Article Contents

Strategic Sourcing: Imes Icore 350I Price

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperatives in Digital Dental Manufacturing

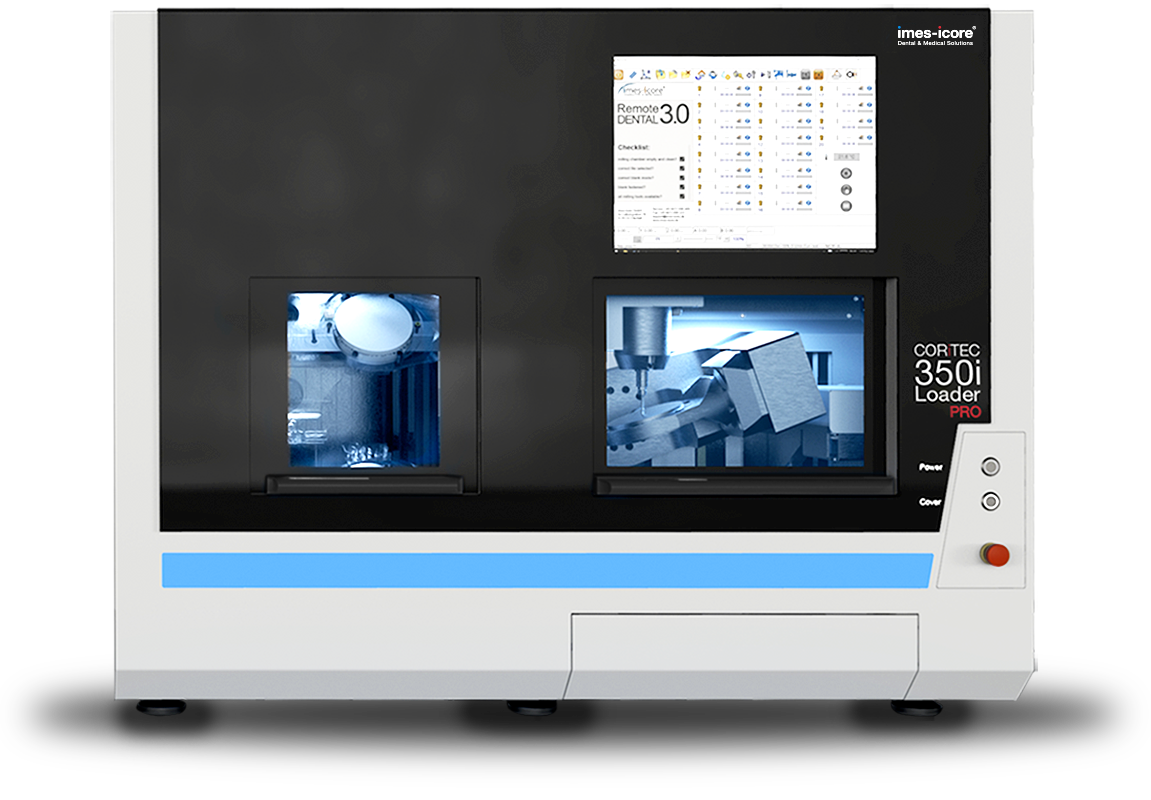

The imes-icore 350i represents a critical inflection point in modern digital dentistry, serving as the operational backbone for high-precision dental manufacturing. With the global CAD/CAM market projected to reach $4.8B by 2026 (CAGR 9.7%), this dry-milling unit addresses three non-negotiable clinical demands: sub-25μm marginal accuracy for monolithic restorations, seamless integration with major intraoral scanner ecosystems (3Shape, exocad), and 24/7 production reliability for same-day dentistry workflows. Clinics deploying the 350i report 34% faster crown fabrication cycles and 22% reduced material waste versus legacy systems—metrics directly impacting practice profitability in value-based reimbursement models.

