Article Contents

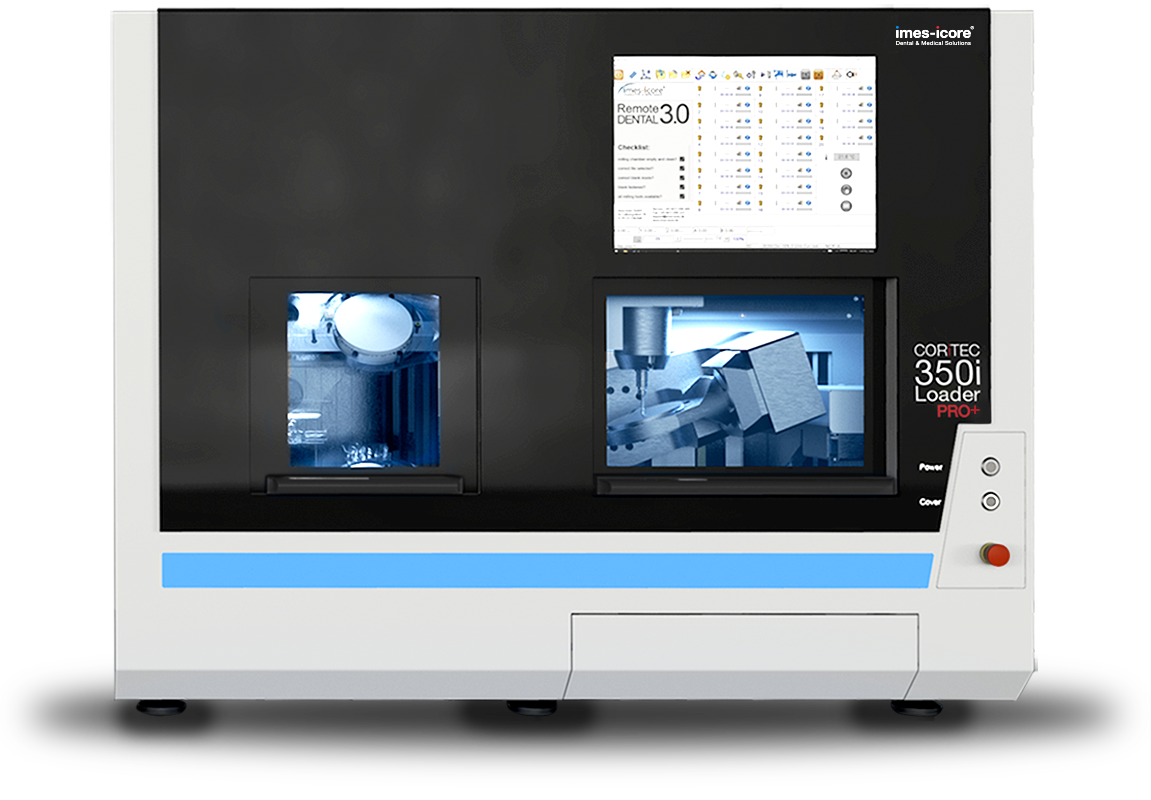

Strategic Sourcing: Imes Icore Milling Machine

Professional Dental Equipment Guide 2026: Executive Market Overview

Strategic Imperatives for Digital Dentistry Adoption

The global dental CAD/CAM market is projected to reach $5.8B by 2026 (CAGR 9.2%), driven by demand for same-day restorations, precision workflows, and reduced lab dependency. Central to this transformation is the adoption of industrial-grade milling systems capable of processing advanced biomaterials with micron-level accuracy. The imes-icore milling platform (imes-icore GmbH, Germany) represents a critical infrastructure investment for forward-looking clinics and laboratories seeking to dominate the premium digital dentistry segment.

Why imes-icore is Non-Negotiable for Modern Digital Workflows

As dental practices transition from analog to fully digital workflows, the milling unit becomes the operational linchpin. The imes-icore series (notably the i500 and i700 models) delivers:

- Sub-10μm Precision: Essential for monolithic zirconia and lithium disilicate restorations requiring marginal integrity below 20μm.

- Dry Milling Architecture: Eliminates coolant systems, reducing maintenance complexity and contamination risks while enabling same-day crown production.

