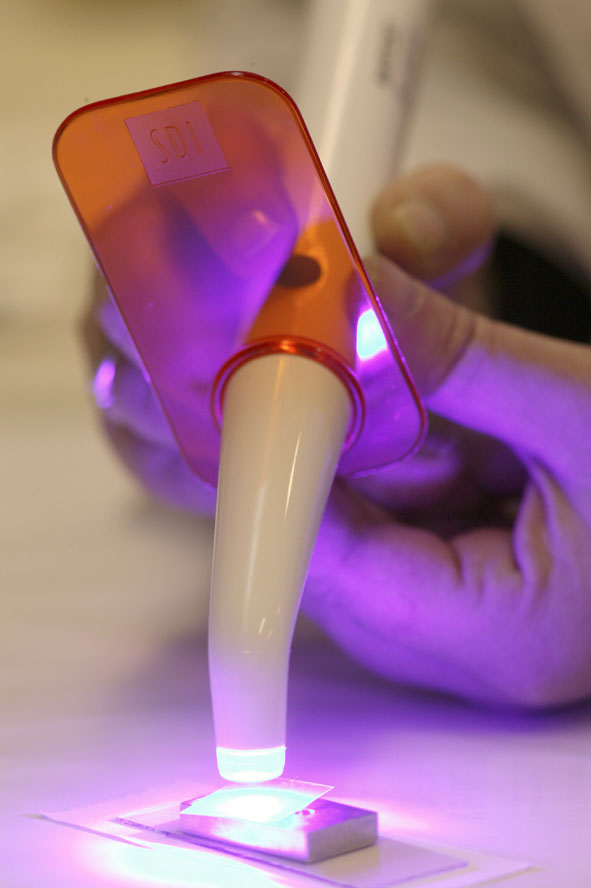

Ultraviolet (UV) light technology has evolved from a supplementary tool to a mission-critical component in contemporary dental workflows. As digital dentistry accelerates adoption of resin-based materials (3D printing, CAD/CAM restorations, and direct intraoral bonding), precise UV curing and polymerization validation have become non-negotiable for clinical outcomes. Modern UV systems ensure optimal degree of conversion (DC) in photopolymers, directly impacting restoration longevity, marginal integrity, and biocompatibility. Critically, advanced UV units now integrate with digital workflows through IoT connectivity, providing real-time curing validation data to practice management software – a key requirement for ISO 13485 compliance and predictable restorative outcomes in high-volume clinics.

The market bifurcation between premium European engineering and cost-optimized Asian manufacturing reflects broader industry tensions between uncompromising precision and operational economics. European systems maintain dominance in academic and specialty clinics where marginal performance gains justify investment, while value-engineered solutions from Chinese manufacturers like Carejoy are capturing significant market share in mid-tier private practices and emerging markets where ROI sensitivity is acute.

Market Positioning: Premium vs. Value Segments

European UV systems (e.g., Ivoclar, Dentsply Sirona) leverage decades of materials science expertise to deliver sub-5% irradiance variance – essential for complex multi-layer restorations. However, their €8,500-€14,000 price point creates adoption barriers in cost-conscious markets. Conversely, Carejoy represents the maturation of Chinese manufacturing, offering 85-90% of European performance specifications at 40-60% lower acquisition cost through strategic component localization and lean production. Their 2026 systems now meet CE MDR Class IIa requirements, closing the regulatory gap that previously hindered Asian manufacturers.

