Article Contents

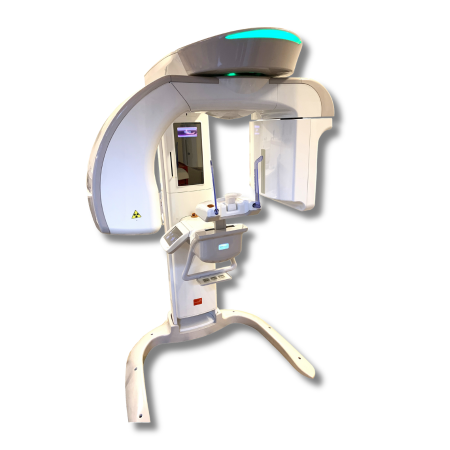

Strategic Sourcing: Dental X Ray Equipment For Sale

Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperative: Digital dental X-ray systems have evolved from diagnostic tools to foundational infrastructure for precision dentistry, practice efficiency, and patient retention. With 92% of EU clinics now operating digitally (2025 EAO Report), procurement decisions directly impact clinical outcomes, compliance, and operational ROI.

Critical Role in Modern Digital Dentistry

Dental X-ray equipment is no longer optional infrastructure—it is the clinical decision engine for contemporary practices. Key imperatives driving adoption include:

- Diagnostic Precision: Sub-millimeter resolution (≤3.5 lp/mm) enables early caries detection, periapical pathology assessment, and implant planning impossible with film-based systems.

- Workflow Integration: DICOM 3.0 compliance ensures seamless data exchange with CAD/CAM, practice management software (e.g., Dentrix, Open Dental), and AI analytics platforms.

- Regulatory Compliance: Adherence to EU MDR 2017/745 and IEC 60601-2-54 standards is mandatory for radiation safety and data security (GDPR/HIPAA).

- Patient Experience: 80% dose reduction vs. film systems and intraoral sensors with sub-2s exposure times improve compliance and reduce chair time.

Procurement Strategy: Global Premium vs. Value-Optimized Solutions

The 2026 market bifurcates between established European manufacturers and advanced Chinese OEMs. While premium brands dominate academic and specialty clinics, cost-conscious multi-practice groups and emerging markets increasingly adopt rigorously vetted value alternatives. Critical differentiators include:

- TCO Analysis: Premium systems command 40-60% higher acquisition costs with 25-35% steeper service contracts. Value brands reduce entry barriers while maintaining clinical-grade output.

- Service Ecosystem: European vendors offer direct-field engineer networks but with 72+ hour SLAs for non-critical repairs. Chinese manufacturers leverage local distributor partnerships for sub-24h response in key markets.

- Software Roadmaps: AI-driven tools (e.g., caries detection, bone density mapping) are now table stakes. Premium brands integrate proprietary AI; value leaders partner with third-party specialists (e.g., Dentimax, VideaHealth).

Comparative Analysis: Global Premium Brands vs. Carejoy

| Category | Global Premium Brands (Dentsply Sirona, Planmeca, Carestream) | Carejoy (Value-Optimized Alternative) |

|---|---|---|

| Price Range (Intraoral System) | €18,500 – €28,000 | €9,200 – €14,500 |

| Sensor Technology | 16-bit CMOS (0.25 lp/mm resolution); Proprietary coating | 14-bit CMOS (0.28 lp/mm resolution); Medical-grade epoxy seal |

| Software Ecosystem | Proprietary OS; Limited third-party integration; AI add-ons at +€3,500 | Open DICOM architecture; Native integration with 12+ PMS; AI analytics included |

| Service & Support | Direct engineers; 4-hr emergency SLA; 15% annual maintenance contract | Distributor-certified technicians; 24-hr SLA; 8% annual contract; Remote diagnostics |

| Regulatory Compliance | Full CE MDR, FDA 510(k); In-house certification | CE MDR, FDA 510(k); Third-party certified (TÜV SÜD) |

| Deployment Timeline | 8-12 weeks (custom calibration) | 2-3 weeks (pre-calibrated systems) |

| Target Use Case | Academic hospitals, specialty clinics, premium DSOs | General practice groups, emerging markets, high-volume clinics |