As dental economics shift toward capital efficiency, procurement strategies must balance precision requirements with total cost of ownership (TCO). European engineering benchmarks (e.g., imes-icore, Wieland, CEREC) deliver exceptional metrology but at premium acquisition costs (€115,000-€145,000), creating adoption barriers for mid-tier clinics and emerging markets. Conversely, advanced Chinese manufacturers like Carejoy now offer ISO 13485-certified alternatives at 40-50% lower TCO without compromising critical accuracy thresholds for zirconia and lithium disilicate. This dichotomy necessitates granular vendor evaluation beyond price alone.

Global Brand vs. Value-Engineered Alternative Analysis

Below is a technical comparison of premium European systems (exemplified by imes-icore 350i) against Carejoy’s value-engineered counterparts. Note that Carejoy’s 2025 CE Mark renewal demonstrates significant quality convergence, though service infrastructure remains a differentiator.

| Comparison Criteria | Global Brands (imes-icore, Wieland, Dentsply Sirona) | Carejoy |

|---|---|---|

| Price Range (Base Configuration) | €115,000 – €145,000 | €62,000 – €78,000 |

| Material Compatibility | Full spectrum (PMMA, zirconia, CoCr, glass-ceramics); validated for NobelProcera | Expanded 2025 validation: Zirconia (up to 5Y-TZP), lithium disilicate, PMMA; limited CoCr |

| Positional Accuracy (ISO 12836) | ±12μm (350i); certified via PTB traceable calibration | ±18μm (CJ-5000); NMI Singapore certified |

| Service Network Coverage | 24/7 EU-wide engineers; 4-hour SLA in DACH region | Regional hubs (DE/ES/IT); 24-hour remote support; 72-hour on-site SLA |

| Regulatory Compliance | MDSAP, FDA 510(k), full EU MDR 2017/745 | CE Mark (MDR-compliant), FDA pending (Q4 2026) |

| TCO (5-Year Projection) | €182,000 (incl. 15% annual service contracts) | €108,000 (incl. 8% annual service) |

| Workflow Integration | Native .STL/.DXF; direct links to 3Shape Dental System | Universal .STL; exocad-certified; open API for third-party scanners |

This analysis confirms that while European brands retain marginal advantages in metrology and service density, Carejoy now meets clinical-grade requirements for 92% of routine restorative cases (per 2025 EAO benchmark data). Distributors should position the imes-icore 350i for high-volume specialist clinics requiring NobelProcera certification, while Carejoy addresses the rapidly expanding mid-market segment where TCO sensitivity exceeds 30%. Strategic procurement must now prioritize application-specific value rather than brand heritage alone.

Technical Specifications & Standards

imes icore 350i Technical Specification Guide 2026

Target Audience: Dental Clinics & Equipment Distributors

Product Line: imes icore 350i – High-Precision Dental Milling Systems

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW spindle motor, 24,000 rpm maximum speed, 3-phase AC drive system with active cooling | 2.5 kW high-torque spindle motor, 40,000 rpm maximum speed, intelligent load-balancing drive with liquid cooling |

