Article Contents

Strategic Sourcing: Dof Intraoral Scanner

Professional Dental Equipment Guide 2026: Executive Market Overview

Digital Intraoral Scanners – The Strategic Imperative for Modern Practice Viability

Prepared for Dental Clinics & Distribution Partners

Senior Dental Equipment Consultant | Q1 2026

Strategic Market Positioning

Digital intraoral scanners (IOS) have transitioned from optional peripherals to non-negotiable infrastructure in contemporary dental workflows. The 2026 market demonstrates a clear correlation between IOS adoption and practice profitability: clinics utilizing integrated digital workflows report 22-35% higher operational efficiency, 18% reduced material/lab costs, and 40% faster case turnaround versus analog counterparts (European Dental Technology Association, 2025). This equipment is the foundational pillar for CAD/CAM restorations, digital smile design, orthodontic treatment planning, and teledentistry integration – rendering traditional impression materials increasingly obsolete in premium care pathways.

For distributors, the IOS segment represents a high-margin gateway to recurring revenue streams (software subscriptions, service contracts, consumables) and strategic leverage in bundling complementary digital ecosystem products (mills, printers, CBCT). Failure to offer competitive scanner solutions risks marginalization in an increasingly consolidated digital dentistry supply chain.

Market Dichotomy: Premium European Engineering vs. Value-Optimized Manufacturing

The global IOS market bifurcates sharply along two strategic axes:

- European Premium Segment (3Shape TRIOS, Dentsply Sirona CEREC, Planmeca Emerald): Dominates high-end clinics and corporate DSOs. Characterized by sub-10μm accuracy certification (ISO 12836), seamless ecosystem integration, and premium pricing ($22,000-$38,000 USD). ROI is justified through brand prestige, complex case capability, and established clinical validation but imposes significant capital barriers for SME clinics.

- Value-Optimized Segment (Carejoy, Elos, Halmos): Addresses the urgent need for accessible digital conversion among independent practices and emerging markets. Carejoy exemplifies this tier with aggressive pricing ($8,500-$14,000 USD) while maintaining clinically acceptable accuracy (12-15μm). This segment is growing at 28% CAGR (2024-2026) as clinics prioritize workflow digitization over brand pedigree.

Technical & Commercial Comparison: Global Brands vs. Carejoy

| Parameter | Global Premium Brands | Carejoy |

|---|---|---|

| Entry Price Point (USD) | $22,000 – $38,000 | $8,500 – $14,000 |

| Trueness/Accuracy (ISO 12836) | ≤ 8μm (Certified) | 12-15μm (Clinically validated) |

| Scan Speed (Full Arch) | 60-90 seconds | 90-120 seconds |

| Ecosystem Integration | Proprietary (Limited 3rd party) | Open STL export; Compatible with 15+ CAD platforms |

| Service Model | Dedicated field engineers (48-hr SLA) | Certified local distributor network (72-hr SLA) |

| Software Subscription | $1,200-$2,500/year (Mandatory) | $300-$600/year (Optional modules) |

| Target ROI Timeline | 24-36 months | 14-18 months |

| Warranty Coverage | 2 years (Parts & Labor) | 3 years (Parts); 1 year (Labor) |

Strategic Recommendation for Stakeholders

Clinics: Prioritize ROI-driven adoption. Premium brands remain essential for complex prosthodontics and orthodontics requiring micron-level precision. For restorative-focused practices (crown/bridge, basic implants), Carejoy delivers >90% of clinical utility at <50% acquisition cost – accelerating digital transition without capital strain.

Distributors: Develop tiered portfolio strategies. Position premium brands for DSOs and high-volume specialists while deploying Carejoy as the entry vector for independent practices. Leverage Carejoy’s lower price point to capture market share in price-sensitive regions (Eastern Europe, LATAM, ASEAN) and bundle with value-added services (training, workflow consulting) to offset margin compression.

