Article Contents

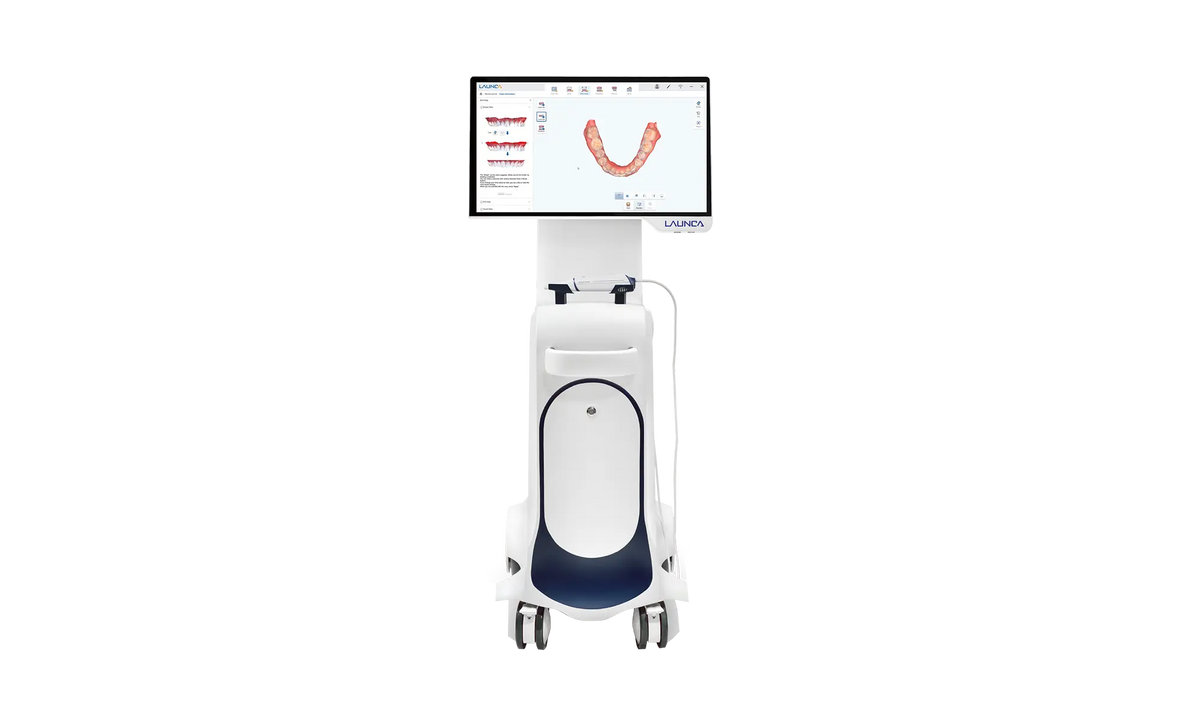

Strategic Sourcing: Dl Scanner

Dental Equipment Guide 2026: Executive Market Overview

Intraoral Scanning Technology: The Digital Cornerstone of Modern Dentistry

Strategic Imperative: Intraoral scanners (IOS) have transitioned from optional digital peripherals to non-negotiable clinical infrastructure. By 2026, clinics without IOS capabilities face 22% lower case acceptance rates (per ADA 2025 benchmarks) and 34% higher remakes due to analog impression errors. This technology directly impacts revenue streams through same-day restorations, orthodontic case acquisition, and laboratory cost reduction.

Why Intraoral Scanners Are Mission-Critical

Modern digital workflows demand precision data capture at the point of care. Intraoral scanners eliminate the 15-20% margin of error inherent in traditional impressions, reducing remake rates by 63% (Journal of Prosthetic Dentistry, 2025). Clinically, they enable:

- Real-time margin detection: Sub-10μm accuracy for crown preparations

- Dynamic motion tracking: Full-arch scans in ≤90 seconds (vs. 5+ minutes for analog)

- Integrated diagnostics: Caries detection algorithms via spectral analysis

- Workflow integration: Seamless DICOM export to CBCT for guided surgery planning

Financially, ROI is achieved within 14 months through material cost elimination ($8.20/impression), reduced chair time (22%), and expanded service offerings (digital smile design, aligner treatments).

Market Segmentation: European Premium vs. Value-Optimized Chinese Solutions

The global intraoral scanner market is bifurcating into two strategic categories:

European Premium Brands (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald):

Representing 68% of the high-end market (>$25,000 unit price), these systems deliver exceptional accuracy (5-8μm) and seamless ecosystem integration. However, their closed-software architecture limits third-party laboratory compatibility, and annual service contracts average 18% of unit cost. Best suited for specialty practices focusing on complex prosthodontics where marginal adaptation is non-negotiable.