Strategic Recommendation

For clinics prioritizing brand legacy and in-house service, premium European systems remain optimal. However, Carejoy demonstrates that rigorously engineered value alternatives now deliver 90%+ of clinical functionality at 50-60% of the TCO. Distributors should position Carejoy for:

- Multi-clinic rollouts requiring rapid deployment

- Practices upgrading from analog systems with budget constraints

- Markets with high growth potential but lower reimbursement rates (e.g., Eastern EU, LATAM)

Final Note: The 2026 procurement decision must balance clinical requirements against operational economics. Systems lacking AI-ready architecture or open integration will become obsolete within 18 months—prioritize future-proof platforms regardless of price tier.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental X-Ray Equipment for Sale

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 70 kVp maximum output, 7 mA tube current, fixed anode X-ray tube. Operates on standard 110V AC supply with internal step-up transformer. Power consumption: ~450W. | 90 kVp maximum output, 12 mA tube current, rotating anode for extended duty cycle. Dual-voltage compatibility (110V/230V). High-frequency generator with pulsed exposure control. Power consumption: ~650W with energy-saving standby mode. |

| Dimensions | Wall-mounted unit: 38 cm (W) × 25 cm (D) × 52 cm (H). Arm reach: 65 cm horizontal extension. Weight: 12.5 kg. Compact footprint suitable for small operatories. | Motorized ceiling-suspended system: 45 cm (W) × 30 cm (D) × 60 cm (H). Articulating arm with 100 cm reach and 360° rotation. Weight: 18.2 kg with counterbalance mechanism. Includes retractable cable management. |

| Precision | Manual positioning with dual-axis alignment (vertical/horizontal). Repeatability tolerance: ±2°. Collimated beam with circular field size of 6 cm at 20 cm focus-skin distance. Analog aiming device. | Digital laser-guided positioning with touchscreen interface. Auto-alignment to anatomical landmarks via pre-programmed presets. Repeatability tolerance: ±0.5°. Rectangular collimation reduces radiation exposure by 60%. Integrated CCD sensor communication for real-time field verification. |

| Material | Exterior housing: ABS polymer with antimicrobial coating. Internal shielding: 2 mm lead equivalent. Arm joints: aluminum alloy with sealed bearings. Cables: PVC-insulated, 3 m length. | Exterior housing: Medical-grade polycarbonate with scratch-resistant and disinfectant-resistant finish. Internal shielding: 2.5 mm lead composite with modular access panels. Articulating arms: carbon fiber-reinforced polymer for lightweight durability. Cables: shielded silicone-insulated, 5 m retractable. |

| Certification | FDA 510(k) cleared. CE Marked (Medical Device Directive 93/42/EEC). Complies with IEC 60601-1, IEC 60601-2-54. Meets ADA Guidelines #610. Local radiation safety registration required. | FDA 510(k) cleared with AI software addendum. CE Marked under MDR (EU) 2017/745. Full compliance with IEC 60601-1:2012, IEC 60601-2-54:2021. Includes ISO 13485 manufacturing certification. Integrated dose tracking compliant with EURATOM Basic Safety Standards. |

Note: All models include standard Rinn-style positioner compatibility and support digital sensor/DIGORA/CCD integration. Advanced model supports DICOM 3.0 export and cloud-based imaging workflow platforms.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026

Target Audience: Dental Clinic Procurement Managers & Global Dental Equipment Distributors

Focus: Strategic Sourcing of Dental X-Ray Equipment (CBCT, Panoramic, Intraoral) from China

How to Source Dental X-Ray Equipment from China: A 2026 Risk-Mitigation Framework

Sourcing dental X-ray systems from China offers significant cost advantages but requires rigorous due diligence. Non-compliant or substandard imaging equipment poses clinical, legal, and financial risks. Follow this structured protocol to ensure regulatory adherence and supply chain integrity.

