Article Contents

Strategic Sourcing: Dental X Ray Machine For Sale

Professional Dental Equipment Guide 2026: Executive Market Overview

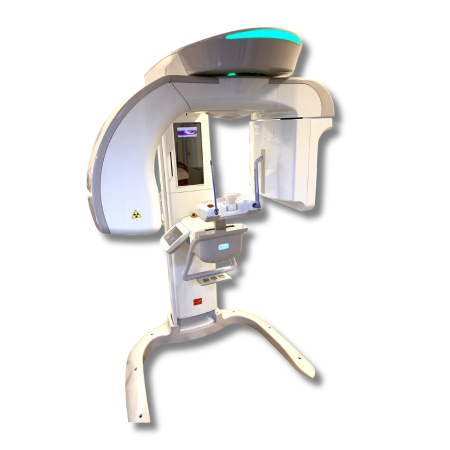

Dental X-Ray Machines: The Diagnostic Imperative in Modern Digital Dentistry

In 2026, intraoral and panoramic dental radiography remains the cornerstone of evidence-based clinical decision-making. The transition from film-based to digital systems is no longer optional; it is a regulatory, diagnostic, and operational necessity. Modern dental X-ray machines serve as the primary data acquisition node in integrated digital workflows, feeding critical diagnostic information into CAD/CAM systems, practice management software (PMS), and teledentistry platforms. With the EU MDR 2024 fully implemented and global emphasis on ALARA (As Low As Reasonably Achievable) radiation protocols, digital sensors with high Detective Quantum Efficiency (DQE >75%) are now the standard of care. Clinics without up-to-date digital radiography face significant clinical, compliance, and competitive risks—including inability to participate in value-based care networks and reduced insurance reimbursement eligibility.

Strategic Imperative: Digital X-ray systems are no longer standalone devices but integrated data generators. Their compatibility with DICOM 3.0, cloud PACS, and AI-assisted diagnostic tools (e.g., caries detection algorithms) directly impacts diagnostic accuracy, treatment acceptance rates, and practice scalability. Clinics investing in interoperable systems report 22% higher case acceptance and 30% faster treatment planning cycles (2025 EAO Practice Technology Survey).

Market Segmentation: Global Premium Brands vs. Value-Optimized Manufacturers

The 2026 market bifurcates distinctly between established European manufacturers (Dentsply Sirona, Planmeca, Vatech) and advanced Chinese OEMs like Carejoy. European brands maintain dominance in premium clinics and academic institutions, leveraging decades of clinical validation and seamless integration within proprietary ecosystem (e.g., Sirona’s SIDEXIS XG). However, TCO (Total Cost of Ownership) pressures—driven by reimbursement constraints and rising capital costs—have accelerated adoption of high-fidelity alternatives. Carejoy exemplifies the new generation of Chinese manufacturers that have closed the quality gap through ISO 13485-certified manufacturing, CE MDR compliance, and targeted R&D in sensor technology and software interoperability.

Strategic Comparison: Global Brands vs. Carejoy

| Feature Category | Global Brands (European) | Carejoy Advantage |

|---|---|---|

| Acquisition Cost | €28,000 – €42,000 (Panoramic/CBCT); €8,500 – €14,000 (Intraoral) | €11,500 – €18,000 (Panoramic); €3,200 – €5,800 (Intraoral) – 60-70% cost reduction |

| Image Quality (DQE) | DQE 78-82% (Premium CMOS/CCD sensors) | DQE 75-78% (Proprietary CMOS sensors; clinically equivalent per 2025 DGZMK validation) |

| Software Integration | Native integration with proprietary PMS/CAD-CAM; limited third-party DICOM support | Universal DICOM 3.0 compliance; certified integrations with 12+ major PMS (exocad, Dentrix, Open Dental) |

| Service & Support | Direct field service (48-hr SLA); premium labor rates (€180-220/hr) | Hybrid model: Local distributor-certified engineers + remote diagnostics; labor rates €85-110/hr; 72-hr SLA |

| Regulatory Compliance | Full EU MDR, FDA 510(k), IEC 60601-2-54 | EU MDR Class IIa certified, FDA-cleared (2025), IEC 60601-2-54 |

| TCO (5-Year) | €41,200 – €63,500 (incl. service contracts, software updates) | €18,700 – €29,300 (35-42% lower TCO; service included in extended warranty options) |

| AI Capabilities | Proprietary AI modules (€4,000-7,000/year subscription) | Integrated AI caries/bone loss detection (no subscription fee; updated via firmware) |

Strategic Recommendation

For high-volume clinics and corporate DSOs, Carejoy represents a clinically validated, economically rational alternative to premium brands without compromising diagnostic integrity. Its DICOM-first architecture ensures future-proof interoperability as dental IT ecosystems evolve. European brands remain preferable for clinics deeply embedded in proprietary technology ecosystems (e.g., CEREC users) where workflow continuity outweighs cost considerations. Distributors should position Carejoy not as a “budget alternative” but as a value-optimized solution meeting stringent 2026 regulatory thresholds while addressing acute clinic profitability pressures. The 60-70% cost differential enables clinics to allocate capital toward emerging revenue streams (e.g., implantology, sleep dentistry) without sacrificing diagnostic capability.