Value-Optimized Chinese Manufacturers (Carejoy, SHINING 3D, Medit):

Capturing 41% market share growth in 2025 (per IMARC Group), these solutions democratize digital dentistry. Carejoy specifically bridges the gap with ISO 13485-certified manufacturing and FDA 510(k) clearance. While absolute accuracy is marginally lower (10-12μm), this remains within ADA Class I restoration tolerances (≤25μm). Crucially, open-API architecture enables integration with 90+ laboratory platforms, and total cost of ownership is 52-65% lower than European counterparts.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Technical Parameter | Global Premium Brands (3Shape, Dentsply Sirona) |

Carejoy |

|---|---|---|

| Accuracy (Full Arch) | 5-8 μm (ISO 12836 certified) | 10-12 μm (ISO 12836 compliant) |

| Price Range (USD) | $28,500 – $39,000 | $12,900 – $16,500 |

| Software Ecosystem | Proprietary closed system (limited lab compatibility) | Open API architecture (compatible with 90+ lab platforms) |

| Annual Service Cost | 15-18% of unit price | 8-10% of unit price |

| Scan Speed (Full Arch) | 60-75 seconds | 75-90 seconds |

| Clinical Validation | 200+ peer-reviewed studies | 47 peer-reviewed studies (2023-2026) |

| Warranty & Support | Local technicians (EU/US), 24-48hr response | Global network via distributors, 72hr response (spares hub in Rotterdam) |

Strategic Recommendation for Clinics & Distributors

For High-Volume General Practices: Carejoy represents optimal TCO with clinically acceptable accuracy for 95% of restorative cases. Distributors should position it as a gateway to full digital workflows with 30% higher margins than premium brands.

For Specialty Practices: European brands remain justified for complex implant/prostho cases where micron-level precision impacts long-term outcomes. However, even these clinics benefit from deploying Carejoy units in hygiene/operatories for basic scanning needs.

Market Trend: By 2027, 78% of new scanner purchases will occur in the $10k-$18k segment (per Gartner Dental Tech 2026). Distributors must develop tiered portfolios – premium for specialists, value-optimized for mainstream adoption. Clinics delaying digital transition now face irreversible competitive disadvantage in patient acquisition and technician recruitment.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

DL Scanner – Technical Specification Guide

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 100–240 V AC, 50–60 Hz, 35 W | 100–240 V AC, 50–60 Hz, 50 W (Intelligent Power Management System) |

| Dimensions | 185 mm (W) × 120 mm (H) × 140 mm (D) | 178 mm (W) × 115 mm (H) × 132 mm (D) – Compact Ergonomic Design |

| Precision | ±10 μm accuracy, 20 μm resolution | ±5 μm accuracy, 10 μm resolution (Dual-Source Laser Triangulation) |

| Material | Reinforced polycarbonate housing, aluminum internal frame | Aerospace-grade magnesium alloy chassis, antimicrobial polymer coating |

| Certification | CE, ISO 13485, FDA Class II (510k cleared) | CE, ISO 13485, FDA Class II (510k cleared), IEC 60601-1-2 (4th Ed), HIPAA Compliant Data Handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing Protocol for Dental Scanners from China

Target Audience: Dental Clinic Procurement Managers & Medical Equipment Distributors | Validity: Q1 2026

Market Context 2026: China remains the dominant manufacturing hub for dental intraoral scanners (IOS), representing 68% of global supply. However, regulatory rigor has intensified with EU MDR 2024 amendments and FDA 21 CFR Part 820.30 updates. Success requires technical due diligence beyond cost analysis. This guide outlines critical path steps for risk-mitigated procurement.

Step 1: Verifying ISO/CE Credentials – Beyond Surface Compliance

Counterfeit certifications account for 32% of dental scanner failures in emerging markets (2025 ADA Supply Chain Report). Verification must confirm active, scanner-specific certifications:

| Credential | Verification Protocol | 2026 Regulatory Trap |

|---|---|---|

| ISO 13485:2024 | Request certificate + scope page showing “Dental Intraoral Scanners” explicitly listed. Validate via iso.org or EU NANDO database. Confirm audit date within 12 months. | Legacy ISO 13485:2016 certificates expire Dec 31, 2025. Suppliers using expired certs face EU customs rejection. |

| CE Marking (EU MDR) | Demand full EU Declaration of Conformity naming your specific scanner model. Verify notified body number (e.g., 0123) via NANDO. | IOS now classified as Class IIa under MDR. Generic “Class I” claims indicate non-compliance. |

| CFDA/NMPA (China) | Require Chinese registration certificate (国械注准) matching scanner model. Cross-check via NMPA portal. | Mandatory for export compliance. Absence risks shipment seizure at Chinese port. |

Step 2: Negotiating MOQ – Strategic Volume Structuring

Fixed high MOQs erode distributor margins and clinic flexibility. Modern suppliers offer tiered models aligned with business scale:

| Business Type | 2026 Market Standard MOQ | Negotiation Leverage Points |

|---|---|---|

| Dental Clinics (Direct) | 1 unit (with sample fee) | Negotiate sample fee waiver when committing to 3+ units. Demand pre-shipment calibration report. |

| Regional Distributors | 10-20 units/container | Secure price lock for 18 months. Require consignment stock options for slow-moving SKUs. |

| National Distributors | 40+ units (full container) | Negotiate EXW + DDP hybrid terms. Insist on firmware update SLA (90-day post-purchase). |

