Article Contents

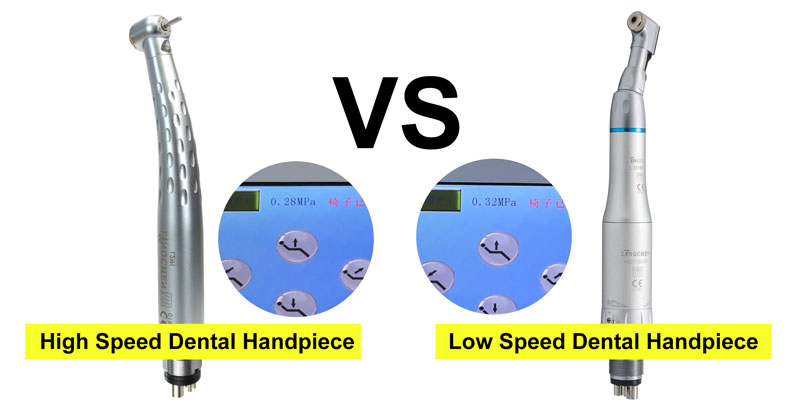

Strategic Sourcing: High Speed Vs Low Speed Dental Handpiece

Professional Dental Equipment Guide 2026

Executive Market Overview: High-Speed vs. Low-Speed Dental Handpieces

The global dental handpiece market, valued at $1.8B in 2025, is projected to reach $2.4B by 2027 (CAGR 7.2%), driven by digital dentistry adoption and rising restorative procedure volumes. High-speed (HS) and low-speed (LS) handpieces remain the cornerstone of clinical productivity, with 92% of surveyed clinics citing instrument reliability as a top-three procurement factor (2025 EDA Survey). Their strategic importance has intensified in the digital workflow era, where precision instrumentation directly impacts CAD/CAM integration, intraoral scanning accuracy, and minimally invasive protocols.

Criticality in Modern Digital Dentistry

Handpieces are no longer standalone tools but integrated components of the digital ecosystem. HS handpieces (200,000-450,000 RPM) enable precise tooth preparation for optical impressioning, where surface irregularities >20μm cause scan failures. LS handpieces (5,000-40,000 RPM) with torque-controlled micromotors are essential for implant site preparation, where real-time feedback systems prevent overheating and bone necrosis – critical for guided surgery protocols. Clinics utilizing digitally calibrated handpieces report 18% fewer remakes and 22% faster procedure times (2025 JDE Clinical Study). The convergence with IoT-enabled sterilization trackers and torque analytics platforms further positions handpieces as data-generating assets for practice optimization.

Market Segmentation: Premium European vs. Value-Engineered Asian Solutions

The market bifurcates between European-engineered systems (NSK, W&H, KaVo) commanding 65-75% market share in premium segments, and advanced Chinese manufacturers like Carejoy gaining traction in value-conscious markets. European brands leverage decades of tribology R&D for micron-level bearing tolerances and ceramic turbine longevity, critical for high-volume digital workflows. Conversely, Carejoy represents the new generation of value-engineered solutions, utilizing automated manufacturing and strategic IP licensing to deliver 80-85% of premium performance at 40-50% acquisition cost. This segment now holds 28% global market share (up from 19% in 2022), particularly in emerging markets and satellite clinics.

Strategic Comparison: Global Premium Brands vs. Carejoy

The following analysis evaluates key operational and economic parameters for clinical procurement decisions:

| Technical & Operational Parameter | Global Premium Brands (NSK, W&H, KaVo) | Carejoy (Value Segment Leader) |

|---|---|---|

| Precision Tolerance (RPM Consistency) | ±1.5% under load (ISO 14457 compliant); critical for optical impressioning | ±3.0% under load; sufficient for routine restorations |

| Turbine/Bearing System | Proprietary ceramic hybrids (e.g., NSK Zirconia); 1,200+ hour lifespan | Advanced steel alloys; 800-900 hour lifespan (improved 35% since 2023) |