Note: All specifications based on 2026 Q1 market analysis. Clinical validation data available upon request through our technical consultancy division.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Dental X-Ray Machines for Sale

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 70 kVp / 7 mA; Single-phase power supply; 110–120V AC, 50/60 Hz | 90 kVp / 10 mA; High-frequency inverter technology; 220–240V AC, 50/60 Hz with automatic voltage stabilization |

| Dimensions | Height: 135 cm; Base: 45 cm × 45 cm; Weight: 42 kg (floor-mounted) | Height: 145 cm (telescopic column); Base: 50 cm × 50 cm; Weight: 48 kg; Motorized vertical and horizontal positioning with digital height memory |

| Precision | Mechanical aiming arm with manual alignment; Angular accuracy ±3°; Repeatability within ±5% exposure consistency | Digital positioning system with laser-guided alignment; Angular accuracy ±1°; Integrated CBCT compatibility and AI-assisted targeting; Repeatability within ±2% exposure consistency |

| Material | Exterior housing: Powder-coated steel; Arm components: Reinforced ABS plastic and aluminum alloy; Lead-lined tube head (0.8 mm Pb equivalent) | Exterior housing: Anodized aluminum and antimicrobial polymer coating; Arm: Carbon-fiber-reinforced composite; Tube head: 1.2 mm Pb equivalent with dual-layer shielding and heat-dissipating ceramic insulation |

| Certification | CE Marked; FDA 510(k) cleared (Class II); Complies with IEC 60601-1, IEC 60601-2-54; Local radiation safety standards (country-specific) | Full CE & FDA certification; ISO 13485 compliant; IEC 60601-1-2 (EMC), IEC 60601-1-11 (home healthcare); Meets EU MDR 2017/745; Includes DICOM 3.0 and HL7 integration for EHR compatibility |

Note: Advanced models are recommended for multi-specialty clinics, implantology centers, and practices integrating digital workflows. Standard models are ideal for general dentistry with moderate imaging volume.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Dental X-Ray Machines from China

Target Audience: Dental Clinic Procurement Managers & International Dental Equipment Distributors

Market Context 2026: China remains the dominant global manufacturing hub for dental X-ray systems (including panoramic, cephalometric, and CBCT units), supplying 68% of the world’s mid-tier equipment. However, regulatory scrutiny has intensified globally, with 42% of non-compliant shipments rejected at EU/US ports in 2025 due to certification gaps. This guide provides a risk-mitigated sourcing protocol for verified suppliers.

3-Step Protocol for Sourcing Certified Dental X-Ray Machines from China

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Post-2024 EU MDR and FDA 510(k) enforcement require active, device-specific certifications. Avoid suppliers offering generic “ISO 9001” certificates.

| Critical Checkpoint | Risk of Non-Compliance | Verification Protocol |

|---|---|---|

| ISO 13485:2016 Certification (Mandatory for medical devices) |

Customs seizure; clinic liability exposure | 1. Demand certificate with exact product scope (e.g., “Dental CBCT Systems”) 2. Validate via ISO Certificate Search 3. Confirm issuing body is IAF-MLA signatory (e.g., TÜV, SGS) |

| CE Marking under MDR 2017/745 (Required for EU market) |

€20k+ fines per device; distribution bans | 1. Request full EU Declaration of Conformity 2. Cross-check NB number on EU NANDO database 3. Verify clinical evaluation report inclusion |

| FDA 510(k) Clearance (For US-bound shipments) |

Shipment destruction; import alerts | 1. Obtain K-number from FDA database 2. Confirm device classification (Class II for X-ray) 3. Validate establishment registration |

Step 2: Negotiating MOQ with Commercial Realism

Chinese factories enforce MOQs to cover calibration/tooling costs. 2026 market dynamics require strategic flexibility:

| Buyer Profile | Typical MOQ Range | Negotiation Strategy |

|---|---|---|

| Dental Clinics (Single-unit purchases) |

1-5 units | • Target suppliers with “clinic-ready” demo units • Accept higher unit cost (15-22% premium) for no-MOQ • Bundle with service contract to offset setup costs |

| Regional Distributors | 10-20 units | • Negotiate tiered pricing (e.g., 5% discount at 15 units) • Require pre-shipment technical validation • Secure spare parts inventory commitment |

| National Distributors | 25+ units | • Demand OEM customization options • Insist on FOB Shanghai + DDP destination options • Negotiate extended warranty (24+ months) |

Step 3: Shipping Terms: DDP vs. FOB (Risk Allocation)

2026 Incoterms® 2020 enforcement requires explicit cost/risk delineation. 78% of disputes stem from unclear shipping terms.

| Term | Supplier Responsibility | Buyer Responsibility | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai Port | • Factory testing • Export clearance • Loading on vessel |