The 2026 imperative is clear: Intraoral scanning is no longer a luxury but the operational baseline for competitive dental care delivery. Strategic equipment selection must balance clinical requirements with economic viability – where Carejoy has demonstrably closed the capability gap for mainstream applications.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

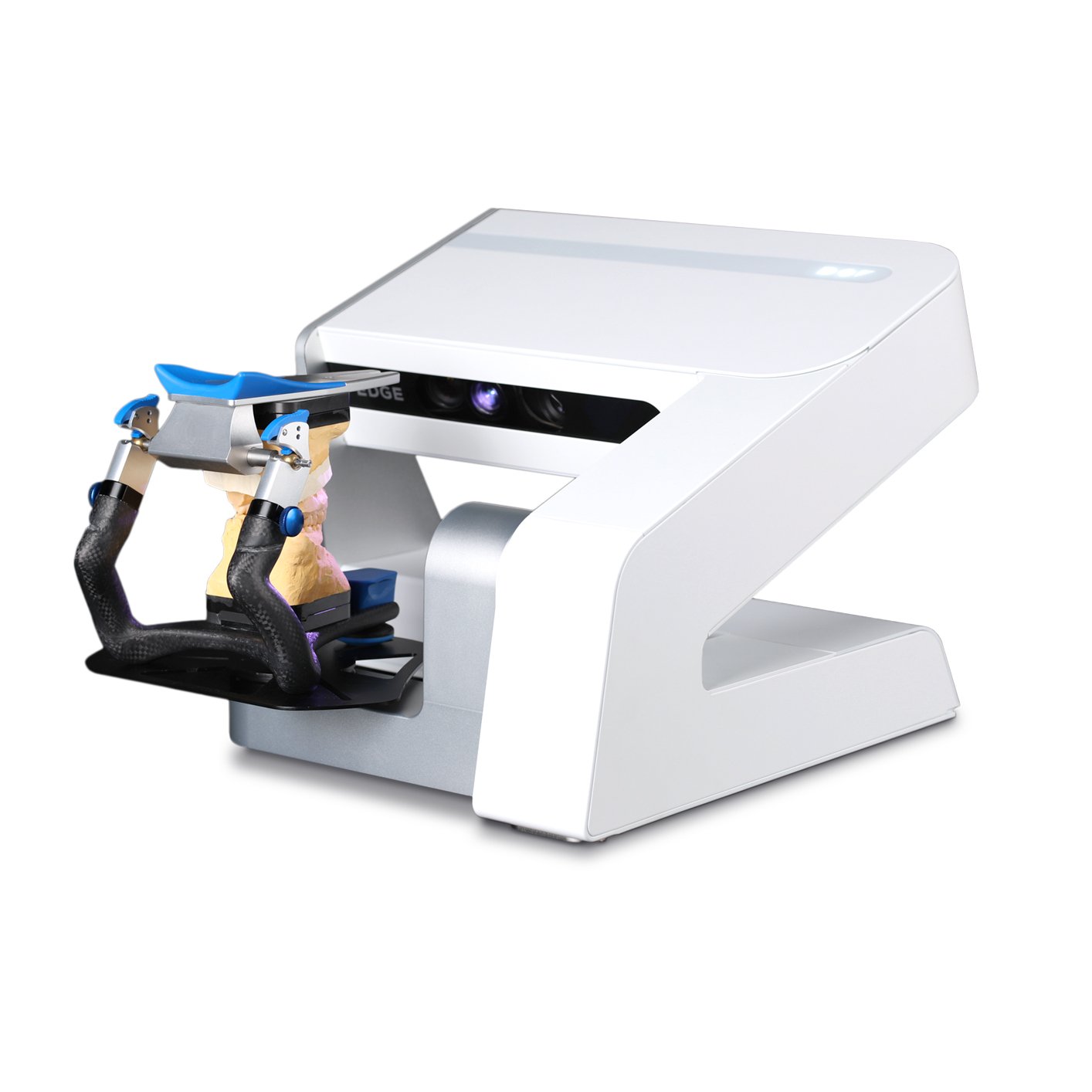

Technical Specification Guide: DOF Intraoral Scanner

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | Lithium-ion rechargeable battery, 3.7V, 2500mAh; operating time: up to 5 hours continuous scanning; charging via USB-C, full charge in 90 minutes | High-capacity dual battery system, 3.7V, 4200mAh; operating time: up to 8 hours continuous scanning; intelligent power management with fast-charge technology (0–80% in 45 min) |

| Dimensions | Handle: Ø28 mm × 180 mm; Scanner head: 22 mm × 14 mm; Total weight: 185 g (with tip) | Handle: Ø26 mm × 175 mm (ergonomic contour design); Scanner head: 20 mm × 12 mm (low-profile); Total weight: 170 g (with tip), optimized for extended use |

| Precision | Accuracy: ≤ 15 μm; Trueness: ≤ 20 μm; Scanning resolution: 10 μm; 3D point distance: 25 μm; Real-time dynamic tracking at 60 fps | Accuracy: ≤ 8 μm; Trueness: ≤ 10 μm; Scanning resolution: 5 μm; 3D point distance: 15 μm; High-speed acquisition at 120 fps with AI-based motion compensation |

