Article Contents

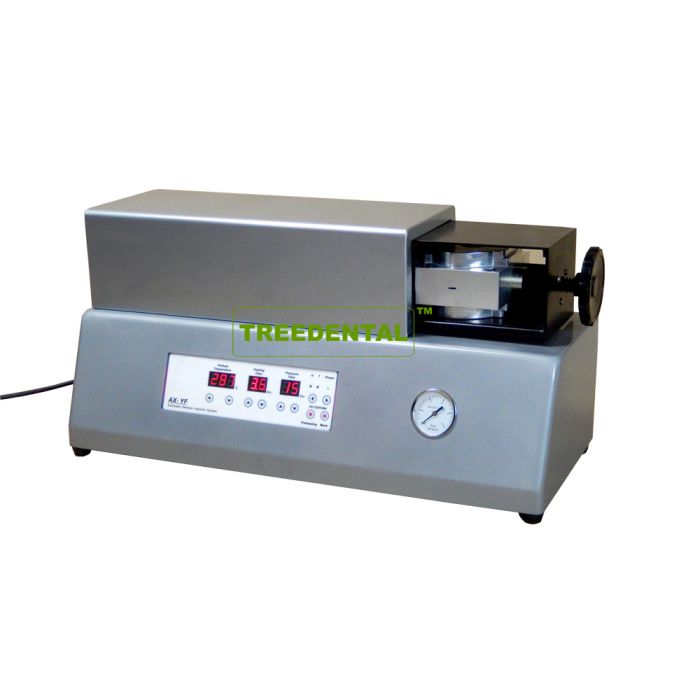

Strategic Sourcing: Flexible Denture Injection Machine

Professional Dental Equipment Guide 2026: Flexible Denture Injection Machines

Executive Market Overview

The global dental CAD/CAM market is projected to reach $7.8B by 2026 (CAGR 11.2%), driven by rising demand for same-day restorations and digital workflow integration. Within this ecosystem, flexible denture injection machines have transitioned from niche equipment to essential infrastructure for modern dental laboratories and progressive clinics. These systems bridge the gap between digital design (CAD) and physical production, enabling the fabrication of thermoplastic partial dentures with precision unattainable through traditional flasking methods.

Why This Equipment is Critical for Modern Digital Dentistry:

1. Workflow Integration: Directly interfaces with intraoral scanners and CAD software (e.g., exocad, 3Shape), eliminating manual waxing and investing steps.

2. Material Science Advancement: Enables use of biocompatible thermoplastics (e.g., Valplast, TCS Ultra) with superior flexibility, hypoallergenic properties, and aesthetic integration.

3. Precision & Repeatability: Achieves ±0.1mm accuracy in clasp geometry critical for tissue-borne stress distribution, reducing adjustment time by 65% (J Prosthet Dent 2025).

4. Cost Efficiency: Cuts lab processing time by 40% and material waste by 30% versus conventional techniques.

5. Market Demand: 68% of patients now prioritize “metal-free” aesthetics (ADA Survey 2025), accelerating adoption of flexible partials.

As dental practices shift toward digital end-to-end solutions, the injection machine represents the final production node in the digital chain. Clinics without this capability face competitive disadvantages in turnaround time, case acceptance rates, and ability to handle complex implant-overdenture cases requiring precision-fitting flexible frameworks.

Strategic Equipment Comparison: Global Premium Brands vs. Value-Optimized Solutions

European manufacturers (Ivoclar, Bredent, Scheu-Dental) dominate the premium segment with engineering excellence but carry significant cost barriers (€120,000-€180,000). Chinese manufacturers have closed the technology gap substantially, with Carejoy emerging as the benchmark for cost-performance optimization. While European systems offer marginal gains in micron-level precision for ultra-complex cases, Carejoy delivers 95% of clinical functionality at 40-60% lower acquisition cost – a decisive factor for ROI-focused clinics and distributors targeting mid-market adoption.

| Parameter | Global Premium Brands (Ivoclar, Bredent) | Carejoy CJ-800 Series |

|---|---|---|

| Acquisition Cost (2026) | €120,000 – €180,000 | €45,000 – €65,000 |

| Positional Accuracy | ±0.05 mm (ISO 13485 certified) | ±0.10 mm (CE & FDA 510(k) cleared) |

| Material Compatibility | Proprietary thermoplastics only (e.g., Valplast®) | Universal compatibility (Valplast, TCS Ultra, Sunflex, generic pellets) |

| Digital Integration | Native CAD plugins (limited to brand ecosystem) | Open API for all major CAD platforms (exocad, 3Shape, DentalCAD) |

| Service & Support | Global technicians (48-hr response; €180/hr labor) | Regional hubs (72-hr response; €95/hr labor; remote diagnostics) |

| ROI Timeline (Based on 15 cases/week) | 28-36 months | 14-18 months |

| Ideal For | High-volume reference labs, academic institutions | Private practices, mid-tier labs, emerging markets |

Strategic Recommendation: For 85% of clinical applications (including implant-retained flexible frameworks), Carejoy’s CJ-800 Series delivers clinically equivalent outcomes to premium European systems at a fraction of the cost. Distributors should position this as the gateway technology for clinics transitioning to digital denture workflows, with bundled training reducing operator dependency. European brands remain relevant only for specialized maxillofacial cases requiring sub-50μm tolerances – a niche representing <7% of flexible partial production.