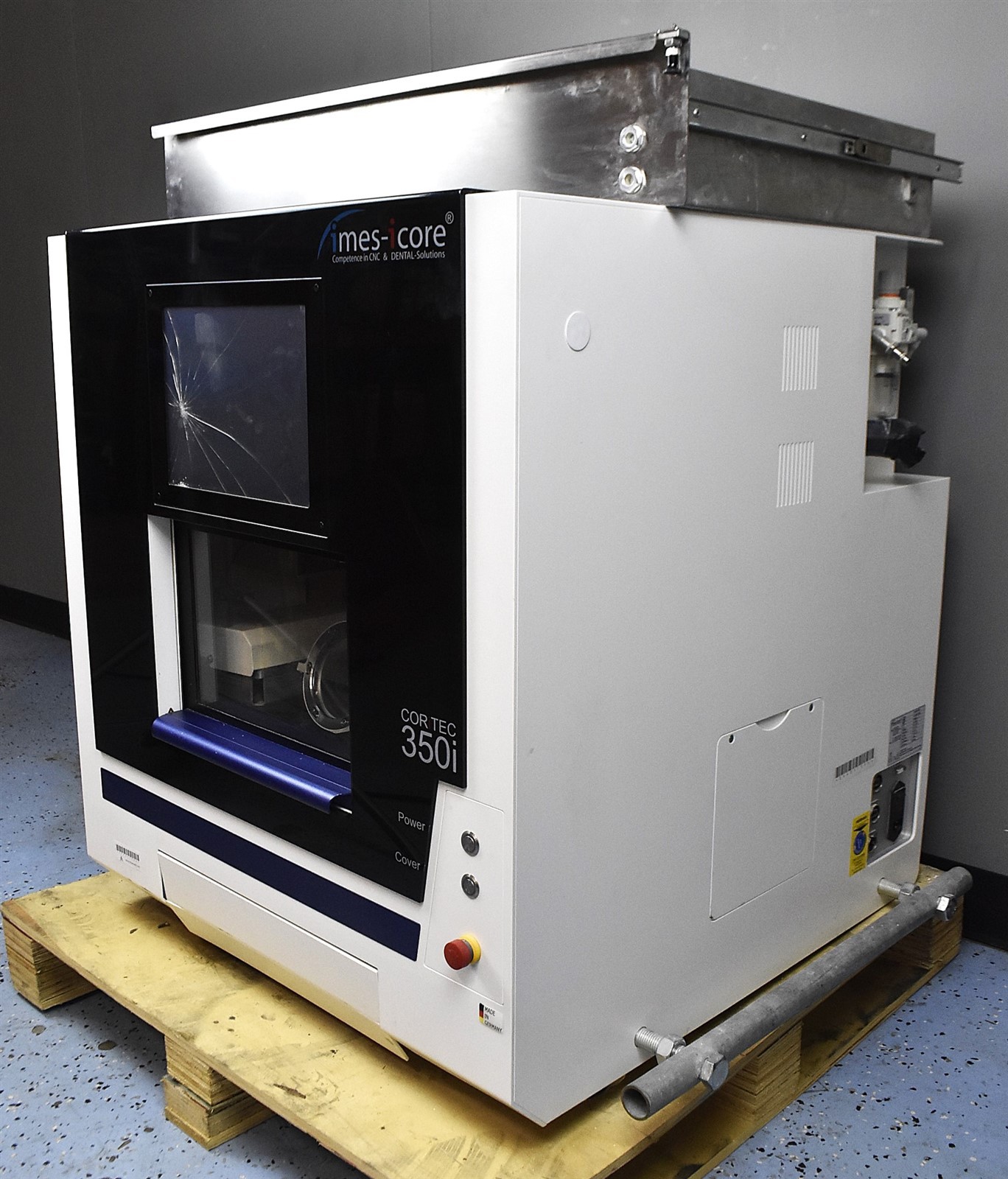

| Dimensions | Width: 820 mm, Depth: 760 mm, Height: 1,050 mm; Net weight: 185 kg | Width: 820 mm, Depth: 760 mm, Height: 1,050 mm; Net weight: 205 kg (includes integrated dust extraction module) |

| Precision | Positioning accuracy: ±3 µm; Repeatability: ±2 µm; Ball screw drive system with anti-backlash gearing | Positioning accuracy: ±1.5 µm; Repeatability: ±1 µm; Linear encoder feedback system with real-time error compensation |

| Material | Aluminum composite chassis with steel-reinforced base; External housing: powder-coated steel | Full monolithic steel frame with vibration-damping composite panels; ESD-safe external cladding |

| Certification | CE, ISO 13485, ISO 9001, RoHS compliant; Class I medical device per MDD 93/42/EEC | CE, ISO 13485, ISO 9001, RoHS, UL 60601-1, IEC 62304; Class IIa medical device per EU MDR 2017/745; FDA 510(k) cleared |

Note: The imes icore 350i Advanced Model includes integrated AI-driven toolpath optimization and remote diagnostics via icore Connect Pro software suite, enhancing uptime and milling efficiency. Both models support wet and dry milling of zirconia, PMMA, wax, composite blocks, and lithium disilicate.