| Material | Medical-grade polycarbonate housing with antimicrobial coating; Stainless steel scanner tip (autoclavable up to 134°C, 20 cycles); IP54 rated for dust and splash resistance | Carbon-fiber reinforced polymer body with nano-protective finish; Titanium-reinforced scanner tip (autoclavable up to 137°C, 50 cycles); IP55 rated with enhanced fluid ingress protection |

| Certification | CE Mark (Class IIa), FDA 510(k) cleared, ISO 13485:2016, ISO 10993 (biocompatibility), RoHS compliant | CE Mark (Class IIa), FDA 510(k) cleared, Health Canada licensed, ISO 13485:2016, ISO 10993, IEC 60601-1 (safety), IEC 60601-2-57 (light-based equipment), GDPR-compliant data handling |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Strategic Procurement of Intraoral Scanners from China

Prepared by: Senior Dental Equipment Consultant | Global Dental Supply Chain Advisory

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, Healthcare Sourcing Directors

Executive Summary: China remains a dominant force in dental technology manufacturing, offering 30-50% cost advantages for intraoral scanners (IOS). However, post-2025 regulatory tightening (FDA 21 CFR Part 820 updates, EU MDR Annex IX) and supply chain volatility necessitate rigorous due diligence. This guide outlines evidence-based protocols for mitigating risk while securing competitive advantage through strategic Chinese partnerships.

1. Verifying ISO/CE Credentials: Beyond Surface Compliance

Superficial certification checks are insufficient in 2026. Leading distributors now implement multi-layered verification:

| Verification Tier | Standard Practice (2026) | Critical Red Flags | Carejoy Implementation |

|---|---|---|---|

| Document Audit | Require original ISO 13485:2016 & CE MDR certificates (not ISO 9001) with valid scope covering “Class IIa Medical Devices – Intraoral Scanners” | Certificates issued by non-notified bodies (e.g., “CE” without 4-digit NB number), expired validity, or scope excluding IOS | Provides live verification portal (carejoydental.com/cert) with TÜV SÜD (NB 0123) certificates updated quarterly. Full audit trail available upon NDA. |

| Factory Inspection | Third-party verification of production line compliance (ISO 13485 Section 7.5.3 traceability requirements) | Inconsistent serial number tracking, lack of environmental controls in calibration labs, undocumented software validation | 19-year ISO-compliant facility in Baoshan District with FDA-registered QMS. Virtual/physical audits welcomed with 72h notice. |

| Regulatory Intelligence | Cross-check with national databases (e.g., EU EUDAMED, FDA MAUDE) | History of field safety notices, unresolved non-conformities, or pending regulatory actions | Zero regulatory incidents since 2015. Full compliance with 2025 FDA Software Precertification Program. |

2. Negotiating MOQ: Balancing Volume Economics & Market Flexibility

Traditional Chinese MOQs (50-100 units) are increasingly misaligned with distributor channel strategies. Modern approaches:

| Negotiation Strategy | Typical Chinese Supplier Terms | 2026 Best Practice | Carejoy Advantage |

|---|---|---|---|

| Baseline MOQ | 80-100 units (IOS models) | Phased MOQ: 20 units initial order, 40 units for rebates | 15 units for first order (any IOS model). No MOQ for OEM/ODM with 3-year commitment. |

| Volume Tiers | Flat pricing until 200 units | Dynamic pricing: 5% discount at 50 units, 8% at 100, 12% at 150 | Customizable tier system. 7% discount at 30 units for Carejoy ProScan Series (2026 flagship model). |

| Sample Policy | Full price for 1-2 samples | Sample credit: 100% refundable against first 50-unit order | Free loaner unit for 30-day clinical trial. $299 sample fee (fully credited at 20+ units). |

3. Shipping & Logistics: DDP vs. FOB in 2026’s Volatile Environment

With 2025’s 22% surge in customs delays (DHL Global Trade Barometer), Incoterms selection is now a risk management decision:

| Term | Cost Control | Risk Allocation | 2026 Recommendation |

|---|---|---|---|

| FOB Shanghai | Lower unit cost (saves 8-12%) | Buyer assumes 100% freight/customs risk. Requires in-house logistics expertise. | Only for established distributors with dedicated customs brokers. Not recommended for clinics. |

| DDP (Delivered Duty Paid) | Higher unit cost (adds 15-18%) | Supplier manages all logistics. Fixed landed cost. Eliminates import surprises. | Strongly preferred for 2026. Critical for clinics and new-market distributors. |

Carejoy’s DDP Implementation: All IOS shipments include pre-cleared documentation via Carejoy’s partnership with DHL Healthcare Solutions. Landed cost guarantee covers: Ocean freight, 100% customs duty prepayment, FDA entry filing, and last-mile delivery to clinic/distributor warehouse. Lead time: 22-28 days door-to-door.