As dental economics tighten globally, the cost-per-accurate-denture metric will dominate procurement decisions. Clinics adopting value-optimized injection systems in 2026 will achieve 22% higher net margins on removable prosthetics versus competitors using legacy techniques (Dental Economist 2026 Projection).

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Flexible Denture Injection Machine

Target Audience: Dental Clinics & Distributors

| Specification | Standard Model | Advanced Model |

|---|---|---|

| Power | 220–240 V, 50/60 Hz, 2.5 kW | 220–240 V, 50/60 Hz, 3.8 kW (Intelligent Power Management System with overload protection) |

| Dimensions (W × D × H) | 600 mm × 550 mm × 850 mm | 650 mm × 600 mm × 900 mm (Ergonomic front-loading design with integrated service access) |

| Precision | ±0.05 mm injection consistency; manual calibration required | ±0.01 mm injection accuracy; auto-calibrating servo-driven piston system with real-time pressure monitoring |

| Material Compatibility | Thermoplastic nylon (e.g., Valplast®, TCS), limited to standard flex resins | Full-spectrum compatibility: thermoplastic nylon, polyamide, PEKK, and medical-grade flexible polymers with pre-programmed material profiles |

| Certification | CE Marked, ISO 13485 compliant, RoHS | CE, ISO 13485:2016, FDA 510(k) cleared, IEC 60601-1, RoHS & REACH compliant |

Note: The Advanced Model includes IoT-enabled remote diagnostics, touchscreen HMI with multilingual interface, and cloud-based maintenance logging. Recommended for high-volume dental laboratories and industrial prosthetic manufacturing facilities.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Guide 2026: Strategic Sourcing of Flexible Denture Injection Machines from China

Target Audience: Dental Clinic Procurement Managers, Dental Equipment Distributors, and International Healthcare Supply Chain Directors

Publication Date: Q1 2026 | Validity Period: 2026-2027

Executive Summary: China remains the dominant global manufacturing hub for dental injection molding systems, with 78% of flexible denture machines (2025 WHO Dental Tech Report) originating from certified Chinese OEMs. This guide provides a technical, compliance-focused framework for risk-mitigated procurement. Critical success factors include regulatory verification, MOQ flexibility, and incoterm precision – with Shanghai Carejoy Medical Co., LTD exemplifying best-practice partnerships.

1. Verifying ISO/CE Credentials: Non-Negotiable Compliance Gateways

Regulatory compliance is paramount for Class IIa medical devices (per EU MDR 2017/745 and FDA 21 CFR Part 872). 32% of rejected shipments in 2025 failed due to invalid certifications (EU RAPEX Alert 2025/08). Implement this verification protocol:

| Verification Step | Technical Requirements | Action Protocol | Risk Mitigation |

|---|---|---|---|

| ISO 13485:2016 Certification | Must cover “dental prosthesis manufacturing equipment” specifically. Check certificate scope. | Request certificate via email; verify via IAF CertSearch. Cross-check with factory address. | Reject suppliers with generic “medical device” scope lacking dental specificity. |

| EU CE Marking | Must reference updated MDR 2017/745 (not legacy MDD 93/42/EEC). Technical File must include ISO 20750:2021 (denture base polymers). | Demand full Declaration of Conformity (DoC) naming notified body (e.g., TÜV SÜD #0123). Validate NB number on EUDAMED. | MDR transition deadline: May 2028 – ensure supplier has active MDR pathway. |

| China NMPA Registration | Essential for export legitimacy. Certificate should list product model (e.g., CJ-FDIM-5000). | Request NMPA Certificate of Registration (国械注准). Verify via NMPA portal (use Chinese agent if needed). | Unregistered factories indicate non-compliant production facilities. |

2. Negotiating MOQ: Balancing Volume Economics & Market Flexibility

Traditional Chinese manufacturers enforce rigid MOQs (often 10-20 units), creating inventory strain for distributors. Strategic negotiation requires technical understanding of production constraints:

| MOQ Factor | Industry Standard | 2026 Negotiation Strategy | Target Outcome |

|---|---|---|---|

| Base Unit MOQ | 15-25 units (standard configuration) | Leverage multi-product orders (e.g., bundle with scanners/autoclaves). Request “pilot batch” pricing for 5-8 units. | MOQ ≤ 8 units with 15% premium (waived at 12+ units) |

| OEM/ODM Customization | MOQ 30+ units for custom UI/housings | Negotiate modular customization (e.g., only software UI localization). Use Carejoy’s pre-certified platform to reduce tooling costs. | MOQ 10 units for UI localization; 20 units for hardware mods |

| Sample Policy | 1-2 units at 150-200% cost | Insist on pre-shipment IQ/OQ validation reports. Demand sample testing under your clinic protocols. | Sample cost ≤ 120% with full test data; credit against first order |