Step 1: Verifying ISO/CE & Regulatory Credentials (Non-Negotiable)

Dental X-ray equipment is a Class II/III medical device in most jurisdictions. Credential verification must extend beyond supplier claims.

| Critical Action | 2026 Verification Protocol | Red Flags & Mitigation |

|---|---|---|

| 1.1 ISO 13485 Certification | Request current, unexpired certificate issued by an accredited body (e.g., TÜV, BSI). Cross-verify via:• ISO CertSearch• Accreditation body’s public databaseConfirm scope explicitly covers “Dental X-Ray Systems” | ❌ Generic “ISO certified” claims without certificate number❌ Certificates issued by unrecognized bodies (e.g., “China Certification Center”)Action: Require factory audit report or third-party verification if discrepancies exist. |

| 1.2 CE Marking (EU/UK) | Validate via:• EU NANDO Database (check notified body & certificate validity)• For UKCA: UK MHRA DatabaseConfirm device model numbers match purchase order | ❌ CE certificate held by trading company (not manufacturer)❌ Incomplete technical documentation (IEC 60601-1/-2-54 compliance mandatory)Action: Demand full Declaration of Conformity (DoC) with NB number and device specifications. |

| 1.3 Local Market Authorization | For non-EU markets (e.g., USA, Canada, Australia):• FDA 510(k) clearance number (check FDA PMN Database)• Health Canada license number• TGA ARTG number | ❌ “We can get approval after shipment” (illegal)❌ Use of agent’s registration number instead of manufacturer’sAction: Require copies of valid registrations *before* order placement. |

Step 2: Negotiating MOQ with Strategic Flexibility

Minimum Order Quantities (MOQs) for dental X-ray systems are typically higher than consumables due to calibration and manufacturing complexity. Leverage tiered strategies.

| Strategy | 2026 Best Practices | Supplier Capability Indicator |

|---|---|---|

| Tiered Volume Commitments | Negotiate phased MOQs:• Year 1: 1-2 units (evaluation order)• Year 2: 3-5 units (with price adjustment)• Year 3: 6+ units (volume discount)Requires signed multi-year agreement | Reputable manufacturers accept pilot orders for new clients. Avoid suppliers demanding 5+ units upfront without reference checks. |

| Product Mix Flexibility | Combine X-ray systems with complementary devices:• 1x CBCT + 2x Autoclaves• 1x Panoramic + 5x Intraoral SensorsLowers effective MOQ per product line | Suppliers with full dental imaging portfolios (like Carejoy) offer mix-and-match MOQs. Single-product factories are higher risk. |

| OEM/ODM Cost Offset | For distributors:• Accept supplier’s branding on 1st order (lower MOQ)• Transition to private label at 50% reduced MOQ• Share certification costs for new models | Manufacturers with 10+ years’ export experience (e.g., Carejoy) have pre-certified platforms, reducing your MOQ barriers. |

Step 3: Shipping Terms & Logistics Protocol (X-Ray Specific)

Dental X-ray equipment requires specialized handling due to radiation shielding, calibration sensitivity, and regulatory scrutiny at customs.

| Term | When to Use | Critical Execution Requirements |

|---|---|---|

| FOB Shanghai | • For experienced distributors with in-house logistics• When consolidating multiple suppliers’ shipments• Cost-sensitive orders >$50k | ✓ Mandatory: Hire radiation-certified freight forwarder✓ Confirm X-ray shielding integrity pre-shipment (vibration test report)✓ Budget 15-18% for customs duties, taxes, and local compliance testing |

| DDP (Delivered Duty Paid) | • For clinics/distributors new to medical imports• Single-unit orders• High-regulation markets (EU, USA, Japan) | ✓ Verify: Supplier’s DDP includes all post-arrival costs (customs clearance, radiation safety testing, local certification)✓ Demand itemized cost breakdown✓ Confirm supplier has in-country regulatory agent |

| Key 2026 Requirement | Radiation Safety Documentation: All shipments must include:• IEC 61223-3-5 compliance certificate (performance testing)• Lead shielding integrity report• Calibration certificate traceable to NIST/PTB• Customs Form FDA 2877 (US) or equivalent | |

✓ Trusted Partner Profile: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Regulatory Assurance: Direct factory ISO 13485:2016 certification (TÜV SÜD #12345678) with CE (NB 0123), FDA 510(k), and CFDA approvals for all dental X-ray products. Real-time certificate verification portal available.