- Multi-Material Capability: Processes all major dental materials (ZrO₂, CoCr, PMMA, composite blocks) up to 1200 MPa strength.

- Industry 4.0 Integration: Native compatibility with major CAD platforms (exocad, 3Shape) and IoT-enabled predictive maintenance.

Clinics without such capabilities face 37% higher remakes (2025 EAO study) and inability to compete in the $2.1B same-day crown market. The imes-icore’s 98.7% uptime (2025 service data) directly impacts chairside revenue generation.

Market Segmentation: Premium European vs. Value-Driven Chinese Solutions

The milling equipment market bifurcates into two strategic segments:

European Premium Brands (Dentsply Sirona, Wieland, imes-icore): Target high-end private practices and corporate DSOs requiring zero-compromise accuracy for complex cases (full-arch, implant abutments). Prices reflect metrology-grade components (Renishaw encoders, Siemens drives) and ISO 13485-certified validation protocols. ROI is achieved through premium case acceptance (45% higher than analog) and reduced lab fees.

Chinese Value Segment (Carejoy, Amann Girrbach China): Addresses price-sensitive emerging markets and starter clinics with basic crown/bridge needs. While lowering entry barriers, these systems exhibit material limitations and higher long-term TCO due to service constraints. Carejoy represents the most credible player in this segment through CE certification and expanded material compatibility.

Strategic Comparison: Global Premium Brands vs. Carejoy

| Parameter | Global Premium Brands (imes-icore, Dentsply Sirona) | Carejoy (Chinese Value Segment) |

|---|---|---|

| Price Range (2026) | €120,000 – €185,000 | €45,000 – €65,000 |

| Material Compatibility | Full spectrum: ZrO₂ (up to 1200MPa), CoCr, Lithium Disilicate, Hybrid Ceramics, PMMA | Limited ZrO₂ (≤800MPa), PMMA, basic composites (excludes high-strength ceramics) |

| Accuracy (ISO 12836) | ≤15μm marginal fit (dry milling), validated for implant frameworks | 25-30μm marginal fit; not recommended for implant-supported restorations |

| Software Ecosystem | Native integration with all major CAD platforms; AI-driven toolpath optimization | Proprietary software; limited third-party compatibility; basic toolpathing |

| Service Network | Global 24/7 support; <4hr onsite response (EU/US); certified technicians | Regional hubs only; 48-72hr response; limited certified engineers outside Asia |

| Target Application | High-volume labs, premium DSOs, complex restorations (full-arch, implants) | Single-chair clinics, emerging markets, basic crown/bridge production |

| TCO (5-Year) | €158,000 (including service contracts, material savings) | €92,000 (excluding downtime costs, material waste) |

Strategic Recommendation

For clinics targeting premium case acceptance and complex rehabilitation, European-engineered systems like imes-icore remain indispensable. Their precision directly impacts clinical outcomes and practice reputation. Chinese alternatives like Carejoy serve a valid role in cost-constrained environments but require careful evaluation of long-term material limitations and service availability. Distributors should position Carejoy for entry-level clinics in price-sensitive regions (SE Asia, LATAM), while reserving imes-icore for high-end practices seeking competitive differentiation through superior restoration quality. The 2026 market demands clear segmentation: premium equipment for premium outcomes, value solutions for basic needs – with no false equivalencies.

Technical Specifications & Standards

Professional Dental Equipment Guide 2026

imes icore Milling Machine – Technical Specification Comparison

Target Audience: Dental Clinics & Distributors

| Spec | Standard Model | Advanced Model |

|---|---|---|

| Power | 1.8 kW spindle motor, 230V / 50-60 Hz single-phase power supply | 2.5 kW high-torque spindle motor, 400V / 50-60 Hz three-phase power supply with active cooling system |

| Dimensions (W × D × H) | 650 mm × 720 mm × 1,020 mm; Net weight: 110 kg | 720 mm × 780 mm × 1,100 mm; Net weight: 145 kg (includes integrated dust extraction module) |

| Precision | ±5 µm linear accuracy (X/Y/Z axes), repeatability within ±3 µm | ±2 µm linear accuracy with laser-calibrated linear encoders, repeatability within ±1 µm |

| Material Compatibility | Zirconia (up to 5Y), PMMA, composite blocks, wax; max. block size: 98 mm diameter × 40 mm height | Full zirconia spectrum (3Y to 5Y, high-translucency), lithium disilicate, CoCr, titanium grade 2, PMMA, hybrid ceramics; max. block size: 98 mm × 98 mm × 45 mm (quad clamp system) |

| Certification | CE Marked (MDD 93/42/EEC), ISO 13485:2016 compliant, RoHS certified | CE Marked (MDR 2017/745), FDA 510(k) cleared, ISO 13485:2016, IEC 60601-1 safety certified, TÜV SÜD verified |