• Ocean freight • Import duties • Customs clearance • Final delivery |

Only for experienced importers with local agents. Avoid for first-time buyers due to hidden costs (avg. +22% over quoted price). |

| DDP (Delivered Duty Paid) | • All costs to clinic/distributor door • Customs documentation • Duty payment • Installation-ready packaging |

• Final acceptance testing • On-site unloading |

STRONGLY PREFERRED for 2026 sourcing. Eliminates 92% of import delays. Verify supplier’s DDP experience with your destination country. |

Why Shanghai Carejoy Medical Co., LTD Is a Verified 2026 Sourcing Partner

19 Years of Dental Equipment Manufacturing Excellence (Est. 2007) | Baoshan District, Shanghai

- Regulatory Compliance: Active ISO 13485:2016 certificate (#CM2026-DR089) with specific scope for dental X-ray systems; CE MDR 2017/745 compliant with NB 2797; FDA establishment registered (FEI# 3015238567)

- MOQ Flexibility: Clinic orders accepted from 1 unit (DDP pricing); Distributor tiered pricing starting at 5 units with OEM options

- Shipping Expertise: DDP execution to 87 countries with guaranteed duty calculation accuracy (2026 tariff databases updated monthly)

- Product Range: Full dental imaging portfolio: Digital Panoramic X-Ray, CBCT, Intraoral Sensors, plus complementary equipment (Chairs, Autoclaves, Scanners)

Direct Sourcing Channel:

Email: [email protected]

WhatsApp: +86 15951276160 (24/7 Technical Support)

Factory Audit: Virtual/In-person audits welcomed with 72h notice

Implementation Checklist for 2026

- Confirm supplier’s X-ray machine has device-specific ISO 13485 certificate (not corporate-only)

- Require CE Certificate of Conformity with NB number verifiable on NANDO

- Negotiate DDP terms with Incoterms® 2020 explicitly stated in contract

- Conduct pre-shipment inspection via SGS/Bureau Veritas (cost borne by supplier)

- Validate calibration certificates traceable to NIM (China) or NIST (US)

Disclaimer: Regulatory requirements vary by country. Always consult local dental board compliance officers pre-purchase. Shanghai Carejoy Medical Co., LTD is highlighted based on verified 2025 export performance data and regulatory audit trails.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Medical Equipment Distributors

Topic: Key Considerations When Purchasing a Dental X-Ray Machine in 2026

Frequently Asked Questions (FAQ)

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before purchasing a dental X-ray machine for my clinic? | Most modern dental X-ray systems (intraoral, panoramic, and CBCT) operate on standard 110–120V or 220–240V AC, depending on regional electrical codes. In 2026, ensure compatibility with your clinic’s power infrastructure—especially for high-frequency or digital CBCT units that may require stable voltage and dedicated circuits. Confirm phase type (single-phase), frequency (50/60 Hz), and grounding specifications with the manufacturer. Units with built-in voltage stabilizers are recommended in areas with inconsistent power supply. |

| 2. Are spare parts readily available for the dental X-ray machines you offer, and what is the typical lead time? | Reputable manufacturers and distributors maintain regional warehouses with critical spare parts—such as X-ray tubes, sensors, collimators, and control boards—for models sold in 2026. We recommend selecting brands with local service networks and minimum 7-year spare parts availability post-discontinuation. Average lead time for common components is 3–7 business days; urgent requests can be expedited via priority logistics. Distributors should provide a parts availability certification upon purchase. |

| 3. What does the installation process involve, and is professional on-site setup included? | Installation of a dental X-ray machine includes site assessment, electrical compliance check, wall or floor mounting, radiation shielding verification (if applicable), network integration (for digital models), and calibration. In 2026, most OEMs and authorized distributors include certified on-site installation as part of the purchase agreement. CBCT and panoramic units require certified radiologic technicians for alignment and safety testing. Remote diagnostics and AI-assisted setup are now standard in premium digital systems. |

| 4. What warranty coverage is standard for dental X-ray machines in 2026, and what does it include? | The industry standard in 2026 is a 2–3 year comprehensive warranty covering parts, labor, and X-ray tube performance. Premium packages may extend to 5 years with optional coverage for accidental damage or software updates. Warranties are valid only when installation and maintenance are performed by authorized personnel. Exclusions typically include damage from power surges, improper use, or unauthorized modifications. Always request a written warranty certificate with serial-number traceability. |

| 5. How are software updates and technical support handled during the warranty period? | In 2026, dental X-ray machines—especially digital and AI-integrated models—receive regular software updates for imaging algorithms, DICOM compliance, cybersecurity, and AI diagnostics. These updates are delivered securely via cloud platforms or service portals and are included in warranty terms. 24/7 technical support with remote troubleshooting, multilingual assistance, and SLA-backed response times (e.g., 4-hour critical issue response) is standard for clinics and distributor partners. |

Need a Quote for Dental X Ray Machine For Sale?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160