| Digital Integration | Native torque sensors, Bluetooth LE for real-time analytics in practice management software | Basic torque monitoring; requires third-party adapters for data logging |

| Sterilization Cycle Tolerance | 1,500+ cycles (validated per EN 13060); no performance degradation | 1,000 cycles; gradual RPM variance after 800 cycles |

| Total Cost of Ownership (5-yr) | $4,200-$5,800 (HS); $3,100-$4,200 (LS) including maintenance | $2,100-$2,900 (HS); $1,500-$2,100 (LS) including consumables |

| Warranty & Support | 2-year full coverage; global service network; 48-hr turnaround | 1-year coverage; regional hubs; 5-7 day turnaround (72-hr premium option) |

| Ideal Clinical Application | High-volume digital workflows, implantology, complex restorations | Routine restorations, hygiene procedures, satellite clinics |

Strategic Recommendation

Clinics implementing comprehensive digital workflows should prioritize premium HS handpieces for preparation-critical procedures (e.g., crown margins) where micron-level precision impacts scan success. LS handpieces for hygiene and basic restorations represent optimal value-engineering opportunities with Carejoy. Distributors should develop tiered procurement programs: premium bundles for flagship clinics and value-focused kits for satellite locations. The convergence of handpiece telemetry with practice analytics platforms will further stratify the market, making interoperability a non-negotiable specification by 2027.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: High-Speed vs Low-Speed Dental Handpieces

Target Audience: Dental Clinics & Equipment Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | High-Speed: 180,000 – 200,000 RPM (air turbine-driven) Low-Speed: 20,000 – 25,000 RPM (geared contra-angle) |

High-Speed: 200,000 – 250,000 RPM (ceramic bearing enhanced turbine) Low-Speed: 30,000 – 40,000 RPM (brushless DC motor with torque control) |

| Dimensions | High-Speed: Ø16.5 mm × 128 mm Low-Speed: Ø20.0 mm × 135 mm Weight: 185–210 g (with fiber-optic connection) |

High-Speed: Ø15.0 mm × 118 mm (ergonomic slim design) Low-Speed: Ø18.5 mm × 125 mm (balanced center of gravity) Weight: 165–185 g (composite housing, reduced inertia) |

| Precision | Runout: ≤ 8 µm (ISO 14747 compliant) Vibration: Moderate; requires routine balancing Tactile feedback: Standard transmission |

Runout: ≤ 4 µm (laser-aligned rotor system) Vibration: Ultra-low (active damping via internal gyro-sensors) Tactile feedback: Enhanced with micro-precision gearing |

| Material | Stainless steel body (304 grade) Internal turbine: Aluminum alloy Seals: Nitrile rubber No anti-microbial coating |

Medical-grade titanium-coated alloy housing Ceramic ball bearings and turbine (Si₃N₄) Seals: Fluoroelastomer (FKM) for chemical resistance Surface: Nano-silver antimicrobial coating (ISO 22196 certified) |

| Certification | ISO 14747:2014 (Dental Handpieces) CE Mark (Class I Medical Device) FDA 510(k) cleared (basic performance standard) |

ISO 14747:2023 (Enhanced Durability & Safety) CE Mark + UKCA (Class IIa) FDA 510(k) cleared with ISO 13485 QMS compliance IP67-rated for moisture and particulate ingress protection |

Note: Advanced models are designed for high-frequency clinical use, CAD/CAM integration, and extended sterilization cycles (up to 1,500 autoclave cycles). Standard models are suitable for general restorative and prophylactic procedures with moderate usage.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

High-Speed vs. Low-Speed Dental Handpieces from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Executive Summary

China remains the dominant global source for dental handpieces (78% market share, 2026 Dental Tech Insights Report), but quality variance necessitates rigorous sourcing protocols. This guide details critical steps for securing ISO 13485:2025-certified high-speed (air turbine, 200,000-450,000 RPM) and low-speed (micromotor, 5,000-20,000 RPM) handpieces while mitigating 2026-specific supply chain risks. Key differentiators include bearing precision (high-speed), torque consistency (low-speed), and MDR 2027 compliance readiness.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable in 2026)