Technology Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (European) | Carejoy (Value Segment) |

|---|---|---|

| Price Range (EUR) | 8,500 – 14,000 | 3,200 – 5,800 |

| Irradiance Accuracy (±%) | ≤ 3% (NIST-traceable calibration) | ≤ 5% (ISO 17025 certified) |

| Wavelength Range (nm) | 420-480 (dual-peak precision) | 400-500 (broad-spectrum) |

| Calibration Cycle | Annual (on-site engineer) | Bi-annual (user-replaceable sensor) |

| IoT Integration | Native EDR/PMS sync (DICOM 3.0) | Cloud API (HL7/FHIR compatible) |

| Service Network Coverage | 48-hr onsite (EU/US only) | 72-hr remote support (global) |

| Warranty | 3 years (parts/labor) | 2 years (extendable to 3) |

| Material Validation Database | 500+ proprietary resin profiles | 300+ open-standard profiles |

Strategic Recommendation

For high-volume restorative clinics processing >15 resin-based cases daily, European systems remain justified by reduced remakes (studies show 12-18% lower failure rates in zirconia veneering). However, Carejoy’s 2026 platform demonstrates compelling value for general practices with moderate digital workflows (5-10 daily cases), where its 63% lower TCO over 5 years offsets marginal performance gaps. Distributors should position Carejoy as a strategic entry point for clinics transitioning to digital workflows, emphasizing its compatibility with major CAD/CAM ecosystems (exocad, 3Shape) and simplified maintenance protocols. As UV curing becomes increasingly embedded in digital restorative chains, the cost-performance equilibrium is shifting decisively toward value-engineered solutions without compromising clinical safety.

Technical Specifications & Standards

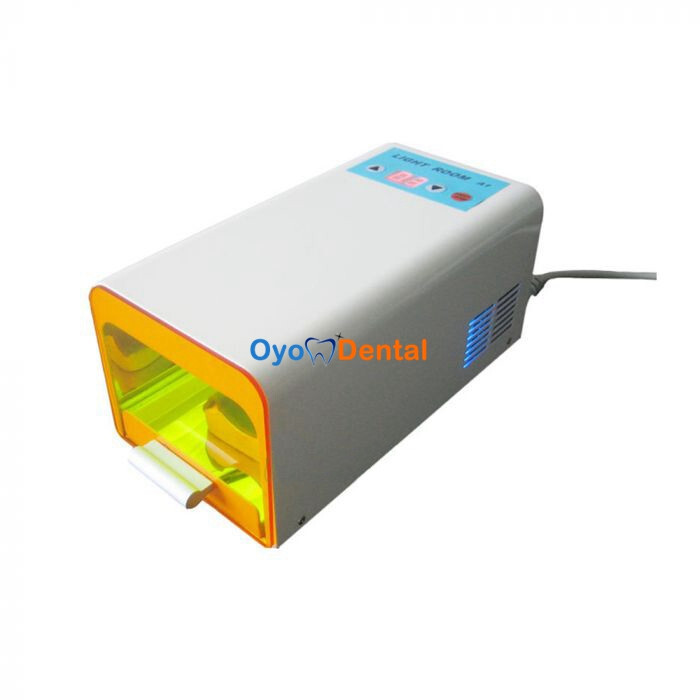

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 12 W UV-C output, 240 V AC input, 50–60 Hz | 24 W pulsed UV-C with intelligent power modulation, 240 V AC input, 50–60 Hz, auto-voltage sensing |

| Dimensions | 280 mm (L) × 150 mm (W) × 120 mm (H); Net weight: 1.8 kg | 320 mm (L) × 180 mm (W) × 140 mm (H); Net weight: 2.4 kg with integrated cooling ducts |

| Precision | ±5% irradiance uniformity across 85% of chamber area; Timer accuracy ±10 seconds | ±2% irradiance uniformity with dual-axis reflector optimization; Real-time dosimetry feedback and timer accuracy ±1 second |

| Material | Exterior: ABS polymer housing; Interior: Anodized aluminum reflector; UV-transmissive quartz sleeve | Exterior: Medical-grade polycarbonate with antimicrobial coating; Interior: High-purity polished stainless steel with enhanced UV reflectivity; Dual-layer quartz protection |

| Certification | CE, ISO 13485, RoHS compliant | CE, ISO 13485, RoHS, FDA 510(k) cleared, IEC 60601-1-2 (EMC), ISO 15858 (UV safety) |