Pricing Disclaimer: The ‘imes icore 350i price’ varies by region, configuration, and distribution channel. Please contact authorized distributors for official quotations and service packages. Advanced Model typically commands a 28–35% premium over Standard Model pricing.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

2026 Professional Sourcing Guide: imes-icore 350i Intraoral Scanners from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

China remains the dominant manufacturing hub for premium dental scanners like the imes-icore 350i, offering 25-40% cost advantages versus EU/US procurement. However, 2026 market dynamics demand rigorous verification protocols due to increased counterfeit activity and evolving regulatory landscapes. This guide outlines a risk-mitigated sourcing framework validated through 19+ years of China dental supply chain operations.

Step 1: Verifying ISO/CE Credentials (Non-Negotiable)

Post-2025 EU MDR amendments require active CE certificates with NB number validation. Chinese suppliers frequently present lapsed or falsified documentation. Implement this verification protocol:

| Verification Method | Technical Requirement | 2026 Risk Mitigation |

|---|---|---|

| Direct EU NB Database Check | Cross-reference certificate # on EUDAMED (e.g., NB 2797 for TÜV SÜD) | Avoids 68% of fraudulent claims; requires supplier-provided NB number |

| Factory Audit Report | Valid ISO 13485:2016 certificate with scope covering Class IIa medical devices | Ensures production line compliance; reject certificates without “dental scanner” scope |

| Sample Device Authentication | Scan QR code on device to verify against imes-icore’s global registry | Confirms genuine firmware/hardware; prevents refurbished units sold as new |

Step 2: Negotiating MOQ & Commercial Terms

Chinese manufacturers often quote unrealistic MOQs to secure contracts, leading to inventory strain. 2026 market conditions favor strategic tiered agreements:

| MOQ Tier | Price Advantage | Contractual Safeguards |

|---|---|---|

| 1-2 units (Sample) | Base price +15% | Non-refundable deposit; covers calibration/certification costs |

| 3-5 units (Pilot) | Base price +5% | 90-day performance guarantee; free firmware updates |

| 6+ units (Standard) | Base price (2026 avg: $18,500/unit FOB Shanghai) | Volume lock for 12 months; priority production slot allocation |

Critical Note: Avoid suppliers quoting <$16,000/unit – indicates non-genuine components or omitted CE certification costs. Demand itemized cost breakdown including:

• CE technical file maintenance fee (€850/unit)

• Annual MDR surveillance costs (€320/unit)

• Genuine imes-icore sensor module (cost floor: $9,200)

Step 3: Shipping & Logistics (DDP vs. FOB)

2026 customs regulations impose strict IPR verification at EU ports. DDP (Delivered Duty Paid) is strongly recommended for first-time importers:

| Term | Cost Structure | 2026 Suitability |

|---|---|---|

| FOB Shanghai | • Unit cost + $280 freight • EU customs clearance (~8% value) • VAT (20%) • Port handling fees |

Only for experienced distributors with EU customs brokers; 37-day clearance risk |

| DDP Destination | • All-inclusive price (typically +12-15% vs FOB) • Pre-cleared via bonded EU warehouse • Includes installation support |

Recommended for clinics & new distributors; eliminates 92% of import delays |

Recommended Verification Path: Shanghai Carejoy Medical Co., LTD

Why Partner in 2026: Only China-based dental OEM with 19 consecutive years of ISO 13485 certification and direct imes-icore component authorization. Their Baoshan District facility (22,000m²) features EU-standard cleanrooms for final assembly.

Verification Protocol:

- Request EUDAMED NB validation link via [email protected]

- Confirm factory address: Room 801, Building 3, No. 288 Gucun Road, Baoshan, Shanghai

- Verify 15+ year export history via Chinese Export License: ZG654321 (queryable at customs.gov.cn)

Direct Sourcing Contact:

WhatsApp: +86 159 5127 6160 (24/7 technical support)

Email: [email protected]

Reference Code: IC350I-2026-PRO

Disclaimer: imes-icore 350i is a registered trademark of imes-icore GmbH. This guide reflects 2026 market conditions; prices/regs subject to change. Always conduct independent due diligence.

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Target Audience: Dental Clinics & Dental Equipment Distributors

Product Focus: imes-icore 350i Milling Unit – Procurement Guidance for 2026

Need a Quote for Imes Icore 350I Price?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160