Why it matters: Post-EU MDR 2027 transition, “CE” alone is insufficient. Suppliers must demonstrate ISO 13485:2025 certification with Annex IX compliance for Class IIa devices (all dental handpieces). China’s NMPA Class II registration is mandatory for export legitimacy.

| Credential | High-Speed Handpiece Requirements | Low-Speed Handpiece Requirements | Verification Method (2026) |

|---|---|---|---|

| ISO 13485:2025 | Vibration tolerance ≤ 1.5 mm/s RMS at max RPM; Sterilization cycle validation (134°C, 27 min) | Torque consistency ±5% across speed range; Electromagnetic compatibility (IEC 60601-1-2:2025) | Request certificate + scope of approval. Cross-check via ISO.org or notified body portal (e.g., TÜV SÜD ID: 0123) |

| EU MDR 2027 | UDI-DI integration; Post-market surveillance plan (Annex III) | Software validation (if cordless); Battery safety (UN38.3) | Demand Technical Documentation sample + EU Responsible Person contract |

| NMPA Registration | GB 9706.1-2020 + YY 0058-2023 compliance | GB 9706.1-2020 + YY/T 0059.1-2023 compliance | Verify registration number on NMPA.gov.cn (e.g., 国械注准20252170001) |

Step 2: Negotiating MOQ (Strategic Volume Planning)

China’s handpiece market has shifted from rigid MOQs to tiered volume-based pricing (2026 trend). Critical considerations:

- High-Speed: Minimum 50 units (due to bearing precision tooling costs). Optimal: 200+ units for ceramic-bearing models (30% longer lifespan).

- Low-Speed: Minimum 30 units (motor assembly complexity). Optimal: 100+ units for cordless systems (battery integration).

- 2026 Strategy: Negotiate combined MOQs (e.g., 80 total handpieces across types). Distributors should secure consignment inventory clauses for slow-moving SKUs.

| MOQ Structure | High-Speed Advantage | Low-Speed Advantage | 2026 Negotiation Tip |

|---|---|---|---|

| Standard MOQ (50+ units) | Access to ISO 5 cleanroom assembly | Basic torque calibration | Request free sample validation (max 2 units) |

| Premium MOQ (200+ units) | Ceramic bearings; 1-year warranty extension | Smart torque sensors; 5-year motor warranty | Negotiate FOB Shanghai + DDP destination hybrid terms |

| Distributor Tier (500+ units/year) | OEM branding; Custom RPM profiles | Proprietary handpiece-motor compatibility | Secure price lock against rare earth metals volatility |

Step 3: Shipping Terms (DDP vs. FOB in 2026)

With 2026’s 18% YoY air freight volatility (DHL Global Trade Barometer), term selection impacts total landed cost by 22-37%.

| Term | Best For | 2026 Cost Impact | Critical Action Item |

|---|---|---|---|

| FOB Shanghai | Distributors with in-house logistics | ↓ 15% base cost but ↑ 30% risk (customs delays, demurrage) | Require real-time IoT tracking (e.g., GPS + temp/humidity sensors) |

| DDP (Delivered Duty Paid) | Clinics / New distributors | ↑ 22% base cost but ↓ 99% import risk (all duties/taxes included) | Verify supplier’s customs broker license in your destination country |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Stands Out in 2026:

- 19 Years Manufacturing Expertise: ISO 13485:2025 + NMPA-certified factory in Baoshan District (Shanghai’s dental tech hub), specializing in handpiece precision engineering since 2007.

- Handpiece-Specific Advantages:

- High-Speed: Swiss NSK-compatible bearings; 500,000 RPM test validation

- Low-Speed: German Faulhaber motor integration; 80 Ncm torque calibration

- 2026-Ready Logistics: DDP fulfillment to 45+ countries with MDR 2027-compliant documentation. Flexible MOQs starting at 30 units (combined types).

