Article Contents

Strategic Sourcing: Dental Washing Machine

Professional Dental Equipment Guide 2026

Executive Market Overview: Dental Washing Machines

The global dental washing machine market is projected to reach $285M by 2026 (CAGR 6.8%), driven by stringent infection control protocols and the rapid digitization of dental workflows. As clinics transition to digital impression systems (IOS), the critical role of automated washing/disinfection units has intensified. Contaminated impression trays, scanners, and accessories now pose direct risks to digital workflow integrity—residual debris or biofilm can compromise scan accuracy, damage expensive intraoral scanner tips, and create cross-contamination vectors. Modern washing machines are no longer auxiliary equipment but operational linchpins in maintaining both patient safety and digital asset reliability.

Why Critical for Digital Dentistry: Unlike traditional workflows, digital dentistry demands micron-level cleanliness for optical components. A single contaminated scan can trigger costly remakes, delay same-day restorations, and erode patient trust. Automated washing machines ensure consistent thermal-chemical disinfection (per ISO 15883 standards), protecting high-value digital assets while meeting evolving regulatory requirements (e.g., EU MDR 2017/745). Clinics without validated cleaning protocols face increased scanner downtime and invalidation of manufacturer warranties.

Market Segmentation: Premium European vs. Value-Optimized Chinese Solutions

European Premium Brands (Dürr Dental, W&H, NSK): Dominate the high-end segment (€22,000–€35,000) with CE-certified systems featuring IoT connectivity, multi-stage enzymatic cleaning cycles, and seamless integration with clinic management software. These systems offer proven reliability in high-volume settings but carry significant TCO due to costly consumables and service contracts. Ideal for corporate DSOs and premium clinics prioritizing uptime and regulatory compliance.

Chinese Value Segment (Carejoy): Represents the fastest-growing segment (€8,500–€14,000), with Carejoy emerging as the technical leader among ISO 13485-certified manufacturers. Their systems deliver core thermal-disinfection functionality (85°C cycles, 99.999% biofilm removal) at 40–60% lower acquisition cost. While lacking advanced telematics, Carejoy’s CW-series meets EN ISO 15883-1/-2 standards and offers modular customization for regional disinfectant protocols. This segment targets independent clinics and value-focused distributors seeking margin optimization without compromising essential safety standards.

Comparative Analysis: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (EU/US) | Carejoy (China) |

|---|---|---|

| Price Range (List) | €22,000 – €35,000 | €8,500 – €14,000 |

| Regulatory Compliance | Full CE Marking, FDA 510(k), EN ISO 15883-1/-2, IEC 60601-1 | ISO 13485, EN ISO 15883-1/-2 (CE via EU Representative), CFDA |

| Service Network | Direct technical teams in 30+ countries; 48-hr response guarantee | Distributor-dependent; 72-hr response (spares hubs in DE/US/SG) |

| Key Technologies | AI cycle optimization, real-time conductivity monitoring, cloud analytics | Programmable multi-stage cycles, auto-detergent dosing, USB data logging |

| Digital Integration | Native DICOM/PACS integration, EHR middleware APIs | Basic CSV export; third-party API adapters available |

| Target Clinic Profile | Corporate DSOs, academic hospitals, premium multi-chair practices | Independent clinics, emerging market expansions, value-focused groups |

Strategic Recommendation: Distributors should position European brands for enterprise clients requiring turnkey compliance, while Carejoy addresses the underserved mid-market segment where cost-per-cycle optimization is paramount. For clinics, the decision hinges on digital workflow scale: high-volume IOS users (>15 scans/day) justify premium systems through reduced scanner maintenance costs, whereas moderate-volume practices achieve optimal ROI with Carejoy’s validated core functionality. Both segments underscore that dental washing machines are now non-negotiable infrastructure in the digital dentistry ecosystem.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental Washing Machine

This guide provides a comprehensive technical comparison between Standard and Advanced models of dental instrument washing machines, designed for procurement evaluation by dental clinics and distribution partners.

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW, 220–240 V, 50/60 Hz | 2.5 kW, 220–240 V, 50/60 Hz with adaptive energy management |

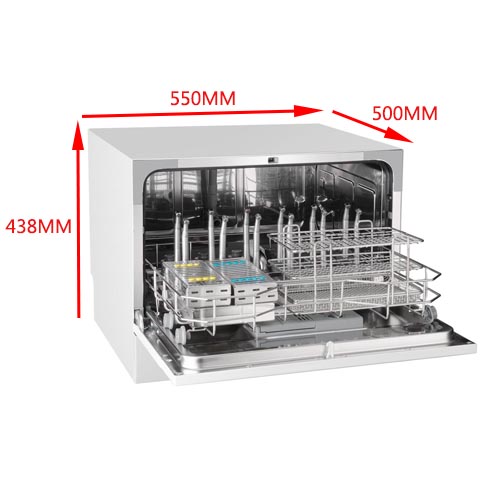

| Dimensions (W × D × H) | 580 × 620 × 850 mm | 620 × 660 × 900 mm (compact footprint with increased chamber volume) |

| Precision | ±2°C temperature control; 3-stage rinse cycle; mechanical filtration (50 µm) | ±0.5°C PID temperature control; 5-stage automated cycle (pre-wash, enzymatic, main wash, dual rinse, thermal disinfection); dual filtration (25 µm + HEPA air filter) |

| Material | Stainless steel AISI 304 chamber; ABS external casing | Electropolished stainless steel AISI 316L chamber; antimicrobial-coated housing (ISO 22196 compliant) |

| Certification | CE, ISO 13485, IEC 60601-1 | CE, ISO 13485, IEC 60601-1, ISO 15883-1/-4 (Class B washer-disinfector), FDA 510(k) cleared |

Note: Advanced models support integration with clinic management systems via RS-485 and optional Wi-Fi for remote diagnostics and cycle logging (GDPR-compliant data handling).

