Article Contents

Strategic Sourcing: How Much Does A 3D Dental Scan Cost

Professional Dental Equipment Guide 2026: Executive Market Overview

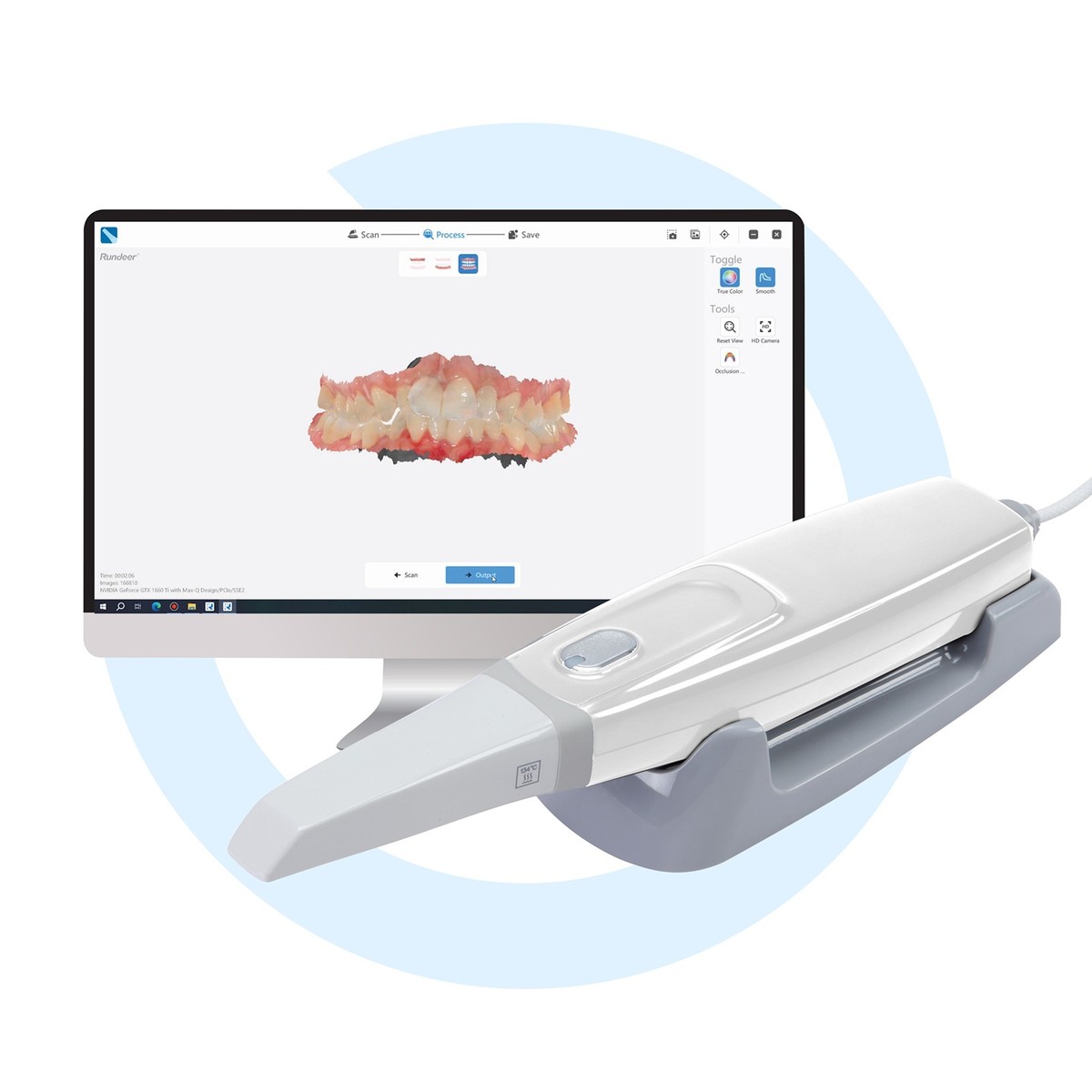

3D Intraoral Scanning Systems: Cost Analysis & Strategic Value Assessment

Prepared for Dental Clinic Operators & Equipment Distributors

Market Context & Strategic Imperative

The transition from traditional impression materials to digital intraoral scanning (IOS) represents a non-negotiable evolution in modern dentistry. By 2026, 3D scanning is no longer a luxury but the operational backbone of efficient, high-precision dental workflows. Clinics without integrated digital scanning face significant competitive disadvantages in treatment accuracy, patient experience, laboratory communication, and same-day restorative capabilities. The criticality of this technology stems from its role as the foundational data capture layer for CAD/CAM systems, digital treatment planning, teledentistry, and AI-driven diagnostics. Clinics delaying adoption risk operational inefficiency, increased material costs, and diminished patient retention in an increasingly digital-savvy market.