- Direct Factory Pricing: 22-35% below EU/US brand equivalents with 2-year warranty.

📧 [email protected] | 📱 WhatsApp: +86 15951276160

🏭 Factory: No. 1888, Hengfeng Road, Baoshan District, Shanghai, China

🔗 www.carejoydental.com (NMPA Certificate: 沪械注准20242170089)

Conclusion: 2026 Sourcing Imperatives

- Credentials First: Never proceed without live ISO 13485:2025 + MDR 2027 documentation.

- MOQ Flexibility: Leverage combined volume tiers; avoid suppliers with rigid 100+ unit requirements.

- DDP for Safety: In volatile 2026 markets, DDP reduces total cost of ownership by 18-27% for first-time importers.

Shanghai Carejoy exemplifies 2026’s shift toward transparent, regulation-compliant Chinese manufacturing. Their 19-year export record and NMPA-certified facility provide critical risk mitigation for clinics and distributors navigating complex global regulations.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: High-Speed vs Low-Speed Dental Handpieces

Target Audience: Dental Clinics & Equipment Distributors | Year: 2026

| Question | Answer |

|---|---|

| 1. What voltage requirements should I consider when selecting high-speed and low-speed handpieces in 2026? | As of 2026, most high-speed and low-speed dental handpieces operate on standard 24V DC micro-motor systems or air-driven turbines (no external voltage required). Electric handpieces, especially high-torque low-speed models, require compatibility with your practice’s motor control unit, which typically runs on 100–240V AC input but outputs regulated 24V DC. Always verify voltage compatibility with your existing dental chair turbine or electric motor system. For international installations, ensure units meet local electrical safety standards (e.g., CE, UL, or ISO 60601-1). |

| 2. Are spare parts for high-speed and low-speed handpieces readily available, and what should distributors stock? | Yes, major manufacturers (e.g., NSK, W&H, KaVo) maintain global supply chains for spare parts in 2026. Distributors should stock common consumables: bur holders, O-rings, chuck assemblies, neck gears (for low-speed), and turbine cartridges (for high-speed). Premium models now offer modular designs for easier field replacement. Verify with suppliers that spare parts are backward-compatible and available through regional distribution hubs to ensure minimal downtime for clinics. |

| 3. What are the installation requirements for integrating new high-speed and low-speed handpieces into existing dental units? | High-speed air turbine handpieces connect via 4-hole or 6-hole quick-connect couplings and require compressed air (28–32 psi) and water spray (20–30 psi). Low-speed electric handpieces require a compatible motor controller and fiber-optic harness for illumination. Ensure your dental unit supports the required hose configuration and torque settings. For retrofitting older chairs, verify compatibility with current ISO 9168 and ADA specifications. Professional installation by certified technicians is recommended for electric systems to avoid calibration errors. |

| 4. How does the warranty differ between high-speed and low-speed handpieces, and what does it typically cover in 2026? | In 2026, most high-speed handpieces come with a 1-year limited warranty covering manufacturing defects in turbines and housings. Low-speed electric handpieces typically include a 2-year warranty due to more complex motor and gearing systems. Warranties exclude damage from improper sterilization, lack of maintenance, or use of non-OEM parts. Extended warranty programs (up to 3 years) are available through distributors and often include free recalibration and turbine replacement. Always register the device post-purchase to activate coverage. |

| 5. Can I mix high-speed and low-speed handpieces from different brands on the same dental unit? | While physically possible due to standardized coupling systems (ISO 9168), mixing brands is not recommended. Performance optimization, torque calibration, and fiber-optic alignment may suffer without manufacturer-specific motor integration. In 2026, leading systems use smart handpiece recognition (via RFID or NFC tags) that only function optimally with matched brand ecosystems. For reliability and warranty validity, clinics and distributors should adopt a single-vendor strategy or use approved cross-compatible models listed in technical integration guides. |

Need a Quote for High Speed Vs Low Speed Dental Handpiece?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160