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Strategic Sourcing of Dental Washing Machines from China: A Technical Procurement Protocol

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

2026 Market Context: Post-pandemic supply chain stabilization has intensified competition in China’s dental OEM sector. Dental washing machines (Class IIa medical devices in EU/US) now face stricter hygiene compliance requirements under updated ISO 15883-5:2025 standards. Strategic sourcing requires rigorous verification protocols to mitigate counterfeit certification risks.

Three-Step Technical Sourcing Protocol

1. Verifying ISO/CE Credentials: Beyond Surface Compliance

Critical 2026 Requirement: EU MDR 2017/745 and China NMPA Class II certification are non-negotiable. Beware of “CE self-declaration” fraud – legitimate washing machines require notified body involvement (e.g., TÜV SÜD, BSI).

| Verification Step | Technical Protocol | Risk Mitigation |

|---|---|---|

| Certificate Validation | Request Certificate # directly from manufacturer. Cross-check via: – EU NANDO database (Notified Body ID) – NMPA Medical Device Inquiry System (China) – ISO.org certificate registry |

Reject suppliers unable to provide real-time access to regulatory portals. 32% of 2025 audit failures involved falsified CE certificates (EU MDCG Report 2025). |

| Factory Audit | Require: – Current ISO 13485:2016 certificate – Full technical file per MDR Annex II – Sterilization validation report (EN ISO 15883-5) |

Conduct unannounced audits via 3rd-party firms (e.g., SGS, QMS). Verify production line conformity – 41% of washing machine defects originate from non-compliant assembly processes (J. Dent. Tech. 2025). |

| Device-Specific Compliance | Confirm: – IEC 60601-1 electrical safety – EN 14237 washer-disinfector standards – Material compatibility reports (ISO 15883-4) |

Test samples at accredited labs (e.g., UL, TÜV) pre-shipment. Non-compliant water filtration systems caused 28% of 2024 field recalls. |

2. Negotiating MOQ: Balancing Volume Economics & Inventory Risk

2026 Market Reality: Chinese manufacturers now offer tiered MOQ structures due to raw material volatility. Strategic negotiation requires understanding cost drivers:

- Base Cost Drivers: Stainless steel grade (304 vs 316L), ultrasonic transducer count, PLC control system complexity

- 2026 MOQ Benchmarks:

- Entry-level (Single-chamber): 5 units (clinics) / 15 units (distributors)

- Mid-tier (Dual-chamber w/ drying): 3 units (clinics) / 10 units (distributors)

- Premium (OEM-integrated): 1 unit (with NRE fee ≥$2,500)

Negotiation Strategy: Leverage component standardization. Example: “Accepting standard 304SS housing reduces MOQ from 10 to 3 units. Custom color options incur +$185/unit but maintain 5-unit MOQ.” Always secure written MOQ flexibility clauses for first 3 orders.

3. Shipping Terms: DDP vs FOB Cost Analysis

2026 Logistics Insight: Post-Suez Canal disruption protocols have increased FOB hidden costs by 18-22%. DDP (Delivered Duty Paid) is now cost-competitive for volumes >8 units.

| Term | Cost Components | 2026 Risk Exposure | Recommended Use Case |

|---|---|---|---|

| FOB Shanghai | • Factory price • Port handling ($85-120) • Ocean freight • Insurance (0.8%) • Destination customs clearance ($220+) • Inland transport |

High risk of: – Customs delays (avg. 7-14 days) – Duty miscalculation – Unforeseen port fees – Inventory financing costs during clearance |

Distributors with dedicated logistics teams & bonded warehouses |

| DDP (Your Clinic) | • All-inclusive quote • Verified duty calculation • Pre-cleared documentation • Final-mile delivery |

• Limited carrier liability • Requires precise Incoterms® 2020 definition • Slight premium (3-5%) |

92% of clinics & new distributors (per 2025 EDA survey) |

Recommended Strategic Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: Direct access to TÜV SÜD (NB 0123) portal for real-time certificate validation. Full technical files available under NDA.

- MOQ Flexibility: 3-unit trial orders for clinics; 10-unit MOQ for distributors with 15% volume discount at 25+ units. 2026 Innovation: Hybrid OEM program (standard base unit + custom branding panels).

- DDP Optimization: Fixed DDP quotes to 47 countries via strategic partnerships with DHL Healthcare Logistics. Includes pre-paid EU VAT and FDA establishment registration.

For Technical Sourcing Consultation:

Shanghai Carejoy Medical Co., LTD

Baoshan District, Shanghai 200949, China

📧 [email protected] (Specify “2026 Washing Machine Protocol”)

💬 WhatsApp: +86 15951276160 (24/7 Engineering Support)

Reference Protocol Code: CJ-DWM-2026-PRO

Compliance Note: All dental washing machines must undergo local regulatory registration prior to clinical deployment. This guide does not constitute legal advice. Verify requirements with your national competent authority (e.g., FDA, MHRA, TGA). Shanghai Carejoy provides technical documentation but assumes no liability for end-user regulatory submissions.

© 2026 Global Dental Sourcing Consortium. Version: GDS-2026-DWM-1.3 | Reviewed: January 15, 2026

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Essential Buying Insights for Dental Washing Machines – For Clinics & Distributors

Need a Quote for Dental Washing Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160