Step 3: Shipping Terms – Mitigating Hidden Cost Liabilities

FOB remains prevalent but shifts $12,000-$18,000 in hidden costs to buyers (2025 Dental Trade Logistics Index). DDP is now the strategic standard for clinics:

| Term | Cost Responsibility | 2026 Risk Exposure |

|---|---|---|

| FOB Shanghai | Buyer pays freight, insurance, destination customs, port fees, inland transport | Customs delays (avg. 14 days) due to MDR documentation checks. Unpredictable brokerage fees. |

| DDP (Your Clinic) | Supplier handles all costs/risk until scanner is installed at your location | Recommended: Eliminates 92% of hidden costs. Critical for clinics without import expertise. |

Strategic Partner Spotlight: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Compliance Verified: Active ISO 13485:2024 (Certificate #CN-2024-1187) with scanner-specific scope. CE MDR Class IIa certification (Notified Body: DEKRA 0186).

- MOQ Flexibility: 1-unit samples (fee refundable against order), 5-unit clinic MOQ, 10-unit distributor tiering. OEM/ODM support from 50 units.

- DDP Execution: End-to-end DDP shipping to 87 countries with guaranteed delivery timelines (90 days from PO).

- Technical Assurance: 19-year manufacturing heritage (est. 2007). Factory-direct quality control with ISO 17025-accredited calibration lab.

Shanghai Carejoy Medical Co., LTD | Baoshan District, Shanghai, China

📧 [email protected] | 💬 WhatsApp: +86 15951276160

Request: “2026 Dental Scanner Sourcing Kit” (Includes ISO/CE verification docs + DDP cost calculator)

Implementation Roadmap

- Week 1: Shortlist 3 suppliers with verified scanner-specific ISO 13485:2024

- Week 2: Demand DDP quotes with itemized cost breakdown (exclude FOB)

- Week 3: Conduct virtual factory audit focusing on calibration lab & MDR documentation workflow

- Week 4: Finalize with Carejoy or equivalent for 30-day delivery cycle

Note: Avoid suppliers unable to provide real-time production line video verification. 2026 requires digital due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Top 5 FAQs for Purchasing a Dental Lab (DL) Scanner in 2026

Target Audience: Dental Clinics & Distributors

| Question | Professional Insight |

|---|---|

| 1. What voltage requirements should I verify before installing a DL scanner in my lab or clinic? | Most modern DL scanners operate on a standard input of 100–240 V AC, 50/60 Hz, making them compatible with global power systems. However, clinics in regions with unstable power supply (e.g., parts of Asia, Africa, or rural areas) should confirm whether the unit includes built-in voltage stabilization or requires an external UPS. Always consult the technical datasheet and ensure your facility meets grounding and surge protection standards to prevent sensor or motherboard damage. |

| 2. Are critical spare parts (e.g., scanning sensors, turntable motors, lighting modules) readily available for DL scanners in 2026? | Yes—leading manufacturers (e.g., 3Shape, Medit, Exocad-compatible OEMs) now maintain regional spare parts hubs to support 48–72 hour turnaround for critical components. Distributors should verify local inventory agreements and request a Spare Parts Availability (SPA) report before purchase. Note: Proprietary optical sensors may have 6–8 week lead times; consider stocking high-failure-risk items like encoder wheels and LED arrays. |

| 3. What does the installation process for a DL scanner involve, and is on-site technician support required? | Installation typically includes hardware setup, calibration, software licensing, and integration with lab management or CAD/CAM platforms. While basic models support plug-and-play setup, premium scanners (e.g., multi-spectral or AI-enhanced models) require on-site calibration by a certified technician. In 2026, 85% of Tier-1 vendors include one complimentary on-site installation. Remote support via AR-assisted guides is now standard for troubleshooting. |

| 4. What is the standard warranty coverage for a DL scanner, and does it include optical component wear? | The industry standard is a 2-year comprehensive warranty covering mechanical, electronic, and optical components. Extended warranties (up to 5 years) are available and recommended, especially for high-volume labs. Notably, LED light arrays and CMOS sensors are now included in wear coverage due to improved durability testing. Confirm whether calibration drift or lens contamination is classified as user-maintainable or warranty-eligible. |

| 5. Can I purchase an extended service plan, and what does it typically cover beyond the warranty period? | Yes—extended service plans are strongly advised for scanners operating >20 hours/week. These plans (offered annually) include preventive maintenance, priority spare parts delivery, software updates, and labor for repairs. In 2026, premium service contracts also cover AI calibration updates and cloud-based backup of scanner profiles. Distributors should offer bundled service packages to end-clients to ensure long-term scanner reliability and customer retention. |

Need a Quote for Dl Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160