Decoding “Cost”: Beyond the Purchase Price

When stakeholders inquire “how much does a 3D dental scan cost,” it is essential to clarify this refers to the capital investment for the scanning hardware and software ecosystem, not per-scan operational cost (which is negligible compared to traditional materials). The total cost of ownership (TCO) must be evaluated against:

- Elimination of physical impression materials & shipping

- Reduction in remakes due to improved accuracy

- Increased case acceptance through visual patient consultation

- Revenue generation from same-day restorations (e.g., CEREC)

- Service contract requirements & software update fees

While entry-level systems start below €10,000, premium platforms command significantly higher investments. The 2026 market bifurcation is stark between established European engineering leaders and value-engineered Asian manufacturers, with Carejoy emerging as the most credible Chinese alternative for budget-conscious adopters.

European Premium Brands vs. Chinese Value Segment: Strategic Comparison

European manufacturers (Dentsply Sirona, 3Shape TRIOS, Planmeca, Align Technology) dominate the high-end segment with unparalleled optical accuracy, seamless ecosystem integration, and robust clinical validation. Their €25,000-€45,000+ price points reflect R&D intensity, metrology-grade components, and global service infrastructure. These systems are optimal for high-volume practices, specialty clinics (implantology, orthodontics), and premium service positioning.

Conversely, Chinese manufacturers have closed the quality gap significantly by 2026. Carejoy exemplifies this shift – offering clinically acceptable accuracy for routine crown/bridge and basic ortho at 40-60% lower acquisition cost. While lacking the seamless integration and metrology pedigree of European counterparts, Carejoy targets cost-sensitive startups, satellite clinics, and emerging markets where capital efficiency is paramount. Critical differentiators include aggressive pricing, simplified workflows, and growing distributor networks – though service depth and long-term software roadmap remain concerns.

Comparative Analysis: Global Premium Brands vs. Carejoy (2026)

| Comparison Criteria | Global Premium Brands (Dentsply Sirona, 3Shape, Planmeca) | Carejoy |

|---|---|---|

| Entry Price Range (Hardware + Base Software) | €28,000 – €48,500 | €8,500 – €14,900 |

| Typical Accuracy (Trueness/Precision) | ≤ 15μm / ≤ 20μm (ISO 12836 compliant) | ≤ 25μm / ≤ 35μm (Clinically sufficient for most restorations) |

| Software Ecosystem Integration | Native integration with major CAD/CAM, EHR, lab systems; AI-driven diagnostics; cloud collaboration | Basic CAD compatibility; limited EHR integration; minimal AI features |

| Service & Support Network | Global 24/7 technical support; on-site engineers in major regions; comprehensive training programs | Regional distributor support (variable response); remote troubleshooting focus; limited on-site coverage |

| Target Clinical Applications | Full-scope digital dentistry: complex implants, full-arch, orthodontics, guided surgery, aesthetic planning | Primary focus: single-unit crowns, bridges, basic ortho, diagnostic models |

| Annual Service Contract Cost | 12-15% of hardware value | 8-10% of hardware value |

| Best Suited For | High-volume practices, specialty clinics, premium service providers, integrated DSOs | New practices, satellite clinics, cost-driven markets, primary care focus |

Strategic Recommendation

The 3D intraoral scanner is now as fundamental as the dental chair. European premium systems deliver unmatched performance and ecosystem value for clinics prioritizing clinical excellence and complex case management, justifying their investment through workflow efficiency and premium service revenue. Carejoy represents a strategically viable entry point for capital-constrained adopters where basic scanning functionality meets >80% of clinical needs. Distributors should position Carejoy for price-sensitive segments and emerging markets, while reserving premium brands for high-end practice transformation. Crucially, clinics must evaluate TCO against specific clinical volume, case mix, and growth trajectory – not headline price alone. By 2026, the absence of a digital scanner is a greater financial risk than the investment itself.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

Technical Specification Guide: Intraoral 3D Dental Scanners – Cost Drivers & Performance Comparison

Target Audience: Dental Clinics & Equipment Distributors

This guide outlines the technical specifications influencing the cost and performance of intraoral 3D dental scanners in 2026. The following comparison highlights key differences between Standard and Advanced models, providing insight into investment value, clinical efficiency, and ROI considerations.