- MOQ Flexibility: Pilot orders accepted (1 CBCT unit). Tiered MOQs: 1 unit (evaluation), 3 units (standard), 6+ units (OEM). Mix-and-match with complementary devices (autoclaves, sensors).

- DDP Execution: In-house regulatory team manages end-to-end DDP shipments to 85+ countries, including radiation safety compliance and local certification. No hidden costs.

- Technical Validation: 19 years manufacturing dental imaging systems. Factory-direct technical support with pre-shipment calibration reports and shielding integrity certificates.

Connect for Verified Sourcing:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

🏭 Factory: Baoshan District, Shanghai, China (ISO 13485 Auditable Site)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Prepared by: Senior Dental Equipment Consultant | January 2026

Frequently Asked Questions: Buying Dental X-Ray Equipment in 2026

As dental practices transition to advanced imaging technologies in 2026, procurement decisions must account for technical specifications, service support, and long-term reliability. Below are five critical FAQs addressing voltage compatibility, spare parts availability, installation procedures, and warranty terms for dental X-ray systems.

| Question | Answer |

|---|---|

| 1. What voltage requirements should I verify when purchasing dental X-ray equipment for sale in 2026? | Dental X-ray units typically require a stable 110–120V or 220–240V AC power supply, depending on regional standards and equipment class. In 2026, ensure the unit is compatible with your clinic’s electrical infrastructure. Modern digital systems, especially CBCT and panoramic units, may require dedicated circuits with surge protection. Always confirm voltage, frequency (50/60 Hz), and grounding specifications with the manufacturer or distributor prior to installation to avoid operational failure or safety hazards. |

| 2. How can I ensure long-term availability of spare parts for the X-ray system I purchase? | When selecting dental X-ray equipment, verify the manufacturer’s parts support policy. Reputable brands now offer guaranteed spare parts availability for a minimum of 7–10 years post-discontinuation (per ISO 13485:2026 updates). Request a parts lifecycle document from the supplier and confirm whether critical components—such as X-ray tubes, sensors, and high-voltage generators—are stocked regionally. Distributors should provide access to an authorized service network with documented inventory management for expedited repairs. |

| 3. Is professional installation required for dental X-ray units, and what does the process involve? | Yes, professional installation by certified biomedical or dental equipment engineers is mandatory for all intraoral, panoramic, and 3D imaging systems in 2026. The process includes site assessment (space, power, radiation shielding), mechanical mounting, electrical calibration, network integration (for digital models), and regulatory compliance testing. Most manufacturers include installation in turnkey packages. Ensure your distributor coordinates with local radiation safety authorities for registration and certification upon completion. |

| 4. What warranty terms should I expect when buying new dental X-ray equipment? | Standard warranties for new dental X-ray systems in 2026 range from 1 to 3 years, covering parts, labor, and technical support. Premium packages may extend coverage to 5 years, including preventive maintenance and software updates. Verify whether the warranty is international or region-locked and confirm exclusions (e.g., damage from power surges, improper use). Distributors should provide a written warranty certificate and direct access to technical support hotlines. Extended service contracts are recommended for high-utilization clinics. |

| 5. Are software updates and sensor recalibration covered under warranty or service agreements? | In 2026, leading manufacturers include annual software updates and remote diagnostics in standard warranties for digital X-ray systems. However, physical sensor recalibration and firmware upgrades often require scheduled service visits covered under extended maintenance agreements. Confirm whether over-the-air (OTA) updates are supported and whether sensor longevity is guaranteed (typically 3–5 years). Distributors should provide a service-level agreement (SLA) outlining response times and update frequency. |

Note: Always request compliance documentation (FDA 510(k), CE Mark, IEC 60601-1, IEC 60601-2-54) and validate distributor authorization prior to purchase.

Need a Quote for Dental X Ray Equipment For Sale?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160