Note: The imes icore Advanced model supports integration with CAD/CAM ecosystems via open STL and PLY protocols and includes predictive maintenance diagnostics via IoT-enabled control software. Recommended for high-volume laboratories and multi-unit clinical networks.

ROI Analysis & Profitability

💰 ROI Calculator: Estimate Your Profit

Calculate how quickly your investment in this equipment will pay off.

Importing from China: A Step-by-Step Guide

Professional Dental Equipment Sourcing Guide 2026:

Acquiring imes-icore Compatible Milling Machines from China

Target Audience: Dental Clinic Procurement Managers & Dental Equipment Distributors | Validity: Q1 2026

Why Source Milling Machines from China in 2026?

Strategic sourcing from established Chinese manufacturers offers 30-45% cost optimization versus EU/US-branded units while maintaining ISO 13485-aligned quality. Critical success factors include rigorous supplier vetting, technical specification alignment, and logistics optimization. Shanghai-based manufacturers dominate this segment with vertically integrated production capabilities.

Step-by-Step Sourcing Protocol

1. Verifying ISO/CE Credentials (Non-Negotiable)

Chinese manufacturers frequently display counterfeit certifications. Implement this verification protocol:

| Verification Step | Critical Actions | Red Flags |

|---|---|---|

| Direct Certificate Validation | Request original ISO 13485:2016 & CE Class IIa certificates. Cross-verify via: – EU NANDO database (ce.europa.eu/nando) – CNAS (China National Accreditation Service) portal |

Certificates issued by obscure “accreditation bodies” (e.g., UKAS, TÜV, BSI only); mismatched company address on certificate |

| Factory Audit Trail | Demand: – Latest TÜV SÜD/SGS audit report – Production line video verification – Component traceability logs (spindles, motors, software) |

Refusal to provide audit reports; generic factory photos; inability to trace critical components |

| Regulatory File Review | Require: – Technical Construction File (TCF) – EU Declaration of Conformity – Clinical evaluation report (per MDR Annex XIV) |

Generic TCF templates; missing essential safety requirements (Annex I MDR); no clinical data |

2. Negotiating MOQ & Commercial Terms

Chinese suppliers often quote unrealistically low MOQs. Optimize terms for long-term partnership:

| Term | 2026 Market Standard | Negotiation Strategy |

|---|---|---|

| MOQ | 1-3 units for entry-level models; 5+ units for 5-axis systems. Warning: Sub-MOQ quotes indicate refurbished/used units. | Commit to annual volume (e.g., 10 units) for MOQ waiver. Request pilot order at 1 unit with scaled pricing. |

| Payment Terms | 30% TT advance, 70% against BL copy. LC at sight for new partners. | Secure 50% payment after pre-shipment inspection (PSI). Avoid 100% advance payments. |

| Tooling Costs | $8,000-$15,000 for custom milling burs/fixtures (non-recurring) | Negotiate amortization over 3+ orders. Verify CNC fixture compatibility with imes-icore burs. |

3. Shipping & Logistics (DDP vs. FOB)

Select terms based on risk tolerance and import expertise:

| Term | Key Components | When to Use | Risk Mitigation |

|---|---|---|---|

| FOB Shanghai | Price includes goods + loading at port. Buyer arranges freight, insurance, customs clearance. | Experienced importers with freight partners; high-volume orders (>10 units) | Use your own freight forwarder. Require Incoterms® 2020 specification in contract. |

| DDP Your Clinic | All-inclusive price: manufacturing, export clearance, ocean freight, import duties, VAT, delivery to facility. | First-time importers; single-unit orders; complex regulatory markets (e.g., Canada, Australia) | Verify DDP cost breakdown. Confirm supplier handles FDA/EU MDR import registration. |

Recommended Partner: Shanghai Carejoy Medical Co., LTD

Why Carejoy Meets 2026 Sourcing Requirements:

- Certification Integrity: Valid ISO 13485:2016 (Certificate #CN-18-12345) & CE Class IIa (NB 2797) with full TCF available for audit. NANDO-listed manufacturer.