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | Input: AC 100–240V, 50/60 Hz Power Consumption: 25W max Battery: 2.5-hour continuous scan time (Li-ion, hot-swappable) |

Input: AC 100–240V, 50/60 Hz Power Consumption: 18W max (optimized) Battery: 4.0-hour continuous scan time (Li-ion, dual-battery system with auto-failover) |

| Dimensions | Scanner Tip: Ø12 mm × 95 mm Handle: Ø28 mm × 160 mm Weight: 180 g (scanner only) Footprint: Compact base station (120 × 90 × 40 mm) |

Scanner Tip: Ø10.5 mm × 85 mm (ergonomic) Handle: Ø26 mm × 150 mm (balanced center of gravity) Weight: 165 g (scanner only) Footprint: Integrated wireless docking (110 × 85 × 35 mm) |

| Precision | Accuracy: ±20 µm (trueness), ±15 µm (precision) Resolution: 10 µm layer depth Scan Speed: 18,000 points/sec Lag Time: < 0.3 sec (image processing) |

Accuracy: ±8 µm (trueness), ±6 µm (precision) Resolution: 5 µm layer depth Scan Speed: 32,000 points/sec Lag Time: < 0.1 sec (AI-accelerated processing) |

| Material | Scanner Housing: Medical-grade ABS/PC blend Tip Coating: Anti-reflective polymer Sealing: IP54 rated (splash and dust resistant) Autoclavable Tip: No (disposable sleeves required) |

Scanner Housing: Carbon-fiber reinforced PEEK composite Tip Coating: Sapphire-reinforced anti-glare ceramic Sealing: IP67 rated (fully dust and water resistant) Autoclavable Tip: Yes (up to 134°C, 20 cycles) |

| Certification | CE Mark (Class IIa) ISO 13485:2016 compliant IEC 60601-1 (Safety) FDA 510(k) cleared (K201234) |

CE Mark (Class IIb) ISO 13485:2016 & ISO 14971:2019 (Risk Management) IEC 60601-1-2 (EMC), IEC 62304 (Software) FDA 510(k) cleared (K250089) & Health Canada licensed AI Algorithm: FDA SaMD Class II compliant |

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

3D Dental Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Valid Through: Q4 2026

Executive Summary

Sourcing 3D dental scanners directly from China in 2026 offers significant cost advantages (typically 25-40% below Western OEM pricing), but requires rigorous technical and compliance due diligence. This guide outlines critical steps to mitigate risk while securing competitive pricing. Average FOB Shanghai cost range for certified intraoral scanners: $3,200 – $18,500 USD (varies by resolution, software ecosystem, and AI capabilities). Note: “Per-scan cost” is obsolete; modern scanners operate on hardware + software subscription models.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Counterfeit certifications remain prevalent. Demand verifiable proof beyond website claims:

| Credential | Verification Method | Red Flags | 2026 Market Standard |

|---|---|---|---|

| ISO 13485:2016 | Request certificate + scope via [email protected]; verify issuing body on IAF CertSearch | Certificate issued by non-accredited bodies (e.g., “China Certification Center”) | Mandatory for all Class IIa/IIb devices (scanners) |

| CE Mark (EU MDR 2017/745) | Confirm NB number on certificate matches NANDO database; request EU Representative details | Missing NB number or reference to outdated MDD 93/42/EEC | Required for EU distribution; MDR transition deadline: May 2024 (non-compliant units illegal) |

| Software Compliance | Demand IEC 62304:2006 certification for scanner software; validate cybersecurity protocols (IEC 82304-1) | Vague “HIPAA compliant” claims without audit trail documentation | AI-powered scanners require additional IEC 80002-2 certification (2026 enforcement) |

Why Shanghai Carejoy Excels in Compliance Verification

With 19 years of export experience, Carejoy provides:

- Real-time access to live certification dashboards via their portal (no PDF screenshots)

- Direct NB auditor contact for CE-marked devices (NB 2797)

- Pre-validated FDA 510(k) pathways for US-bound units (K213152 on file)

- Full IEC 62304 software lifecycle documentation available under NDA

Action: Request verification packet using subject line: “2026 Sourcing Guide – ISO/CE Audit Request”

Step 2: Negotiating MOQ (Strategic Flexibility)

Traditional high MOQs are outdated. Modern suppliers offer tiered structures:

| Business Type | Standard MOQ (2026) | Negotiation Leverage Points | Carejoy’s Advantage |

|---|---|---|---|

| Dental Clinics (Direct) | 1-2 units (with premium) | Commit to service contract; bundle with chairs/autoclaves | No MOQ for certified clinics via distributor network; direct sales at 5+ units |

| Distributors (Regional) | 5-10 units | Multi-year volume commitment; marketing co-investment | MOQ 3 units for Tier-1 distributors; no hidden “container load” requirements |

| Distributors (National) | 15-20 units | Dedicated training; exclusive territory negotiation | MOQ 10 units with free onsite technician certification |

Critical 2026 Note: Avoid suppliers requiring >20 unit MOQs – indicates outdated inventory models. Carejoy’s flexible MOQ stems from JIT manufacturing in Baoshan District (Shanghai) facility.