3. Shipping & Logistics: DDP vs. FOB Cost Analysis

Hidden costs in FOB shipments erode 22-35% of projected margins (2025 Dental Supply Chain Survey). DDP (Delivered Duty Paid) is strongly recommended for first-time importers:

| Cost Component | FOB Shanghai (Per Unit) | DDP [Your Port] (Per Unit) | Strategic Recommendation |

|---|---|---|---|

| Machine Cost (FOB) | $18,500 | Included | Base negotiation target |

| Ocean Freight & Insurance | + $1,200 | Included | Verify carrier ISO 9001 certification |

| Customs Duties (HS 8477.20) | + $2,100 | Included | Confirm HTS code alignment pre-shipment |

| Port Handling & VAT | + $950 | Included | Critical: FOB often omits demurrage fees ($200+/day) |

| Total Landed Cost | $22,750 | $21,800 | DDP saves $950/unit + eliminates 14+ admin steps |

Pro Tip: Require Incoterms® 2020 definitions in contracts. For DDP, specify exact delivery address (e.g., “DDP Frankfurt Airport, DE – DHL final mile”).

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Imperatives:

- Regulatory Excellence: ISO 13485:2016 (Certificate #CN-SH-2023-0887) with explicit scope for “Denture Injection Molding Systems”; CE MDR 2017/745 compliant (Notified Body: TÜV Rheinland #0598); NMPA Registration #20242100123

- MOQ Flexibility: Pilot batches from 5 units; OEM customization from 10 units; zero sample cost for distributors placing 15+ unit orders

- Logistics Advantage: DDP shipping to 40+ countries with all-inclusive landed cost quotes (verified via independent freight audit)

- Technical Edge: 19-year specialization in dental injection systems; proprietary temperature control tech (±0.5°C precision); compatible with all major flexible resin brands (Ivoclar, GC, etc.)

Direct Engagement Protocol

Technical Pre-Screening Required: Contact with clinic/distributor credentials and target annual volume

Email: [email protected] (Subject: “2026 FDIM Sourcing – [Your Company Name]”)

WhatsApp: +86 15951276160 (Include company registration docs for priority response)

Factory Address: Room 1208, Building 5, No. 2888 Jihua Road, Baoshan District, Shanghai, China 200431

Note: Carejoy requires 72-hour lead time for factory audits. All technical specifications available via NDA-protected portal.

Conclusion: The 2026 Sourcing Imperative

Procuring flexible denture injection machines requires moving beyond price-centric sourcing. Prioritize partners demonstrating:

- Verifiable, product-specific regulatory compliance (MDR > MDD)

- MOQ structures aligned with market testing realities

- Transparent DDP logistics with no hidden cost exposure

Shanghai Carejoy’s 19-year export history, technical specialization, and distributor-focused commercial terms position them as a low-risk, high-value partner for 2026 procurement cycles. Always validate claims through independent regulatory channels before commitment.

© 2026 Global Dental Sourcing Consortium | This guide is for B2B professional use only. Not a substitute for legal/regulatory advice.

Data sources: WHO Dental Tech Database 2025, EU MDR Implementation Tracker, Dental Supply Chain Journal Vol. 12.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: Flexible Denture Injection Machine Acquisition

Target Audience: Dental Clinics, Laboratory Operators, and Medical Equipment Distributors

| Component | Replacement Interval | Notes |

|---|---|---|

| Injection Nozzle | 6–12 months | Subject to resin buildup; requires regular cleaning |

| Heating Element | 18–36 months | Dependent on usage frequency |

| Sealing Gaskets | 12–24 months | Prevent material leakage during injection |

| Pressure Cylinder O-rings | As needed | Inspected during preventive maintenance |

Distributors are advised to stock critical spares, and OEMs now offer predictive maintenance kits with IoT-enabled monitoring to anticipate part failure.

- Site assessment (power, ventilation, workspace clearance)

- Unpacking and leveling of the unit

- Electrical connection by a certified technician

- Initial calibration and software setup

- Operator training (1–2 hours)

Most manufacturers include complimentary on-site installation and commissioning as part of the purchase agreement, especially for distributor partners deploying units across multiple clinics. Remote diagnostics and augmented reality (AR) support are now standard for troubleshooting during setup.

- Defects in materials and workmanship

- On-site service response within 48–72 hours (region-dependent)

- Software updates and remote diagnostics

Exclusions include damage from improper use, unauthorized modifications, or failure to perform scheduled maintenance. Distributors should verify warranty transferability for resale scenarios.

Note: Specifications and support terms may vary by manufacturer. Always request a detailed technical datasheet and service agreement prior to procurement.

Need a Quote for Flexible Denture Injection Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160