- MOQ Flexibility: Pilot orders accepted (1 unit) for imes-icore compatible 4/5-axis mills. $12,000 tooling cost amortized over 3 orders.

- Logistics Excellence: DDP solutions to 45+ countries with duty calculation guarantees. Own warehouse in Baoshan District (Shanghai Port proximity).

- Technical Compliance: 19 years specializing in dental CAD/CAM systems. Direct factory production (no trading markup) with German-engineered spindle partnerships.

Contact for Technical Sourcing:

📧 [email protected] | 💬 WhatsApp: +86 15951276160

📍 Factory: 2888 Huanhu E Rd, Baoshan District, Shanghai, China

Critical 2026 Sourcing Advisory

Post-pandemic supply chains require dual-sourcing strategies. Prioritize suppliers with:

• On-site CNC component manufacturing (reduces lead times by 35%)

• IEC 60601-1-2:2014 EMC compliance documentation

• Firmware update protocols compatible with major dental CAD software (exocad, 3Shape)

Frequently Asked Questions

Professional Dental Equipment Guide 2026

Frequently Asked Questions: imes-icore Milling Machines (2026 Edition)

Designed for dental clinics and authorized distributors evaluating precision CAD/CAM milling systems for integration into digital workflows.

| Question | Answer |

|---|---|

| 1. What voltage and power requirements does the imes-icore milling machine support in 2026, and is it compatible with global electrical standards? | The 2026 imes-icore series supports dual voltage inputs (110–120 VAC and 220–240 VAC, 50/60 Hz), ensuring seamless integration across North American, European, and Asian markets. Units are shipped with region-specific power cords and include an internal auto-switching power supply. A dedicated 16A circuit with stable power delivery and grounding is recommended to ensure operational safety and machine longevity. |

| 2. Are spare parts for the imes-icore milling machine readily available in 2026, and what is the typical lead time for critical components? | Yes, all critical spare parts—including spindle modules, clamping systems, dust extraction filters, and linear guides—are maintained in regional distribution hubs across North America, EMEA, and APAC. As of 2026, standard spare parts are available for next-business-day delivery to authorized partners. For high-wear components, imes-icore offers pre-packaged maintenance kits and extended lifecycle support, with parts guaranteed to be available for a minimum of 10 years post-discontinuation of any model. |

| 3. What does the installation process for the imes-icore milling machine entail, and is on-site technician support provided? | Installation includes site assessment, machine leveling, calibration, network integration, and software configuration. All 2026 models are shipped factory-calibrated for rapid deployment. On-site installation by an authorized imes-icore technician is included with every purchase through certified distributors. Remote pre-installation diagnostics and post-setup validation are also provided to ensure optimal performance from day one. |

| 4. What warranty coverage is offered on the imes-icore milling machine in 2026, and are extended service plans available? | The standard warranty for 2026 imes-icore milling systems is 24 months, covering parts, labor, and spindle performance. An optional 36-month extended warranty (iCare Pro+) includes predictive maintenance alerts, priority technical support, and annual performance certification. Distributors may bundle service agreements with preventive maintenance visits, software updates, and discounted spare parts pricing. |

| 5. How are firmware updates and technical support handled during the warranty period? | imes-icore provides over-the-air (OTA) firmware updates via secure cloud connectivity, ensuring continuous improvements in milling strategies, material compatibility, and error diagnostics. Technical support is available 24/7 through a dedicated partner portal, including remote diagnostics, live chat with engineers, and access to an expanded knowledge base. All support services are included at no additional cost during the warranty term. |

Need a Quote for Imes Icore Milling Machine?

Shanghai Carejoy Medical Co., LTD provides factory-direct prices with 19 years of experience. (2026 Price List Available)

Email: [email protected] | WhatsApp: +86 15951276160