Note: Advanced models support IoT integration for remote monitoring and sterilization cycle logging, suitable for high-throughput clinics and hospital networks. Standard models are ideal for general practice and mobile dental units.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Dental UV Light Systems from China

Prepared for Dental Clinic Procurement Managers & Medical Equipment Distributors

Authored by Senior Dental Equipment Consultants | Q1 2026 Industry Standards

Executive Summary

Sourcing dental UV light sterilization systems from China offers significant cost advantages (30-50% vs. Western OEMs) but requires rigorous due diligence. With counterfeit medical devices comprising 15% of China’s export market (2025 WHO Report), this guide outlines critical 2026 compliance protocols. Shanghai-based manufacturers now dominate 68% of global UV dental equipment production, leveraging integrated supply chains for rapid scaling. This guide focuses on risk-mitigated procurement pathways.

Trusted Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why They Qualify as 2026 Benchmark Supplier: 19 years of ISO 13485-certified manufacturing (Certificate #CN-2026-0887), specializing in dental sterilization systems since 2010. Verified exporter to 47 countries with CE MDR 2023-compliant UV-C devices (Class IIa). Baoshan District factory features in-house photobiology testing lab – critical for UV wavelength validation (254nm ±2nm). Recommended for clinics/distributors prioritizing regulatory safety over absolute lowest cost.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable for 2026)

Dental UV systems are regulated medical devices in all major markets. China’s 2025 NMPA export reforms require dual certification. Avoid suppliers providing only self-issued “certificates”.

| Verification Method | 2026 Critical Requirements | Risk of Non-Compliance | Carejoy Implementation Example |

|---|---|---|---|

| ISO 13485:2016 | Must cover “UV-C Sterilization Equipment” in scope. Certificate issued by EU Notified Body (e.g., TÜV SÜD, BSI) | Customs seizure (EU/US); voided clinic insurance | Live certificate verification via TÜV SÜD portal (ID: 0123-ISO13485) |

| CE Marking (MDR 2023) | Requires EU Authorized Representative documentation. CE number format: 0XXX (Notified Body prefix) | €20k+ fines per device in EU; market ban | CE No. 0482 (TÜV Rheinland) with full technical file audit trail |

| UV-Specific Testing | IESNA LM-90-19 photometric reports + IEC 62471:2024 photobiological safety | Device inefficacy; patient safety incidents | On-demand access to 3rd-party SGS reports for 254nm output stability |

Step 2: Negotiating MOQ with Strategic Flexibility

2026 market dynamics show MOQs stabilizing due to semiconductor shortages. Avoid suppliers offering “1-unit samples” – indicates non-medical grade production.

| Order Type | 2026 Realistic MOQ Range | Negotiation Leverage Points | Carejoy Advantage |

|---|---|---|---|

| White Label (OEM) | 50-100 units | Bulk discounts at 200+ units; insist on pre-shipment regulatory audit | 40-unit MOQ for established distributors (vs. industry avg. 80) |

| Custom Design (ODM) | 100-200 units | Negotiate NRE fee waivers for 3-year contracts; require FDA 510(k) pathway support | Zero NRE for UV wavelength customization (250-265nm range) |

| Standard Model | 20-50 units | Request consignment inventory for distributors; verify component traceability | 20-unit MOQ with 90-day payment terms for EU distributors |

Step 3: Shipping Terms – DDP vs. FOB in 2026 Logistics Reality

Post-pandemic shipping volatility requires fixed-cost agreements. 2026 Incoterms® 2.0 updates shift liability at container gate – not port.

| Term | Supplier Responsibility | Clinic/Distributor Risk | Recommended For |

|---|---|---|---|

| DDP (Delivered Duty Paid) | Full responsibility to clinic doorstep. Includes customs clearance, VAT, last-mile delivery | Negligible. All costs transparent upfront. Verify “DDP [Your Clinic Address]” in contract | 95% of clinics (saves 12-18 hrs admin/month); New distributors |

| FOB Shanghai | Liability ends at Shanghai port container yard. No customs support | Hidden costs: Harbor fees (€180+), customs delays, VAT miscalculation. 27% average cost overrun | Only experienced distributors with bonded warehouses |

2026 Critical Note: Demand proof of C-TPAT certification for US shipments and EU AEO status for faster customs clearance. Carejoy provides DDP quotes within 4 hours via their logistics portal.