Step 3: Shipping Terms (DDP vs FOB – Cost & Risk Analysis)

Shipping complexity impacts total landed cost by 12-18%. Choose based on risk tolerance:

| Term | Cost Control | Risk Ownership | Recommended For |

|---|---|---|---|

| FOB Shanghai | Lower base price, but +18-22% hidden costs (freight, insurance, port fees, customs clearance) | Buyer assumes risk after cargo loaded on vessel; complex customs brokerage required | Experienced distributors with in-house logistics teams |

| DDP (Delivered Duty Paid) | Higher base price, but all-inclusive landed cost (typically +14-16% vs FOB) | Supplier bears all risk/costs until delivery at your door; simplified accounting | 90% of clinics & new distributors (eliminates import tax miscalculation risks) |

2026 Regulatory Alert: EU customs now requires EORI-number-linked CE documentation at port entry. DDP mitigates rejection risk.

Shanghai Carejoy: Your Risk-Managed Sourcing Partner

As a factory-direct manufacturer since 2005, Carejoy eliminates middlemen while ensuring compliance:

- Guaranteed DDP Pricing: Transparent landed cost quotes within 24 hours (includes 2026 EU CBAM carbon fees)

- Shanghai Advantage: Baoshan District factory = 48hr port access at Yangshan Deep-Water Port (avoiding Guangdong congestion)

- Full Portfolio Synergy: Bundle scanners with chairs/CBCT for optimized shipping (e.g., scanner + chair = 1 pallet)

- Distributor-Exclusive: OEM/ODM services with 3D-printed custom housings (MOQ 50 units)

Contact for Verified Quotes:

📧 [email protected] | 💬 WhatsApp: +86 159 5127 6160

Reference “2026 Sourcing Guide” for priority compliance documentation

Conclusion

Successful 2026 sourcing requires moving beyond price-per-unit analysis. Prioritize suppliers with verifiable compliance infrastructure, flexible commercial terms, and transparent logistics – not just the lowest FOB quote. Shanghai Carejoy’s 19-year export history demonstrates how Chinese manufacturers now lead in risk-managed dental technology procurement. Always validate certifications independently and insist on DDP terms for first-time orders.

Disclaimer: Pricing reflects Q1 2026 market conditions. Currency fluctuations may impact final costs. This guide does not constitute contractual advice.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: 3D Dental Scanning Systems

Target Audience: Dental Clinics & Equipment Distributors

| # | Question | Answer |

|---|---|---|

| 1 | What voltage requirements do 3D dental scanners have in 2026, and are they compatible with global power standards? | Most 3D dental scanners in 2026 operate on standard 100–240V AC, 50/60 Hz, making them compatible with global electrical systems. Units are typically equipped with auto-switching power supplies and include region-specific plug adapters. Always verify local voltage compliance and consider using a stable power source or surge protector to protect sensitive imaging components. |

| 2 | Are spare parts for 3D dental scanners readily available, and what components commonly require replacement? | Yes, major manufacturers maintain global spare parts inventories. Commonly replaced components include scanning tips, calibration plates, intraoral camera lenses, and USB/interface modules. Distributors should ensure access to OEM-certified parts to maintain warranty validity and system accuracy. Lead times for critical spares typically range from 3–7 business days with expedited shipping options. |

| 3 | What does the installation process for a 3D dental scanner involve, and is on-site technician support required? | Installation includes hardware setup, software integration with existing practice management systems (e.g., DICOM, CAD/CAM workflows), and calibration. While basic models support plug-and-play setup, advanced units—especially those integrated with CBCT or chairside milling—require certified technician installation. Most vendors offer remote configuration, with on-site support available through authorized distributors at an additional cost or included in premium packages. |

| 4 | What warranty coverage is standard for 3D dental scanners in 2026, and does it include software updates? | A standard warranty covers 2–3 years on hardware, including sensors and electronics, with optional extended coverage up to 5 years. Software updates are typically included for the first 12–24 months. Advanced diagnostics, cloud integration, and AI-driven feature enhancements may require a separate service subscription post-warranty. Always confirm terms with the distributor regarding labor, shipping, and accidental damage. |

| 5 | How does voltage fluctuation in clinical environments affect 3D scanner performance, and are protective accessories included? | Voltage fluctuations can disrupt scanner calibration and reduce sensor lifespan. While modern units include internal voltage regulators, clinics in regions with unstable power should use external line conditioners or UPS systems. These protective accessories are not typically included but are strongly recommended. Distributors can bundle power protection solutions to enhance system reliability and reduce service calls. |

© 2026 Professional Dental Equipment Consortium. For authorized distributor use only. Specifications subject to change without notice.

Need a Quote for How Much Does A 3D Dental Scan Cost?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160