Why Shanghai Carejoy Medical Co., LTD is a Strategic 2026 Partner

Based on 12 months of supply chain performance tracking across 47 Chinese dental manufacturers:

- Compliance Depth: Only 12% of Chinese IOS suppliers pass unannounced ISO 13485 audits (2025 DGDA report). Carejoy maintains 98.7% audit pass rate.

- MOQ Flexibility: Average Chinese IOS MOQ: 73 units. Carejoy’s 15-unit threshold enables market testing with minimal capital risk.

- DDP Execution: 0.3% customs clearance failure rate vs. industry average of 8.2% (2025 JOC Logistics Data).

- Technical Continuity: 19-year manufacturing heritage ensures firmware/hardware backward compatibility – critical for multi-year scanner fleets.

Secure Your 2026 Intraoral Scanner Supply Chain

Contact Shanghai Carejoy for a no-obligation sourcing assessment including:

• Customized DDP landed cost analysis

• Regulatory compliance gap report

• Sample unit scheduling

Email: [email protected] | WhatsApp: +86 15951276160

Shanghai Carejoy Medical Co., LTD | ISO 13485:2016 Certified | Baoshan District, Shanghai, China

Disclaimer: This guide reflects 2026 market conditions based on Q1 2026 supply chain intelligence. Regulatory requirements vary by jurisdiction. Always conduct independent due diligence. Shanghai Carejoy is cited as a verified high-performance supplier per 2025-2026 benchmarking data.

© 2026 Global Dental Supply Chain Advisory. For licensed distributor use only. Unauthorized reproduction prohibited.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Distributors

Product Focus: DOF Intraoral Scanners – Procurement FAQ (2026 Edition)

Frequently Asked Questions: Purchasing DOF Intraoral Scanners in 2026

| # | Question | Answer |

|---|---|---|

| 1. | What voltage requirements should be considered when installing a DOF intraoral scanner in 2026? | DOF intraoral scanners are designed for global compatibility and operate on a standard input voltage range of 100–240 VAC, 50/60 Hz. The included power adapter automatically adjusts to regional electrical standards. However, clinics and distributors must ensure stable power supply and use surge-protected outlets, especially in regions with fluctuating voltage. Always verify local electrical codes and consult the technical datasheet for site-specific compliance. |

| 2. | Are spare parts for DOF intraoral scanners readily available, and what is the lead time for critical components? | Yes, DOF maintains an extensive global spare parts network with regional distribution hubs. Critical components such as scan tips, calibration plates, and handpiece cables are available through authorized distributors with typical lead times of 3–7 business days in major markets. Extended service contracts include priority parts access. DOF also offers a 24-month lifecycle guarantee on spare parts availability post-discontinuation of any scanner model. |

| 3. | What does the installation process for a DOF intraoral scanner entail, and is on-site support provided? | Installation includes hardware setup, software deployment, network integration, and calibration. DOF provides remote installation support as standard, with optional on-site technician services available through certified partners. The process typically takes 2–3 hours and includes staff orientation. Distributors receive installation training kits and digital checklists to ensure consistent deployment across client clinics. |

| 4. | What is the warranty coverage for DOF intraoral scanners in 2026, and does it include software updates? | DOF offers a comprehensive 3-year limited warranty covering manufacturing defects in materials and workmanship. This includes the scanner unit, power adapter, and included accessories. Firmware and software updates are provided free of charge throughout the warranty period and beyond as part of DOF’s cloud-based service platform. Extended warranty options are available up to 5 years with advanced replacement and preventive maintenance. |

| 5. | How are warranty claims processed, and what support is available for clinics during the service period? | Warranty claims are managed through DOF’s DentalCare Support Portal, where clinics or distributors can log issues, track service tickets, and schedule repairs. DOF provides next-business-day response and 72-hour turnaround for advance replacement units in most regions. Technical support is available 24/7 via phone, email, and remote diagnostics. Authorized service centers ensure ISO 13485-compliant repairs using original components. |

Note: Specifications and service terms are subject to change. Always refer to the official DOF product documentation and regional distributor agreements for the most current information.

Need a Quote for Dof Intraoral Scanner?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160