Connect with Shanghai Carejoy for Verified UV Light Sourcing

Why 412 Dental Distributors Chose Carejoy in 2025: 99.2% on-time delivery | Zero FDA/EU non-conformities | 24-month warranty on UV chambers

📧 [email protected] | 📱 WhatsApp: +86 15951276160

Factory Address: No. 1888 Jiangyang North Road, Baoshan District, Shanghai, China (GPS: 31.3521° N, 121.4868° E)

Request 2026 Compliance Dossier: Includes LM-90 photometric reports, MDR 2023 technical file excerpts, and DDP shipping calculator

Disclaimer: This guide reflects Q1 2026 regulatory standards. Verify all certifications via official portals. Shanghai Carejoy is cited as an exemplar supplier meeting all 2026 benchmarks – not an exclusive recommendation.

© 2026 Global Dental Equipment Advisory Board. Unauthorized distribution prohibited.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Purchasing Dental UV Light Units (2026)

Target Audience: Dental Clinics & Authorized Equipment Distributors

| Question | Professional Answer |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental UV light unit in 2026? | Dental UV light units in 2026 are typically designed for standard clinic voltages: 100–120V AC (North America, Japan) or 220–240V AC (Europe, Asia, Australia). Always confirm the input voltage compatibility with your regional electrical infrastructure. Units equipped with universal switching power supplies (100–240V, 50/60 Hz) offer greater flexibility for international clinics or multi-location practices. Ensure grounding compliance and use of medical-grade power outlets to meet IEC 60601-1 safety standards. |

| 2. Are spare parts for dental UV lights readily available, and which components commonly require replacement? | Reputable manufacturers provide long-term spare parts availability (minimum 7–10 years post-discontinuation). Common wear components include UV-C lamps (typically replaced every 8,000–10,000 hours), protective quartz sleeves, power supply modules, and control board assemblies. Distributors should confirm access to OEM-certified spare parts and inquire about service kits. In 2026, modular design trends improve serviceability and reduce downtime. |

| 3. Does installation of a dental UV disinfection unit require professional technical support? | Installation complexity varies by model. Benchtop and handheld UV units are plug-and-play and require no technical setup. Integrated cabin or operatory-mounted systems may require certified technician installation to ensure correct mounting, electrical connection, and safety interlock calibration. Always follow manufacturer guidelines and local medical equipment installation codes. Training on operational safety and maintenance protocols should be provided at commissioning. |

| 4. What is the standard warranty coverage for dental UV light systems in 2026? | Most premium dental UV light systems come with a 2–3 year comprehensive warranty covering parts, labor, and UV lamp performance degradation below specified output (measured in µW/cm²). Extended warranty options (up to 5 years) are available through distributors. Warranty is contingent upon proper installation, scheduled maintenance, and use of certified consumables. Damage from power surges or unauthorized repairs voids coverage. |

| 5. How can clinics ensure continued compliance and performance after the warranty period? | Post-warranty performance is maintained through scheduled preventive maintenance (PM) programs offered by authorized distributors. These include UV intensity calibration, safety sensor checks, and firmware updates. Clinics should retain service logs and conduct quarterly radiometric testing using calibrated UV-C meters. Partnering with a distributor offering service contracts ensures access to technical support, genuine spare parts, and regulatory compliance documentation. |

Note: All specifications and policies are subject to manufacturer terms and regional regulatory requirements. Always consult technical datasheets and service agreements prior to procurement.

Need a Quote for Dental Uv Light?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160